Electrocoating Market Share, Size, Trends, Industry Analysis Report

By Type (Cathodic Epoxy, Cathodic Acrylic, Anodic); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2891

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

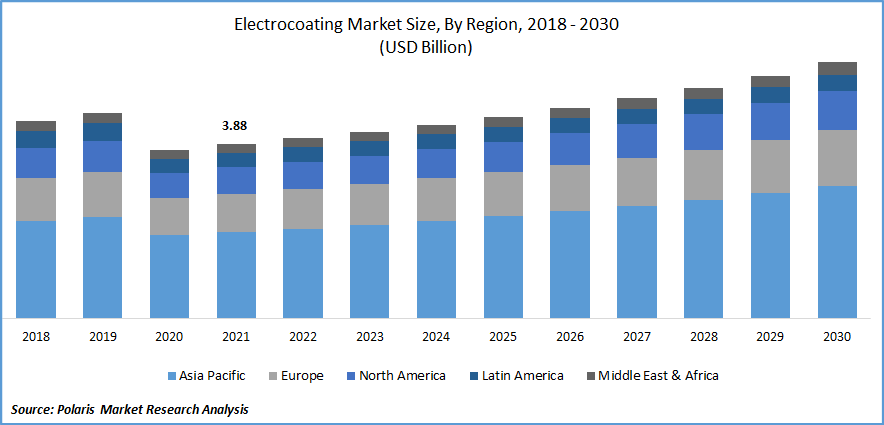

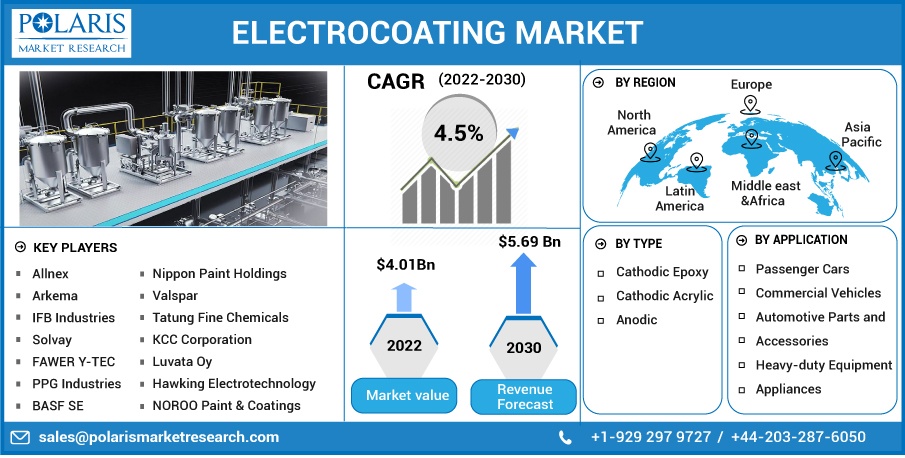

The electrocoating market was valued at USD 3.88 billion in 2021 and is expected to grow at a CAGR of 4.5% during the forecast period.

The market for electrocoating is growing because it offers various advantages like cost-efficient, high-performance, and eco-friendly coating. It can coat complex parts and products with high performance. Electrocoating is widely used to cover many products in several segments, including automotive components, appliances, transformers, automobiles, metal, furniture, etc.

Know more about this report: Request for sample pages

E-coating is a technique that draws the paint substance to the metal surface using an electrical current. Applications for electro coatings use paint particles put in a fluid bath. Paint particles accumulate to create a continuous, smooth, low-profile layer. The process is repeated to get the desired film thickness. The magnitude of the applied voltage difference controls the film thickness. The film thickens with increasing voltage. The requirements for passenger vehicles, heavy-duty, light, and commercial vehicles are fueling the growth of the industry. The low cost is another factor for the rise in demand for E-coating.

Covid-19 hurts the market. Due to the worldwide lockdown imposed by the governments to stop the spreading of the virus, all the automobile manufacturing companies, which are the biggest user of electrocoating, have shut down their manufacturing. This has led to a reduction in the production capacities of electrocoating. Many automobile manufacturers like BMW, Ford, etc. face a decline in their market share because of the effect of the pandemic thus the global market of electrocoating decreases in the automotive sector.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Due to strict rules and regulations and policies by the government, the focus has been shifted to environment-friendly coating and materials. The US and European governments are concerned about air pollution therefore they are emphasizing less or zero toxic emissions. Electrocoating is environmentally friendly. Many companies use electrocoating because it is VOC (volatile organic compound) and HAP (hazardous air pollutant) free.

