Global Engineered Wood Adhesives Market Size, Share, Trends, Industry Analysis Report

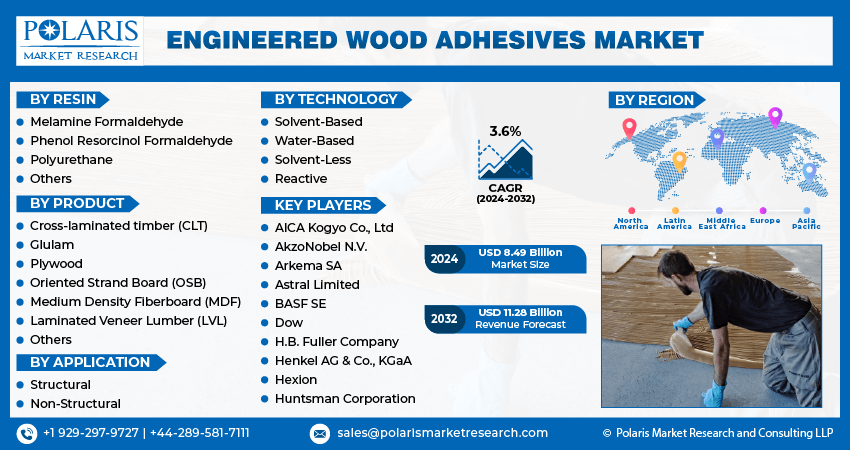

: Information By Resin (Melamine Formaldehyde, Phenol Resorcinol Formaldehyde, Polyurethane, Others); By Product; By Technology; By Application, and By Region (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Jul-2024

- Pages: 116

- Format: PDF

- Report ID: PM4992

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

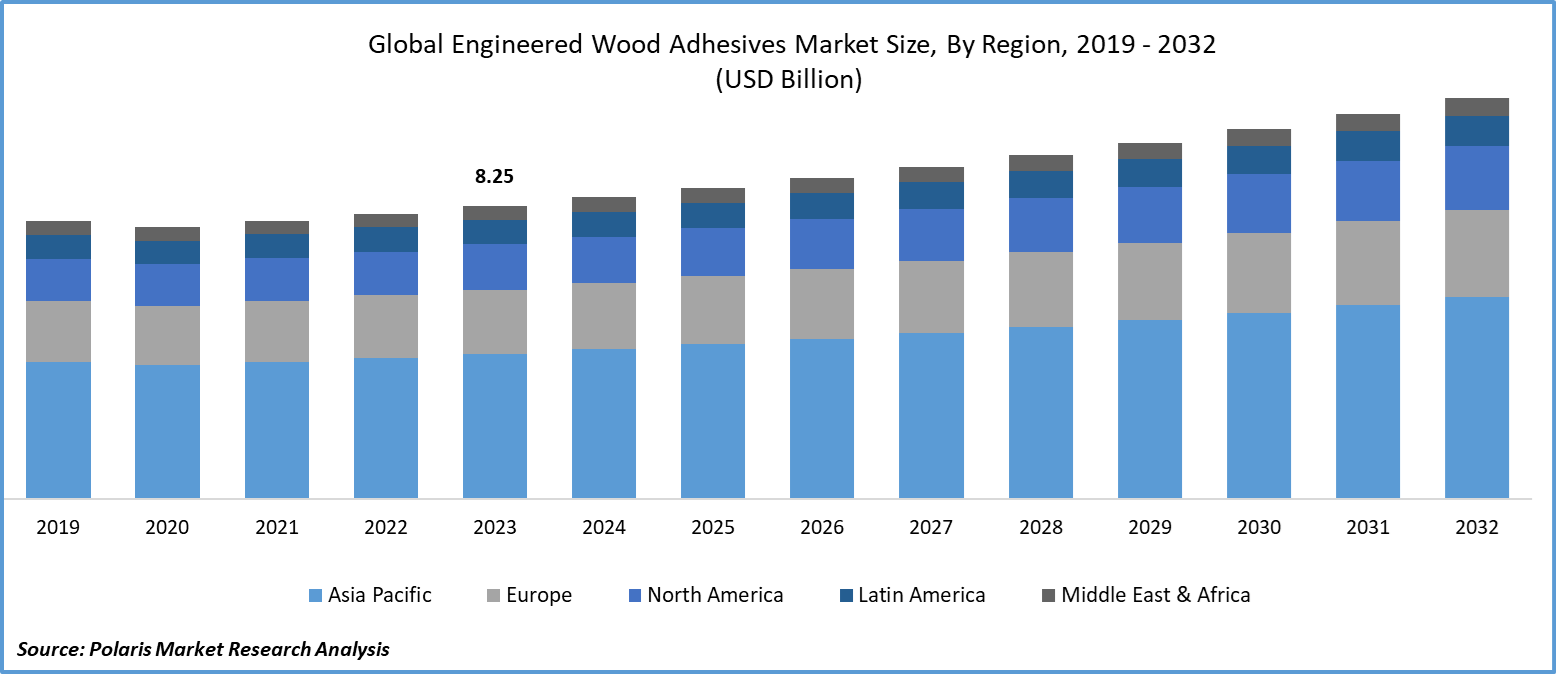

Global engineered wood adhesives market size was valued at USD 8.25 billion in 2023. The engineered wood adhesives industry is projected to grow from USD 8.49 billion in 2024 to USD 11.28 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.6% during the forecast period (2024 - 2032).

