Dragon Fruit Powder Market Share, Size, Trends, Industry Analysis Report

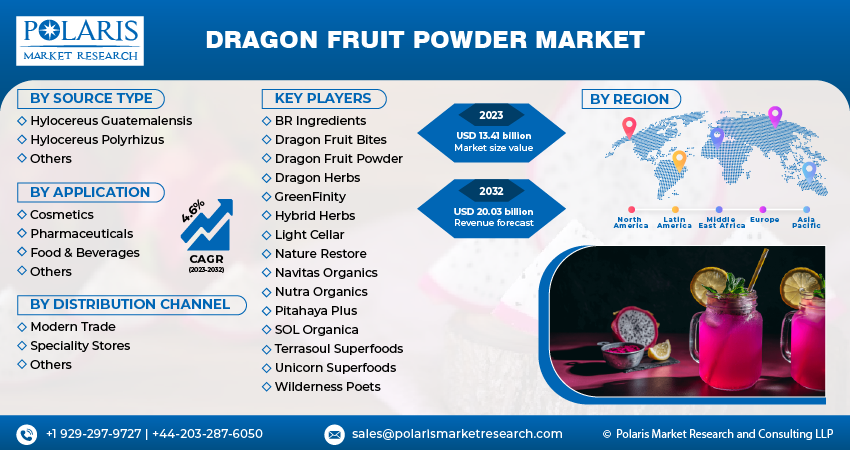

By Source Type (Hylocereus guatemalensis, Hylocereus Polyrhizus, Others); By Application; By Distribution Channel; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 117

