Efficacy Testing Market Share, Size, Trends, Industry Analysis Report

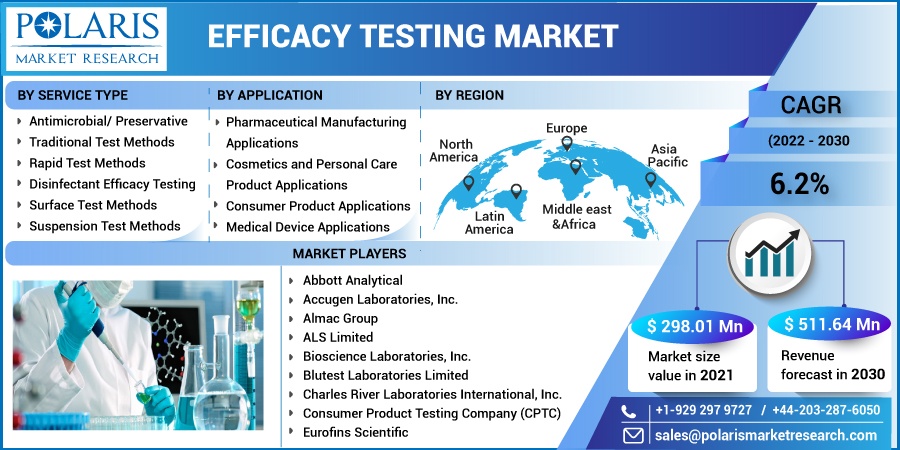

By Service Type (Antimicrobial/Preservative Efficacy Testing, Disinfectant Efficacy Testing), By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 114

- Format: PDF

- Report ID: PM2561

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

The global efficacy testing market was valued at USD 298.01 million in 2021 and is expected to grow at a CAGR of 6.2% during the forecast period. The industry is primarily driven by the expanding pharmaceutical and biotechnology industries, which are supported by government policies and are witnessing a positive trend in their research and development activities.

Know more about this report: Request for sample pages

Efficacy testing is used to establish the proficiency of the product by analyzing the toxicology test, stability test, and protection test. Clinical trials, in particular efficacy studies, provide objective verification of a product's effectiveness using specialized equipment and scientific methods.

Since the major objective of this kind of study is to ascertain how well a sponsor-developed product such as cream performs for a certain claim, the demand for the industry is expected to grow. The clinical study development evaluates the effectiveness of a product by assessing many predefined criteria and utilizing scientific methodologies in order to acquire improved quantitative results.

The outbreak of the Covid-19 pandemic had a positive impact on the efficacy testing market. The COVID-19 pandemic changed how people view cleanliness, causing an anxious demand for disinfection products that quickly depleted their stock, which in turn, accelerated the growth of the industry.

Furthermore, governmental organizations also announced special financial aid for the development of preventive and curative drugs, the purchase of critical care medical devices, and the fast-track approval of diagnostic tests in response to the EPA adding numerous natural disinfectants to its "approved" list for combating COVID-19.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The primary factors fueling the growth of the efficacy testing market are the rise in consumer health concerns, changes in lifestyle, an increase in cosmetic products by the Gen-Z population, and increased consumer awareness of the advantages and necessity of products that have undergone certification examination.

There are several opportunities in the efficacy testing market as a result of the research and development activities of several businesses and government organizations that have grown quickly. Due to the industry’s enormous development potential and underutilized customer base, emerging economies have drawn significant investments from all over the world. The industry is expected to grow as a result of these factors.

Report Segmentation

The market is primarily segmented based on service type, application, and region.

|

By Service Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Disinfectant efficacy testing segment accounted for the largest share

The growth of the market in the disinfectant efficacy testing segment is attributed to the increasing production and use of surface disinfectants owing to rising awareness of personal hygiene among consumers.

Furthermore, the rising environmental concern among people is another factor contributing to the growth of the industry. The growing need to determine the biocidal effect of a disinfectant in the environment as well as validate sanitizing agents for effectiveness against organisms is projected to fuel the demand for the industry.

Pharmaceutical manufacturing applications segment accounted for the largest share

The demand for the market in the pharmaceutical sector is driven by the R&D investments in the life sciences sector as well as the expanding use of antimicrobial efficacy testing for various types of medical devices in the pharmaceutical and cosmetic industries.

Furthermore, the strict restrictions on the microbiological testing of pharmaceutical medications for regulatory approval and the increasing emphasis on patient safety are largely responsible for the growth of this market.

North America accounted for the largest share in the global market in 2021

North America dominated with the largest revenue share in 2021. The demand for the market was further increased by high pharmaceutical company investment in R&D in this region, stringent drug development laws, and rising government expenditure for life science research activities.

Moreover, Asia Pacific is expected to witness a high CAGR in the global efficacy testing market in 2021. The main factors driving the growth of efficacy testing in the Asia Pacific are the aging population, the rapid rise in chronic diseases, and rising investments in better healthcare facilities. The public's rising health consciousness has also increased the demand for these services and goods.

Competitive Insight

Some of the major players operating in the global market include Abbott Analytical, Accugen Laboratories, Inc., Almac Group, ALS Limited, Bioscience Laboratories, Inc., Blutest Laboratories Limited, Charles River Laboratories International, Inc., Consumer Product Testing Company (CPTC), Eurofins Scientific, Helvic Laboratories (A Tentamus Company), Intertek Group PLC, Lucideon, Microchem Laboratory, MSL Solution Providers, Nelson Laboratories, LLC (A Sotera Health Company), North American Science Associates, Pacific Biolabs, SGS SA, Toxikon, and Wuxi Apptec.

Recent Developments

In May 2021, Intertek, a leading total quality assurance provider, announced the expansion of its Health, Environmental, & Regulatory Consultancy (HERS) business segment into Russia and Spain in order to focus on the industries including chemicals, health & beauty products (personal care products, cosmetics, sanitizers), food & nutrition, agri & biocides, packaging & food contact, and consumer goods.

In January 2019, RB (formerly known as Reckitt Benckiser), a global producer of popular consumer health, hygiene and home products, entered into a strategic alliance with Diversey Inc., a provider of efficient cleaning and hygiene technologies, in the North American industrial and institutional cleaning market.

Efficacy Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 298.01 million |

|

Revenue forecast in 2030 |

USD 511.64 million |

|

CAGR |

6.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Service Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Abbott Analytical, Accugen Laboratories, Inc., Almac Group, ALS Limited, Bioscience Laboratories, Inc., Blutest Laboratories Limited, Charles River Laboratories International, Inc., Consumer Product Testing Company (CPTC), Eurofins Scientific, Helvic Laboratories (A Tentamus Company), Intertek Group PLC, Lucideon, Microchem Laboratory, MSL Solution Providers, Nelson Laboratories, LLC (A Sotera Health Company), North American Science Associates, Pacific Biolabs, SGS SA, Toxikon, and Wuxi Apptec |