The engineered wood adhesives market refers to the sector specializing in adhesives used in the manufacturing of engineered wood products such as plywood, particle board, and laminated veneer lumber. These adhesives bond wood particles and fibers together to create strong, durable composite materials. The engineered wood adhesives market is growing due to advancements in technology aimed at reducing VOC emissions, improving resistance to environmental conditions, and enhancing bonding strength. Environmental legislation and increasing consumer preference for sustainable construction materials are crucial for manufacturers. The industry’s shift towards more environmentally friendly options, which include soy-based products and other bio-based adhesives, drives the market for engineered wood adhesives.

To Understand More About this Research:Request a Free Sample Report

Moreover, activities like renovating, modifying, and building office spaces and commercial buildings create a demand for wood furniture, thus increasing the need for wood adhesives. Also, adhesives like MUF and PRF are known for their exceptional stability in damp weather and their ability to withstand moisture. This makes them suitable for outdoor and cargo requirements, thereby driving the market for engineered wood adhesives.

Engineered Wood Adhesives Market Trends

Increasing Advancements in Adhesive Technologies Driving Market Growth

The growth of the engineered wood adhesives market is largely driven by advancements in adhesive technology. This encompasses a wide range of developments and improvements in adhesive compositions and application methods. Adhesive manufacturers are continuously innovating to create products that meet the specific requirements of engineered wood products, including moisture resistance, heat resistance, and flexibility. These innovations are expanding the potential uses of engineered wood in various industries. New adhesive formulations and compositions are being developed to meet evolving market demands, such as increased bonding capacity, durability, and environmental sustainability. For instance, in May 2023, Henkel opened its new Technology Center in Bridgewater, enhancing collaboration with partners and showcasing innovations in adhesives, sealants, and coatings to drive market growth and sustainability in North America.

Expansion of the Furniture Manufacturing Industry Drives Market Growth

The furniture manufacturing industry's growth is a major factor driving the demand for engineered wood adhesives. The demand for furniture, particularly made from engineered wood products, continues to rise, and adhesive solutions play a critical role in ensuring the structural integrity and longevity of the furniture. Engineered wood, such as plywood, particleboard, and medium-density fiberboard (MDF), has become the preferred material for furniture producers over traditional solid wood. For instance, manufacturers like Follmann have introduced FOLCO REACT, a new series of polyurethane hotmelt adhesives for the wood and furniture industry, in partnership with H&H Maschinenbau. These adhesives offer efficient bonding, fast setting, and high flexibility.

In addition, advancements in adhesive technologies have made engineered wood products more versatile and durable. This, in turn, has led to their increased adoption in furniture manufacturing, construction, and other industries, driving the engineered wood adhesives market revenue.

Engineered Wood Adhesives Market Segment Insights

Engineered Wood Adhesives Resin Insights

The global engineered wood adhesives market segmentation, based on resin, includes melamine formaldehyde, phenol resorcinol formaldehyde, polyurethane, and others. The phenol-resorcinol-formaldehyde segment is expected to hold the largest market share during the forecast period. This is due to its essential properties of longevity, moisture resistance, and capacity to accommodate varying temperatures, making it essential for structural applications such as laminated beams and CLT. Furthermore, major players such as Hexion have been accelerating their presence in this segment by investing in adhesive products that are green-certified and comply with all industrial regulations.

Engineered Wood Adhesives Product Insights

The global engineered wood adhesives market segmentation, based on product, includes cross-laminated timber (CLT), glulam, plywood, oriented strand board (OSB), medium-density fiberboard (MDF), laminated veneer lumber (LVL), and others. The plywood segment dominated the market in 2023, driven by increased construction activity and rising demand for more eco-friendly building materials. Plywood is made up of multiple layers of wood veneers glued together using different adhesives at high temperatures and pressure and is widely used in construction, furniture, and cabinetry. Exterior-grade plywood is manufactured using phenol-resorcinol-formaldehyde (PRF) adhesives, which are more resistant to moisture and heat. Thus, the rising application of plywood is expected to drive the market industry outlook.

The oriented strand board (OSB) segment is expected to grow at the highest CAGR rate over the study period due to the wide application of OSB in construction and building materials. OSB is cheaper than plywood while offering similar strength and dimensional stability. OSB panels, which are made of waterproof heat-cured adhesives and cross-oriented strands of wood, are becoming more popular for floor, roofing, and wall sheathing in residential construction. The growing need for affordable housing and urbanization is fueling this growth, particularly in China and India. For example, the ongoing urbanization efforts by the Chinese government and the post-pandemic recovery of the Indian construction market have led to a significant increase in the demand for OSB products.

