Electrophysiology Mapping and Ablation Devices Market Size, Share, Trends, Industry Analysis Report

By Product (Mapping & Lab Systems, Diagnostic Catheters, Ablation Catheters), By Procedure, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6216

- Base Year: 2024

- Historical Data: 2020-2023

Overview

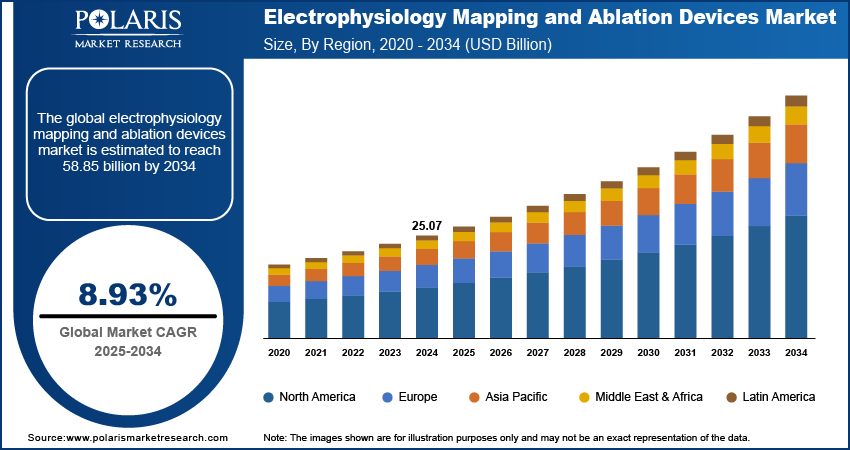

The global electrophysiology mapping and ablation devices market size was valued at USD 25.07 billion in 2024, growing at a CAGR of 8.93% from 2025 to 2034. Key factors driving demand for electrophysiology mapping and ablation devices include expanding healthcare spending, rising prevalence of cardiovascular diseases, and increasing geriatric population.

Key Insights

- The ablation catheters segment accounted for a major revenue share in 2024 due to growing preference for catheter-based ablation procedures.

- The EP ablation procedures segment held 88.12% of revenue share in 2024 due to the increasing incidence of atrial fibrillation.

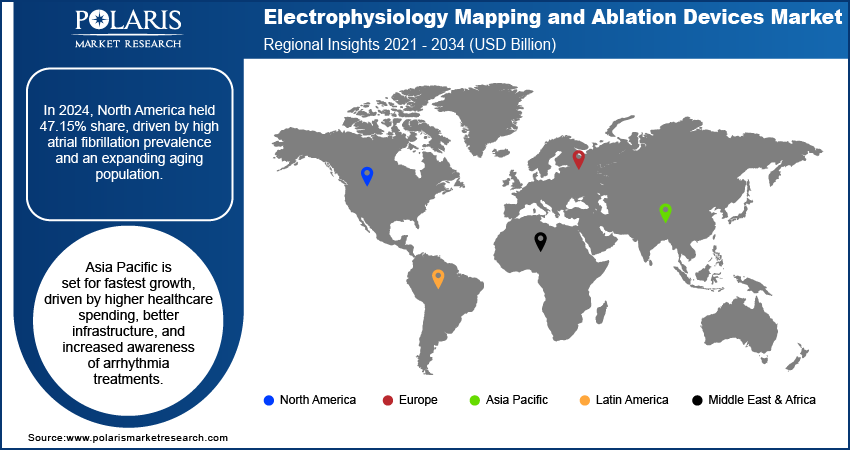

- North America electrophysiology mapping and ablation devices market accounted for 47.15% of global revenue share in 2024, due to the growing aging population.

- The U.S. held the largest revenue share in North America in 2024, due to the rising prevalence of cardiovascular diseases.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to improving healthcare infrastructure.

Industry Dynamics

- The expanding healthcare spending globally is driving the demand for electrophysiology mapping and ablation devices by allowing facilities to purchase high-precision EP systems.

- The increasing geriatric population is fueling the market growth as older adults face a higher risk of cardiac arrhythmias.

- Rapid advancements in 3D mapping and AI-enabled navigation are projected to create a lucrative opportunity during the forecast period.

- Risk of complications during or after the procedure hampers the market growth.

Market Statistics

- 2024 Market Size: USD 25.07 Billion

- 2034 Projected Market Size: USD 58.85 Billion

- CAGR (2025–2034): 8.93%

- North America: Largest Market Share

AI Impact on Electrophysiology Mapping and Ablation Devices Market

- The market is witnessing the emergence of AI-enabled ablation devices to optimize their performance.

