Enterprise Governance, Risk & Compliance Market Share, Size, Trends, Industry Analysis Report

By Component (Software, Services); By Software (Audit Management, Compliance Management, Risk Management, Policy Management, Incident Management, Others); By Services; By Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 111

- Format: PDF

- Report ID: PM2115

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

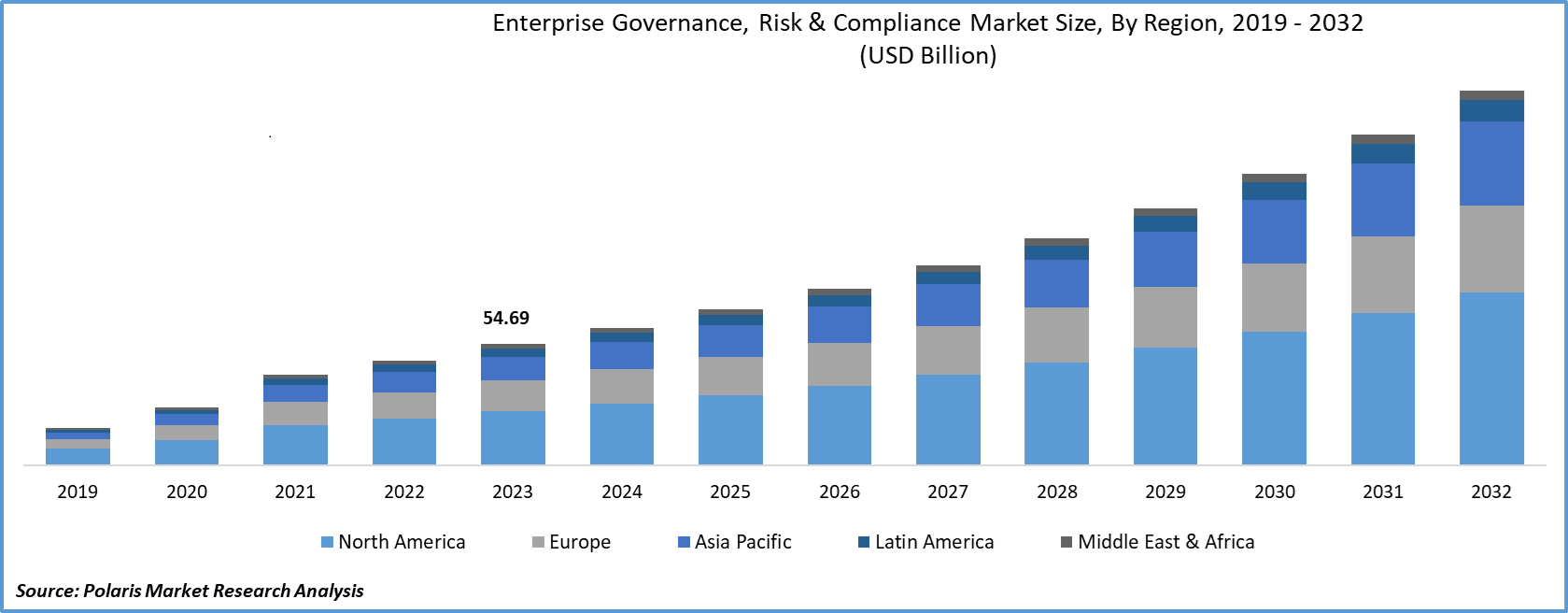

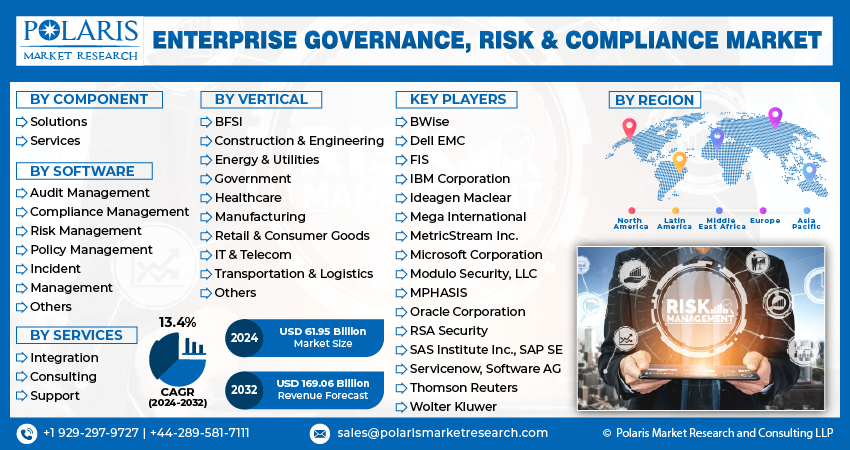

The global enterprise governance, risk & compliance market size was valued at USD 54.69 billion in 2023. The market is anticipated to grow from USD 61.95 billion in 2024 to USD 169.06 billion by 2032, exhibiting the CAGR of 13.4% during the forecast period.

The growth of enterprise governance market is accredited to the surge in implementation of governance, risk & compliance solutions in enterprises, coupled with the robust market growth in the adoption of big data and IoT in GRC solutions, which is now required to optimize the 360-degree view of the organization’s risk landscape and increase focus to prevent reputational risks due to non-compliance. Furthermore, the increasing threats among business organizations due to digitalization and sharing of the massive amount of data along with the growing need for efficiency in cost-saving and financial assessment solutions is further expanding the implementation of enterprise governance, risk & compliance (EGRC) globally.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

In the wake of the COVID-19 pandemic, the business-facing a rapid change in its functioning and security requirement with the surge in proliferation of the Internet of Things (IoT) & Artificial Intelligence (AI) technology along with external reporting obligations, are anticipated to create an unprecedented requirement for enterprise governance, risk, and compliance management. Moreover, several companies are aggressively pursuing digital transformation strategies in improving risk and compliance management to address customer needs during the ongoing COVID-19 pandemic. This, in turn, has forced the enterprise to utilize such enterprise governance, risk & compliance (EGRC) solutions, which has positively impacted the market growth.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the Enterprise Governance, Risk & Compliance Market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Industry Dynamics

Growth Drivers

