Europe Equine Healthcare Market Size, Share, Trends, Industry Analysis Report

: By Product (Vaccines, Pharmaceuticals, Medicinal Feed Additives, Orthobiologics, Diagnostics, Software, and Others), Indication, Activity, Distribution Channel, and Country – Market Forecast, 2024–2032

- Published Date:Sep-2024

- Pages: 119

- Format: PDF

- Report ID: PM5064

- Base Year: 2023

- Historical Data: 2019-2022

Europe Equine Healthcare Market Outlook

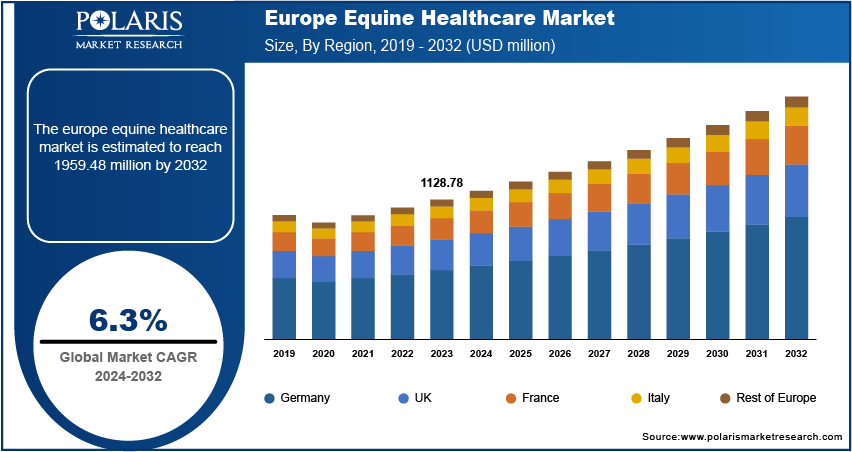

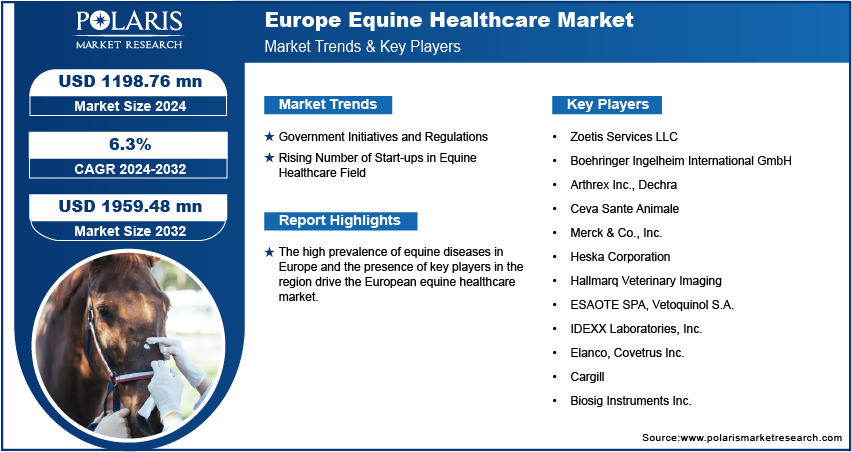

The Europe equine healthcare market size was valued at USD 1,128.78 million in 2023. The market is anticipated to grow from USD 1,198.76 million in 2024 to USD 1,959.48 million by 2032, exhibiting a CAGR of 6.3% during 2024–2032.

Europe Equine Healthcare Market Overview

The high prevalence of equine diseases in Europe drives the equine healthcare market in the region. Higher disease prevalence prompts a stronger emphasis on preventive care, including vaccinations, parasite control, and biosecurity measures. This drives demand for products and services aimed at disease prevention. Further, the growth of equestrian activities in Europe propels the regional market growth. The number of horses in Europe rises as equestrian activities, including recreational riding, competitive sports, and breeding, become popular. This naturally increases the need for veterinary care and health management.

The presence of key players in Europe is expected to create significant opportunities for the Europe equine healthcare market during the forecast period. Dechra is one of the top brands in Europe for horse medicine, continuously developing effective drugs and vaccines that help equine health professionals treat their patients. For instance, in August 2022, Dechra Pharmaceuticals launched “Strangvac,” a protein-based strangles vaccine for horses and ponies to protect against strangles caused by streptococcus equi infection.

To Understand More About this Research: Request a Free Sample Report

Europe Equine Healthcare Market Drivers

Government Initiatives and Regulations

European governments often implement and enforce stringent animal welfare regulations. These standards mandate regular veterinary check-ups, vaccinations, and preventive care to ensure the health and well-being of horses. For instance, the European Commission launched EUNetHorse, the Horizon Europe project for equine animals. This project aims to exchange knowledge and learning between actors and stakeholders of the equine sector, to improve equine animals' healthcare. Compliance with such regulations increases the demand for equine healthcare services.

