Consumer Packaged Goods (CPG) Market Size, Share, Trends, Industry Analysis Report

By Packaging Material (Plastic, Metal, Paperboard, Glass), By Product Type, By Distribution Channel, By Packaging Type, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5913

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

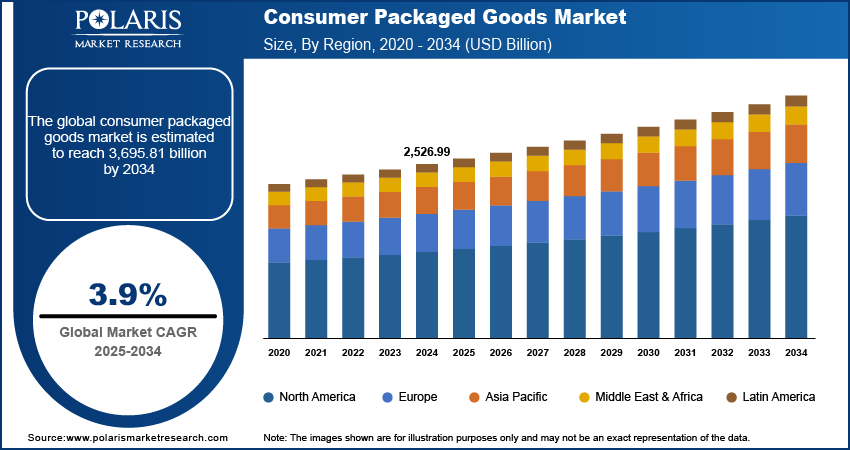

The global consumer packaged goods (CPG) market size was valued at USD 2,526.99 billion in 2024 and is anticipated to register a CAGR of 3.9% from 2025 to 2034. The consumer packaged goods industry is mainly driven by a growing population and rising disposable incomes. Additionally, the increasing use of e-commerce platforms is making it easier for people to buy CPG products online, further boosting demand.

Key Insights

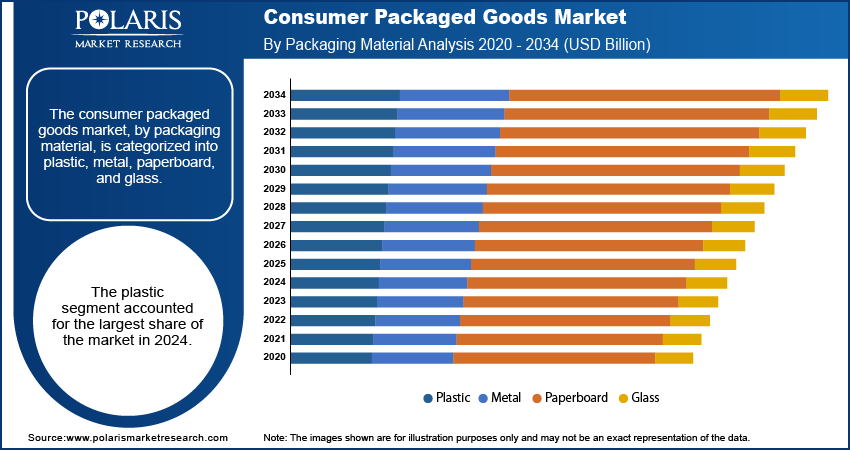

- The plastic segment held the largest share in 2024 due to its versatility, lightweight, and cost-effectiveness.

- The food and beverages segment held the largest share in 2024. The sheer volume and frequency of purchase of these items contribute significantly to their dominant position.

- The supermarkets/hypermarkets segment held the dominant share in 2024. Their extensive shelf space enables the display of a wide range of CPG brands and product variations. This factor is making them a primary point of sale for everyday essentials.

- The flexible packaging segment held the largest share in 2024. This dominance is driven by its many benefits, including lightweight nature, cost-effectiveness, and efficient use of materials.

