Digital Battlefield Market Share, Size, Trends, Industry Analysis Report

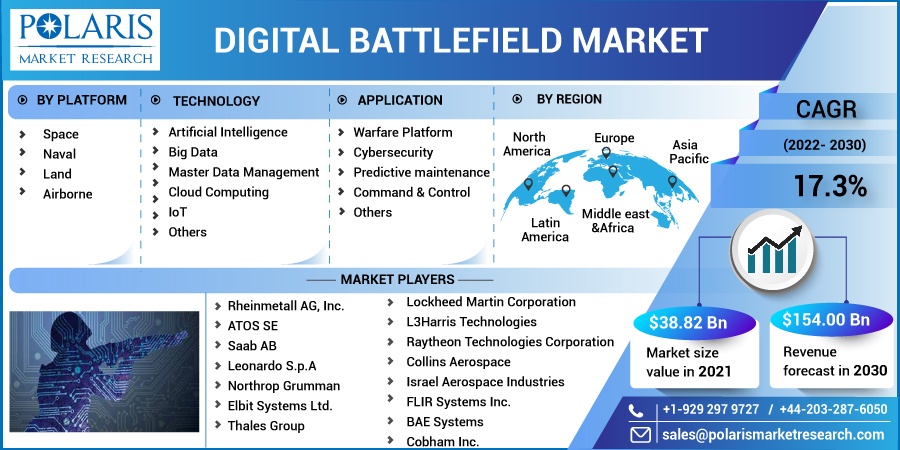

By Technology (Artificial Intelligence, Big Data, Master Data Management, Cloud Computing, IoT, Others); By Platform; By Application; By Region; Segment Forecast, 2022-2030

- Published Date:Oct-2022

- Pages: 118

- Format: PDF

- Report ID: PM2690

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

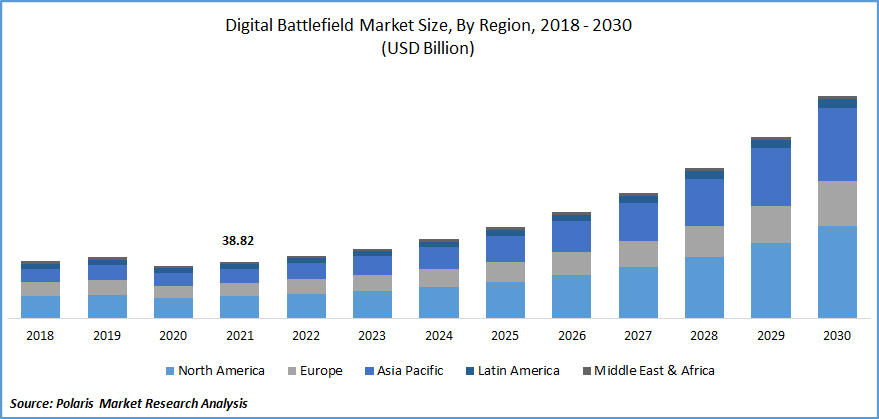

The global digital battlefield market is valued at USD 38.82 billion in 2021 and is projected to grow at a CAGR of 17.3% during the forecast period. A digital battlefield is a matrix of military intelligence systems & sub-systems, weapon modules, communication & surveillance systems, and connected aerial platforms.

Know more about this report: Request for sample pages

Owing to military improvements and current appropriation policies, huge demand amidst defense operations remains notable, specifically in growing nations such as the US, Russia, Germany, China, and others.

Growing attentiveness to cloud computing in the defense segment, a surge in digitalization and funding in the military fragment for upgrading military components and digital information infrastructure, the massive need for gadgets running on 5G telecommunication technology for rapid and secure data transfer, and fast pace enhancement in AI, IoT, Big Data, machine learning, automation, and robotics technologies are some of the key aspects driving the growth of the industry during the forecast period.

Digital battlefield products are installed in space that assist in actual terrain mapping, which supports army decision makers to take the simultaneous verdict, particularly in a time of combative conditions.

Rising prevalence of terrorist attacks, increasing demand for tools based on high-speed connection mechanisms and LOC controversy, and innovations in the military sector to produce defense instrumentation along with the increasing application of digital battlefield systems & sub-systems for immediate and actual mapping with the deployment on Geographical Information System (GIS) to encounter unauthorized activity and security threats will propel the industry trend over the projection period.

Organizations, namely Rolta India Limited, Harris Geospatial, and Hexagon AB, assist militaries with geodata and other associated statistics across the world to aid multiple risky defense operations. Sophisticated tools can be unified with geospatial techniques, which bestow purview for software deployment to ease the technology usage and need less training for soldiers.

Landscape mapping and complete battlefield illustrations support defense decision makers in recognizing the topographical character of the war place, and artillery, camouflage subject detection, finding rival forces' locations, differentiating individual terrain, and impulsive generating maps are some of the vital factors accountable for industry growth in coming years.

