Deception Technology Market Share, Size, Trends, Industry Analysis Report

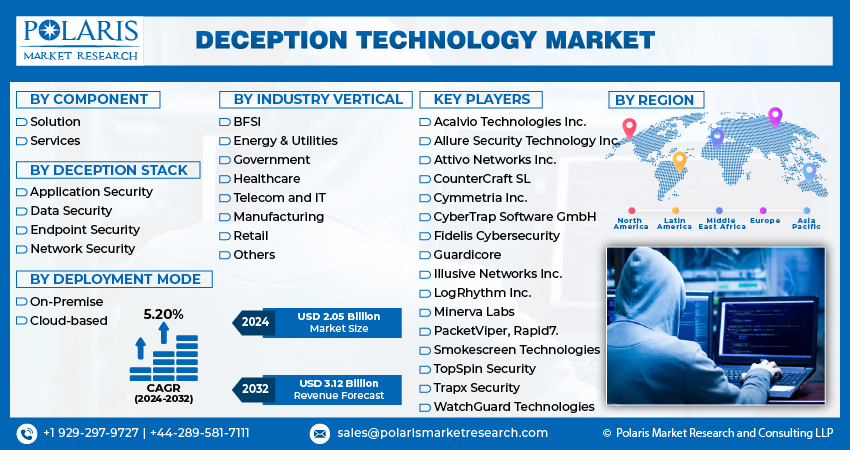

By Component (Solution and Services); By Deception Stack; By Deployment Mode; By Industry Vertical; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3753

- Base Year: 2023

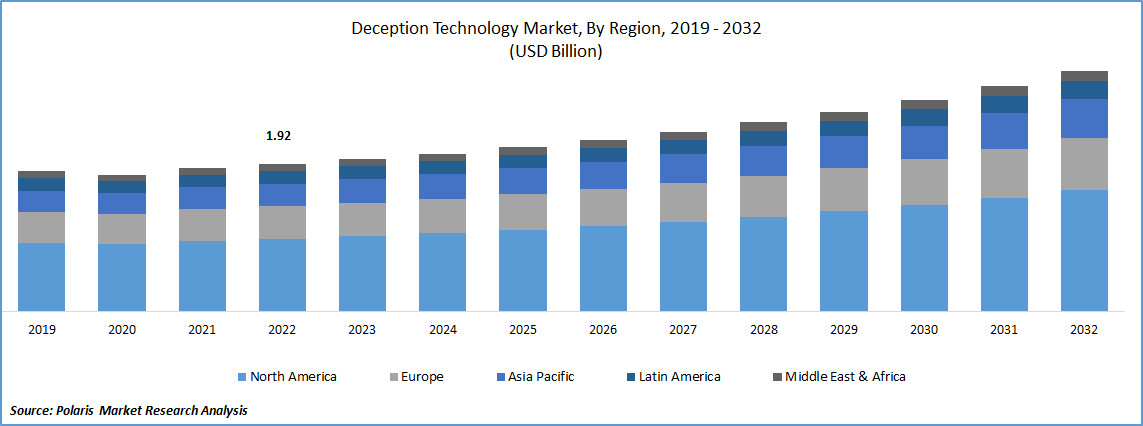

- Historical Data: 2019-2022

Report Outlook

The global deception technology market was valued at USD 1.98 billion in 2023 and is expected to grow at a CAGR of 5.20% during the forecast period.

To Understand More About this Research: Request a Free Sample Report

The exponential growth of advanced persistent threat and zero-day attacks and surging need for effective and efficient solutions for early detection of cybercriminals and attackers coupled with the rapidly growing adoption of BYOD within several large enterprises, are major factors propelling the market growth. In addition, introduction to deception technology integrated with artificial intelligence and machine learning, which ensures the dynamicity of deception techniques and reduce the operational overheads, are likely to generate lucrative growth opportunities for the market.

- For instance, in April 2022, Acalvio Technologies, introduced new FedRamp Ready ShadowPlex platform has been successfully deployed with the Department of Homeland Security Cybersecurity and Infrastructure Security Agency. The newly developed platform leverages novel AI capabilities by making deception autonomous and effective.

Moreover, deception technology solutions are now being integrated with threat intelligence platforms to enhance their effectiveness, by leveraging threat intelligence feeds and sharing insights across different security tools, allowing organizations to improve the identification and response to threats.

Product innovations, technological advancements, and the introduction of regulatory policies have been detailed in the report to enable businesses to make more informed decisions. Furthermore, the impact of the COVID-19 pandemic on the deception technology market demand has been examined in the study. The report is a must-read for anyone looking to develop effective strategies and stay ahead of the curve.

The outbreak of the COVID-19 pandemic has positively impacted the growth of the deception technology market. The rapid spread of the deadly coronavirus across the globe resulted in drastic shift towards the online and remote working, which created lucrative opportunities for the cybercriminals. Since, with the increasing risk of cyber threats, many organizations have significantly recognized the importance of investing in advanced and robust cybersecurity measures in order to protect their data and network.

Industry Dynamics

Growth Drivers

Increasing number of cybersecurity attacks

With the significant growth in the number of cybersecurity attacks against military organizations, state and local government, and large business enterprises and increasing need for safeguarding critical information coupled with the surging investments by major government agencies towards preventing cybercrime, the demand and adoption of these technology solutions have drastically increased.

- For instance, according to a report published in 2022, the US government announced the budget of USD 5.8 trillion that includes USD 10.9 billion in cybersecurity funding, with an increase of 11% from the previous year. Around USD 2.5 billion will be provided to cybersecurity and infrastructure security agency with an increased of USD 500 million from previous year.

Furthermore, the rising proliferation of zero-trust architecture security services across the world and rapid development of several new emerging technologies, and surging trend for adopting new advanced solutions among major IT organizations, are further likely to propel the global market growth globally.

