Dental Practice Management Software Market Share, Size, Trends, Industry Analysis Report

By Deployment Mode (On-premise, Web-based, Cloud-based); By Application; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 119

- Format: PDF

- Report ID: PM4927

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

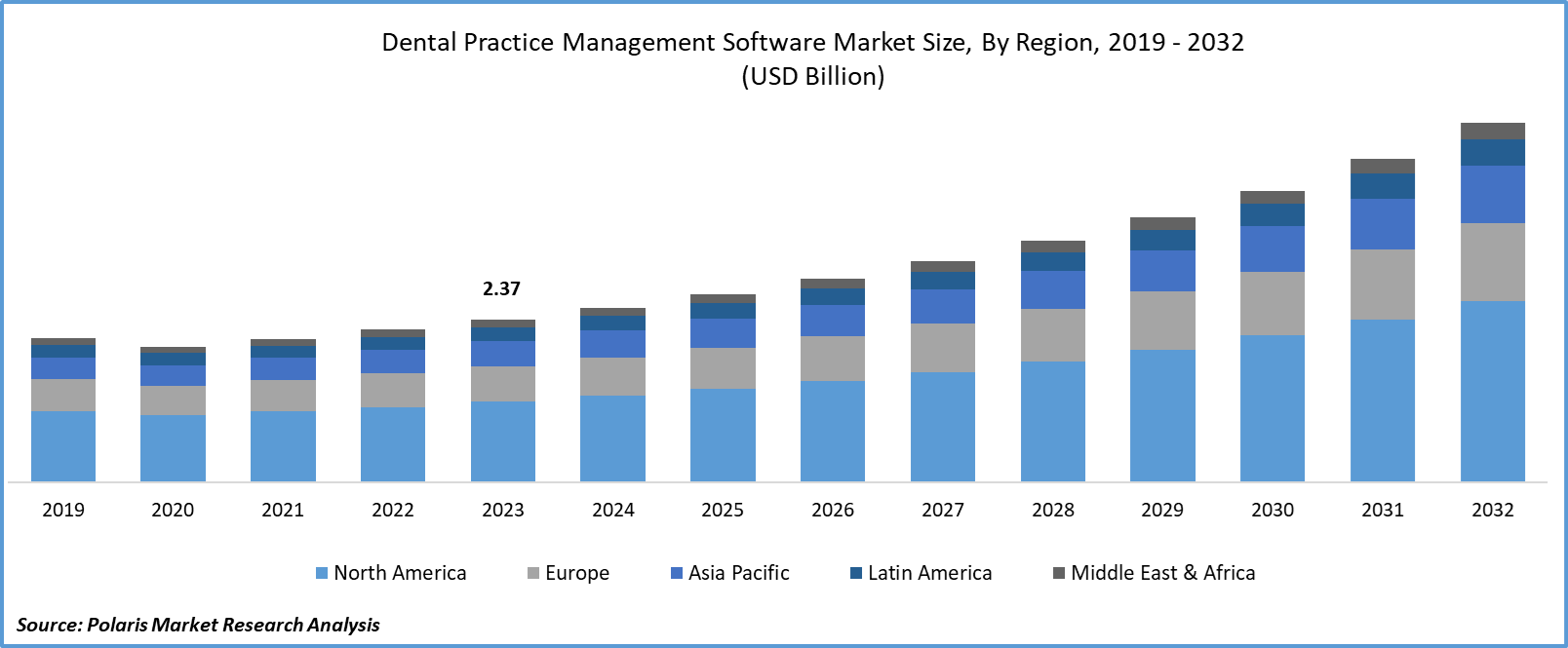

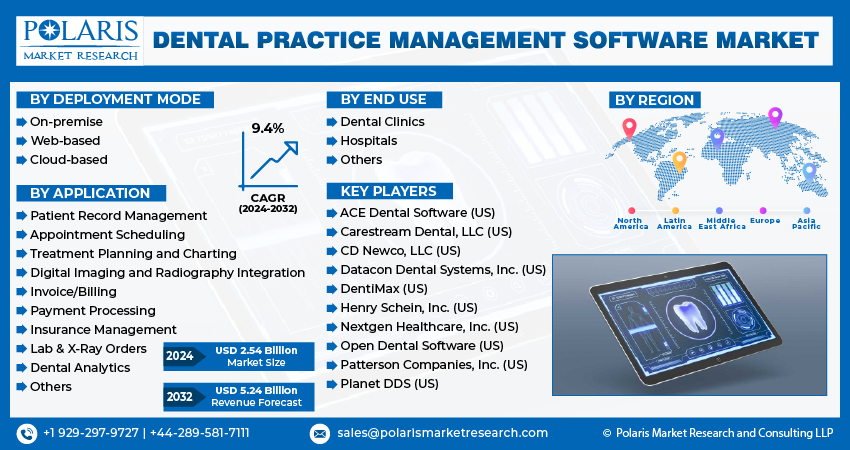

Dental Practice Management Software Market size was valued at USD 2.37 billion in 2023. The market is anticipated to grow from USD 2.54 billion in 2024 to USD 5.24 billion by 2032, exhibiting the CAGR of 9.4% during the forecast period.

Market Overview

The rising number of people opting for preventive dental care is driving the growth of appointments among dental clinics. This is enforcing hospitals and clinics to adopt dental practice management software due to its potential to improve productivity and the functioning of their offices. The digital integration of dental imaging and radiography is becoming crucial for dentists to understand patients’ health conditions in less time. In addition, the growing strategic planning among the market players is boosting the development of effective practice management software in the dental care.

For instance, in August 2023, Planet DDS, a cloud-based dental provider, entered into a partnership agreement with Pearl to extend the use of artificial intelligence for dental imaging.