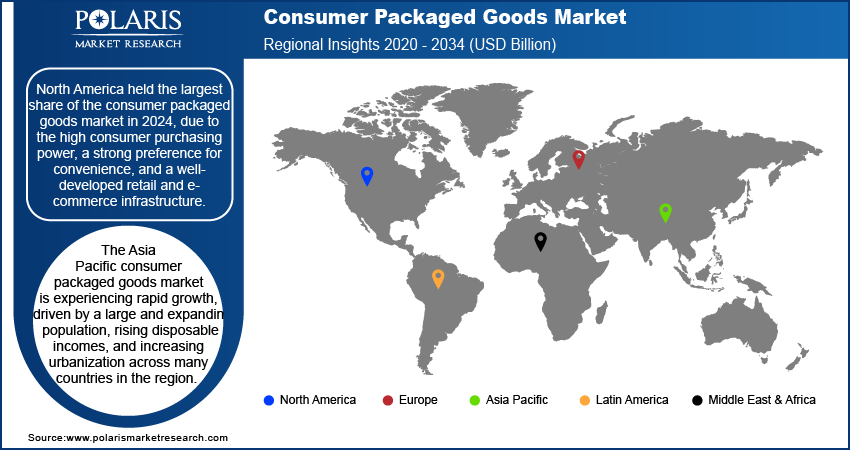

- North America accounted for the largest share in 2024. The region is dynamic and mature, characterized by high consumer spending power and a strong emphasis on convenience and innovation.

- The Asia Pacific CPG market is experiencing rapid growth. The growth is driven by a large and expanding population and rising disposable incomes.

Industry Dynamics

- Rising penetration of e-commerce and digital retail platforms drives the market expansion.

- Increasing urbanization and changing lifestyles boost the industry growth.

- Continuous product innovation and increasing demand for customization are expected to offer lucrative opportunities during the forecast period

- Supply chain disruptions hinder the CPG industry development.

Market Statistics

2024 Market Size: USD 2,526.99 billion

2034 Projected Market Size: USD 3,695.81 billion

CAGR (2025–2034): 3.9%

North America: Largest market in 2024

AI Impact on Consumer Packaged Goods (CPG) Market

- Artificial intelligence (AI) tools analyze current and emerging market trends, and consumer preferences to accelerate product ideation and reformulation.

- The technology helps automate replenishment, consolidate warehouses, and reduce waste, especially in temperature-sensitive products such as beverages and ice creams.

- AI systems are used to analyzes data from social media and e-commerce platforms to plan marketing strategies and boost return on investments (ROI).

- These tools identify the effective promotional strategies. They help reduce costs and increase net revenue.

To Understand More About this Research: Request a Free Sample Report

The consumer packaged goods (CPG) industry deals with everyday items that consumers buy regularly and use up quickly. These include a wide range of products such as food items, ready-to-drink beverages, personal care items, and household cleaners, which are sold through various retail channels and online stores.

The demand for consumer packaged goods is heavily influenced by constantly evolving consumer preferences and values. Beyond basic needs, consumers are increasingly prioritizing aspects such as health and wellness, ethical sourcing, and environmental sustainability in their purchasing decisions. This shift means that CPG companies must adapt their product offerings, ingredients, packaging, and even their brand messaging to resonate with these changing priorities.

Continuous product innovation and the increasing demand for customization are crucial drivers in the CPG sector. In a highly competitive landscape, offering novel products, new flavors, improved functionalities, or personalized options helps companies stand out and capture consumer interest. This includes everything from new ingredient combinations and healthier formulations to smart packaging and products tailored for specific dietary needs or lifestyles.

Industry Dynamics

Increasing Urbanization and Changing Lifestyles

The emerging trend of rapid urbanization is a significant driver of the consumer packaged goods industry growth. As more people move from rural to urban areas, their daily routines, living spaces, and consumption habits undergo notable changes. Urban dwellers often lead busier lives, resulting in a higher demand for convenient, ready-to-consume food and beverage items, as well as personal care products designed for efficiency. This shift also impacts packaging preferences, favoring smaller, single-serve options suitable for on-the-go consumption or smaller living spaces.

