Excitation Systems Market Share, Size, Trends, Industry Analysis Report

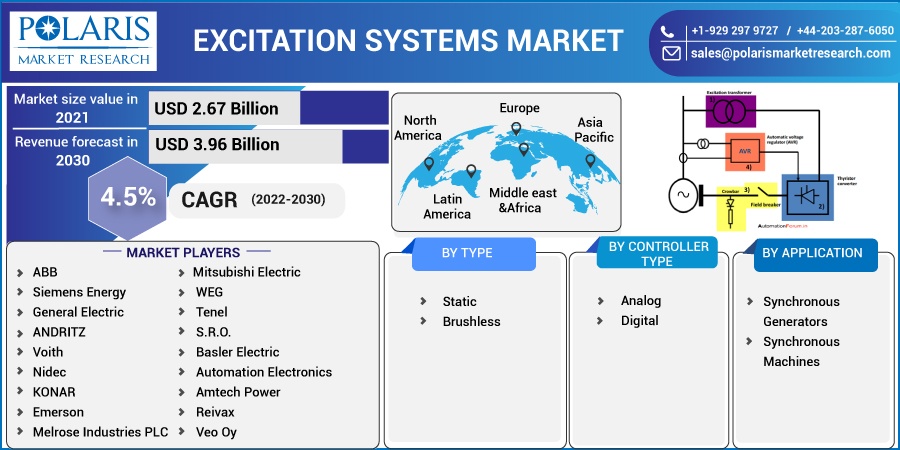

By Type (Static, Brushless); By Application (Synchronous Generators, Synchronous Machines); By Controller Type; By Region; Segment Forecast, 2022-2030

- Published Date:Oct-2022

- Pages: 128

- Format: PDF

- Report ID: PM2683

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

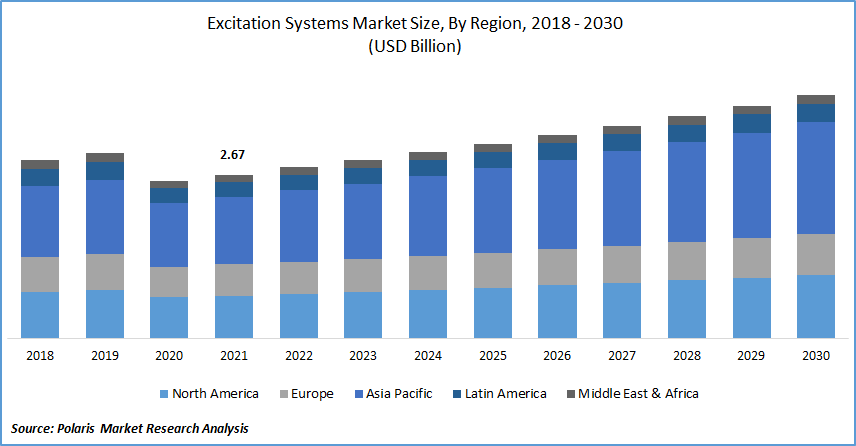

The global excitation systems market was valued at USD 2.67 billion in 2021 and is expected to grow at a CAGR of 4.5% during the forecast period. Excitation systems are becoming more common in switching devices as a result of their capacity to guarantee reliable long-term operations, which is expected to propel the global excitation systems market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The growing demand for unregulated power sources is one of the primary factors influencing the world market for excitation systems. The complexity of excitation systems' designs, which makes maintenance tough, is another factor limiting the market's growth on a global scale.

Synchronous motors and generators are both parts of a synchronous machine. In order to achieve operational dependability, stability, and quick transient response of their assets in accordance with grid needs, power plant owners and operators use excitation systems, a crucial component in many power generation systems. Together, excitation systems and synchronous machines ensure the steady and continuous electricity supply necessary for effective plant operation.

Growing concerns about global warming, carbon dioxide emissions, and pollution have compelled countries to shift toward more sustainable energy sources. Governments are implementing initiatives to solve these environmental problems. According to the International Energy Agency, the number of countries pledging to reach net zero emissions over the next few decades is growing.

Government commitments to date, however, fall far short of what is required to achieve net zero global energy-related CO2 emissions by 2050 and give the world a reasonable chance of keeping the global temperature rise to 1.5 degrees Celsius, even if fully implemented. The study demonstrates how to achieve a net zero energy system by 2050 while assuring consistent and inexpensive energy sources, ensuring everyone has access to energy and fostering strong economic growth.

The COVID-19 outbreak has had an impact on the power sector globally. As nations deployed partial or complete lockdown methods to battle the epidemic, some gadget manufacturing companies were forced to close their facilities and activities across areas. Power demand has significantly decreased as a result of the COVID-19 epidemic.

Governments, however, were compelled to restrict corporate operations in order to decrease the harm that the coronavirus posed. The decline in business activity has had a short-term negative impact on excitation systems.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The key driver of market expansion is the rise in demand for synchronous machines, which are necessary for dependable operation, steady power supply, and adequate plant operations. Synchronous machines can be used to create both synchronous generators and motors.

