Delivery Drone Market Share, Size, Trends, Industry Analysis Report

: By Drone Type (Rotary Blade, Fixed Wing, and Hybrid), Application, Component, Payload, Duration, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 128

- Format: PDF

- Report ID: PM1658

- Base Year: 2024

- Historical Data: 2020-2023

Delivery Drone Market Overview

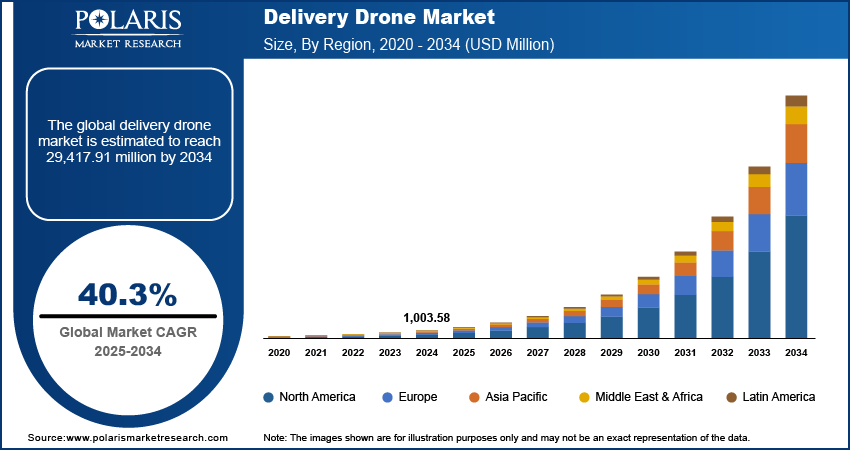

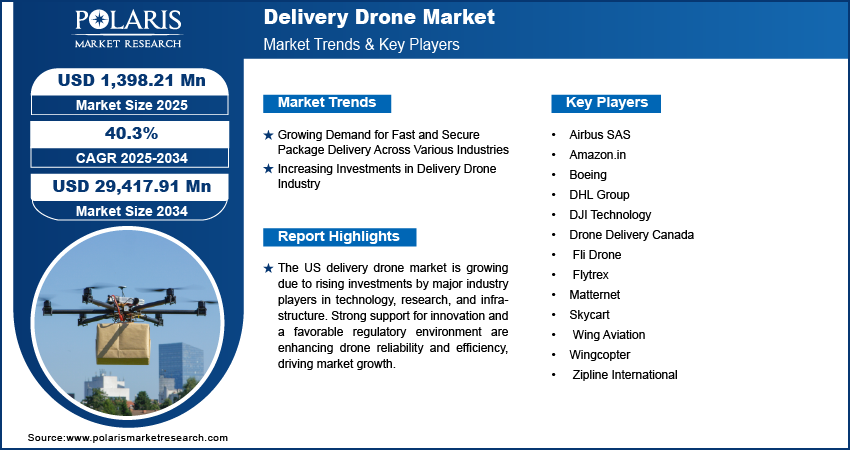

The delivery drone market size was valued at USD 1,003.58 million in 2024. The market is projected to grow from USD 1,398.21 million in 2025 to USD 29,417.91 million by 2034, exhibiting a CAGR of 40.3% during 2025–2034.

A delivery drone is an unmanned aerial vehicle designed to transport goods to specified locations. It improves logistics efficiency through advanced navigation, automation, and real-time tracking across various sectors.

The growing adoption of e-commerce is driving the delivery drone market growth. Online shopping is becoming increasingly popular, due to which consumers demand faster and more efficient delivery options. The need for contactless, timely, and sustainable delivery methods has led to greater investments in delivery drone technology. The drones offer significant advantages, including reduced delivery times and lower operational costs, aligning with the expectations of businesses and consumers. Therefore, the adoption of e-commerce is driving the delivery drone market demand.

To Understand More About this Research: Request a Free Sample Report

The delivery drone market value is expected to grow significantly due to technological advancement in delivery drone systems. The delivery drone market value is expected to grow significantly due to technological advancement in drone systems. Companies are integrating advanced technology, such as artificial intelligence, into drone systems for faster navigation and management and to lower operational costs, due to which the demand for advanced delivery drones is expected to rise. For instance, in September 2024, Arrive AI launched fully automated delivery drones integrated with artificial intelligence, which showcases an increased number of companies integrating advanced technologies. Therefore, the ongoing technological advancements in delivery drones are anticipated to drive the growth of the delivery drone market.

Delivery Drone Market Driver Analysis

Growing Demand for Fast and Secure Package Delivery Across Various Industries

In the healthcare sector, timely delivery of medical supplies, medicines, and even vaccines is critical. Drones can deliver these essential items quickly and efficiently, even in remote or hard-to-reach areas. Industries are prioritizing speed and reliability, for which drones offer a practical solution to meet these demands. In addition, industries such as retail and food delivery are benefiting from delivery drone technology to ensure faster deliveries to customers. Drones can reduce delivery times significantly. The ability to deliver goods quickly and directly, without the need for traditional transportation, is particularly valuable in situations where speed is a matter of urgency, such as emergency medical deliveries. Therefore, the growing demand for faster delivery across various industries is driving the delivery drone market expansion.

Increasing Investments in Delivery Drone Industry

Companies and investors are recognizing the potential of drones for efficient and cost-effective delivery services. Thus, they are spending more money on research, development, and innovation. For instance, according to the UAV Commercial, in 2021, the drone industry received funding of USD 3,540 million, showcasing an increase in funding in the industry. This funding allows for advancements in drone technology, improving their speed, safety, and ability to carry heavier loads. The ongoing investments help accelerate the adoption of drones, making them a more viable and competitive option for delivery logistics. Therefore, increased investments in the drone industry propel the delivery drone market expansion.

Delivery Drone Market Segment Analysis

Delivery Drone Market Assessment by Drone Type Outlook

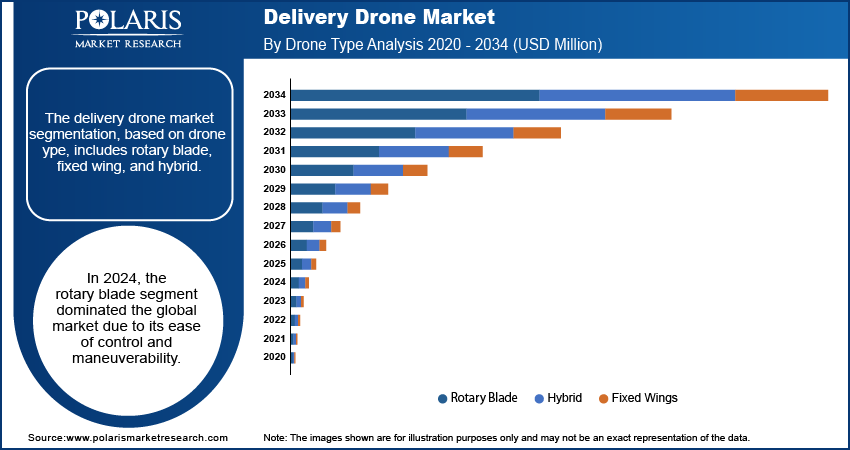

The delivery drone market segmentation, based on drone type, includes rotary blade, fixed wing, and hybrid. In 2024, the rotary blade segment dominated the global market due to its ease of control and maneuverability. These drones, commonly known as multirotors, can take off and land vertically, making them ideal for navigating tight spaces and urban environments. Their simple design and ability to hover in place give them a clear advantage over other drone types, allowing for more precise and flexible deliveries. Consequently, rotary blade drones are widely preferred for short-distance deliveries and applications that require high precision, contributing to their dominance in the global market.

The hybrid segment is expected to experience the highest growth rate due to its unique advantages. Hybrid drones utilize multiple power sources for their flight systems. These drones are increasingly popular for effectively managing long-distance and heavy-duty deliveries, particularly in applications such as agriculture and defense. Their ability to fly for extended periods makes hybrid drones more efficient compared to traditional aircraft, thereby contributing to the segment growth.

Delivery Drone Market Evaluation by Application Outlook

The delivery drone market segmentation, based on application, includes e-commerce, logistics, quick service restaurants, retail, and healthcare. The e-commerce segment is expected to experience significant revenue growth during the forecast period. This is due to the increasing adoption of drones in the public sector and the retail industry. Drones are revolutionizing storage and delivery processes in e-commerce, significantly improving operational efficiency and meeting the demand for fast delivery, thereby driving the e-commerce segment growth in the global market.

Delivery Drone Market Regional Analysis

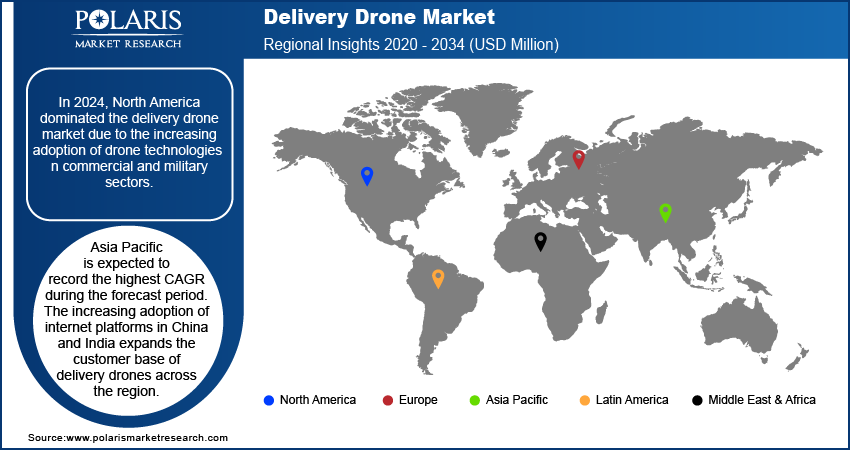

By region, the study provides the delivery drone market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the delivery drone market share in 2024 due to the increasing adoption of drone technologies in the commercial and military sectors. Drones are being used to deliver goods, especially in e-commerce, and to transport medical supplies, to improve efficiency in critical situations. The region’s strong investments in drone innovation, along with supportive regulations, have accelerated the use of delivery drones for these applications. This, in turn, is boosting the delivery drone market expansion in North America.

The US delivery drone market is experiencing significant growth, driven by the presence of major players in the industry. Leading companies are investing heavily in drone technology, research, and infrastructure, pushing the development of innovative delivery solutions. This has helped make drones more reliable and efficient for delivering goods. The country’s strong support for technology and favorable regulatory environment is further boosting the delivery drone market growth in the US.

Asia Pacific is expected to record the highest CAGR during the forecast period, driven by emerging economies such as China and India. These countries are increasingly adopting internet-based platforms to reach a large customer base. This market expansion is likely to lead to a more robust regulatory framework, especially in developed nations, where governments are actively creating new regulations for commercial drone operations. Additionally, many start-ups are exploring innovative drone applications and focusing on improving safety measures for these devices, positively impacting the delivery drone market growth in Asia Pacific.

Delivery Drone Market – Key Players and Competitive Analysis Report

The delivery drone market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the delivery drone market are Airbus SAS, Amazon, Boeing, DHL Group, DJI Technology, Drone Delivery Canada, Fli Drone, Flytrex, Matternet, Skycart, Wing Aviation, Wingcopter, and Zipline International.

The Boeing Company, founded in 1916, is an American multinational corporation headquartered in Arlington, Virginia. It is one of the largest aerospace manufacturers worldwide, operating in the design, production, and sale of a wide range of aerospace products, including commercial airplanes, military aircraft, rotorcraft, rockets, satellites, and missiles. Boeing operates through three main divisions—Boeing Commercial Airplanes (BCA), Boeing Defense, Space & Security (BDS), and Boeing Global Services (BGS). The BCA division focuses on the production of commercial jetliners, with key models such as the 737, 767, 777, and 787 families. This division has delivered over 10,000 aircraft globally. BDS is responsible for military aircraft and space systems, offering products such as the KC-46 aerial refueling aircraft and the AH-64 Apache helicopter. This division serves military and commercial sectors with a diverse portfolio that incorporates advanced technologies. BGS provides aftermarket support services for commercial and defense customers. This division plays a critical role in maintaining and upgrading various aircraft types. Boeing's operations span more than 150 countries, supported by a global supplier network that facilitates economic engagement and operational capabilities.

Amazon.com, Inc., founded in 1994 and headquartered in Seattle, Washington, is a major entity in the e-commerce and cloud computing sectors. The company has expanded its operations to include various segments, such as Amazon Web Services (AWS), which provides cloud computing solutions, and subscription services such as Amazon Prime. Its product range includes electronics, apparel, groceries, and digital media. Amazon operates in multiple regions, including North America, Europe, Asia Pacific, and Latin America. The US is its largest market, followed by Germany and the UK. The company has established localized websites and fulfillment centers worldwide to enhance delivery efficiency. Amazon's delivery drone program is known as Prime Air. In 2023, Amazon began testing drone deliveries in selected regions of Italy, the UK, and the US, aiming to deliver packages weighing up to five pounds within an hour. This initiative responds to the growing consumer demand for quicker delivery options in urban areas.

Key Companies in Delivery Drone Market

- Airbus SAS

- Amazon

- Boeing

- DHL Group

- DJI Technology

- Drone Delivery Canada

- Fli Drone

- Flytrex

- Matternet

- Skycart

- Wing Aviation

- Wingcopter

- Zipline International

Delivery Drone Industry Developments

May 2024: Drone Delivery Canada and Volatus Aerospace Corp. announced a merger of equals, aiming to become a global leader in drone technology and services. This strategic alliance is expected to expand market reach, drive innovation, and enhance capabilities in the rapidly evolving drone industry, setting both companies up for significant growth.

May 2021: Skycart launched the Nimbus, the world's first four-drop delivery drone. According to the company, this innovative drone is capable of delivering to four locations in one mission, with a maximum speed of 80 mph, a range of 100 miles, and a payload capacity of 15 kg. The Nimbus enhances delivery efficiency, particularly for emergency medical supplies, while reducing traffic and emissions.

Delivery Drone Market Segmentation

By Drone Type (Revenue – USD Million, 2020–2034)

- Rotary Blade

- Fixed Wing

- Hybrid

By Application (Revenue – USD Million, 2020–2034)

- E-commerce

- Quick Service Restaurants

- Retail

- Healthcare

- Others

By Component (Revenue – USD Million, 2020–2034)

- Airframe

- Propulsion System

- Controller System

- Camera & Sensors

- Others

By Payload (Revenue – USD Million, 2020–2034)

- Less Than 2 Kg

- 2 Kg to 5 Kg

- More Than 5 Kg

By Duration (Revenue – USD Million, 2020–2034)

- Less Than 30 Minutes

- More Than 30 Minutes

By Region (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Delivery Drone Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,003.58 million |

|

Market Size Value in 2025 |

USD 1,398.21 million |

|

Revenue Forecast by 2034 |

USD 29,417.91 million |

|

CAGR |

40.3% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The delivery drone market size was valued at USD 1,003.58 million in 2024 and is projected to grow to USD 29,417.91 million by 2034.

The global market is projected to register a CAGR of 40.3% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Airbus SAS, Amazon, Boeing, DHL Group, DJI Technology, Drone Delivery Canada, Fli Drone, Flytrex, Matternet, Skycart, Wing Aviation, Wingcopter, and Zipline International.

The rotary blade segment dominated the global market in 2024 due to its ease of control and maneuverability.

The e-commerce segment is expected to experience significant revenue growth during the forecast period due to the increasing adoption of drones in delivery.