Over 55% of the world's population lives in urban areas, and this is expected to rise to 68% by 2050, according to the World Health Organization (WHO). This significant population shift leads to increased demand for convenient and readily available CPG. Thus, the growing urban population, with its distinct demand trends, significantly drives the overall market growth.

Growth of E-commerce and Digital Penetration

The rapid expansion of e-commerce platforms and increasing digital penetration globally are transforming how consumers purchase goods, particularly in the CPG sector. Online shopping offers unparalleled convenience, a wider product selection, and competitive pricing, which appeals to a broad range of consumers. This shift has led CPG companies to invest heavily in their digital presence, direct-to-consumer (D2C) channels, and last-mile delivery solutions to meet evolving consumer demand. The accessibility of online platforms enables consumers to easily discover new products and brands, further fueling consumption.

According to the International Telecommunication Union (a UN specialized agency and official global ICT statistics provider), there are 5.52 billion internet users worldwide. This widespread digital penetration makes it easier for consumers to shop online for CPG products, changing traditional buying behaviors. This continued growth in online sales channels and digital engagement plays a crucial role in CPG sales. With high digital penetration, consumers rely on online information, including reviews and product details, to make purchasing decisions. This highlights the importance of CPG brands providing transparent and easily accessible product information online.

Which Trends are Disrupting the Consumer Packaged Goods (CPG) Market?

The CPG industry Shifting consumer behavior and digital disruption are driving the CPG market growth. CPG brands adopt D2C models to increase engagement and improve margins. Further, inflation drives value-conscious purchasing, boosting the expansion of private labels. Automation and AI integration enable personalization and efficiency across CPG ecosystem. Industry players are adopting these trends to gain competitive advantages. It will also help offer innovative and customized products.

|

Trend |

Description |

Impact on Market |

|

Direct-to-Consumer (D2C) Models |

CPG Brands are using digital platforms to sell products directly |

Higher margins, access to better customer data, and personalized engagement |

|

Preference for Sustainability and Eco-Friendly Packaging |

Increasing shift toward biodegradable and recyclable products and refill formats |

Enhances brand trust and reduces regulatory risks |

|

Health, Wellness, and Functional Products |

Rising demand for organic, clean-label, and fortified products |

Propels innovation across food, household, and beauty categories |

|

Personalization Through Data and AI Integration |

Hyper-targeted products, subscriptions, and offers |

Contributes to increasing loyalty and repeat purchase rates |

|

Integration of Omnichannel Retail Channels |

Seamless shopping experience across online and offline ecosystems |

Boosts accessibility and enhances convenience |

|

Digitization and Automation in Supply Chain |

Adoption of IoT, robotics, and real-time tracking |

Enhances resilience and cost efficiency |

|

Private Label Expansion |

Retailer brands are gaining high trust and adoption |

Heightens competition and price pressure on traditional CPG brands |

-market-size-worth-usd-3,695.81-billion-by-2034.png)

Segmental Insights

Packaging Material Analysis

The plastic segment held the largest share in 2024, due to its versatility, light weight, cost-effectiveness, and ability to be molded into various shapes and sizes. Plastic offers excellent barrier properties, helping to preserve product freshness and extend shelf life, which is crucial for many CPG items such as food and beverages.

The paperboard packaging segment is anticipated to witness the highest growth rate during the forecast period. This growth is largely driven by increasing consumer awareness and preference for sustainable and environmentally friendly packaging solutions. Paperboard, being recyclable and biodegradable, aligns well with global efforts to reduce plastic waste and promote a circular economy.

Product Type Analysis

The food and beverages segment held the largest share in 2024. The segment includes a vast array of daily necessities, from packaged foods and snacks to soft drinks and dairy products, which are fundamental to consumer consumption patterns. According to United States Department of Agriculture, average American households spent a substantial amount on food at home, indicating the continuous and high demand for these essential products. This underscores how deeply integrated food and beverages are into everyday life. Thus, the sheer volume and frequency of purchase of these items contribute significantly to their dominant position.