A steady and continuous power supply is made possible by the synchronous machine and excitation system, which is necessary for effective plant operation. As a result, the synchronous machine's excitation mechanism influences operational readiness and assures dependable long-term operation.

Another significant factor propelling the global market for excitation systems is the rise in demand for renewable energy. According to the International Renewable Energy Agency's annual report, Global renewable power capacity was 3 068 GW at the end of 2021.

In 2021, the capacity of renewable energy generation increased by 260 GW. By 2021, there will be a total of 1.46 Terawatt of renewable capacity, 60% of which will be added in Asia. The largest contributor to the continent's new capacity was China, which added 121 GW. As a result, it is projected that rising renewable energy demand will propel the worldwide excitation systems market over the forecast period.

Report Segmentation

The market is primarily segmented based on type, controller type, application, and region.

|

By Type |

By Controller Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Brushless segment is expected to witness fastest growth

The market for brushless excitation systems will experience the greatest rate of growth in 2021. Brushless excitation systems supply field current to synchronous generators without the use of slip rings or carbon brushes.

Opportunities for market growth are being created by improvements in battery technology that reduce battery costs and increase charging speed, as well as increased government support in the form of tax breaks and incentives to promote environmentally friendly electrical vehicles with brushless DC motors.

By 2025, the IEA projects that China will sell 50% of all passenger electric cars sold globally. Furthermore, a surge in the use of electric vehicles with brushless DC motors is being encouraged by Europe's aggressive efforts to decarbonize society.

Digital accounted for the largest market share in 2021

The fastest and most rapidly expanding market category is reportedly digital control. Digital excitation techniques enhance both transient and dynamic stability, which significantly enhances generator performance. Another important element that is anticipated to boost demand for digital control systems throughout the projected period is the simplicity of analogue to digital control conversion.

Synchronous generators sector is expected to hold the significant revenue share

The most significant and fastest-growing segment is anticipated to be synchronous generators during the projection period. When the generator is operating, the synchronous generator is intended to provide the turbo-generator excitation winding with automatically regulated DC. A power generation system, automatic regulators, protection and control systems, and other functional excitation systems are all included in the generator system.

Different manufacturers operating in the electric car market are switching from traditional induction motors to synchronous motors. As a result, the market for synchronous generators is anticipated to increase significantly in the coming years. In the upcoming years, it is anticipated that expansion in the power generation sector will build a platform for synchronous generator sales development as synchronous generators are manufactured.

For instance, Hyundai introduced The IONIQ Electric, which features a 100kW electric motor that is incredibly quiet and, maybe best of all, is intrinsically more dependable, quicker, and simpler than a traditional gas engine while emitting zero emissions. It also features a permanent-magnet synchronous motor.

Asia Pacific is predicted to be the largest market throughout the forecast period

During the projected period, Asia Pacific is anticipated to rule the worldwide excitation systems market. Growing urbanization and industrialization in the area can be linked to the region's dominance. Furthermore, the region is experiencing a tremendous increase in the development of infrastructure connected to smart cities. As a result, the market for excitation systems is growing in the area.

In 2021, China and India held a significant portion of the excitation systems market in the Asia Pacific. This was mostly caused by the nation's industrial sector's explosive rise in 2021. Based on the Central Electricity Authority of India's Load Generation and Balance Report, the electrical energy demand for 2021-22 is expected to be at least 1915 TWh, with a peak demand of 298 GWH.

Increased demand for electrical equipment, or an increased demand for power in the home sector, is brought on by growing urbanization and rising income levels. Industrial demand for electricity is being driven by the rise in demand for materials for infrastructure, capital goods, and transportation.

Competitive Insight

Some of the major players operating in the global market include ABB, Siemens Energy, General Electric, ANDRITZ, Voith, Nidec, KONAR, Emerson, Melrose Industries, Mitsubishi Electric, WEG, Tenel, Basler Electric, Automation Electronics, Amtech Power, Reivax, PLUTON, NR Electric, Birr Machines, SVEA, and Nelumbo Icona.

Recent Developments

- In November 2020, Oklahoma Gas and Electric awarded Emerson a contract for the modernisation and fusion of nine distinct control systems. Ovation technology from the Emerson has provided Oklahoma Gas and Electric with a number of benefits at its Redbud power plant, allowing the firm to produce megawatts while cutting fuel costs.

- A deal between ANDRITZ and Companhia Hidrelétrica do So Francisco, which was signed in May 2020, will see ANDRITZ complete the modernization and digitalization of the whole Brazilian hydropower complex Sobradinho.

Excitation Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2.78 billion |

|

Revenue forecast in 2030 |

USD 3.96 billion |

|

CAGR |

4.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Controller Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ABB, Siemens Energy, General Electric, ANDRITZ, Voith, Nidec, KONAR, Emerson, Melrose Industries PLC, Mitsubishi Electric, WEG, Tenel, S.R.O., Basler Electric, Automation Electronics, Amtech Power, Reivax, Veo Oy, L & S Electric, PLUTON, NR Electric, Birr Machines, SVEA, and Nelumbo Icona. |