Flow Computer in Oil & Gas Market Share, Size, Trends, Industry Analysis Report

By Offering (Hardware, Software, Support Services); By Operation; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 118

- Format: PDF

- Report ID: PM3410

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

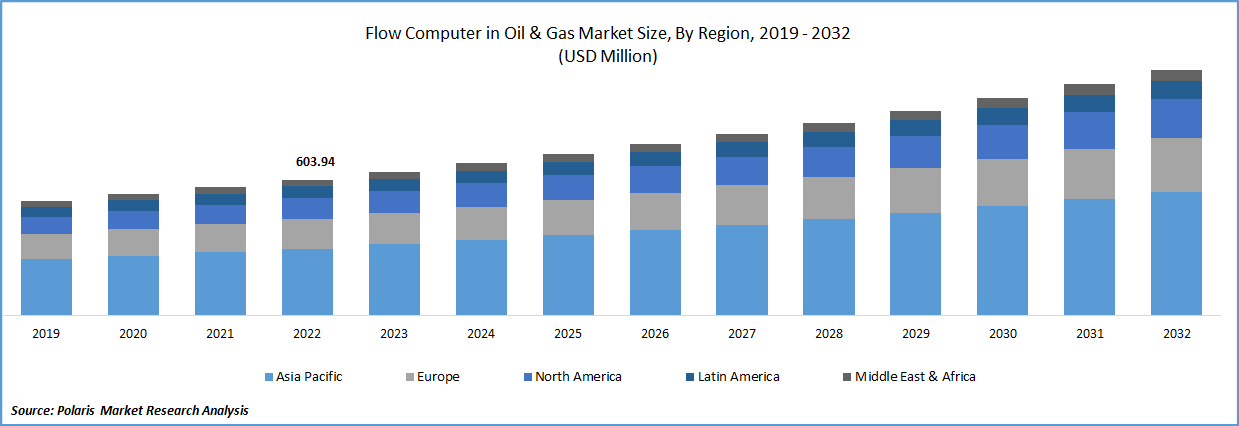

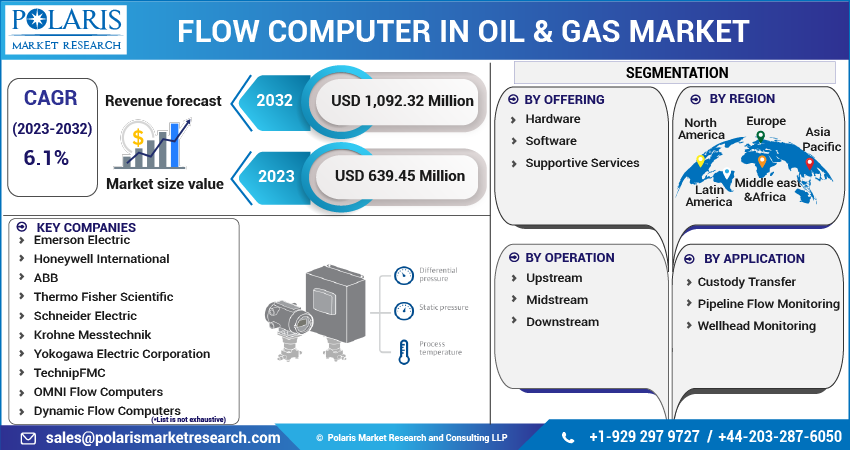

The global flow computer in oil & gas market was valued at USD 603.94 million in 2022 and is expected to grow at a CAGR of 6.1% during the forecast period. Technological advancements in oil and gas industry and suitability for many functions drive the market's expansion, as do the growing adoption of process automation, which opens up opportunities for the flow computer industry.

To Understand More About this Research: Request a Free Sample Report

India is one of the world's fastest-growing economies, and as such, it has seen a significant increase in demand for oil and gas. With the rising demand for energy in India, the country is expected to be one of the largest markets for oil and gas in the world. To meet this growing demand, the oil and gas industry in India is investing heavily in new technologies that can improve efficiency, reduce costs, and increase productivity. One such technology is the flow computer, which is used to measure the flow rate of oil and gas in pipelines.

India's oil demand might increase to 11% in the upcoming years. India would therefore strive to increase its refining capacity from 250 million mt today to up to 450 million mt by 2030. Given that the nation has set a goal to increase the share of gas in its energy mix to 15% by 2030 from roughly 6%, Modi predicted that India's gas demand will increase by more than 500% in the near future.

For Specific Research Requirements, Request a Customized Report

Industry Dynamics

Growth Drivers

Technological advancements in flow measurement and monitoring technologies, such as ultrasonic, vortex, and Coriolis flow meters, are driving the adoption of flow computers in the oil and gas industry. These technologies provide accurate and real-time data on fluid flow rates and volumes, improving the efficiency and safety of oil and gas transportation.

The oil and gas industry is subject to strict regulatory requirements aimed at ensuring safe and environmentally responsible operations. Flow computers are an essential tool for compliance with these requirements, providing accurate and auditable data on fluid flow rates and volumes. The oil and gas industry are rapidly adopting automation and digitalization technologies, including the Industrial Internet of Things (IIoT) and cloud-based solutions. Flow computers are an essential component of these technologies, providing real-time monitoring and control of fluid flow rates, volumes, and pressure.

Report Segmentation

The market is primarily segmented based on offering, operation, application, and region.

|

By Offering |

By Operation |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Hardware Segment is Expected to Grow at Higher Rate in the Study Period

Hardware segment is projected to witness higher growth for the flow computer in oil & gas market in the forecast period. The increasing demand for oil and gas globally is driving the demand for flow measurement equipment in the upstream segment of the oil and gas industry. Flow computers play a critical role in measuring and monitoring fluid flow rates, volumes, and pressure, which enables operators to optimize production processes and maximize oil and gas recovery. Hardware-based flow computers are becoming increasingly popular due to their high accuracy and reliability. As a result, the demand for hardware-based flow computers is increasing, driving the growth of the hardware segment. This will further propel the growth of the market in upcoming years.

Upstream Segment Accounted for the Largest Market Share in 2022

Upstream segment is expected to continue driving the growth of the flow computer market in the oil and gas industry, as the demand for oil and gas continues to rise, and new exploration and production activities are undertaken to meet this demand. Additionally, advancements in flow computer technology, such as the integration of wireless connectivity and advanced data analytics capabilities, are also expected to contribute to the growth of the market in the upstream segment.

The upstream segment of the oil and gas industry is subject to strict regulatory requirements aimed at ensuring safe and environmentally responsible operations. Flow computers are an essential tool for compliance with these requirements, as they provide accurate and auditable data on fluid flow rates and volumes, which can be used to demonstrate compliance with regulatory requirements.

Pipeline Flow Monitoring Segment is Expected to Hold the Significant Revenue Share

Pipeline flow monitoring segment is projected to witness larger revenue share for the market in the study period. The flow computer market is constantly evolving, with new advancements in technology, such as the integration of wireless connectivity and advanced data analytics capabilities. These new capabilities enable pipeline operators to remotely monitor and control pipeline operations, optimize flow rates, and reduce operating costs.

Pipeline operators are under increasing pressure to improve operational efficiency, reduce costs, and increase the safety and reliability of pipeline operations. Flow computers play a key role in achieving these objectives, enabling operators to monitor and optimize pipeline operations in real-time and make necessary adjustments to maintain a consistent flow rate and prevent pipeline damage or failure. This will further fuel the growth of the market in coming years.

Apac Projected to Registered with Higher Growth Rate in the Study Period

APAC is expected to have a higher growth rate in the coming years. Many countries in this region are investing heavily in the development of their oil and gas industry to meet the rising demand for energy. This is leading to the construction of new pipelines, refineries, and other oil and gas infrastructure, which is driving the demand for flow computers.

Several governments in the Asia Pacific region are taking initiatives to improve the efficiency and safety of their oil and gas industry. This includes the adoption of advanced flow measurement and monitoring technologies, which is driving the growth of the flow computer market. The Indian government plans to invest $20 billion and build a production capacity of 15 million tonnes of compressed bio-gas from 5,000 units by 2023.

North America Garnered with the Larger Revenue Share Throughout the Forecast Period

The oil and gas industry in this region is known for its technological advancements, including advanced flow measurement and monitoring technologies. This has led to a high demand for flow computers to ensure efficient and safe transportation of oil and gas products. The production of shale gas has been rapidly increasing in North America, particularly in the United States, which has led to the construction of new pipelines and other infrastructure. This is driving the demand for flow computers for accurate measurement and monitoring of fluid flow rates, volumes, and pressure.

The construction of petrol pipes in the United States is driving the growth of the flow computer market in the oil and gas industry by increasing the demand for accurate flow measurement, real-time monitoring, compliance with regulatory requirements, and investment in pipeline infrastructure. According to Energy's Liquids Pipeline Projects Database, pipeline firms finished 14 petroleum liquid pipeline projects in the United States in 2021.

Competitive Insight

Some of the major players operating in the global flow computer in oil & gas market include Emerson Electric, Honeywell International, ABB, Thermo Fisher Scientific, Schneider Electric, Krohne Messtechnik, Yokogawa Electric Corporation, TechnipFMC, OMNI Flow Computers, Dynamic Flow Computers, Contrec Limited, Kessler-Ellis Products, Sensia, Prosoft Technology, Flowmetric, Spirax Sarco, SICK, Badger Meter, Quorum Business Solution, Endress+Hauser, PLUM, Fluidwell, Oval Corporation, Seneca srl and Hoffer Flow Controls.

Recent Developments

- In December 2022, Emerson Electric introduced new single & multiple meters run-gas flow-based meter computers. They provide a more realistic solution for far-off oil and gas production locations because they are field-mounted & are mostly explosion-proof systems.

- In June 2022, ABB & Wison Offshore & Marine collaborated in order to create and put into operation floating liquefied natural gas (FLNG) facilities all over the world.

Flow Computer in Oil & Gas Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 639.45 million |

|

Revenue forecast in 2032 |

USD 1,092.32 million |

|

CAGR |

6.1% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Offering, By Operation, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Emerson Electric, Honeywell International, ABB, Thermo Fisher Scientific, Schneider Electric, Krohne Messtechnik, Yokogawa Electric Corporation, TechnipFMC, OMNI Flow Computers, Dynamic Flow Computers, Contrec Limited, Kessler-Ellis Products, Sensia, Prosoft Technology, Flowmetric, Spirax Sarco, SICK, Badger Meter, Quorum Business Solution, Endress+Hauser, PLUM, Fluidwell, Oval Corporation, Seneca srl and Hoffer Flow Controls. |

FAQ's

key companies in flow computer in oil & gas market are Emerson Electric, Honeywell International, ABB, Thermo Fisher Scientific, Schneider Electric, Krohne Messtechnik, Yokogawa Electric Corporation, TechnipFMC.

The global flow computer in oil & gas market is expected to grow at a CAGR of 6.1% during the forecast period.

The flow computer in oil & gas market report covering key segments are offering, operation, application and region.

key driving factors in flow computer in oil & gas market are technological advancements in flow measurement and monitoring technologies.

The global flow computer in oil & gas market size is expected to reach USD 1,092.32 million by 2032.