Energy as a Service Market Size, Share, Trends, Industry Analysis Report

: By Type, By End Use (Commercial, and Industrial), and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM2146

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

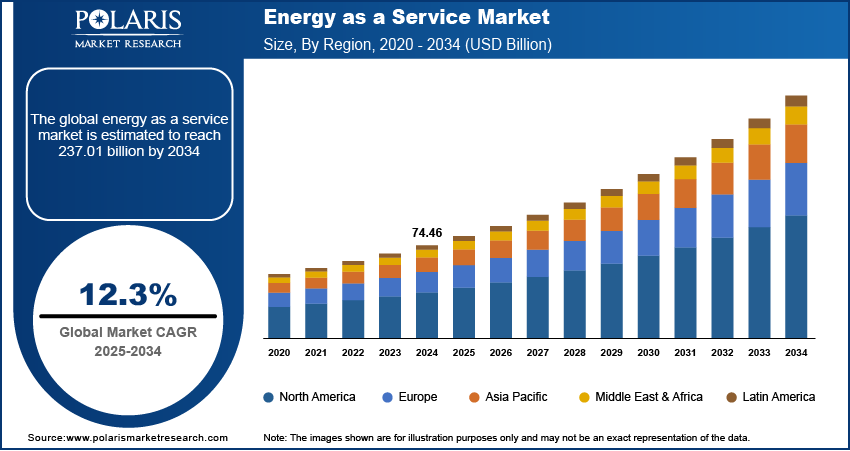

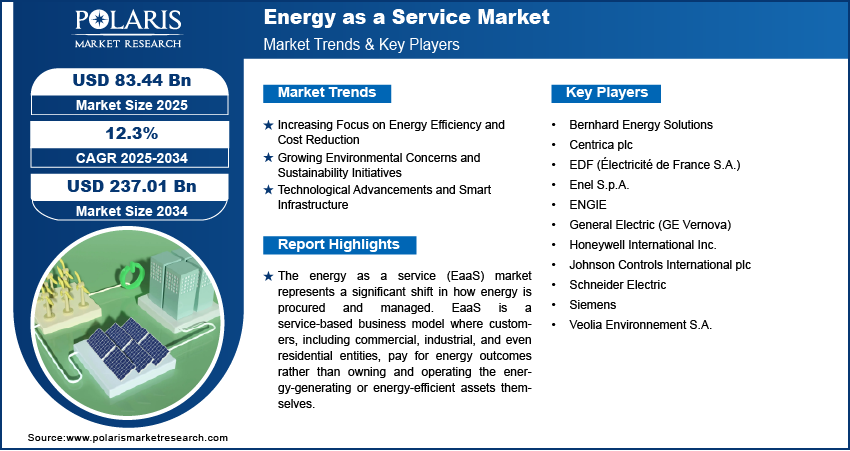

The energy-as-a-service market size was valued at USD 74.46 billion in 2024, growing at a CAGR of 12.3% during 2025–2034. The rising emphasis on energy efficiency, introduction of supportive government regulations and incentives, and the integration of advanced technologies are the key factors driving market growth.

Key Insights

- The energy supply services segment accounts for the largest market share. The segment’s dominance is primarily attributed to the need for a reliable and consistent power supply across various sectors.

- The industrial segment is projected to register a higher growth rate during the projection period. Growing emphasis on optimizing energy consumption in manufacturing contributes to the segment’s robust growth.

- North America dominates the market, driven by the presence of several energy service companies and the early adoption of energy efficiency measures.

- Asia Pacific is projected to register the highest growth rate during the projection period. Rapid industrialization and rising energy demand from a growing population drive market growth in the region.

Industry Dynamics

- The growing shift among organizations towards solutions that can optimize energy consumption and lower utility bills is fueling the adoption of the energy-as-a-service model.

- Rising initiatives by businesses and governments globally to reduce carbon footprint and transition to clean energy sources are driving market growth.

- Increasing environmental concerns and the shift towards sustainability are fueling the energy-as-a-service market demand.

- High initial investment costs may present challenges to market expansion.