Almost all leftover paint is recovered. To get rid of any excess paint buildup can be removed at a post-rinse stage. Any color gathered during the rinse stages is added to the application bath after the filtered post-rinses. In contrast to powder or paint overspray, most electrocoating systems are automated, allowing for exact control of the amount of paint sprayed into a product. Therefore, there is a minimum waste of paint. so, the sale of E-coating has risen, which increases the overall global market.

The agricultural sector is gaining significant growth in India and China. Therefore, the market for equipment used in agriculture is growing. Agricultural equipment is mostly exposed to moist and dry conditions, which reduces its corrosion and wear and tear properties. So, the equipment should be painted with coatings that have the best wear and tear properties and are corrosion-free. Electrocoating has good corrosion resistance properties and is used for this purpose. Therefore, the demand for e-coating in the agricultural sector has fueled the market.

In August 2022, Axalta Coating introduced Cromax Gen, its next-generation basecoat technology, for the Latin American automotive refinish market. For body shops, the new product will boost efficiency and save expenses.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Cathodic Epoxy type accounted for the largest revenue share during the forecast period

Because of its outstanding adhesion and corrosion protection qualities and its compatibility with a variety of liquid and powder topcoat materials, cathodic epoxy electrocoat is a widely-liked primer technology. This technique can also be employed for single-coat applications when resistance to ultraviolet (UV) rays is not required because it has good aesthetic features. Today's cathodic epoxy e-coat materials are suitable for items with a potential cure temperature above 380°F and are environmentally safe.

They are widely used in automobile manufacturing because they are humidity-free, have fine salt spray, and are corrosion-resistant. Due to the increase in demand for vehicles that use cathodic epoxy electrocoating, the global market is rising in growth opportunities. Electro coatings made of cathodic acrylic are applied in a single coat. It is often employed in situations where ferrous substrates need to have both UV durability and corrosion resistance. The coating is durable but not scratch, chip, or pealing resistant.

Because anodic epoxy electrocoat products generally have better adhesion and corrosion resistance than regularly used liquid paint priming materials, they are also frequently used as primers. Anodic epoxy e-coat materials are ideal for coating assemblies of components that include heat-sensitive components like bearings and seals. Curing parts can be heated to as low as 180°F.

The passenger cars segment dominated the market share in 2021

Due to its humidity resistance and anti-corrosive properties, electrocoating is used for bolts, engine covers, driveshafts, frames, springs, etc. Due to the significant need for color customization in the automobile industry and the availability of electrocoating in a wide variety of colors, this sector has adopted e-coat at a rapid rate. Appliances and the automobile sector employ cathodic-type e-coat for parts with cavities, complicated ware packages, and hidden portions that need coatings because they contain highly chemical and corrosion-resistant materials. These factors are expected to drive the growth of the e-coat market.

In February 2022, Nippon Paint Automotive started selling "PROTECTION Car Interior VK Coat," an anti-viral & anti-bacterial coating for car interiors. Electrocoating coats the batteries used in electric vehicles such as Zinc Nickel alloy because it can withstand high temperatures and thus reduce the risk of fire damage. With the increasing demand for electric cars, electrocoating for e-vehicles batteries positively fuels the growth of the global market.

Asia Pacific is expected to hold the largest market share

Asia-Pacific region dominated the global market share. The need for e-coating in the Asia-Pacific area is fueled by several important factors, including rising vehicle production, increasing farmers using advanced agricultural equipment, and expanding industries. Additionally, China is concentrating on boosting demand for the manufacturing and marketing of electric vehicles, which is predicted to increase the market for e-coat.

The rising output of passenger automobiles and commercial vehicles drives the strong demand for e-coating in the automotive industry. The market is expanding due to factors like the vast population base and the relocation of manufacturing facilities from North America and Europe to Asia Pacific.

Competitive Insight

Key players include Allnex, Arkema, IFB Industries, Solvay, FAWER Y-TEC Automotive, Axalta Coating, PPG Industries, BASF, Nippon Paint Holdings, Valspar, Tatung Fine Chemicals, KCC Corporation, Luvata Oy, Hawking Electrotechnology, and NOROO Paints.

Recent Developments

In March 2022, Allnex announced the acquisition of a Manufacturing site in Maharashtra, India. This acquisition leads to the expansion of the company in India.

In March 2021, Axalta coating released a new product to expand its industrial coatings, a cathodic tin-free electro-coat primer that is environment-friendly.

Electrocoating Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.01 billion |

|

Revenue forecast in 2030 |

USD 5.69 billion |

|

CAGR |

4.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Allnex, Arkema, IFB Industries, Solvay, FAWER Y-TEC Automotive Chassis System, Axalta Coating Systems, PPG Industries, BASF SE, Nippon Paint Holdings, Valspar, Tatung Fine Chemicals, KCC Corporation, Luvata Oy, Hawking Electrotechnology, NOROO Paint & Coatings. |