Eye Protection Equipment Market Size, Share, Trends, Industry Analysis Report

By Product, By Lens Type, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6337

- Base Year: 2024

- Historical Data: 2020-2023

Overview

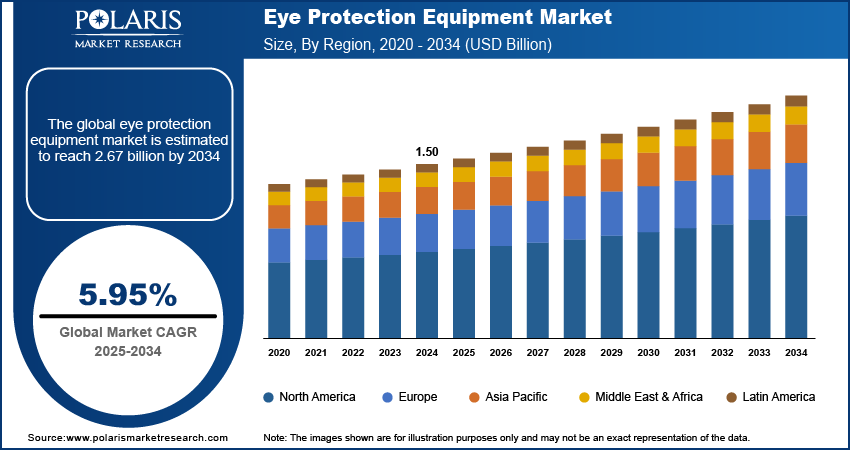

The global eye protection equipment market size was valued at USD 1.50 billion in 2024, growing at a CAGR of 5.95% from 2025 to 2034. Key factors driving demand for eye protection equipment include the expansion of mining industry worldwide coupled with rising defense expenditure worldwide.

Key Insights

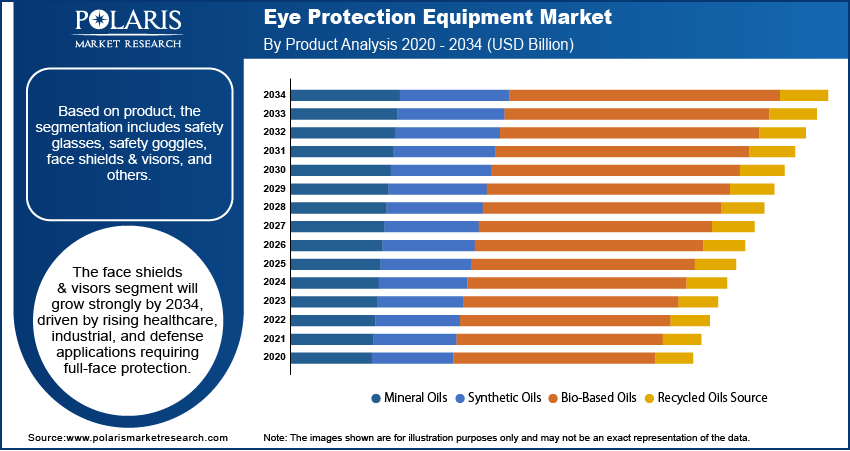

- The safety glasses segment dominated the market share in 2024.

- The face shields & visors segment is projected to grow at a rapid pace in the coming years, driven by increasing adoption in industrial workplaces, healthcare settings, and laboratories for enhanced splash and impact protection.

- The North America eye protection equipment market dominated the global market share in 2024.

- The U.S. eye protection equipment market is growing due to stringent workplace safety regulations, higher occupational safety awareness, and the rising defense spending.

- The market in Asia Pacific is projected to grow at a fast pace from 2025-2034, propelled by rapid industrialization, infrastructure development, and growing adoption of workplace safety standards.

- Countries such as China and Japan are playing a key role in regional growth, due to expanding construction and manufacturing sectors, coupled with strong government emphasis on worker protection.

Industry Dynamics

- Expansion of mining industry worldwide is fueling the market growth due to higher risk of dust, debris, and chemical exposure requiring protective eyewear.

- Rising defense expenditure worldwide drive the demand for eye protection equipment due to the growing need for advanced ballistic and tactical protective gear for military personnel.

- The expansion of advanced and smart eye protection is expected to create lucrative opportunities during the forecast period.

- The high cost of advanced eye protection equipment is anticipated to restrain market growth.

Market Statistics

- 2024 Market Size: USD XY Billion

- 2034 Projected Market Size: USD XY Billion

- CAGR (2025–2034): XY%

- North America: Largest Market Share

Eye protection equipment is designed to shield eyes from dust, chemicals, heat, and radiation in industrial and medical settings. This includes safety glasses, goggles, face shields, and welding helmets that provide protection from injuries, improving workplace safety, and meeting global safety standards. The market continues to grow as industries emphasize advanced personal protective equipment solutions to ensure safety, productivity, and compliance in high-risk environments.

The expansion of solar energy projects worldwide is boosting the demand for eye protection equipment as workers involved in panel manufacturing, installation, and maintenance require advanced safety eyewear to shield against glare, UV radiation, and welding hazards. The International Renewable Energy Agency states that global installed solar energy capacity reached over 1866 GW in 2024 marking a significant rise from 863 GW in 2021. Thus solar infrastructure projects drives the adoption of specialized protective eyewear meeting the occupational health standards in renewable energy operations.

Urbanization and large scale industrial and infrastructure projects are driving the demand for eye protection equipment in construction, manufacturing and heavy engineering sectors. The rapid rise of megacities and industrial areas also introduced urgent demand for stricter workplace safety measures to fairly protect workers from hazards such as dust, chemical exposure, sparks and debris while working. According to the United Nations, the urban population represented 57% of the global population and is projected to reach 68% by 2050, significantly boosting construction and industrial activity. These developments are inducing companies and governments to procure eye protection equipment in order to adopt better protective solutions geared toward significantly increasing worker safety, reducing accident rates, and upholding occupational health requirements.

Drivers & Opportunities

Expansion of Mining Industry Globally: The growth of the global mining industry is accelerating demand for eye protection equipment due to heightened safety requirements in drilling, blasting, crushing, and material handling operations. Workers in mines are frequently exposed to dust particles, flying debris, and chemical hazards, creating a strong need for advanced protective eyewear. World Economic Forum states that autonomous mining equipment market rose from USD 3.1 billion in 2020 to USD 6.2 billion by 2026.This growth is leading to use of safety goggles and glasses that provides durability, clear visibility and compliance to occupational safety standards in harsh environments.

Rising Defense Expenditure Worldwide: The increasing defense budgets across the globe is generating a need for eye protection equipment as militaries are focusing more on improved safety and effectiveness of their defense teams. According to the Stockholm International Peace Research Institute, worldwide defense expenditure surged over USD 2718 billion in 2024, reflecting an increase of 9.4% from 2023. This consistent growth of defense budgets is fueling investments in high-performance protective eyewear with ballistic resistance, anti-fog coating, and compatibility with advanced helmets as well as communications systems.

Segmental Insights

Product Analysis

By product, the market is segmented into safety glasses, safety goggles, face shields & visors, and others. The safety glasses segment dominated the market in 2024 as it is the most common eye protection used in industrial, construction and lab. It provides a lightweight, cost effective way of protection from dust, flying debris and chemical splash. For example, in July 2025 Ergodyne launched new safety glasses that combines style with performance, protection and comfort for workers which reflects the industry’s focus on innovation and user friendly designs.

Face shields & visors segment is expected to grow the most until 2034 as it provides protection from chemical splash, sparks and pathogens in healthcare and laboratory settings. Furthermore, the advancing of lightweight designs, anti-scratch, and integrated headgear continue to increase demand for face shields.

Application Analysis

In terms of lens type, the market is segmented into clear lens, tinted/colored lens, anti-fog lens, UV protection lens and others. Clear lens equipment segment dominated the market in 2024 due to its wide application in indoor industrial facilities, laboratories and cleanrooms. These lenses provide unaltered vision while protecting against impact, making them the most versatile and commonly used option across multiple sectors. Their dominance is marked by consistent demand from large-scale manufacturing and healthcare institutions.

The UV protection lens segment is expected to witness the fastest growth over the forecast period due to rising awareness of damage caused by ultraviolet radiation exposure. This is important in outdoor industries such as construction, mining and agriculture. Moreover employees are exposed to harsh sunlight in energy projects that drives the demand for UV protective eye wear.

End User Analysis

By end user the market is segmented into industrial & manufacturing, construction, healthcare & laboratories, military & defense, mining, and others. The industrial & manufacturing dominated the market in 2024 owing to strict safety protocols in automotive, chemical, and electronics manufacturing facilities. High exposure to particulates, chemical splashes, and flying debris in these environments necessitates continuous use of protective eyewear.

The healthcare & laboratories segment will grow the fastest through 2034 as the risk of exposure to infectious agents increases and laboratory based diagnostic procedures grow in clinical and research settings. Also the increasing prevalence of biotechnology and pharmaceutical R&D where people handle hazardous chemicals and biological samples is creating new opportunities for this segment.

Regional Analysis

North America dominated the eye protection equipment market in 2024, driven by strict occupational safety standards, strong enforcement of workplace protection regulations and a culture of prioritizing worker health in hazardous environments. The region’s high defense spending also contributes to the demand as military personnel require advanced protective eyewear for training and combat readiness. Also widespread use of protective gear in healthcare, laboratories and industrial facilities is sustaining the region’s leadership.

U.S. Eye Protection Equipment Market Insights

US military spending is driving demand for eye protection gear as the armed forces are looking for advanced safety gear to protect personnel from ballistic threats, laser exposure and hazardous environments during combat and training operations. The Stockholm International Peace Research Institute states that US defense spending reached USD 916.01 billion in 2023 from USD 734.34 billion in 2019, a 24.7% increase in four years. This investment in defense modernization fuels the adoption of specialized protective eyewear enhancing soldier safety, field readiness and overall military capabilities.

Europe Eye Protection Equipment Market Assessments

The market in Europe is projected to hold a substantial revenue share in 2034 due to stringent regulatory frameworks on worker safety and a well-established culture of compliance with occupational protection laws. Countries such as Germany, France and the U.K. demonstrate consistent deployment of protective eyewear in industries including construction, automotive, and heavy manufacturing. The rise of renewable energy projects, as well as increased focus on industrial modernization, expanded the scope for eye protection equipment adoption, firming the region’s position in the global market.

Asia Pacific Eye Protection Equipment Market Trends

Asia Pacific is anticipated to record the fastest growth during the forecast period, driven by large-scale industrial expansion and rapid construction activities across emerging economies. The boom in residential and infrastructure development is creating huge demand for protective eyewear in construction and related industries. Moreover government initiatives to improve occupational safety standards and growing adoption of protective gear in healthcare, chemical processing and manufacturing hubs is driving the market growth in the region.

India Eye Protection Equipment Market Overview

The expansion of India’s real estate sector is accelerating the demand for eye protection equipment as large-scale construction projects increase the workforce exposed to dust, debris, sparks and chemical hazards. According to Cushman & Wakefield, India’s real estate sector drew investments totaling USD 2.77 billion in the second quarter of 2024. Simultaneously according to the India Brand Equity Foundation, the real estate sector projected a CAGR growth of 9.2% from 2023 to 2028. The surge in residential, commercial and infrastructure development drives the need for reliable protective eyewear ensuring worker safety on construction sites.

Key Players & Competitive Analysis

The eye protection equipment market is moderately competitive, with major players such as 3M Company, Honeywell International Inc., MSA Safety Incorporated, Uvex Group, Bolle Safety, Kimberly-Clark Corporation, Pyramex Safety Products, LLC, and Radians, Inc. These companies focus on developing advanced protective eyewear, including safety glasses, goggles, and face shields, designed to safeguard against chemical splashes, impact hazards, radiation, and infectious agents across industrial, healthcare, and laboratory settings. The competitive dynamics are further shaped by strategic partnerships, product innovations, and acquisitions aimed at expanding portfolios and boosting market presence in high-demand sectors. The growing investment in materials science for scratch-resistant coatings, lens polarization, and integrated face and eye protection systems is transforming the competitive landscape.

A few major companies operating in the eye protection equipment industry include 3M Company, Honeywell International Inc., MSA Safety Incorporated, Uvex Group, Bolle Safety, Kimberly-Clark Corporation, Pyramex Safety Products, LLC, Radians, Inc., Studson, PIP Global, JSP Ltd., and Gentex Corporation.

Key Players

-

- 3M Company

- Bolle Safety

- Gentex Corporation

- Honeywell International Inc.

- JSP Ltd.

- Kimberly-Clark Corporation

- MSA Safety Incorporated

- PIP Global

- Pyramex Safety Products, LLC

- Radians, Inc.

- Studson

- Uvex Group

Eye Protection Equipment Industry Developments

August 2025: Studson launched two new lines of safety eyewear namely Guardian and Watchman offering better protection to the eyes during industrial and construction work. They are designed for good fit, clarity of vision, comfort and useful features conducive to regular use.

February 2024: Bolle Safety introduced the SWIFT industrial collection of safety glasses and OTG goggles that are designed to go beyond minimum safety requirements for the industrial workforce. The eyewear offers a combination of durability, comfort, and style, while the Bolle PLATINUM Lite coating endows the lenses with anti-scratch and anti-fog properties enabling clear vision in any situation.

Eye Protection Equipment Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Safety Glasses

- Safety Goggles

- Face Shields & Visors Others

- Others

By Lens Type Outlook (Revenue, USD Billion, 2020–2034)

- Clear Lens

- Tinted / Colored Lens

- Anti-Fog Lens

- UV-Protection Lens

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Industrial & Manufacturing

- Construction

- Healthcare & Laboratories

- Military & Defense

- Mining

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Eye Protection Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.50 Billion |

|

Market Size in 2025 |

USD 1.59 Billion |

|

Revenue Forecast by 2034 |

USD 2.67 Billion |

|

CAGR |

5.95% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.50 billion in 2024 and is projected to grow to USD 2.67 billion by 2034.

The global market is projected to register a CAGR of 5.95% during the forecast period.

North America dominated the market in 2024 driven by strong defense spending, advanced industrial practices, and strong adoption of personal protective equipment (PPE) across industries.

A few of the key players in the market are 3M Company, Honeywell International Inc., MSA Safety Incorporated, Uvex Group, Bolle Safety, Kimberly-Clark Corporation, Pyramex Safety Products, LLC, Radians, Inc., Studson, PIP Global, JSP Ltd., and Gentex Corporation.

The clear lens segment dominated the market revenue share in 2024 due to its wide usage in general workplaces, laboratories, and construction sites where high visibility and optical clarity are essential.

The healthcare & laboratories segment is projected to witness the fastest growth during the forecast period due to rising demand for protective eyewear against biological hazards, chemicals, and infectious diseases.