- Format: PDF

- Report ID: PM3899

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

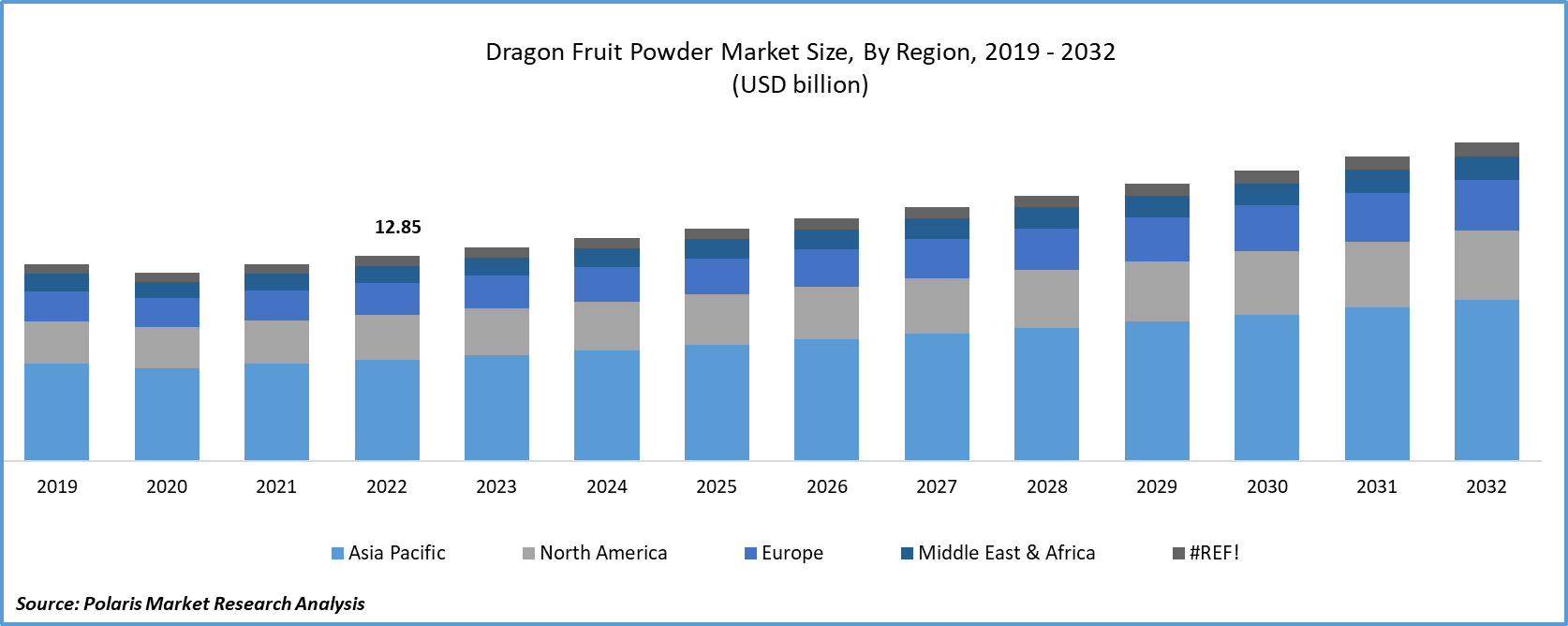

The global dragon fruit powder market was valued at USD 12.85 billion in 2022 and is expected to grow at a CAGR of 4.6% during the forecast period.

Rising demand for fruits worldwide is creating new growth potential for dragon fruit powder. One of the primary issues in purchasing the product by households is time constraint and shelf life because, in this busy world, everyone is becoming busy with their work schedule, which is leading to less time for food preparation, grocery shopping, and food intake. This problem can now be solved by having fruit powders like orange powder and dragon fruit powder. The inconvenience of storing fruit for a long period of time can be replaced by consuming the product in powdered form.

To Understand More About this Research: Request a Free Sample Report

Basically, dragon fruit powder is made from dried dragon fruits, which are the outcome of spray drying or freeze drying, and grinded into powder. It provides the same fruit but is different from time to time, assisting in increasing the lifespan of the fruit. Governments are initiating new policies to equate supply and demand in the marketplace, as it is one of their primary duties to create affordability for their citizens.

- For instance, in March 2023, the Union Agriculture Ministry of India is working on a plan to extend the cultivation area of the exotic fruit to 50,000 hectares in the next five years from 3,000 hectares now in an effort to decrease imports and enhance production of dragon fruit.

Moreover, the pandemic stimulated demand for fruits with higher potential for improving immunity. Dragon fruit is abundant in vitamin C, which boosts immunity and improves general health. This fruit witnessed higher demand as it can improve the body's resistance against potentially deadly infections. Consumers are finding fruits in powder form to reduce time to buy from retailers frequently.

However, one of the restraining factors for the dragon fruit powder market is seasonal availability. Dragon fruit is a tropical fruit that is available mostly in the summer. This places supply shortages on the companies specialized in the manufacturing of dragon fruit powder, restraining the supply of it to end consumers.

Growth Drivers

Dragon Fruit Powder is witnessing higher demand owing to the awareness of its nutritional benefits

Dragon fruit is included in the list of superfoods due to its high nutritional and antioxidant content. The fruit has a vivid pinkish-red exterior, a mild flavor, and a texture that is a cross between a pear, passion fruit, and kiwi. This tropical fruit is a good choice due to its low-calorie count, great nutritional value, and abundance in antioxidants. According to research, frequent consumption of dragon fruit may help control cholesterol levels, improve heart health, and manage diabetes. In order to improve the flavor of yogurt and smoothies, dragon fruit powder is also offered. Its applications in various disciplines of the food processing industry are driving the demand for dragon fruit powder in the study period. Dragon fruit powder is a good source of essential vitamins and minerals, including vitamin C, vitamin B2 (riboflavin), vitamin B3 (niacin), iron, magnesium, and calcium. Vitamin C, in particular, is important for immune support and skin health.

Report Segmentation

The market is primarily segmented based on source type, application, distribution channel and region.

|

By Source Type |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Type Analysis

Hylocereus Polyrhizus segment is expected to witness the highest growth during the forecast period

The Hylocereus polyrhizus segment is projected to grow at a higher rate during the projected period, mainly driven by its higher nutritional profile compared to other dragon fruit varieties. This fruit is perceived to have a higher antioxidant content, driving demand for its powder among a large number of people. Furthermore, this is known for having a unique flavor, fuelling demand from the food processing industry. Its appealing color of vibrant red and magenta is one of the factors fueling demand for its fruit powder and expanding the market.