Global Engineered Wood Adhesives Market, Segmental Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Engineered Wood Adhesives Regional Insights:

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. In 2023, the Asia Pacific region had the largest market share due to rapid urbanization and infrastructure development in countries such as China, India, and Southeast Asian nations. There is a growing demand for engineered wood products such as plywood, particle board, and MDF (Medium Density Fiberboard), leading to an increased demand for high-quality adhesives to attach these products. Additionally, many Asian nations are focusing on green and eco-friendly construction practices due to the rapid increase in pollution in the region.

For instance, in February 2024, INDIAWOOD 2024 showcased woodworking and furniture technology with 950 firms from 50+ countries, attracting 75,000 trade visitors to explore advanced machinery, materials, and industry innovations.

Further, the major countries studied in the market report are US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil and Others.

Europe engineered wood adhesives market is expected to grow at a significant CAGR due to the increasing demand for engineered wood products (EWP) such as plywood, particleboard, and oriented strand board (OSB). These products are widely used in construction, furniture manufacturing, and other industries. Also, the market is competitive, with the presence of both global and regional players. Major companies involved in the European engineered wood adhesives market include Henkel AG & Co. KGaA, and Akzo Nobel N.V., among others.

North America is expected to experience significant growth in the coming years. This growth is being driven by increased construction activity, especially in the residential sector, and a growing demand for engineered wood products such as plywood, oriented strand board, and laminated veneer lumber (LVL). Additionally, the market has seen an increase in demand for eco-friendly adhesive products due to strict guidelines regarding their use, which is driving the market's growth.

Global Engineered Wood Adhesives Market, Regional Coverage, 2019 - 2032 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Engineered Wood Adhesives Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the engineered wood adhesives market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the engineered wood adhesives industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global engineered wood adhesives industry to benefit clients and increase the market sector. In recent years, the engineered wood adhesives industry has witnessed some technological advancements. Major players in the engineered wood adhesives market include AICA Kogyo Co., Ltd, AkzoNobel N.V., Arkema SA, Astral Limited, BASF SE, Dow, H.B. Fuller Company, Henkel AG & Co., KGaA, Hexion, and Huntsman Corporation.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. In May 2023, BASF reintroduced biomass balance to flooring adhesives, enhancing sustainability with reduced CO2 footprint and fossil resource savings, leveraging its Verbund concept for efficient value chains.

Henkel AG & Co. KgaA is a multinational company that is primarily involved in the designing, manufacturing, and sale of home care & laundry, and beauty care products along with adhesive technologies. The laundry segment of the company is widely popular around the world. The company has a presence in nearly 120 countries. In July 2022, Henkel Adhesive Technologies invested in 3RT to advance sustainable timber construction solutions through innovative hardwood technology and automated production processes.

Key companies in the engineered wood adhesives market include:

- AICA Kogyo Co., Ltd

- AkzoNobel N.V.

- Arkema SA

- Astral Limited

- BASF SE

- Dow

- H.B. Fuller Company

- Henkel AG & Co., KGaA

- Hexion

- Huntsman Corporation

Engineered Wood Adhesives Industry Developments

- February 2024: Henkel and Covestro collaborated to create engineered wood adhesives, which will increase the sustainability of wooden construction. Covestro provides bio-based polyurethane raw ingredients to Henkel for the development of adhesives.

- February 2024: TreadBond offered a 99% RH adhesive solution for engineered wood installations, simplifying moisture testing and ensuring a secure bond without surface damage.

- November 2023: Henkel introduced bio-based Loctite PUR adhesives, reducing CO2 emissions by over 60% and enabling sustainable transformation in load-bearing timber construction.

Engineered Wood Adhesives Market Segmentation:

Engineered Wood Adhesives Resin Outlook

- Melamine Formaldehyde

- Phenol Resorcinol Formaldehyde

- Polyurethane

- Others

Engineered Wood Adhesives Product Outlook

- Cross-laminated timber (CLT)

- Glulam

- Plywood

- Oriented Strand Board (OSB)

- Medium Density Fiberboard (MDF)

- Laminated Veneer Lumber (LVL)

- Others

Engineered Wood Adhesives Technology Outlook

- Solvent-Based

- Water-Based

- Solvent-Less

- Reactive

Engineered Wood Adhesives Application Outlook

- Structural

- Non-Structural

Engineered Wood Adhesives Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Engineered Wood Adhesives Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 8.25 billion |

|

Market Size Value In 2024 |

USD 8.49 billion |

|

Revenue Forecast in 2032 |

USD 11.28 billion |

|

CAGR |

3.6% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global engineered wood adhesives market size was valued at USD 8.38 billion in 2023 and is projected to grow to USD 11.28 billion by 2032

The global market is projected to grow at a CAGR of 3.6% during the forecast period, 2024-2032

Asia Pacific had the largest share of the global market for engineered wood adhesives

The key players in the market are AICA Kogyo Co., Ltd, AkzoNobel N.V., Arkema SA, Astral Limited, BASF SE, Dow, H.B. Fuller Company, Henkel AG & Co., KGaA, Hexion, and Huntsman Corporation

The phenol resorcinol formaldehyde category dominated the market in 2023

The plywood segment had the largest share in the global market