Dental Inlays & Onlays Market Share, Size, Trends, Industry Analysis Report

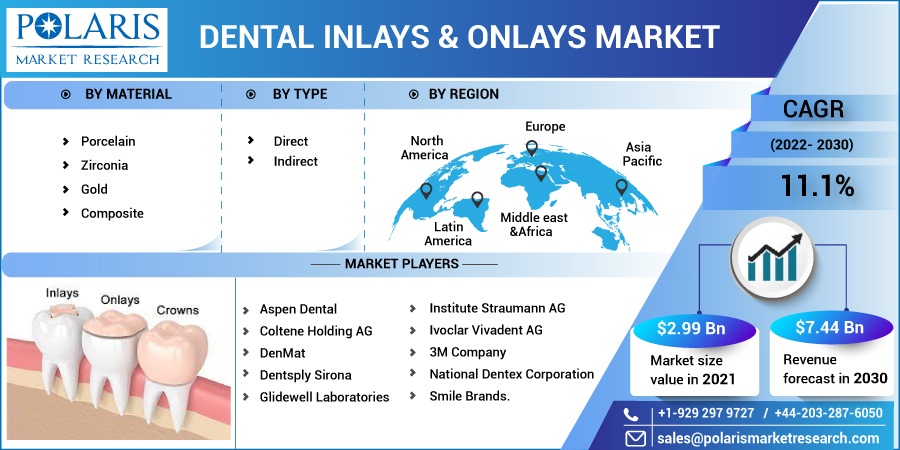

By Material (Porcelain, Zirconia, Gold, Composite); By Type (Direct, Indirect); By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 118

- Format: PDF

- Report ID: PM2581

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

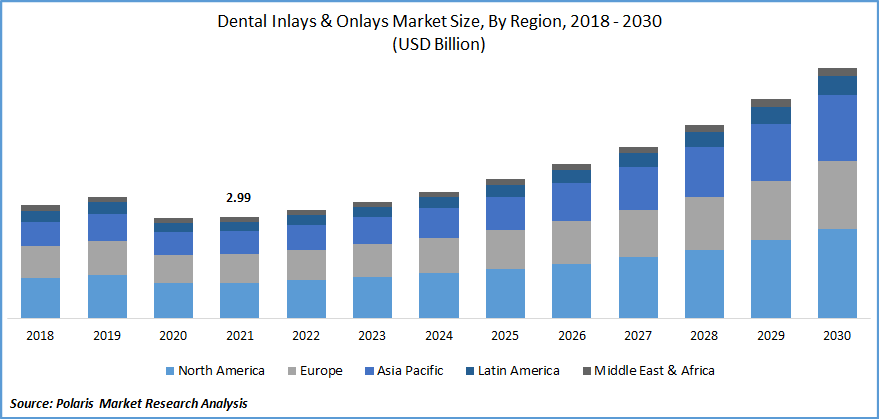

The dental inlays & onlays market was valued at USD 2.99 billion in 2021 and is expected to grow at a CAGR of 11.1% during the forecast period. Inlays and onlays are dental renewals that many dentists use for dental recovery. These renewals are essential from both the aesthetic and practical point of view. It is often used in place of traditional filling to treat tooth decay or similar structural damage.

Know more about this report: Request for sample pages

The main difference between inlays and onlays is that inlays are placed inside the cavity in the tooth, and onlays are placed at the tip or replace the tips of the tooth. They are used in molars or premolars if the tooth damages are more. It aids in restoring the ability to chew and bite food during meals. It also strengthens the weak tooth and prevents further damage. As they are alternatives to a crown, many patients prefer fitting it, which has led to the growth of the dental inlays & onlays market.

Increased auxiliary support, supports remaining tooth structure, wear resistance, biocompatibility, good tissue response, more precise control of contours and contact, and reduced polymerization shrinkage are some applications driving the market growth. Dental inlays and onlays have enhanced physical features to traditional composite fillings for posterior teeth, less microleakage, a strong and durable nature, and minimal post-operative sensitivity to direct composite fillings, which is also complementing market growth.