The Hylocereus guatemalensis segment led the industry market with a substantial revenue share in 2022, largely attributable to its lower sweetness. This fruit has a balanced sweet level, which is a more appealing option for consumers with mild sweets and patients suffering from diabetes. These factors are contributing to the expansion of the dragon fruit powder market soon.

By Application Analysis

Food and Beverages segment witnessed the largest market share in 2022

The food and beverages segment accounted for the largest share. Consumers are learning about the health benefits associated with fruits and vegetables and also the effects of conventional food and beverages. This is stimulating manufacturers to adopt natural flavors for beverages like dragon fruit powder in the production process. Rising health and wellness trends are demonstrating the significance of the adoption of organic ingredients in new product innovations. Its nutritional value is driving its use in the food and beverage industry.

The cosmetics segment is expected to grow at the fastest rate in the coming few years owing to its ability to assist the skin care industry. The presence of appealing color in dragon fruit is used in cosmetics products like lipstick as it is one of the best options for the manufacturers rather than artificial additives.

By Distribution Channel Analysis

Speciality stores held a significant market revenue share in 2022

The specialty stores segment held a significant market share in revenue share in 2022, which is highly accelerated due to providing a platform for similar products in one place. Dragon fruit powder is a natural product, and the e-commerce companies specialized in organic and natural products will be creating a marketplace for these products too to meet ongoing consumer demand for healthy products with higher nutritional value. As companies add these goods to their market basket, consumers' access to the products will increase, driving demand.

Regional Insights

Asia Pacific projected to have a larger share of the global market in 2022

The Asia Pacific region witnessed the largest market share in 2022 and is expected to maintain its trend over the expected period. Governments are incentivizing people to cultivate dragon fruit and increase supply to control the price range in the market. The Government of India is working hard to improve the productivity of various crops under the Atma Nirbhay Bharat initiative. The Uttar Pradesh government is providing financial assistance of Rs. 30000 per hectare for the farmers who are cultivating dragon fruit, along with the technical assistance rendered by the state horticulture department. This enhances the productivity of dragon fruit in the region and expands the additional production of dragon fruit in the form of exports to other countries.

The Europe region will grow at rapid pace. This is attributable to the rising demand for healthy products, primarily fruits and vegetables. After the United States, the European Union is the world's second-largest single market for organic goods. According to FiBL, European organic retail sales have been increasing at a rate of 14.9% annually and are estimated to be EUR 52 billion in 2020. This signifies the potential rise in demand for organic products like dragon fruit powder in the coming years.

Key Market Players & Competitive Insights

The dragon fruit powder market is expected to witness higher competition due to the presence of several players. Major companies in the market are continuously upgrading their technologies to stay ahead of the competition. Companies are looking forward to collaborations and acquisitions to increase their market share and gain a competitive advantage.

Some of the major players operating in the global market include:

- BR Ingredients

- Dragon Fruit Bites

- Dragon Fruit Powder

- Dragon Herbs

- GreenFinity

- Hybrid Herbs

- Light Cellar

- Nature Restore

- Navitas Organics

- Nutra Organics

- Pitahaya Plus

- SOL Organica

- Terrasoul Superfoods

- Unicorn Superfoods

- Wilderness Poets

Recent Developments

- In April 2023, Rihanna & Vita Coco added tropical fruit flavor into its product line. Tropical Fruit, the sixth flavor in the Vita Coco line-up, is a delicious all-natural mashup of coconut water, dragon fruit, orange, & pineapple.

Dragon Fruit Powder Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 13.41 billion |

|

Revenue forecast in 2032 |

USD 20.03 billion |

|

CAGR |

4.6% from 2022 – 2030 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Source Type, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |