Flexible Packaging Market Size, Share, Trends, Industry Analysis Report

: By Type (Bags, Pouches, Wraps, and Others), Material (Paper, Plastic, Flexible Foam, Aluminum Foil, Bioplastics, and Others), End-Use (Food and Beverage, Healthcare, Retail, Consumer Goods, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM1549

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

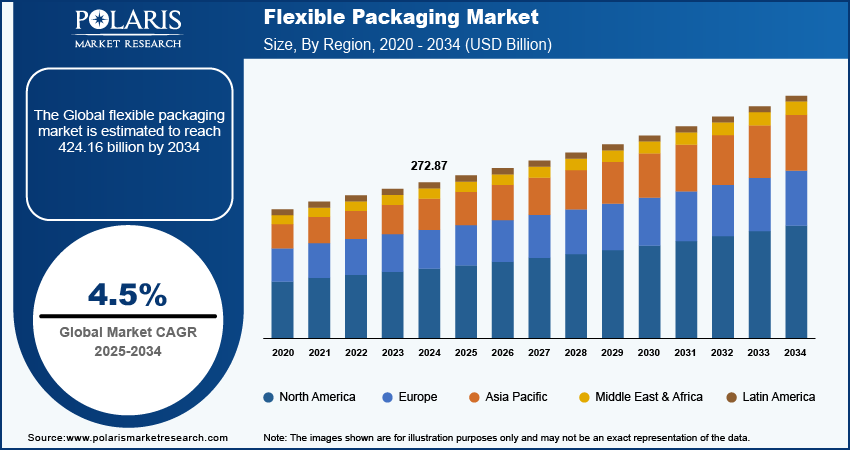

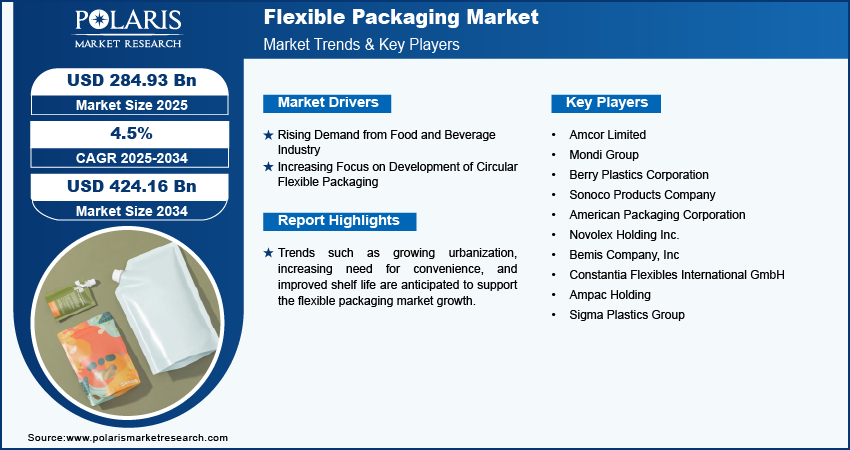

The global flexible packaging market size was valued at USD 272.87 billion in 2024, exhibiting a CAGR of 4.5% from 2025 to 2034. The increased demand from the food and beverage sector, emphasis on sustainability, urbanization, and the trend towards eco-friendly, circular packaging are all contributing to the growth of the market.

Key Insights

- In 2024, the pouches category dominated in terms of revenue because of their convenience, affordability, and multifaceted nature as a cost-effective substitute for conventional packaging.

- In 2024, the food and beverage category dominated the market because of the convenience of ready-to-eat meals and increased consumer purchasing power.

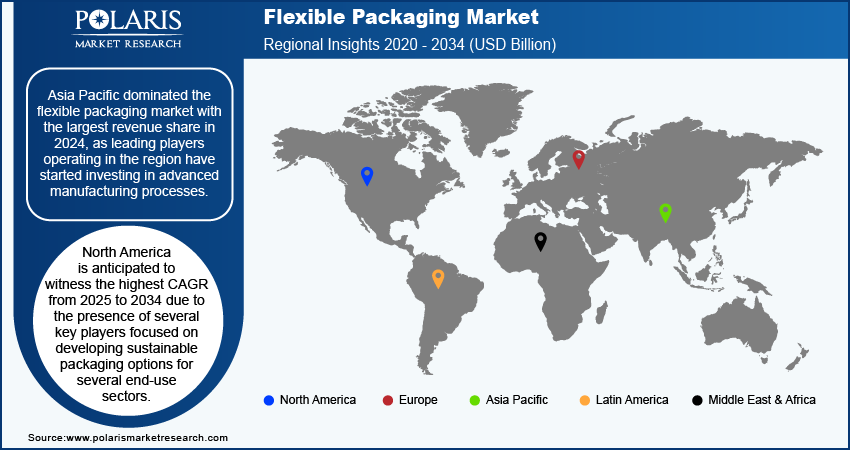

- In 2024, Asia Pacific dominated the market due to increased purchasing power, expanding retail reach, and investment in high-tech production to cater to diverse consumer needs.

