Europe Propylene Glycol Market Size, Share, Trends, & Industry Analysis Report

By Grade (Pharmaceutical & Food Grade, Industrial Grade), By Source, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6367

- Base Year: 2024

- Historical Data: 2020-2023

Overview

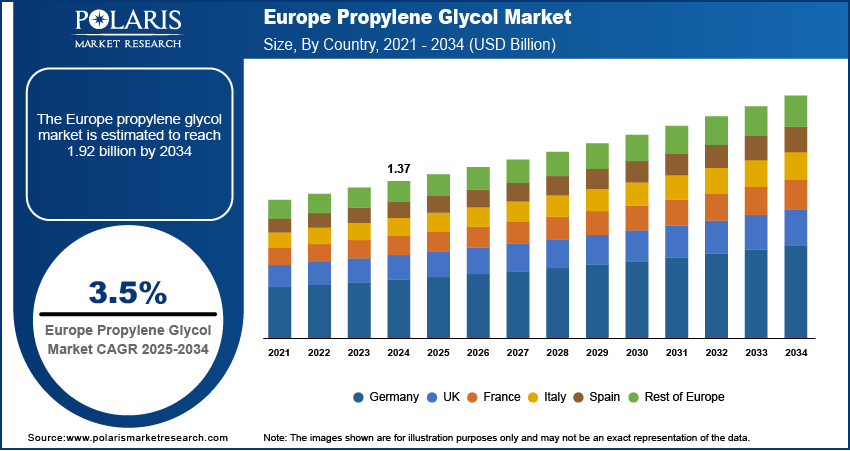

The Europe propylene glycol market size was valued at USD 1.37 billion in 2024, growing at a CAGR of 3.5% from 2025–2034. Key factors driving demand is established automotive manufacturing hub, and stringent environmental regulations promoting bio-based alternatives.

Key Insights

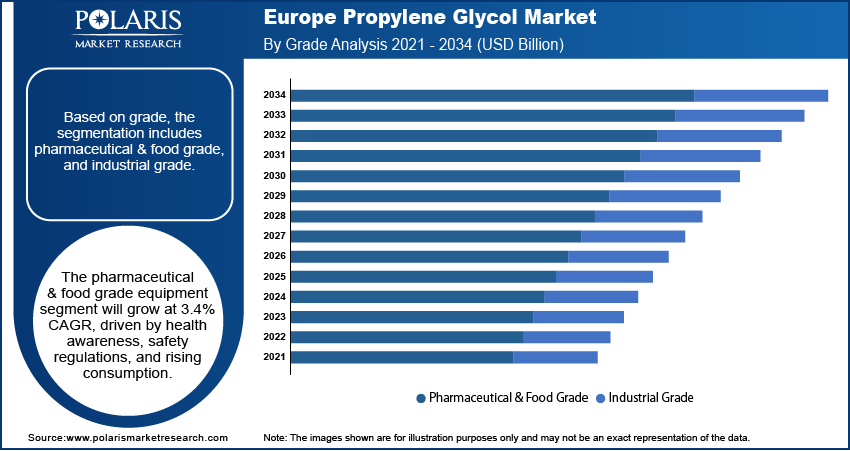

- The pharmaceutical and food grade equipment segment is expected to grow at a CAGR of 3.4% during the forecast period, driven by Europe’s strict health, safety, and quality regulations, which demand high-purity and compliant formulations.

- In 2024, the pharmaceutical segment accounted for a notable 12.12% of total market revenue, supported by the region’s highly advanced and tightly regulated pharmaceutical industry, which drives consistent demand for pharmaceutical-grade propylene glycol.