As inlays and onlays are well-fitted at all the edges and with minimal preparation, teeth can be easily cleaned with full coverage restorative alternatives such as a crown. Composite fillings can diminish during the curing process, whereas gold or porcelain inlays or onlays do not shrink faster.

The COVID-19 pandemic has negatively impacted the dental inlays & onlays industry. Lockdowns have restricted the supply chain of products, reflecting a decrease in sales and production, hampering the market growth. The pandemic resulted in a fall in the number of patient visits to dental clinics, leading to decreased utilization of facilities.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Growing advancements in restoration and an increase in consumer awareness regarding inlays and onlays is driving the market growth. Additionally, a growing number of dental practices, including group and corporate procedures, and an increase in the number of dental practitioners also complement the revenue growth.

Increasing awareness regarding a surge in demand for cosmetic dentistry among the young population, the high adoption rate, and the increase in the prevalence of diseases are crucial aspects leading the market growth. Also, the rise in the number of clinics across the globe has increased the sales and production of dental inlays and onlays.

Inlays and onlays are made up of modern CAD-CAM technology, which combines advanced computer software, a milling unit, and a 3D scanner, which allows precise fitting. Also, it does not contain any allergic material, so it can be safely used. Inlays and onlays are more conventional than crowns, appear aesthetically perfect, durable, and give prolonged tooth life, increasing patient compliance and boosting the growth of inlays and onlays.

Report Segmentation

The market is primarily segmented based on material, type, and region.

|

By Material |

By Type |

By Region |

|

|

|

Know more about this report: Request for sample pages

Porcelain accounted for the largest market share in 2021

Based on material, the dental inlays & onlays report is categorized into porcelain, zirconia, gold, and composite, where porcelain accounted most significant market share in 2021. Porcelain-made inlays and onlays match tooth color and look natural; as a result, the demand for porcelain material is high.

This material does not produce any reaction and is more cost-effective, durable, and long-lasting than other materials. It's preferred mostly when the damaged or broken part of teeth is too large for a conventional filling. As it is naturally translucent, the material is popular among patients. Additionally, porcelain inlays and onlays feature more detrimental stress at the occlusal surface and protect against debonding at the dentin-restoration surface.

Direct type is expected to grow at the highest rate during the forecast period

The market has been segmented into direct and indirect based on types of inlays and onlays. The direct type segment accounted for the largest market share in 2021. It is also estimated to be the fastest-growing segment during the forecast period as it requires only one visit and is an easy process for a patient to go through.

Direct inlays and onlays have a fixed surface that matches the structure of the present enamel to aid it in staying in place when bonded with cement or adhesive. The rise in patient preference for direct type inlays and onlays and the surge in the adoption of minimum time-consuming dental procedures are driving market growth.

Direct inlays and onlays are made within a set of dental clinics by professionals. Additionally, direct inlays and onlays need minimum preparation time, which is the better option for natural teeth. With these applications, there is an increase in the dental inlays & onlays market.

North America is projected to grow at the highest growth rate during the forecast period

The market in North America is estimated to increase at the fastest rate in the dental inlays & onlays market during the forecast period due to a growing surge in the number of procedures in the region, an increase in public awareness regarding oral health, and increase in the prevalence of diseases.

Additionally, an increase in expenditure on teeth care, an increase in demand for technologically advanced cosmetic dentistry procedures, the presence of well-built healthcare infrastructure, the availability of skilled dental professionals, and high personal disposable income are the factors driving the market growth in the region.

Competitive Insight

Some of the major players operating in the global market include Aspen Dental, Coltene Holding AG, DenMat, Dentsply Sirona, Glidewell Laboratories, Institute Straumann AG, Ivoclar Vivadent AG, 3M Company, National Dentex Corporation, Smile Brands.

Dental Inlays & Onlays Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.99 billion |

|

Revenue forecast in 2030 |

USD 7.44 billion |

|

CAGR |

11.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Material, By Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aspen Dental, Coltene Holding AG, DenMat, Dentsply Sirona, Glidewell Laboratories, Institute Straumann AG, Ivoclar Vivadent AG, 3M Company, National Dentex Corporation, Smile Brands. |