The proliferation of EGRC is rising at a significant pace considering the global scenario. The rapid rise in globalization and commercialization has further promoted governments to form and implement new policies for fair trade practices. EGRC plays a crucial role in addressing the complication of conforming with strict regulatory policies.

Furthermore, it becomes essential for enterprises to keep on abreast with this changing business scenario as well as upgrade their existing enterprise governance, risk & compliance solutions to prevent non-compliance. Hence, it is expected to strengthen the trend for enterprise governance, risk & compliance in developed and emerging markets due to ensure data security and privacy protection.

Additionally, the rise in enterprise governance & compliance market demand for EGRC solutions has been expanding continually in enterprises to overcome the monetary and regulatory hazards of non-compliance, and the increasing incidents of cyber-attacks drive more safety requirements. As per the EC-Council, nearly 300% growth is witnessed in cyber-attacks on IoT devices globally in 2019 compared to 2018. This accelerating market demand for EGRC solutions on the back of the digital transformation strategies has forced enterprises to deploy advanced risk management solutions to lower the possibilities of cybersecurity attacks. As a result, it plays a critical role in changing the dynamics of the enterprise governance, risk & compliance market during the forecast period.

Report Segmentation

The market is primarily segmented on the basis of component, software, services, vertical, and region.

|

By Component |

By Software |

By Services |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Component

Based on the component segment, the software segment is expected to account for the highest market share of enterprise governance, risk & compliance and is expected to retain its dominance during the foreseen period. This is mainly due to the reduced cost of ownership of software with incorporated solutions that are extensively utilized to manage myriad regulations, including quality control, supply chain, and OSHA.

Furthermore, the rise in need for assessment of third party and supplier audit and risks, coupled with the advent of IoT, has led to a considerable upgrade in the business processes with significant innovations in GRC processes, and hence, is creating a huge implementation of such software in the concerned market.