Market Statistics

Market Size in 2024: USD 74.46 billion

2034 Projected Market Size: USD 237.01 billion

CAGR (2025-2034): 12.3%

North America: Largest Market in 2024

AI Impact on Energy as a Service Market

- AI optimizes energy distribution by analyzing consumption patterns and predicting demand in real time.

- Machine learning models enhance efficiency by identifying cost-saving opportunities and reducing energy waste.

- AI-powered platforms enable predictive maintenance for energy infrastructure, minimizing downtime and operational risks.

- Continuous AI learning improves demand forecasting and renewable integration, supporting more sustainable and resilient energy services.

To Understand More About this Research: Request a Free Sample Report

The energy as a service (EaaS) market represents a transformative business model in the energy sector. Instead of customers owning and managing energy infrastructure, a third-party provider offers comprehensive energy-related services through a contractual agreement. This can include energy supply, installation, and maintenance of energy systems such as solar panels or efficient HVAC, energy management, and optimization services. The core idea revolves around customers paying for the energy service they consume, often through a subscription or pay-per-use model, thereby eliminating the need for significant upfront capital investment. This shift allows businesses and other entities to focus on their primary operations while benefiting from reliable, efficient, and often cleaner energy solutions managed by experts.

The increasing emphasis on energy efficiency and cost reduction drives the EaaS market growth. Organizations are actively seeking ways to lower their operational expenses and optimize energy consumption. Furthermore, the growing environmental concerns and the push toward sustainability are fueling demand for cleaner energy alternatives. Government incentives and supportive regulations aimed at promoting renewable energy adoption and reducing carbon emissions also act as crucial growth drivers. The integration of advanced technologies such as smart grids, IoT (Internet of Things), and AI (Artificial Intelligence) further propels the industry development by enabling real-time monitoring, predictive analytics, and automated energy management, making EaaS solutions more attractive and effective for a wide range of end users.

Market Dynamics

Increasing Focus on Energy Efficiency and Cost Reduction

Organizations, facing increasing energy prices and a heightened awareness of operational expenses, are actively seeking solutions that can optimize their energy consumption and lower their utility bills without requiring substantial upfront capital expenditure. Buildings account for ∼40% of global energy consumption and a similar percentage of greenhouse gas emissions. EaaS solutions often focus on optimizing energy use in buildings, offering potential energy savings of 15–30% through smart controls, efficient HVAC systems, and lighting upgrades.

The EaaS model directly addresses this need by offering services that implement energy-efficient technologies and management strategies, with payments often tied to actual energy savings. A study published on the National Institutes of Health (NIH) website in 2023, titled "Energy Efficiency Interventions and Economic Benefits in Commercial Buildings," highlighted that implementing energy-efficient measures, often facilitated through service-based contracts, resulted in significant reductions in operating costs for commercial buildings. This economic advantage, coupled with the ease of outsourcing energy management, makes EaaS an increasingly attractive proposition. Hence, the escalating focus on energy efficiency and the compelling need for cost reduction across various sectors boost the energy-as-a-service (EaaS) market expansion.

Growing Environmental Concerns and Sustainability Initiatives

Businesses and governments worldwide are setting ambitious targets for reducing their carbon footprint and transitioning to cleaner energy sources. EaaS models often facilitate the adoption of renewable energy technologies such as solar power and energy-efficient systems without the heavy initial investment that might deter many potential adopters. A report published by the Environmental Protection Agency (EPA) in 2022, "The Role of Renewable Energy in Greenhouse Gas Reduction," emphasized the critical role of distributed generation and efficient energy use in achieving national climate goals. EaaS providers often specialize in deploying and managing these sustainable solutions, making it easier for organizations to meet their environmental targets and enhance their sustainability credentials. This alignment with global environmental imperatives and the facilitation of sustainable practices are strongly driving the energy as a service market demand.