The cosmetics and personal care products segment is anticipated to witness the highest growth rate during the forecast period. This surge is fueled by increasing consumer awareness regarding personal grooming, hygiene, and wellness, coupled with a growing desire for specialized and innovative products. The aging global population, as noted by the Population Reference Bureau of the U.S., also contributes to this trend, as older consumers increasingly seek antiaging and specialized skincare solutions. The continuous introduction of new products, rising disposable incomes, and the strong influence of beauty trends are all propelling the demand for cosmetics and personal care items, making it a dynamic and fast-growing area.

Distribution Channel Analysis

The supermarkets/hypermarkets segment held the dominant share in 2024. These large-format stores offer a vast selection of products in one convenient location, allowing for bulk purchases and a complete shopping experience. Their extensive shelf space enables to display a wide range of CPG brands and product variations, making them a primary point of sale for everyday essentials.

The e-commerce segment is anticipated to witness the highest growth rate during the forecast period. Owing to the increasing internet penetration, rising smartphone usage, and a preference for convenience, online platforms are transforming consumer buying habits. E-commerce offers consumers the flexibility to shop anytime, anywhere, and often provides access to a wider variety of niche and specialty CPG products not readily available in physical stores.

Packaging Type Analysis

The flexible packaging held the largest share in 2024, This dominance is driven by its many benefits, including its lightweight nature, cost-effectiveness, and efficient use of materials, which reduces transportation costs and overall waste. Flexible packaging, such as pouches and films, also offers excellent barrier properties, helping to extend the shelf life of various products such as snacks, beverages, and personal care items. The growing demand for convenient, on-the-go food options has significantly boosted the adoption of flexible packaging solutions worldwide, as noted in various industry analyses on packaging trends for packaged food products.

The rigid packaging segment is anticipated to witness the highest growth rate during the forecast period. In rigid packaging, various materials such as glass, metal, and rigid plastics are used. Its growth is being propelled by increasing consumer demand for premium products and robust product protection. Rigid packaging offers superior protection against impact and contamination, ensuring product integrity and often conveying a sense of quality or luxury, particularly for beverages, high-end cosmetics, and certain food items. The focus on sustainability also plays a role, with innovations in recyclable and reusable rigid formats gaining traction as consumers become more environmentally conscious.

Regional Analysis

The North America consumer packaged goods market accounted for the largest share in 2024. The region is dynamic and mature, characterized by high consumer spending power and a strong emphasis on convenience and innovation. Consumers in this region increasingly seek products that align with health and wellness trends, leading to a rise in demand for organic, natural, and functional foods and beverages. The robust e-commerce infrastructure and high digital penetration also play a significant role, as consumers frequently turn to online channels for their CPG purchases. This shift is driving companies to enhance their omnichannel strategies and invest in direct-to-consumer models.

U.S. Consumer Packaged Goods Market Trends

In North America, the U.S. holds the largest revenue share due to its large and diverse consumer base. Key trends in the country include a growing demand for sustainable and ethically sourced products, with consumers often willing to pay more for environmentally friendly packaging and production. There is also a notable rise in demand for health-conscious items, including plant-based foods and personalized nutrition solutions. The rapid growth of e-commerce, as highlighted by the U.S. Census Bureau's consistent reporting on increasing online retail sales, continues to reshape distribution strategies, pushing companies to innovate in supply chain and last-mile delivery to meet consumer expectations for speed and convenience.

Europe Consumer Packaged Goods Market Overview

The consumer packaged goods market in Europe is heavily influenced by a strong focus on sustainability, strict regulations concerning product safety and environmental impact, and a diverse consumer landscape. Consumers across the region are increasingly eco-conscious, leading to a significant demand for products with reduced environmental footprints, including those with recyclable or biodegradable packaging. This trend is pushing CPG companies to innovate in their product formulations and packaging solutions. The adoption of e-commerce is also steadily growing, with consumers increasingly comfortable purchasing a wide range of CPG items online, driving digital transformation across the region's retail sector.