- From 2025 to 2034, North America is expected to experience the fastest growth, driven by the adoption of green packaging and government support for traceability.

Industry Dynamics

- The increasing demand for smaller and user-friendly packaging has prompted manufacturers to develop more eco-friendly packaging options, driving market growth.

- The increasing trend toward flexible packaging in the food and beverage segment, driven by hectic lifestyles and the demand for cost-efficient and convenient solutions, is fueling market growth.

- The increasing emphasis on principles of the circular economy, such as recycling and resource efficiency, is powering the growing worth of the market.

- One of the major constraints in the flexible packaging market is the complexity of recycling intricate materials, as well as the environmental impact of non-recyclable packaging elements.

Market Statistics

2024 Market Size: USD 272.87 billion

2034 Projected Market Size: USD 424.16 billion

CAGR (2025-2034): 4.5%

Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Flexible packaging refers to non-rigid packaging materials used for packaging and protecting products. According to the flexible packaging association, it is any package or any part of a package whose shape can be readily changed. Flexible packaging is extremely customizable and can be tailored according to the requirements. Additionally, the packaging offers consumer convenience, is easy to transport and store, enhances shelf appeal, and produces fewer emissions. Bags, pouches, tubes, cardboard, and shrink film are a few common examples of flexible packaging.

The flexible packaging market growth is driven by factors such as improved economic conditions, demographic and socio-economic changes, and environmental concerns. Trends such as growing urbanization, increasing need for convenience, and improved shelf life are anticipated to support the market growth. Additionally, the rising demand for consumer-friendly packaging and the downsizing of packaging has encouraged packaging producers to develop more sustainable solutions, further supporting the market expansion.

The rising focus on sustainability and the growing need for eco-friendly packaging are other factors contributing to the rising flexible packaging market value. Increased demand for packaged foods, growth of the pharmaceutical industry, the transition from conventional packaging solutions to modern alternatives, and rising demand from emerging economies are expected to create lucrative flexible packaging market opportunities during the forecast period.

Market Drivers

Rising Demand from Food & Beverage Industry

In the twenty-first century, packaging has become more efficient, sustainable, and cost-effective. Owing to busy schedules, modern consumers are increasingly opting for packaged meals served in flexible and convenient packaging. As a result, more food businesses are looking to use flexible packaging in their products. Packaging companies are responding to this shift by engaging in strategic developments such as mergers and acquisitions and joint ventures that enable them to provide cost-effective, innovative packaging solutions. Therefore, the growing demand for flexible packaging in the food & beverage industry boosts the flexible packaging market growth.

Increasing Focus on Development of Circular Flexible Packaging

Flexible packaging aligns well with the principles of circular economy, as it is more resource-efficient compared to traditional packaging. Also, it emits fewer greenhouse gases while offering several benefits, including durability, versatility, and space efficiency. As the emphasis on the circular economy continues to rise globally, several governments and companies are undertaking initiatives to recycle packaging waste and promote resource optimization. A notable example of such initiatives is CEFLEX (Circular Economy for Flexible Packaging), a collaboration of over 180 European organizations, companies, and associations representing the entire value chain of flexible packaging. CEFLEX aims to make all flexible packing circular in Europe by 2025. Thus, the rising focus on the development of circular flexible packaging contributes to the increasing flexible packaging market value.

Segment Insights

Market Insights by Type

The flexible packaging market segmentation, based on type, includes bags, pouches, wraps, and others. The pouches segment accounted for the largest revenue share in 2024. Pouches are small, single-use bags commonly made from plastic films, aluminum-deposited films, or vapor-deposited films. They are easy to use and available in a diverse range of sizes and formats. Also, pouches are heat-sealable and usually considered a cost-effective alternative to containers made of cardboard, glass, and metal. Thus, the convenience and affordability of pouches make them a highly popular option across various sectors.