Technological Advancements and Smart Infrastructure

The rapid advancements in technology, particularly in areas such as smart grids, IoT (Internet of Things), and AI (Artificial Intelligence), enable sophisticated energy monitoring, predictive maintenance, and optimized energy management, which are core components of many EaaS offerings. The ability to remotely monitor energy consumption, identify inefficiencies, and automate adjustments leads to significant cost savings and improved reliability for EaaS customers. The increasing deployment of IoT devices and sensors in energy infrastructure enables real-time monitoring, data collection, and intelligent control of energy consumption and generation. This smart infrastructure is fundamental to the effectiveness of many EaaS offerings. The number of IoT connections in the utilities sector is projected to reach over 400 by 2027.

Research published on the National Center for Biotechnology Information (NCBI) in 2024, titled "Impact of IoT and AI on Energy Management Systems," discussed how the integration of these technologies in energy service models enhances efficiency and provides valuable data-driven insights for better energy decision-making. The increasing sophistication and effectiveness enabled by these technological advancements and smart infrastructure are making energy as a service solutions more compelling, fueling the energy as a service industry development.

Segment Insights

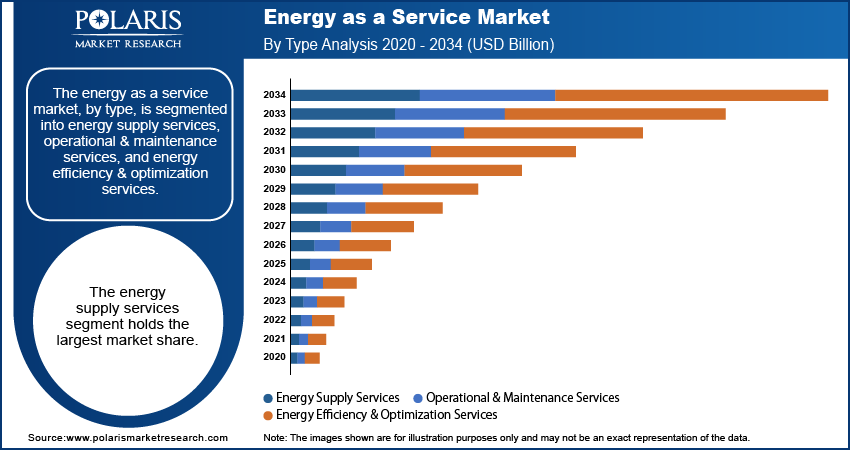

Market Assessment – By Type

The energy as a service market, by type, is segmented into energy supply services, operational & maintenance services, and energy efficiency & optimization services. The energy supply services segment holds the largest share, owing to the fundamental need for consistent and reliable energy provision across various end-user sectors. Businesses and institutions often prioritize securing their energy needs, and EaaS models offering bundled energy supply, potentially including renewable sources, provide a convenient and often cost-effective solution compared to managing energy procurement independently. The comprehensive nature of these service agreements, which can encompass energy generation, procurement, and delivery, contributes significantly to the substantial market share held by energy supply services within the broader energy as a service landscape.

The energy efficiency & optimization services subsegment is anticipated to exhibit the highest growth rate during the forecast period. This rapid expansion is fueled by the increasing emphasis on sustainability, cost reduction, and the integration of advanced technologies. Organizations are progressively recognizing the long-term benefits of minimizing energy waste and optimizing their energy usage. EaaS providers offering services such as energy audits, implementation of energy-saving measures, and deployment of smart and energy efficient building technologies are witnessing a surge in demand. The potential for significant cost savings and the alignment with environmental regulations and corporate social responsibility goals are key factors driving the accelerated growth of the energy efficiency & optimization services segment.

Market Evaluation – By End Use

By end use, the market is segmented into commercial and industrial. The commercial segment accounts for a larger share. This substantial share is primarily driven by the extensive energy requirements of a diverse range of commercial entities, including office buildings, retail spaces, healthcare facilities, and educational institutions. These sectors often seek comprehensive energy solutions that can enhance operational efficiency, reduce energy costs, and contribute to sustainability goals without the complexities of managing energy infrastructure directly. The broad adoption of EaaS models across these varied commercial applications underpins the segment's leading position.