- AI is an important component in the development of robotic-assisted procedures, which reduce operator fatigue, provide stable catheter positioning, and enable remote navigation capabilities for complex interventions.

- To enhance visualization, AI is integrated with real-time 3D imaging with electro-anatomical maps, which helps electrophysiologists navigate complex cardiac structures.

- AI tools support smarter scheduling, case documentation, and efficient resource allocation, improving overall efficiency in EP labs.

Electrophysiology (EP) mapping and ablation devices are specialized medical tools used to diagnose and treat cardiac arrhythmias by identifying and eliminating abnormal electrical pathways in the heart. EP mapping involves inserting catheters with electrodes into the heart to record electrical signals and create a 3D map of cardiac activity, pinpointing arrhythmia sources. Once identified, ablation devices are employed to destroy problematic tissue, restoring normal rhythm.

These procedures are minimally invasive and are commonly used for conditions such as atrial fibrillation, supraventricular tachycardia, and ventricular tachycardia. EP mapping ensures precise targeting, while ablation delivers controlled energy to disrupt abnormal signals without damaging surrounding tissue. Advanced systems integrate real-time imaging and AI-enhanced mapping for higher accuracy. The usage of ablation devices improves patient outcomes, minimizing complications and recurrence rates, making them an important tool of modern cardiac electrophysiology.

The global electrophysiology mapping and ablation devices market growth is driven by the rising prevalence of cardiovascular diseases, particularly atrial fibrillation. Atrial fibrillation disrupts normal heart rhythms, making minimally invasive surgeries or procedures such as catheter ablation essential to restore proper electrical activity, and EP mapping systems help cardiologists visualize arrhythmias accurately before ablation. Therefore, as AFib cases increase, hospitals and clinics invest in advanced EP devices to meet the growing need for effective, long-term solutions, fueling market expansion.

Drivers & Opportunities

Expanding Healthcare Spending: Governments and private insurers are allocating funds to modernize healthcare infrastructure, allowing facilities to purchase high-precision EP systems for diagnosing and treating arrhythmias such as atrial fibrillation. Increased budgets are supporting training for electrophysiologists, ensuring the effective use of electrophysiology mapping and ablation devices. Additionally, greater healthcare spending is expanding patient access to specialized treatments, driving higher procedure volumes and boosting demand for EP mapping and ablation equipment. Hence, the growing financial support is accelerating the adoption of these life-saving technologies.

Increasing Geriatric Population: The increasing geriatric population is fueling the demand for electrophysiology (EP) mapping and ablation devices as older adults face a higher risk of cardiac arrhythmias, particularly atrial fibrillation. Age-related degenerative changes in the heart’s electrical system make seniors more prone to irregular heartbeats, necessitating advanced diagnostic and treatment solutions such as EP mapping and catheter ablation. Additionally, older individuals often prefer treatments with shorter recovery times, making ablation therapies more appealing than open-heart surgery. According to the United Nations, the global population aged 65 and older is projected to reach 2.2 billion by the late 2070s. Therefore, this demographic shift ensures a steady growth in demand for EP devices as cardiology centers expand services to cater to aging populations.