Germany Consumer Packaged Goods Market Insights

The CPG market in Germany exhibits specific trends and shows a strong preference for high-quality, often organic, and locally sourced products, reflecting a deep-seated appreciation for freshness and transparency. The market also sees a notable emphasis on health and wellness, with a consistent demand for nutritious and functional food and beverage options. Furthermore, the robust retail infrastructure, including well-established supermarket chains and a growing online retail presence, ensures efficient distribution of CPG products throughout the country.

Asia Pacific Consumer Packaged Goods Market Overview

The Asia Pacific consumer packaged goods (CPG) market is experiencing rapid growth, driven by a large and expanding population, rising disposable incomes, and increasing urbanization across many countries in the region. This dynamic environment presents significant opportunities for CPG companies, as a growing middle class seeks a wider variety of modern, convenient, and aspirational products. The region is also at the forefront of digital adoption, with mobile commerce and social media influencing purchasing decisions significantly. This leads to a strong emphasis on localized product offerings and tailored marketing strategies to cater to the diverse preferences of consumers. The China consumer packaged goods market stands out as a critical market in Asia Pacific, characterized by its immense consumer base and sophisticated digital ecosystem. The country's CPG sector is heavily impacted by the rapid adoption of e-commerce, including live-streaming commerce, which has fundamentally reshaped how products are marketed and sold. Chinese consumers also show a strong interest in health, wellness, and premiumization, leading to increased demand for high-quality imported goods and innovative domestic brands that offer unique benefits. The blend of traditional retail with advanced digital platforms defines the competitive landscape in the country.

Key Players and Competitive Insights

The consumer packaged goods market is highly competitive, characterized by a large number of players vying for consumer attention and shelf space. Companies constantly innovate with new products, engage in extensive marketing efforts, and optimize their supply chains to expand their business.

A few prominent companies in the industry include Nestlé S.A.; PepsiCo; Procter & Gamble; Unilever N.V.; The Coca-Cola Company; Mondelez International, Inc.; Danone S.A.; Colgate-Palmolive Company; General Mills, Inc.; and Kraft Heinz Company.

Key Players

- Colgate-Palmolive Company

- Danone S.A.

- General Mills, Inc.

- Kraft Heinz Company

- Mondelez International, Inc.

- Nestlé S.A.

- PepsiCo

- Procter & Gamble

- The Coca-Cola Company

- Unilever N.V.

Industry Developments

May 2025: The Coca-Cola company launched Sprite + Tea, which combines Sprite's crisp lemon-lime refreshment with the smooth, classic flavor of tea. The packaging creatively blends Sprite’s signature green with gold and amber accents, featuring dynamic splash graphics and a youthful font that stands out from traditional tea beverages.

February 2025: Colgate-Palmolive’s Hill’s Pet Nutrition division acquired Prime100, an Australian fresh pet food brand, to enter the fresh pet food category and strengthen its presence in Australia. The transaction is expected to close by Q2 2025, financed by debt and cash, pending regulatory approval.

Consumer Packaged Goods Market Segmentation

By Packaging Material Outlook (Revenue – USD Billion, 2020–2034)

- Plastic

- Metal

- Paperboard

- Glass

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Food & Beverages

- Cosmetics & Personal Care Products

- Household Care Products

- Health Care Products

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Supermarkets/Hypermarkets

- Convenience Stores

- e-Commerce

- Others

By Packaging Type Outlook (Revenue – USD Billion, 2020–2034)

- Rigid

- Flexible

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Consumer Packaged Goods Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2,526.99 billion |

|

Market Size in 2025 |

USD 2,619.22 billion |

|

Revenue Forecast by 2034 |

USD 3,695.81 billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2,526.99 billion in 2024 and is projected to grow to USD 3,695.81 billion by 2034.

The global market is projected to register a CAGR of 3.9% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market are Nestlé S.A.; PepsiCo; Procter & Gamble; Unilever N.V.; The Coca-Cola Company; Mondelez International, Inc.; Danone S.A.; Colgate-Palmolive Company; General Mills, Inc.; and Kraft Heinz Company.

The plastic segment accounted for the largest share of the market in 2024.

The cosmetics and personal care products segment is expected to witness the fastest growth during the forecast period.