The industrial segment is projected to experience a higher growth rate during the forecast period. This rapid growth is propelled by the energy-intensive nature of industrial operations and the increasing focus on optimizing energy consumption in manufacturing, processing, and other industrial facilities. EaaS solutions offering services such as on-site power generation, waste heat recovery, and advanced energy management systems are becoming increasingly attractive to industrial players seeking to improve energy efficiency, lower operational costs, and meet stringent environmental regulations. The potential for significant energy savings and enhanced operational resilience in the industrial sector is a key driver fueling the accelerated growth of this segment.

Regional Analysis

The energy-as-a-service market, based on region, is segmented into five major regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America and Europe have historically been significant contributors to the market, driven by established energy efficiency initiatives and supportive regulatory frameworks. Asia Pacific is emerging as a high-growth area, fueled by rapid industrialization and increasing energy demand. Latin America and the Middle East & Africa are also witnessing growing adoption of EaaS solutions, albeit from a smaller base, driven by factors such as infrastructure development and the need for energy diversification. Each region presents unique market dynamics influenced by local regulations, economic conditions, and the maturity of energy infrastructure.

North America holds the largest share of the market, driven by several factors such as the early adoption of energy efficiency measures, a well-established base of energy service companies, and supportive government policies promoting energy conservation and renewable energy integration. Furthermore, the presence of a sophisticated industrial and commercial sector with a strong focus on operational cost reduction and sustainability initiatives has significantly contributed to the widespread adoption of EaaS models across the region. The mature energy infrastructure and technological advancements in North America have also facilitated the implementation and scaling of diverse energy as a service offering, solidifying its leading market share.

The Asia Pacific market is projected to exhibit the highest growth rate over the forecast period. This rapid expansion is driven by the region's burgeoning industrialization, increasing energy demand from a growing population, and supportive government initiatives aimed at improving energy access and promoting clean energy technologies. The rising awareness regarding energy efficiency and the need to reduce reliance on traditional energy sources are also contributing to the increased adoption of EaaS solutions in countries across the Asia Pacific. The significant market potential in this region, coupled with increasing investments in smart grid infrastructure and renewable energy projects, positions Asia Pacific as the region with the most promising growth trajectory in the market.

Key Players and Competitive Insights

A few of the major active players in the energy as a service market include ENGIE, Schneider Electric, Siemens, General Electric (GE Vernova), Honeywell International Inc., Veolia Environnement S.A., EDF (Électricité de France S.A.), Centrica plc, Johnson Controls International plc, Enel S.p.A., and Bernhard Energy Solutions. These companies offer a range of services encompassing energy supply, operational and maintenance services for energy infrastructure, and energy efficiency and optimization solutions, catering to the diverse needs of commercial and industrial end users.

The competitive landscape of the market is characterized by a mix of large multinational corporations and specialized service providers. Competition is intensifying as more companies recognize the market potential and the growing demand for outsourced energy solutions. Key competitive factors include the breadth and depth of service offerings, technological innovation, pricing strategies, geographical reach, and the ability to provide customized solutions tailored to specific client needs. Companies are focusing on developing integrated platforms that leverage data analytics and IoT to deliver enhanced energy management and cost savings, creating a dynamic and evolving industry environment.

ENGIE, headquartered in Courbevoie, France, offers a comprehensive suite of energy as a service solutions to businesses and communities globally. Their offerings include renewable energy supply, energy efficiency retrofits, district heating and cooling networks, and smart building management systems. ENGIE's focus on providing integrated and decarbonized energy solutions makes it a significant player in addressing the evolving energy needs of various sectors.

Honeywell International Inc., with its principal office in Charlotte, North Carolina, US, provides a wide array of technologies and services relevant to the market. Their offerings encompass building automation systems, energy management software, smart grid solutions, and performance contracting for energy efficiency projects. Honeywell's expertise in automation and control technologies enables it to deliver solutions that optimize energy consumption and improve operational efficiency for its clients.

List of Key Companies in Energy as a Service Market

- Bernhard Energy Solutions

- Centrica plc

- EDF (Électricité de France S.A.)

- Enel S.p.A.

- ENGIE

- General Electric (GE Vernova)

- Honeywell International Inc.