Rising Number of Start-ups in Equine Healthcare Field

The entry of new players into the European equine healthcare market creates a competitive environment among new and existing market players. This competition leads to improved and advanced services, better pricing, and more options for horse owners. Coho, a France-based startup, developed a unique application that tracks and monitors horses when in stables. The introduction of new treatment options by start-ups also drives the Europe equine healthcare market growth.

Europe Equine Healthcare Market Restraint

Lack of Trained Horse Veterinarian

A shortage of trained equine veterinarians results in fewer available veterinary services, particularly in rural or less accessible areas. This limited access discourages horse owners from seeking necessary healthcare services. Thus, the lack of trained horse veterinarians significantly restrains the European equine healthcare market growth.

Europe Equine Healthcare Market Segment Analysis

By Product Analysis

Pharmaceuticals Segment Held Largest Share of European Equine Healthcare Market in 2023

The pharmaceuticals segment accounted for the largest share of the European equine healthcare market in 2023 due to the persistent demand for advanced treatments for common equine conditions such as respiratory infections and musculoskeletal issues. The development of new and innovative drugs, coupled with a rising focus on preventive care, has also driven the market growth for this segment. Pharmaceutical companies have invested heavily in research and development to create more effective and safer treatments, further strengthening the segment's dominance.

The software segment is expected to grow at a robust pace in the coming years, owing to the increasing integration of digital technologies in equine healthcare management. Innovations such as electronic health records, telemedicine, and data analytics tools are transforming how veterinary practices monitor and manage equine health. These technological advancements offer enhanced accuracy in diagnostics and treatment planning, which appeals to a growing number of veterinarians and horse owners seeking to improve the efficiency and effectiveness of care. The rising adoption of these digital solutions is expected to drive the European equine healthcare market for the software segment in the coming years.

By Activity Analysis

Sports and Racing Segment Held Largest Share of European Equine Healthcare Market in 2023

The sports and racing segment held the largest share of the European equine healthcare market in 2023 due to the growing popularity of equestrian sports and competitive racing across Europe. High-value racehorses and competition horses require rigorous medical care to ensure peak performance and prevent injuries. This has driven the demand for specialized healthcare services that enhance the health and performance of these elite animals. Therefore, stakeholders in this segment, including owners, trainers, and veterinarians, prioritize comprehensive healthcare solutions to maintain competitive advantage and comply with regulatory standards.

The recreation segment is estimated to register a significant CAGR during the forecast period. The rise in recreational riding and leisure activities involving horses has led to an increase in awareness and demand for healthcare services tailored to non-competitive equines. The expansion of recreational riding facilities and the growing emphasis on the overall health and longevity of horses used for leisure activities are driving the segment.

Country Insights

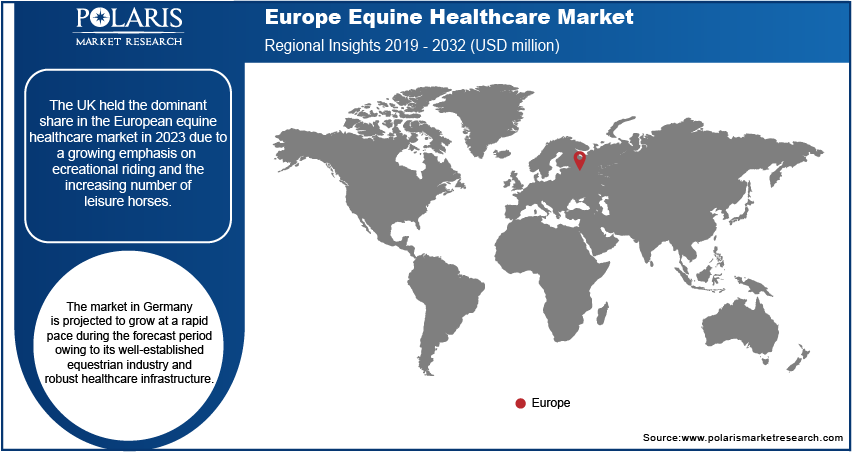

UK Accounted for Largest Share in European Equine Healthcare Market in 2023

The UK held the dominant share in the European equine healthcare market in 2023 due to a growing emphasis on recreational riding and the increasing number of leisure horses. The UK’s large equestrian community, coupled with rising interest in horse welfare and preventive care, drives demand for innovative healthcare solutions. Recreational riding has gained popularity across various demographic groups, leading to a higher need for regular veterinary services and health management. The UK’s strong infrastructure for competitive and recreational equestrian activities, combined with its focus on comprehensive care for horses, positions it as a key country in the market. Furthermore, the increasing incidence of equine influenza, West Nile virus, and tetanus diseases among horses in the country further boosts the market growth. Since November 9, 2021, equine influenza (EI) has been reported on ten separate occasions in the UK, which represents more than 40% of the 24 EI diagnoses made in 2021.