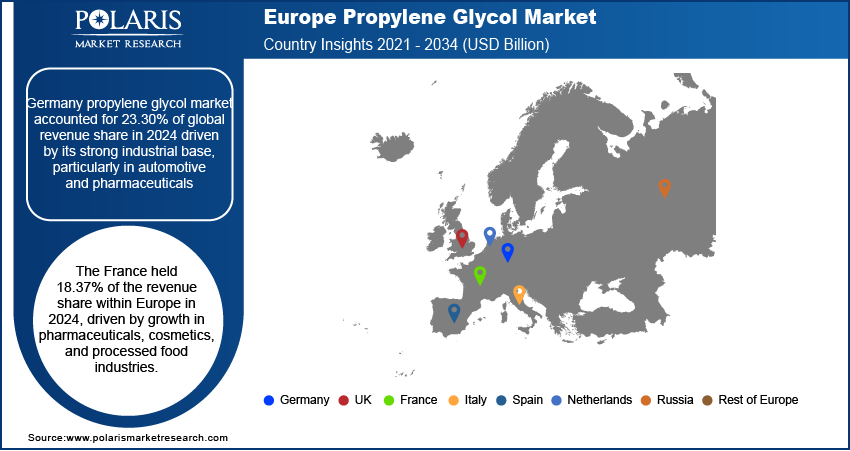

- Germany led the global propylene glycol market in 2024, capturing a 23.30% share of global revenue, fueled by its strong industrial base, especially in the automotive and pharmaceutical sectors.

- France held an 18.37% revenue share within the European market in 2024, driven by expanding demand from the pharmaceutical, cosmetics, and processed food industries, all of which rely heavily on high-quality propylene glycol for various applications.

Industry Dynamics

- Established automotive manufacturing hub are driving the demand for propylene glycol.

- Stringent environmental regulations promoting bio-based alternatives is driving the Europe propylene glycol market

- The growth in construction, manufacturing, and electronics sectors fuels the need for industrial-grade propylene glycol.

- Strict environmental regulations and health concerns related to excessive consumption or exposure to synthetic propylene glycol limits the growth.

Market Statistics

- 2024 Market Size: USD 1.37 Billion

- 2034 Projected Market Size: USD 1.92 Billion

- CAGR (2025-2034): 3.5%

- Germany: Largest Market Share

AI Impact on the Industry

- AI enhances production efficiency by optimizing chemical reaction parameters and real-time process control, leading to higher yield and reduced energy consumption in propylene glycol manufacturing.

- AI-powered supply chain analytics improve demand forecasting, inventory management, and logistics planning, enabling more resilient and cost-effective distribution of propylene glycol across industries.

- AI-driven quality control systems use machine learning and computer vision to detect impurities and ensure consistent purity levels, especially critical in pharmaceutical and food-grade propylene glycol.

- Predictive maintenance powered by AI helps monitor equipment used in glycol production, reducing unplanned downtime, lowering maintenance costs, and extending asset life.

- AI-supported market analysis tools assist manufacturers in identifying emerging trends, regulatory shifts, and consumer demand patterns, enabling faster, data-driven strategic decisions.

Propylene Glycol is a colorless, odorless, and slightly viscous liquid used as a solvent, humectant, and preservative in various industries. It is commonly found in food, pharmaceuticals, cosmetics, and industrial applications like antifreeze and de-icing solutions. Produced from petroleum or bio-based sources, it is generally recognized as safe (GRAS) when used appropriately.

Europe is home to a well-established pharmaceutical sector in countries like Germany, Switzerland, and the UK. Propylene glycol is a major excipient used in a wide range of medications such as syrups, injections, creams, and capsules. The demand for safe and effective drug ingredients rises with Europe’s aging population and increasing investment in healthcare infrastructure. Additionally, European standards for pharmaceutical quality are among the highest, creating strong demand for pharmaceutical-grade propylene glycol in both domestic production and exports, thereby driving the growth.

The European cosmetics and personal care industry is one of the largest globally, with consumers demanding high-quality, safe, and sustainable ingredients in their products. Propylene glycol is commonly used in skincare, haircare, and cosmetic formulations as a moisturizer and solvent. The shift toward dermatologically tested and non-irritant products has increased demand for propylene glycol due to its proven safety profile. Additionally, the rise in natural and organic cosmetics is further supporting the growth of bio-based propylene glycol. This growing demand from both mass-market and premium segments is fueling expansion in the region.

Drivers & Opportunities

Established Automotive Manufacturing Hub: Europe is a major global center for automotive manufacturing, home to brands like BMW, Volkswagen, Renault, and Mercedes-Benz. Propylene glycol plays a major role in vehicle coolants, antifreeze, and brake fluids, essential for engine performance and safety. The demand for efficient thermal management systems is increasing as Europe continues to advance in electric vehicle and hybrid vehicle technologies. This directly boosts the need for propylene glycol in automotive fluids. Furthermore, vehicle maintenance culture and aftermarket service demand in Europe support consumption of glycol-based products, thereby driving the growth.