The rising number of COVID-19 cases worldwide is deriving a financial cutdown. The COVID-19 epidemic is crucially affected nations across the world. Service and solution provisioners of digital battlefields have also been highly influenced owing to a disturbance in the demand-supply system and transportation facilities. Also, the business operation drop-off has marshaled contraction investment in digital battlefield products. These aspects have unsympathetically affected the expansion of the global market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The surge in investments, joint military operations carried out in developed nations, and digitalization accomplished in the defense segment for deploying modern military instruments & gadgets are aspects boosting the growth of the global market. Moreover, new innovations, product launches, and procurement programs subjected in emerging countries such as the US, Russia, China, India, and others are expected to fuel the industry's progress.

The application of AI-derived digital battlefield products, utilization of 5G technology, coupled with the amalgamation of geographical information systems (GIS) and satellite-oriented topographical mapping solutions and gadgets are anticipated to propel the develop key opportunities for industry participants in the industry in the forecast phase.

Report Segmentation

The market is primarily segmented based on by platform, technology, application, and regions.

|

By Platform |

Technology |

Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Space segment holds the key market share in 2021

Based on platform, the space category is expected to showcase the biggest CAGR during the forecast period. Digital battlefield products application in the space section enables actual-time mapping of entities across the targeted terrain and assists in satellite-based transmission networks. Space equipment in defense systems significantly boosts segment growth and provides new and innovative business opportunities to market players.

The airborne division is anticipatory to edge the global digital battlefield market during the forecast session. The market expansion in the airborne fragment is ascribed to the increasing adoption of ultra-modern communication technology, advanced battlefield systems and sub-systems, and high investments in military forces regarding digital battlefield systems & products.

Cloud-Computing category dominate the market share in 2021

By technology, cloud computing technology led the market in 2021 owing to the advance and centralized data storage. In the defense sector, data security has a major priority. Mater data management plays a vital role in the battlefield market due to the technology-oriented authority in which military operations and information technology operate consecutively to certify the authenticity, reliability, and liability of the defense official's shared master data assets are vital factors boosting the growth of the segment.

North America leads the market in 2021

The United States, with its powerful military and effective economic strategy, is popular among its major producers, service providers, and exporters of the digital battlefield market. Agreements/contracts were the key policy accepted by major players to succor their dominance in the digital battlefield market, accompanied by new equipment inventions with newfangled technologies.

The advanced military approach of the US demonstrates a surge in defense financial estimation to involve modern abilities in competitive defense modules of the US military to encounter incoming security threats.

Moreover, many players also partnered to create distinct centers for the R&D of the latest digital battlefield technologies. For instance, the US defense allocated USD 53 million, to Intelligence Collection Flight (ICF), an international consulting and digital solution contributor, for the assistance of its cyber security and technology degradation facility. The contract was conceded beneath computers, communications, combat systems, intelligence, surveillance, command, control, and undetermined reconnaissance carriage, an imprecise quota contract admitted to ICF.

The digital battlefield market in APAC regions is expected to exhibit exceptional growth during the projection session. Leading-edge innovations and technological upgrades are some of the prominent aspects in the Asia Pacific region, and mergers and collaborations are also playing a vital role in market expansion in the region.

Latin America region has a considerable defense structure and economic strategies and is admired owing to the presence of the major market participants, producers, and service providers of digital battlefield systems & sub-systems. Fast pace deployment of modern and huge investment performed by the market players and government in their military division and additionally a rising adoption of hi-tech potentiality in subsist defense module of the region to encounter an incoming nations security threat.

Competitive Insight

Some of the key players operating in the global market include Rheinmetall AG, Inc., ATOS SE, Saab AB, Leonardo S.p.A., General Dynamics Corporation, Northrop Grumman, Elbit Systems Ltd., Thales Group, Lockheed Martin Corporation, L3Harris Technologies, Raytheon Technologies Corporation, Collins Aerospace, Israel Aerospace Industries, FLIR Systems Inc., BAE Systems, Cobham Inc., and Others.

Recent Developments

In 2022, E-Hang partnered with Aerotree Flight Services, a subordinate of AEROTREE Group Malaysia, to set up a business named urban air mobility, together with Maintenance, Repair, and Overhaul (MRO), and operate a training program in Malaysia.

In 2020, Raytheon Technologies Corporation was suggested by the United States Air Force take part in an IDIQ treaty, which was evaluated at US$ 950 million, to establish an Advanced Battle Management System (ABMS) to join defense plans of action all over the world. It is anticipated to transfigure the prospects battle technical brilliance of the Air Force in the US.

In December 2020, the Royal Netherlands Military accorded Elbit Systems Ltd. US$ 50 million to provide digital battlefield products. The agreement involves delivering hi-tech defense equipment and automotive battlefield gadgets to the Netherlands military.

Digital Battlefield Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 42.95 billion |

|

Revenue forecast in 2030 |

USD 154.00 billion |

|

CAGR |

17.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Platform, By Technology, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Rheinmetall AG, Inc., ATOS SE, Saab AB, Leonardo S.p.A., General Dynamics Corporation, Northrop Grumman, Elbit Systems Ltd., Thales Group, Lockheed Martin Corporation, L3Harris Technologies, Raytheon Technologies Corporation, Collins Aerospace, Israel Aerospace Industries, FLIR Systems Inc., BAE Systems, Cobham Inc., and Others. |