The equine healthcare market in Germany is projected to grow at a rapid pace during the forecast period, owing to its well-established equestrian industry and robust healthcare infrastructure. The country boasts a strong tradition in equine sports and racing, supported by numerous prestigious events and a significant number of competitive horses. This tradition drives substantial investments in equine medical treatments and preventive care. Additionally, Germany’s advanced veterinary research institutions and high standards of care contribute to the market growth in the country. The country’s comprehensive approach to equine health, supported by a network of specialized veterinary clinics and research facilities, strengthens its major role in the sector.

Key Market Players and Competitive Insights

Prominent market players are investing heavily in research and development to expand their offerings, which will help the European equine healthcare market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. Major players in the European equine healthcare market include Ceva Sante Animale, Heska Corporation, Esaote SPA, Zoetis Services LLC, Elanco, and Covetrus Inc.

List of Major Players Operating in Europe Equine Healthcare Market

- Zoetis Services LLC

- Boehringer Ingelheim International GmbH

- Arthrex Inc.

- Dechra

- Ceva Sante Animale

- Merck & Co., Inc.

- Heska Corporation

- Hallmarq Veterinary Imaging

- ESAOTE SPA

- Vetoquinol S.A.

- IDEXX Laboratories, Inc.

- Elanco

- Covetrus Inc.

- Cargill

- Biosig Instruments Inc.

Recent Developments in Industry

- In March 2023, Zoetis, the major player in animal health, announced the expansion of its multi-purpose diagnostics platform, Vetscan Imagyst, to include two new applications, one for AI dermatology and another for AI equine FEC analysis.

- In August 2021, Dechra announced the launch of a new antibiotic oral powder, “Equibactin,” to treat horses from bacterial infection.

Report Coverage

The Europe equine healthcare market report emphasizes key country countries across the region to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions. It provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, indication, activity, distribution channel, country, and futuristic opportunities.

Europe Equine Healthcare Market Report Segmentation

The Europe equine healthcare market is primarily segmented on the basis of product, indication, activity, distribution channel, and country.

By Product Outlook (Revenue, USD million, 2019–2032)

- Vaccines

- Pharmaceuticals

- Parasiticides

- Anti-infectives

- Anti-inflammatory & Analgesics

- Other Pharmaceuticals

- Medicinal Feed Additives

- Orthobiologics

- Diagnostics

- Diagnostic Test Kits

- Diagnostic Equipment

- Software

- Practice Management Software

- Imaging Software

- Telehealth Software

- Other Software

- Other

By Indication Outlook (Revenue, USD million, 2019–2032)

- Musculoskeletal Disorders

- Parasitic Infections

- Equine Herpes Virus

- Equine Viral Arteritis (EVA)

- Equine Influenza

- West Nile Virus

- Tetanus

- Other

By Activity Outlook (Revenue, USD million, 2019–2032)

- Sports/Racing

- Recreation

- Other

By Distribution Channel Outlook (Revenue, USD million, 2019–2032)

- Veterinary Hospitals & Clinics

- E-commerce

- Equestrian Facilities

- Other

By Country Outlook (Revenue, USD million, 2019–2032)

- Germany

- UK

- France

- Italy

- Spain

- Switzerland

- Sweden

- Netherland

- Russia

- Rest of Europe

Europe Equine Healthcare Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1198.76 million |

|

Revenue Forecast in 2032 |

USD 1959.48 million |

|

CAGR |

6.3 % from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Europe Equine Healthcare Industry Trend Analysis (2023) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

PDF + Excel |

|

Customization |

Report customization as per your requirements with respect to countries and segmentation. |

FAQ's

The Europe equine healthcare market size was valued at USD 1,128.78 million in 2023 and is projected to grow to USD 1,959.48 million by 2032.

The market is projected to grow at a CAGR of 6.3 % during the forecast period.

The UK accounted for the largest market share.

Zoetis Services LLC; Arthrex Inc.; Dechra; Ceva Sante Animale; Merck & Co., Inc.; Heska Corporation; Hallmarq Veterinary Imaging; ESAOTE SPA; Vetoquinol S.A.; IDEXX Laboratories, Inc.; Elanco; Covetrus Inc.; Cargill; and Biosig Instruments Inc. are among the key players in the market.

The software segment is projected for significant growth in the global market during 2024–2032.

The sports/racing segment dominated the market in 2023.