Flexible Heater Market Share, Size, Trends, Industry Analysis Report

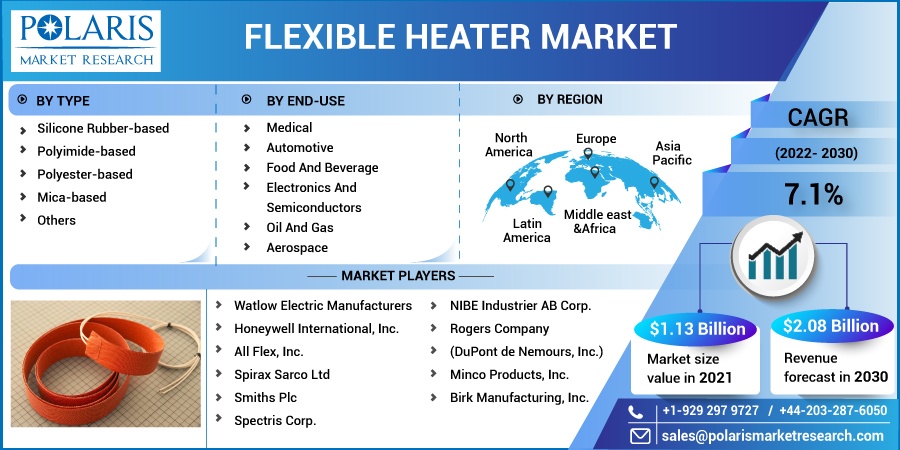

By Type (Silicone rubber-based, Polyimide-based, Polyester-Based, Mica-based, Others); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 119

- Format: PDF

- Report ID: PM2687

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

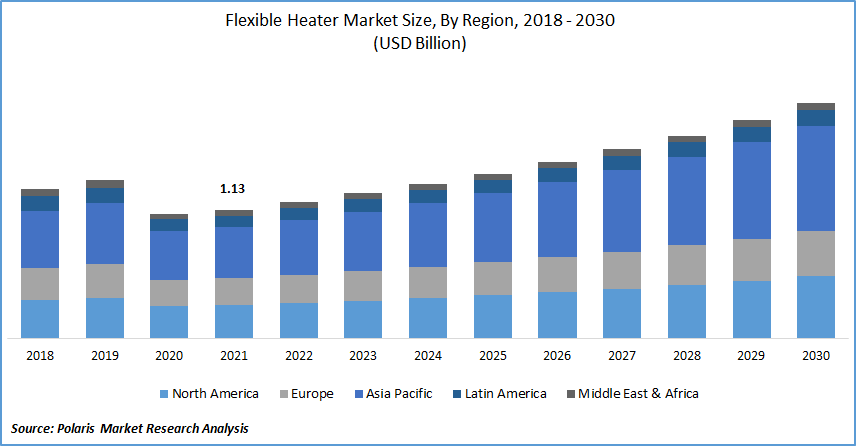

The global flexible heater market was valued at USD 1.13 billion in 2021 and is expected to grow at a CAGR of 7.1% during the forecast period. The increasing demand for flexible heaters from a wide range of industries drives market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The other factors that fuel the market growth are the flexible formation and advanced features of this device. Increasing adoption of this heater in medical applications and aerospace industries also fuels the market.

The flexible prototype, technical improvements, the launch of novel products, and the extensive usage of Flexible Heater in clinical applications propel the market forward. These heaters may be found in plasma etch systems, probing stations, IC testing handling equipment, photo-resist tracking systems, fax machines, and many more.

A flexible heater is thin, a lightweight heater that really can work intermittently at 500°F/260°C and constantly at 392°F/200°C. A Flexible Heater is a device that delivers heat to a surface that demands it. As the name implies, the heater may be used on every surface in order to achieve its shape flexibility. It is widely utilized in consumer devices, aerospace & defense, and many other sectors.

Electronic devices like coffee makers, wax melters, & freezers also employ flexible heaters. Demand for these items is anticipated to increase, driving market expansion. Additionally, the medical sector is anticipated to expand at the quickest rate during the projected period because of the growing usage of this heater in several medical equipment and diagnostic tools.

Furtherly, these heaters are utilized in various aerospace and defense equipment. In the upcoming years, it is expected that the semiconductor and electronic manufacturing sector, which now holds the highest market share in Asia Pacific, will expand more quickly.

The COVID-19 pandemic has impacted many businesses, causing revenue decreases and market expansion. The COVID-19 epidemic has lowered both the supply and demand for flexible heaters. Lockdowns caused by the COVID-19 outbreak restricted the export and import of necessary electrical components and supplies in a number of different nations. The distribution network, production capacity, and a number of other variables have all had a detrimental impact on the expansion of the flexible heaters industry as a result of COVID-19. In terms of the development and use of flexible heating elements, China is slightly behind the rest of the globe, but it is catching up rapidly. Due to the scarcity of flexible heating element resources in China and the advancement in flexible heating element technology, this product has a substantial market in China.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The market is expanding quickly due to the use of flexible heaters for hospital devices. These heaters give modern medical equipment a controlled temperature.

In addition to the healthcare sector, manufacturers benefit from using a flexible heater in LCDs, food equipment, surgical equipment, smart gadgets, military equipment, and photo-resist track systems. Because they are now more affordable and equipped with cutting-edge technology, flexible heaters are luring businesses and opening up significant market expansion opportunities.

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Silicone rubber-based is expected to witness faster growth as compared to its counterparts

In 2021, the markets for silicone rubber-based types had the biggest market share. Flexible heaters made of silicone rubber are used in electronic appliances, including coffee makers, refrigerators, and wax makers, as well as semiconductor systems like IC test material handling, plasma etch systems, photo-resist track systems, and probing stations. The market for flexible heaters made of silicone rubber is anticipated to have the largest growth during the projected period due to rising demand for such systems. The trend for silicone rubber-based heaters has been increasing exponentially, as evidenced by the rise in demand in the electronics and semiconductors and medical industries. This growth is also attributable to their flexibility, quicker warm-ups, improved heat transfers, and lower wattage requirements.

Electronics and semiconductor segment is expected to account for the largest share in 2030

The flexible heaters market had the highest revenue share in 2021 in the electronics and semiconductor category. Because heat is a crucial component in the processing & testing of semiconductors, flexible heaters are used in semiconductor production in the electronics & semiconductor industries. In the telecommunications sector, flexible heaters keep electronics, fiber optics, and amplifiers running at their best for at least 15 years in above- or below-ground enclosures.

North America is expected to dominate and witness the fastest growth over the forecast period

North American region dominated the flexible heaters market in 2021. The United States is the world's biggest producer of high-tech goods. This covers the production of medical products, semiconductors, computers, measurement and control equipment, as well as airplanes and spacecraft. All these goods must have flexible heaters installed inside them, increasing the demand for flexible heaters in the area.

Competitive Insight

Some of the major players operating in the global market include Watlow Electric Manufacturers, Honeywell International, Inc., All Flex, Inc., Spirax Sarco Ltd (Chromalox), Smiths Plc, Spectris Corp. (Omega Engineering, Inc.), NIBE Industrier AB, Corp. Rogers Company (DuPont de Nemours, Inc.), Minco Products, Inc., & Birk Manufacturing, Inc.

Recent Developments

Feb 2022: Watlow agreed with HEATON to provide standard products, services, and thermal systems to the aerospace industry.

Mar 2021: Honeywell acquired a majority stake in Fiplex Communications. This acquisition will expand the in-building connectivity and communications solutions it provides to its customers, and Fiplex's solutions will become a platform of innovation for the company’s wireless technologies.

Flexible Heater Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1.20 billion |

|

Revenue forecast in 2030 |

USD 2.08 billion |

|

CAGR |

7.1% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By End-Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Watlow Electric Manufacturers, Honeywell International, Inc., All Flex, Inc., Spirax Sarco Ltd (Chromalox), Smiths Plc, Spectris Corp. (Omega Engineering, Inc.), NIBE Industrier AB, Corp. Rogers Company (DuPont de Nemours, Inc.), Minco Products, Inc., & Birk Manufacturing, Inc. |