- Johnson Controls International plc

- Schneider Electric

- Siemens

- Veolia Environnement S.A.

Energy as a Service Industry Developments

- May 2025: Bernhard announced its rebranding as ENFRA. The company stated that the name change was made to reflect its evolution as one of the leading providers of energy solutions across the U.S.

- May 2025: Centrica Energy announced the opening of its first office in the U.S. The office opening is part of its expansion in North America. The company stated that the expansion will improve its power trading capabilities and allow it to better serve its clients worldwide.

- December 2024: Schneider Electric launched a range of innovative solutions to address the growing energy and sustainability demands. The new energy management tools harness AI to optimize energy use, lower emissions, and boost operational performance. These offerings also incorporate energy-as-a-service (EaaS) models, providing businesses with adaptable and scalable energy management solutions.

- March 2023: Honeywell announced a strategic investment in Redaptive, a key player in the energy-as-a-service (EaaS) sector. The partnership is focused on improving energy efficiency in commercial and industrial facilities without the need for upfront capital. Combining Honeywell’s expertise in energy performance contracting with Redaptive’s advanced data technologies, the collaboration aims to drive carbon reduction and support long-term sustainability goals.

Energy as a Service Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Energy Supply Services

- Operational & Maintenance Services

- Energy Efficiency & Optimization Services

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Commercial

- Industrial

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Energy as a Service Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 74.46 billion |

|

Market Size Value in 2025 |

USD 83.44 billion |

|

Revenue Forecast by 2034 |

USD 237.01 billion |

|

CAGR |

12.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The energy as a service market has been segmented into detailed segments of type and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

Growth strategies within the energy as a service market are increasingly focused on expanding service portfolios to offer more integrated and comprehensive solutions. Companies are emphasizing the development of digital platforms leveraging IoT and AI for enhanced energy management and predictive analytics, attracting clients seeking optimized performance and cost savings. Strategic partnerships and collaborations with technology providers and energy infrastructure developers are also key to broadening market reach and service capabilities. Furthermore, a strong emphasis on demonstrating tangible energy savings and sustainability benefits through effective marketing and communication is crucial for driving market penetration and attracting environmentally conscious customers across commercial and industrial sectors. Tailoring service offerings to specific industry needs and highlighting the reduced upfront investment compared to traditional energy infrastructure ownership remains a significant market entry assessment strategy.

FAQ's

The market size was valued at USD 74.46 billion in 2024 and is projected to grow to USD 237.01 billion by 2034.

The market is projected to register a CAGR of 12.3% during the forecast period.

North America had the largest share of the market.

A few key players include ENGIE, Schneider Electric, Siemens, General Electric (GE Vernova), Honeywell International Inc., Veolia Environnement S.A., EDF (Électricité de France S.A.), Centrica plc, Johnson Controls International plc, Enel S.p.A., and Bernhard Energy Solutions.

The commercial segment accounted for a larger share in 2024.

Following are a few of the market trends: ? Growing Adoption of Renewable Energy Integration: EaaS models are increasingly incorporating renewable energy sources such as solar and wind power into their service offerings, aligning with the global push for decarbonization and providing customers with cleaner energy options without the upfront investment. ? Rise of Smart Grid Technologies and Digitalization: The integration of smart grid technologies, IoT (Internet of Things) devices, and digital platforms is enabling real-time monitoring, control, and optimization of energy consumption and generation within EaaS frameworks. ? Emphasis on Energy Efficiency and Optimization Services: There is a growing demand for EaaS providers to offer advanced energy efficiency and optimization services, leveraging data analytics and AI to identify energy-saving opportunities, predict maintenance needs, and optimize energy usage for commercial and industrial clients.

Energy as a service (EaaS) is a business model where customers pay for energy-related services over a contract period without making significant upfront capital investments in energy infrastructure. Instead of owning and operating assets such as solar panels, efficient HVAC systems, or energy storage, along with long duration energy storage, customers pay a service provider a recurring fee for the energy outcomes they desire, such as heating, cooling, lighting, or overall energy management.