Segmental Insights

Product Analysis

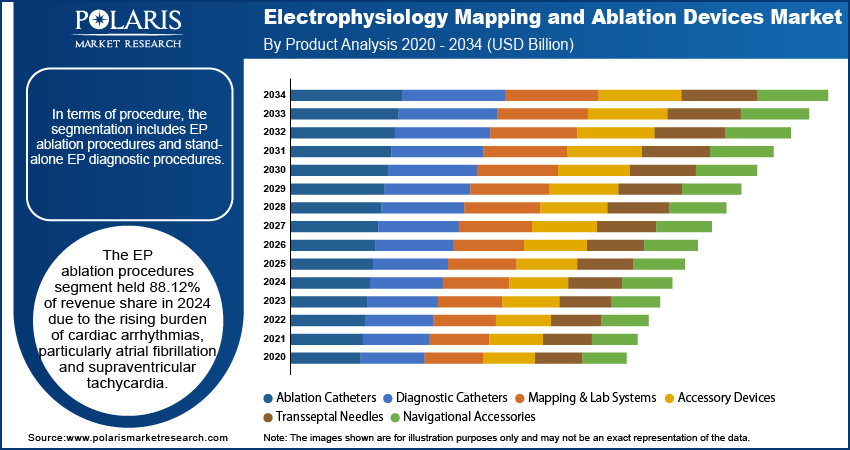

Based on product, the segmentation includes mapping & lab systems, diagnostic catheters, ablation catheters, accessory devices, transseptal needles, and navigational accessories. The ablation catheters segment accounted for a major revenue share in 2024 due to the rising prevalence of cardiac arrhythmias, particularly atrial fibrillation, and the growing preference for catheter-based ablation procedures over pharmacological treatments. Hospitals and cardiac centers increasingly adopted radiofrequency and cryoablation catheters as they delivered more effective and durable outcomes with fewer side effects. Technological advancements, such as contact force-sensing catheters and improved tip designs, enhanced procedural accuracy and safety, which further drove physician adoption. The increasing number of catheter ablation procedures performed globally, supported by favorable reimbursement policies and an expanding geriatric population, contributed to the dominance of the segment.

The mapping & lab systems segment is projected to grow at a robust pace in the coming years, owing to the rising demand for precise, real-time cardiac mapping during ablation procedures. Electrophysiologists are increasingly relying on these systems to guide complex ablation cases, especially in persistent atrial fibrillation and ventricular tachycardia. Additionally, continuous innovations in AI-driven mapping technologies and integration with robotic navigation platforms are enhancing system efficiency and accuracy, supporting the segment’s sustained growth.

Procedure Analysis

In terms of procedure, the segmentation includes EP ablation procedures and stand-alone EP diagnostic procedures. The EP ablation procedures segment held 88.12% of revenue share in 2024 due to the rising burden of cardiac arrhythmias, particularly atrial fibrillation and supraventricular tachycardia. Clinicians increasingly opted for ablation as a first-line therapy due to its long-term efficacy and reduced reliance on antiarrhythmic drugs. Technological advancements in ablation catheters, such as contact force sensing and irrigated tip designs, improve the safety and precision of procedures. The growing adoption of minimally invasive techniques and favorable clinical guidelines further encouraged healthcare providers to perform EP ablation procedures. Furthermore, the increasing number of specialized electrophysiology labs in hospitals and rising awareness about early arrhythmia treatment supported the expansion of the segment.

The stand-alone EP diagnostic procedures segment is expected to grow at a rapid pace during the forecast period, owing to its critical role in early and accurate arrhythmia detection. Physicians are now relying on these procedures to evaluate complex cardiac conduction disorders before selecting appropriate therapeutic interventions. Improvements in 3D mapping technologies and signal processing software are enhancing diagnostic accuracy, making these procedures crucial for both initial evaluations and pre-ablation planning.

Regional Analysis

The North America electrophysiology mapping and ablation devices market accounted for 47.15% of global revenue share in 2024. This dominance is attributed to the high prevalence of cardiac arrhythmias, particularly atrial fibrillation (AFib), and the growing aging population. According to the Population Reference Bureau, the number of Americans ages 65 and above is projected to increase from 58 million in 2022 to 82 million by 2050. Advanced healthcare infrastructure, widespread adoption of minimally invasive procedures, and strong reimbursement policies further supported market growth in the region. Additionally, technological advancements, such as high-density mapping systems and robotic-assisted ablation, enhanced procedural efficiency and safety, which encouraged their adoption. Increased awareness of arrhythmia treatments and rising investments in cardiac care also contributed to the growing demand in North America.

U.S. Electrophysiology Mapping and Ablation Devices Market Insights

The U.S. held the largest revenue share in the North America electrophysiology mapping and ablation devices landscape in 2024, due to the increasing incidence of cardiovascular diseases, particularly atrial fibrillation, which affects millions of Americans. The American Heart Association estimated that the prevalence of atrial fibrillation in the U.S. will increase from 1.7% in 2020 to 2.4% by 2050. The presence of major medical device companies and continuous innovation in ablation technologies, such as cryoablation and radiofrequency ablation, also contributed to the country's dominance. Additionally, the growing preference for outpatient EP procedures and the expansion of specialized cardiac centers further drove market growth.

Europe Electrophysiology Mapping and Ablation Devices Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to the increasing geriatric population and the high burden of cardiac arrhythmias. Government initiatives promoting advanced cardiac care and the presence of established healthcare systems are supporting market expansion. Countries such as Germany, France, and the UK are at the front of adopting innovative EP technologies. The European Society of Cardiology (ESC) guidelines emphasize early diagnosis and treatment of arrhythmias, further boosting demand.