Stringent Environmental Regulations Promoting Bio-Based Alternatives: Europe has some of the strictest environmental regulations in the world, which is pushing industries to adopt sustainable and low-emission alternatives. Consequently, there is growing interest in bio-based propylene glycol, especially in Western European countries. EU policies like the Green Deal and REACH regulation are encouraging manufacturers to reduce dependence on fossil-based chemicals. This regulatory pressure is driving innovation in cleaner production methods and promoting the use of renewable feedstocks. The demand for eco-friendly products from both industries and environmentally conscious consumers is accelerating the growth of bio-based propylene glycol across Europe, thereby boosting the growth.

Segmental Insights

Grade Analysis

Based on grade, the segmentation includes pharmaceutical & food grade, and industrial grade. Pharmaceutical & food grade equipment segment is projected to grow at a CAGR of 3.4% over the forecast period driven by the region’s stringent health, safety, and quality standards. Regulatory bodies like the European Medicines Agency (EMA) and European Food Safety Authority (EFSA) mandate the use of high-purity ingredients, making pharmaceutical and food-grade propylene glycol essential. The rise in chronic diseases, aging populations, and increased health awareness are boosting pharmaceutical consumption. Simultaneously, the popularity of packaged and processed foods across Europe, particularly in urban areas, is pushing food-grade glycol demand, thereby fueling the segment growth.

Source Analysis

Based on source, the segmentation includes petroleum-based propylene glycol, and bio-based propylene glycol. Bio-based propylene glycol segment is expected to witness a significant share over the forecast period driven by region’s strong commitment to sustainability and green chemistry. Strict EU environmental policies, including the European Green Deal and carbon neutrality targets, are pushing industries to shift from petroleum-based chemicals to renewable alternatives. Consumer demand for eco-friendly, biodegradable, and ethically sourced ingredients is further rising. Manufacturers in Europe are responding by investing in bio-refineries and adopting circular economy practices. Bio-based propylene glycol is gaining traction across industries as sustainability becomes a central business priority, thereby driving the segment growth.

End User Analysis

In terms of end user, the segmentation includes food and beverage, automotive, personal care and cosmetics, chemical, pharmaceutical, construction, and others. The automotive held 20.65% of revenue share in 2024 as Europe is a global hub for automotive manufacturing and home to brands like Volkswagen, BMW, Mercedes-Benz, and Volvo. The region's automotive sector is a major consumer of propylene glycol, primarily used in antifreeze, coolants, and braking fluids. There is a growing need for advanced thermal management solutions with increasing production of electric and hybrid vehicles, driving demand for high-performance glycol-based fluids. Stricter emission regulations and a strong aftermarket maintenance culture in Europe further support the usage, positively impacting the segment growth.

The pharmaceutical segment held significant revenue share in 2024, holding 12.12% as region’s pharmaceutical industry is one of the most advanced and regulated globally, contributing significantly to the demand for pharmaceutical-grade propylene glycol. The region has a robust healthcare system, increasing R&D investment, and a growing elderly population, which are boosting drug development and consumption. Propylene glycol is widely used as a solvent and carrier in various formulations like injectables, creams, and oral medications. Additionally, rising demand for generic drugs and expansion of domestic pharmaceutical manufacturing, particularly in countries like Germany, Switzerland, and the UK, are further fueling the growth of this segment in Europe.

Country Analysis

Germany propylene glycol market accounted for 23.30% of global revenue share in 2024 driven by its strong industrial base, particularly in automotive and pharmaceuticals. The demand for glycol-based coolants and fluids remains high as home to some of the world’s largest car manufacturers like Volkswagen, BMW, and Mercedes-Benz. The country’s pharmaceutical sector is further highly developed, supported by a strong regulatory framework and ongoing R&D investment. Additionally, Germany is advancing in green chemistry and sustainable manufacturing practices, which is encouraging the adoption of bio-based propylene glycol. The combination of industrial strength and environmental focus fuels growth.

France Propylene Glycol Market Insight

The France held 18.37% of the revenue share within Europe in 2024, driven by growth in pharmaceuticals, cosmetics, and processed food industries. The country has a strong tradition in skincare and personal care products, where propylene glycol is widely used as a moisturizer and solvent. France is further among the top pharmaceutical producers in Europe, contributing to the rising demand for pharmaceutical-grade glycol. Moreover, increased consumer preference for organic and sustainable products is pushing manufacturers toward bio-based glycol solutions. Government regulations focused on product safety and environmental sustainability are further supporting the steady growth across major sectors.