To Understand More About this Research: Request a Free Sample Report

Furthermore, technological evolution is altering the way hospitals, companies, and other institutions work globally due to its ability to promote operational performance and limit errors that can be caused by humans. Moreover, rising investments in the research and development of user-friendly practice management software are expected to create new demand potential for the global market. For instance, in November 2023, Asprodental, a dental practice management software provider, raised USD 1.8 million in seed funding.

Growth Drivers

Rise in Cloud-Based Deployments

There are increased investments in the cloud-based deployments in the practice management for remote dental consultations, coupled with recent service upgrades. This assists dental staff in accessing the patient's health condition, assigning appointments, remainders, and payment processes instantly from anywhere with internet connectivity. Furthermore, it reduces the maintenance costs of data storage, breaches, and security concerns in dental offices.

The rising product upgrades to enhance their software performance by market players in cloud-based solutions are further boosting their use in the marketplace. For instance, in January 2024, Planet DDS introduced Cloud 9 Pay to improve the convenience of receiving payment from patients for orthodontic practices.

Increase Prevalence of Dental Diseases

The significant uptick in the number of people suffering from dental diseases is optimally influencing the demand for dental practice management software globally. Changing eating patterns and lower oral hygiene are leading to oral cancer, edentulism, and periodontal diseases. According to the World Health Organization, around 2 billion people witness cavities in their permanent teeth, while 514 million children suffer from cavities in their primary teeth.

Restraining Factors

The Lower Interest in Opting for New Technologies is Likely to Impede Market Growth

The resistance to adopt new technologies by the dental professionals is one of main factor lagging the adoption of dental practice management software in the world. The limited knowledge of the operation process and satisfaction with the existing hospital performance is expected to restrain market growth in the long run.

Report Segmentation

The market is primarily segmented based on deployment mode, application, end use, and region.

|

By Deployment Mode |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Deployment Mode Analysis

Web-Based Segment is Expected to Witness the Highest Growth During the Forecast Period

The web-based segment will grow rapidly, mainly driven by its potential to streamline office operations through the internet browser rather than the installation of software. The extensive storage capacity, which does not require to purchase memory for the increased patient appointments, and potential to streamline updates in dental practice are fueling its use around the world.

By Application Analysis

Insurance Management Segment Accounted for the Largest Market Share in 2023

The insurance management segment held the largest share. The increasing number of people consuming dental insurance policies to cut down on their health expenditure is encouraging health centres to focus on the development of transparent insurance claim procedures. For instance, in September 2023, SimplyHealth, an insurance provider announced an increase in income by 8% from 2022 due to the increasing demand from corporate and dental plan consumers. The capability of dental practice management software in helping patients in claim policy seamlessly is contributing to its adoption.

By End Use Analysis

Dental Clinics Segment Held the Significant Market Revenue Share in 2023

The dental clinics segment held the largest share, due to rise in the number of people witnessing oral health issues. This is driving the establishment of new dental clinics in the global market. For instance, in June 2022, Apollo Dental introduced its 110th dental clinic in Hyderabad, India. As more clinics evolve, there will be a significant proportion of firms utilizing dental practice management software in the coming years.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North America region held the dominant share. This is due to the presence of established healthcare providers in the region, which is driving the utility of new technologies in hospitals. The increasing investments by the dental care providers is anticipated to further propel the market growth in the study period. For instance, in November 2023, Cathay Capital announced an investment in the dental services market in partnership with Parkview Dental Partners to expand its expansion in Florida.

Furthermore, government policies to extend the outreach of dental care to the needy people are optimally influencing the global dental practice management software market. For instance, in February 2024, the UK government announced an investment of USD 253 million in the National Health Service Mission to promote dental care. This development will create the need for insurance management, and in turn, dental software in the hospitals.

APAC expected to grow at the fastest rate, owing to the growing population in the major countries, mainly China and India. Based on the India Dental Association statistics, about 98% of the people in India are estimated to have dental problems, and 60% of the parents do not know their children's dental health condition. The presence of a larger population necessitates that dental clinics incorporate artificial intelligence into their operations to cater to a larger number of patients and enhance patient satisfaction.

Key Market Players & Competitive Insights

Strategic Partnerships to Drive the Competition

The dental practice management software market is moderately competitive. The rising efforts taken by the dental practice management software players in the form of research activities, partnerships, and acquisitions to improve their solution offerings in the marketplace are boosting market growth. For instance, in May 2023, Oryx Dental Software announced the integration of Pearl’s second opinion detection abilities into its dental imaging feature set with the partnership.

Some of the major players operating in the global market include:

- ACE Dental Software (US)

- Carestream Dental, LLC (US)

- CD Newco, LLC (US)

- Datacon Dental Systems, Inc. (US)

- DentiMax (US)

- Henry Schein, Inc. (US)

- Nextgen Healthcare, Inc. (US)

- Open Dental Software (US)

- Patterson Companies, Inc. (US)

- Planet DDS (US)

Recent Developments in the Industry

- In November 2023, Global Dental Services, a parent company of Clove Dental, raised an equity investment of USD 50 Mn, a sovereign wealth fund, from the Qatar Investment Authority.

Report Coverage

The dental practice management software market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, deployment mode, application, end use, and their futuristic growth opportunities.

Dental Practice Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.54 billion |

|

Revenue forecast in 2032 |

USD 5.24 billion |

|

CAGR |

9.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global dental practice management software market size is expected to reach USD 5.24 billion by 2032

Key players in the market are ACE Dental Software, Carestream Dental, CD Newco, Datacon Dental Systems

North America contribute notably towards the global Dental Practice Management Software Market

Dental Practice Management Software Market exhibiting the CAGR of 9.4% during the forecast period.

The Dental Practice Management Software Market report covering key segments are deployment mode, application, end use, and region.