Germany Electrophysiology Mapping and Ablation Devices Market Overview

The demand for electrophysiology mapping and ablation devices in Germany is being driven by its robust healthcare system and high adoption of advanced medical technologies. The country has a large patient pool suffering from arrhythmias, supported by strong diagnostic and treatment protocols. Reimbursement policies under the German healthcare system are facilitating the use of EP procedures, leading to market growth. Additionally, Germany is a hub for medical research, with companies introducing next-generation ablation systems, such as pulsed-field ablation (PFA), further accelerating market development.

Asia Pacific Electrophysiology Mapping and Ablation Devices Market Assessment

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to increasing healthcare expenditure, improving healthcare infrastructure, and rising awareness of arrhythmia treatments. The share of government health expenditure in the total health expenditure of India between FY15 and FY22 has increased from 29.0% to 48.0%. Countries such as Japan, China, and India are witnessing a surge in AFib cases linked to aging populations and lifestyle changes, which is fueling the demand for electrophysiology mapping and ablation devices. However, cost sensitivity and limited reimbursement in some emerging countries may slow down growth compared to Western regions. Despite this, increasing medical tourism and partnerships with global device manufacturers are expected to boost demand in the coming years.

Key Players & Competitive Analysis

The electrophysiology (EP) mapping and ablation devices market is highly competitive, driven by technological advancements and increasing demand for minimally invasive cardiac arrhythmia treatments. Key players such as Abbott Laboratories, Johnson & Johnson, Medtronic, and Boston Scientific dominate the market, leveraging extensive R&D investments and robust product portfolios. Abbott’s EnSite X EP System and Medtronic’s Arctic Front cryoablation devices lead in precision and efficacy, while Biosense Webster’s CARTO 3D mapping system remains a gold standard for real-time cardiac visualization. Regional players in Asia Pacific are expanding their presence with cost-effective solutions, intensifying price competition. Strategic partnerships, mergers, and acquisitions further shape the landscape, accelerating innovation. Regulatory approvals and reimbursement policies remain critical challenges, particularly for novel technologies.

A few major companies operating in the electrophysiology mapping and ablation devices market include Abbott; Biotronik SE & Co KG; Boston Scientific Corporation; CardioFocus, Inc.; GE HealthCare; Johnson & Johnson; Koninklijke Philips N.V.; Medtronic; MicroPort Scientific Corporation; and Siemens Healthineers.

Key Players

- Abbott

- Biotronik SE & Co KG

- Boston Scientific Corporation

- CardioFocus, Inc.

- GE HealthCare

- Johnson & Johnson

- Koninklijke Philips N.V.

- Medtronic

- MicroPort Scientific Corporation

- Siemens Healthineers

Electrophysiology Mapping and Ablation Devices Industry Developments

In May 2025, Abbott announced the launch of the TactiFlex Sensor Ablation Catheter with a flexible tip and contact force technology.

In November 2024, Johnson & Johnson announced that it received U.S FDA approval for the VARIPULSE pulsed field ablation platform for the treatment of atrial fibrillation.

In October 2024, Boston Scientific Corporation announced it received U.S. FDA approval for the navigation-enabled FARAWAVE NAV ablation catheter for the treatment of paroxysmal atrial fibrillation.

Electrophysiology Mapping and Ablation Devices Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Mapping & Lab Systems

- Diagnostic Catheters

- Ablation Catheters

- Accessory Devices

- Transseptal Needles

- Navigational Accessories

By Procedure Outlook (Revenue, USD Billion, 2020–2034)

- EP Ablation Procedures

- Stand-Alone EP Diagnostic Procedures

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electrophysiology Mapping and Ablation Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 25.07 Billion |

|

Market Size in 2025 |

USD 27.25 Billion |

|

Revenue Forecast by 2034 |

USD 58.85 Billion |

|

CAGR |

8.93% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 25.07 billion in 2024 and is projected to grow to USD 58.85 billion by 2034.

The global market is projected to register a CAGR of 8.93% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Abbott; Biotronik SE & Co KG; Boston Scientific Corporation; CardioFocus, Inc.; GE HealthCare; Johnson & Johnson; Koninklijke Philips N.V.; Medtronic; MicroPort Scientific Corporation; and Siemens Healthineers.

The ablation catheters segment dominated the market revenue share in 2024.

The stand-alone EP diagnostic procedures segment is projected to witness the fastest growth during the forecast period.