UK Propylene Glycol Market

The market in UK is expected to register a CAGR of 3.4% during the forecast period driven by growing demand in the healthcare, automotive, and personal care sectors. The need for pharmaceutical-grade glycol rises with a well-established pharmaceutical industry and a large consumer base for over-the-counter medicines. The UK is further investing in electric vehicle infrastructure and clean energy, increasing demand for high-performance coolants and thermal fluids. Furthermore, the personal care industry is booming, with consumers seeking clean-label and eco-friendly products. Post-Brexit regulatory clarity and increasing focus on domestic manufacturing and sustainability are further accelerating the use of propylene glycol across industries, thereby driving the growth.

Netherlands Propylene Glycol Market Overview

The demand in Netherlands is rising as the Netherlands serves as a major logistics and chemical production hub in Europe. Its advanced infrastructure supports large-scale distribution of chemicals across the continent. The country is further known for its strong agricultural and food processing industries, which are major consumers of food-grade propylene glycol. Additionally, the Netherlands is actively investing in bio-based economy initiatives and circular production models, encouraging the use of renewable feedstocks in glycol manufacturing. A focus on innovation, sustainability, and export-oriented production drive propylene glycol demand in multiple end-use sectors.

Key Players & Competitive Analysis

The Europe propylene glycol market features a competitive landscape dominated by several global and regional players with strong manufacturing and distribution capabilities. Key companies such as BASF SE, INEOS Oxide Ltd., LyondellBasell Industries, and Helm AG are headquartered or have major operations in Europe, giving them a strategic advantage in supply chain integration and regulatory compliance. These companies focus heavily on product innovation, sustainability, and bio-based alternatives to meet the region's stringent environmental standards. Strategic collaborations, capacity expansions, and investments in R&D are common competitive tactics. Players like Temix Oleo S.R.L. are also gaining ground with niche offerings in bio-based propylene glycol, catering to rising demand in food, cosmetics, and pharmaceuticals. The competitive landscape is further shaped by increasing pressure to reduce carbon emissions and shift toward circular economy models. As a result, companies that can align with EU green policies and offer high-quality, sustainable solutions are likely to lead the market.

Key Players

- Adeka Corporation

- Archer-Daniels-Midland Company

- Asahi Glass Co., LTD.

- BASF SE

- Dow Chemicals

- Helm AG

- Huntsman International LLC

- INEOS Oxide Ltd.

- LyondellBasell Industries Holdings B.V.

- Royal Dutch Shell PLC

- Sumitomo Chemicals

- Temix Oleo S.R.L.

Industry Developments

April 2025, Platts, part of S&P Global Commodity Insights, launched weekly spot price assessments for propylene glycol in Northwest Europe, covering industrial, pharmaceutical, and fragrance grades to enhance market transparency and pricing accuracy.

Europe Propylene Glycol Market Segmentation

By Grade Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Pharmaceutical & Food Grade

- Industrial Grade

By Source Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Petroleum-Based Propylene Glycol

- Bio-Based Propylene Glycol

By End User Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Food and Beverage

- Automotive

- Personal Care and Cosmetics

- Chemical

- Pharmaceutical

- Construction

- Others

By Country Outlook (Revenue - USD Billion; Volume – Kilotons; 2021–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Propylene Glycol Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.37 Billion |

|

Market Size in 2025 |

USD 1.42 Billion |

|

Revenue Forecast by 2034 |

USD 1.92 Billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, Countrys, and segmentation. |

FAQ's

The market size was valued at USD 1.37 billion in 2024 and is projected to grow to USD 1.92 billion by 2034.

The global market is projected to register a CAGR of 3.5% during the forecast period.

Germany dominated the market in 2024

A few of the key players in the market are Adeka Corporation; Archer-Daniels-Midland Company; Asahi Glass Co., LTD.; BASF SE; Dow Chemicals; Helm AG; Huntsman International LLC; INEOS Oxide Ltd.; LyondellBasell Industries Holdings B.V.; Royal Dutch Shell PLC; Sumitomo Chemicals; Temix Oleo S.R.L.

The pharmaceutical and food grade segment dominated the market revenue share in 2024.

The pharmaceutical segment is projected to witness the fastest growth during the forecast period.