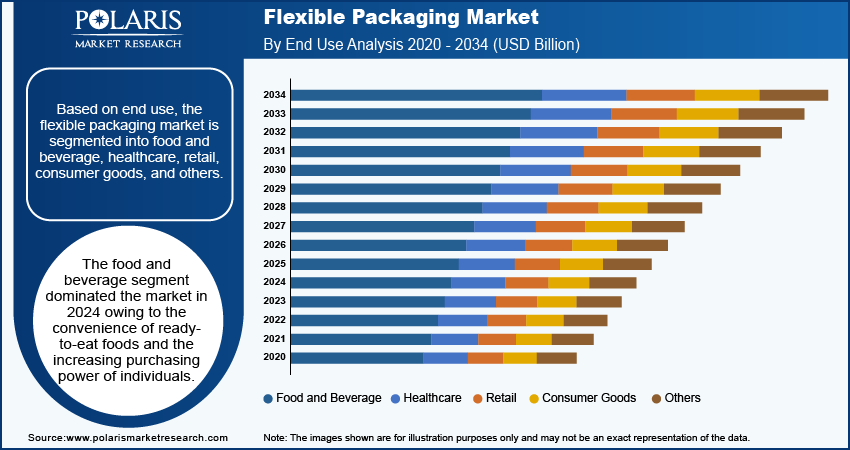

Market Insights by End-Use

The flexible packaging market, based on end-use, is segmented into food and beverage, healthcare, retail, consumer goods, and others. The food and beverage segment dominated the market in 2024 owing to the convenience of ready-to-eat foods and the increasing purchasing power of individuals. Flexible packaging is favored in the food and beverage sector as it can extend shelf life and offer convenience to consumers. Products such as snacks, beverages, and frozen foods use flexible packaging in the form of pouches and wrappers to reduce waste and increase transportability.

Market Outlook by Regional Insights

Asia Pacific dominated the largest flexible packaging market share in 2024. The region’s growing purchasing power has enabled consumers to purchase products from a sizable number of retail facilities, boosting the demand for flexible packaging solutions. Also, leading players operating in the region have started investing in advanced manufacturing processes to ensure product integrity and cater to diverse consumer needs.

The flexible packaging market in China has witnessed a rapid increase in demand from end-use industries such as cosmetics, food & beverages, pharmaceuticals, and household care. Besides, the implementation of stringent government regulations aimed at reducing packaging waste is anticipated to support the market growth in the country.

North America is anticipated to register the highest CAGR from 2025 to 2034. The region has the presence of several leading players focused on developing sustainable packaging options for several end-use sectors. Government initiatives aimed at increasing the traceability of packaging circulating in North America are driving businesses to use flexible packaging solutions.

Key Players & Competitive Insights

The flexible packaging market is characterized by fragmentation. It has the presence of several small and medium-sized companies. The leading market players are making significant investments in R&D to extend their product lines. Also, they are undertaking several strategic initiatives, such as mergers and acquisitions and partnerships, to expand their global reach. To expand and survive in a more competitive environment, the flexible packaging market must offer cost-effective items.

In recent years, the flexible packaging market has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. A few leading players in the market are Amcor Limited; Mondi Group; Berry Plastics Corporation; Sonoco Products Company; American Packaging Corporation; Novolex Holding Inc.; Bemis Company, Inc; Constantia Flexibles International GmbH; Ampac Holding; and Sigma Plastics Group.

List of Key Players

- Amcor Limited

- Mondi Group

- Berry Plastics Corporation

- Sonoco Products Company

- American Packaging Corporation

- Novolex Holding Inc.

- Bemis Company, Inc

- Constantia Flexibles International GmbH

- Ampac Holding

- Sigma Plastics Group

Flexible Packaging Industry Developments

May 2024: Amcor and AVON partnered to introduce the AmPrima Plus refill pouch for the AVON Little Black Dress classic shower gels in China. According to Amcor, the launch of the new pouch is aimed at reducing water consumption and carbon footprint.

March 2024: Berry Global announced the expansion of recycling capacity at three of its European recycling facilities. By leveraging the firm's global access to recycled plastic, the expansion aims to cater to the rising demand for recycled high-performance films.

Flexible Packaging Market Segmentation

By Type Outlook

- Bags

- Pouches

- Wraps

- Others

By Material Outlook

- Paper

- Plastic

- Flexible Foam

- Aluminum Foil

- Bioplastics

- Others

By End-Use Outlook

- Food and Beverage

- Healthcare

- Retail

- Consumer Goods

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Flexible Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 272.87 billion |

|

Market Size Value in 2025 |

USD 284.93 billion |

|

Revenue Forecast by 2034 |

USD 424.16 billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2020 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The flexible packaging market value reached 272.87 billion in 2024 and is projected to grow to 424.16 billion by 2034.

The market is projected to record a CAGR of 4.5% from 2025 to 2032.

Asia Pacific accounted for the largest flexible packaging market share.

A few key players in the market are Amcor Limited; Mondi Group; Berry Plastics Corporation; Sonoco Products Company; American Packaging Corporation; Novolex Holding Inc.; Bemis Company, Inc; Constantia Flexibles International GmbH; Ampac Holding; and Sigma Plastics Group.

The pouches segment accounted for the largest market share in 2024.

The food and beverage segment dominated the market in 2024.