On the contrary, the services segment is also expected to grow significantly and gaining a high market share by 2028. The market demand for enterprise governance, risk & compliance services is anticipated to increase backed by the reduced cost of internet connectivity, and the growing utilization of Wi-Fi by business organizations is lowering the costs of technology. This is projected to strengthen the market demand for enterprise governance, risk, and compliance management services over the coming years.

Insight by Application

The BFSI segment is expected to witness large revenue in the global enterprise governance, risk & compliance market. The growing use of enterprise governance, risk & compliance helps in effective risk management by recognizing potential threats to consumers and third parties, including each business line and its operation in the sector. Further, enterprise governance, risk & compliance is gaining wide popularity in the BFSI sector on the back of the increasing focus to improve its overall performance and provide a seamless experience to its consumers. Hence, the BFSI is also looking for a framework that can assist organizations in meeting several regulatory and compliance-related constraints. This, in turn, is expected to gain a significant profit share that accelerates the growth of the global enterprise governance market.

Whereas, the telecom segment is anticipated to pave a high market share in revenue share over the study period, as telecom companies are extremely regulated due to the nature of data stored, collected, and processed in the industry. Furthermore, the rising number of directives and risk of penalty fees for non-compliance in the IT sector is also projected to impel the segment market growth over the foreseen period.

Geographic Overview

Geographically, North America dominated the global enterprise governance market and accounted for the largest revenue share primarily due to the robust market growth and early implementation of advanced technologies and software associated with risk and compliance management in the region. Additionally, the rise in deployment of cloud-based computing applications, coupled with the rising liability of information breaches to cyber threats to manage the general business activities, is further expanding the enterprise governance market growth at a rapid pace considering the global scenario.

United States and Canada are further estimated to register the increased number of innovative products and partnerships agreements that will prolong the utility of EGRC solutions as well as increase risk and compliance management programs to prevent monetary losses across these countries. As a result, in September 2019, U.S.-based OneTrust LLC unveiled its integrated and flexible governance, risk, and compliance management platform named OneTrust GRC. The main objective is to provide a complete, seamless, and evaluated view of the business risk portfolio, which is expected to bolster the region’s market growth.

Moreover, Asia-Pacific is expected to witness a high CAGR over the study period. The market demand for enterprise governance, risk & compliance in the region is attributed to an increase over the forecast period, owing to the growing implementation of sophisticated technologies, including IoT, AI, and cloud computing, to effectively manage changing customer requirements, coupled with the rise in need for assessments that present huge opportunities for the acceptance of the EGRC solutions.

As per the International Data Corporation (IDC), Asia-pacific dominated the IoT spending in 2019 with more than 35.7%, subsequently the United States of America with nearly 27.3%, and is further expected to increase the spending on IoT by almost USD 398.6 billion in Asia-pacific in 2023. Hence, enterprise governance, & compliance has gained immense recognition, so the enterprise governance market is gaining significant prominence worldwide.

Competitive Landscape

Some of the major players operating in the global enterprise governance, risk & compliance market include BWise, Dell EMC, Fidelity National Information Services, Inc. (FIS), FIS, IBM Corporation, Ideagen, Maclear, mega international, MetricStream Inc., Microsoft Corporation, Modulo Security, LLC, MPHASIS, Oracle Corporation, RSA SECURITY, SAS Institute Inc., SAP SE, SERVICENOW, Software AG, Thomson Reuters, Wolter Kluwer

Enterprise Governance, Risk & Compliance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 61.95 billion |

|

Revenue forecast in 2032 |

USD 169.06 billion |

|

CAGR |

13.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2032 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Component, By Software, By Services, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

BWise, Dell EMC, Fidelity National Information Services, Inc. (FIS), FIS, IBM Corporation, Ideagen Maclear, Mega International, MetricStream Inc., Microsoft Corporation, Modulo Security, LLC, MPHASIS, Oracle Corporation, RSA Security, SAS Institute Inc., SAP SE, Servicenow, Software AG, Thomson Reuters, Wolter Kluwer |

Gain profound insights into the 2024 Enterprise Governance, Risk & Compliance Market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2029. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.