Report Segmentation

The market is primarily segmented based on component, deception stack, deployment mode, industry vertical, and region.

|

By Component |

By Deception Stack |

By Deployment Mode |

By Industry Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

Solution segment accounted for the largest market share in 2022

The solution segment accounted for major market share, that is mainly accelerated to increased rate of deployment of these solutions in manufacturing, BFSI, government, and many other industry verticals along with its ability to provide organizations with proactive and automated approach to cybersecurity, by creating a network of deceptive traps and decoys.

The services segment is likely to grow at substantial growth rate during the projected period, that is mainly driven by growing proliferation for deception technology services across the globe, as it provides a proactive approach to identifying and mitigating threats, acting as a crucial layer of defense in an ever-evolving threat landscape.

By Deception Stack Analysis

Network security segment is likely to gain highest growth during forecast period

The network security segment is projected to account for highest growth rate over the next coming years, which is highly attributable to its numerous beneficial characteristics and features like help in generating an illusion of larger attack surface and effectively diverting the attackers from several critical assets and offers early detection capabilities. Along with this, the ability of network security to efficiently integrate with existing security infrastructure of companies including SIEM, threat intelligent platforms, security orchestration tools.

The data security segment captures the largest segment market share in 2022, which is significantly driven by increasing need to keep crucial and important data safe from ever-rising sophistication of cyber threats and also assist in identifying insider threats by tracking suspicious or unauthorized activities.

By Deployment Mode Analysis

Cloud-based segment held the significant market share in 2022

The cloud-based segment held the significant market share in terms of revenue in 2022, on account of continuously rising popularity of these solutions among small and large enterprises along with its cost-effectiveness and less expenditure on installation and maintenance compared to other solutions available in the market. Additionally, these types of deception solutions are generally easier and faster to deploy compared to on-premises alternatives, which makes it attractive to organizations with limited IT resources and looking for rapid implementation.

The on-premises segment is projected to exhibit a steady growth rate during the anticipated period, mainly due to its ability to provide organizations with the ability to easily customize and tailor the deception technology and environment in order to meet their specific requirements and needs in best possible manner.

By Industry Vertical Analysis

Manufacturing segment is anticipated to witness highest growth during forecast period

The manufacturing segment is projected to grow at steady rate, owing to constantly rising adoption of intellectual property and industry 4.0 across the globe, which enable manufacturers to easily connect their range of smart devices to the organization’s network and reduce the complexity of their manufacturing processes. It further helps manufacturers protecting manufacturing site endpoints, infrastructure, and IoT devices from various external attackers, that is likely to bode well for the segment market growth in the near future.

Regional Insights

North America region dominated the global market in 2022

North America held the largest share. The regional market growth can be largely accelerated to rapidly surging development and adoption of different types of emerging technologies and robust presence of major market players particularly in developed countries like US and Canada. In addition, significant rise in the number of cyberattacks on businesses, critical infrastructure, and government institutions, leading to higher demand for innovated defense systems to combat these sophisticated threats, and have paved the way for huge growth opportunities.

- For instance, according to our findings, 1 in every 2 internet users in North America had their account breached in the year of 2021 and the USA is country with second highest number of victims per million internet users in 2022. Additionally, around 53.35 million United States citizens were affected due to cyber crime in the first quarter of 2022.

The Asia Pacific region is anticipated to emerge as fastest growing region with healthy CAGR over the forecast period, on account of rising prevalence for adopting bring your own device technologies among various organizations and rising focus of major businesses across the region towards market expansion mainly in developing economies like China, India, Indonesia, and Singapore.

Key Market Players & Competitive Insights

The deception technology market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Acalvio Technologies Inc.

- Allure Security Technology Inc.

- Attivo Networks Inc.

- CounterCraft SL

- Cymmetria Inc.

- CyberTrap Software GmbH

- Fidelis Cybersecurity

- Guardicore

- Illusive Networks Inc.

- LogRhythm Inc.

- Minerva Labs

- PacketViper

- Rapid7.

- Smokescreen Technologies

- TopSpin Security

- Trapx Security

- WatchGuard Technologies

Recent Developments

- In January 2022, Honeywell, announced the expansion of its OT Cybersecurity Portfolio with the launch of the “Active Defense and Deception Technology Solution”, that is mainly designed to detect known and unknown attacks across the whole operational technology environments. The new platform is powered by the Acalvio.

- In May 2022, CounterCraft, announced the launch of its new service, that provide deception-powered threat information & effectively revolutionize the ability to generate specific & adversary based threat. The newly developed service brings the power of deception technology in order to efficiently gather real-time and accurate threat.

Deception Technology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.05 billion |

|

Revenue forecast in 2032 |

USD 3.12 billion |

|

CAGR |

5.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Deception Stack, By Deployment Mode, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Attivo Networks Inc., Illusive Networks Inc., Guardicore, PacketViper, Allure Security Technology Inc., CyberTrap Software GmbH, Fidelis Cybersecurity, Trapx Security, WatchGuard Technologies, Smokescreen Technologies, TopSpin Security, Minerva Labs, LogRhythm Inc., CounterCraft SL, Cymmetria Inc., Acalvio Technologies Inc., and Rapid7. |

The deception technology market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

FAQ's

The global deception technology market size is expected to reach USD 3.12 billion by 2032.

Key players in the Deception Technology Market are WatchGuard Technologies, Fidelis Cybersecurity, Trapx Security, Illusive Networks.

North America contribute notably towards the global Deception Technology Market.

The global deception technology market is expected to grow at a CAGR of 5.2% during the forecast period.

The Deception Technology Market report covering key segments are component, deception stack, deployment mode, industry vertical, and region.