Fluoropolymer Processing Aid Market Share, Size, Trends, Industry Analysis Report

By Polymer Type (PE, PP, PVC, Other), By Application, By Region, Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3632

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

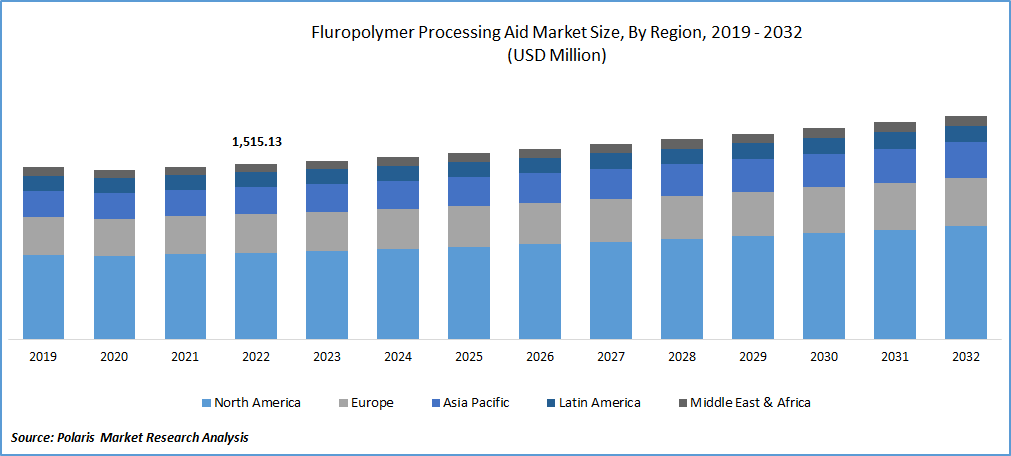

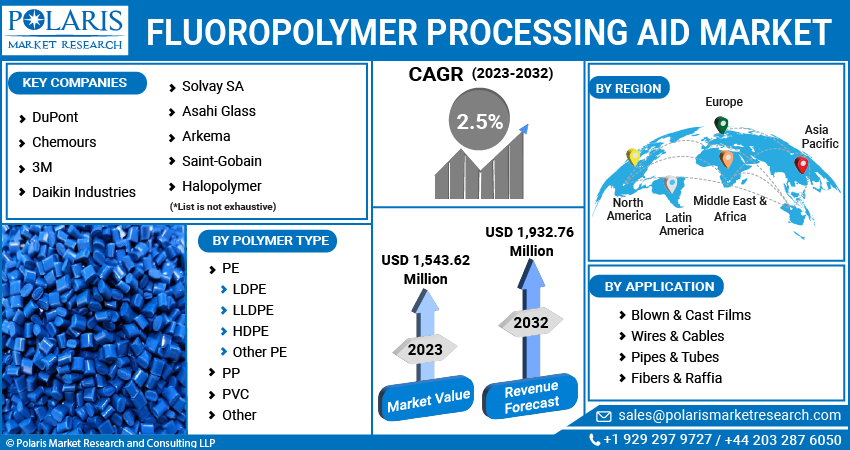

The global fluoropolymer processing aid market was valued at USD 1,515.13 Million in 2022 and is expected to grow at a CAGR of 2.5% during the forecast period.

The Fluoropolymer Processing Aid Market is experiencing significant growth due to increasing demand for high-performance materials, advancements in processing technologies, and expanding applications in the automotive, electronics, and packaging industries.

Know more about this report: Request a Free Sample Report

The Fluoropolymer Processing Aid Market is experiencing significant growth due to increasing demand for high-performance materials, advancements in processing technologies, and expanding applications in the automotive, electronics, and packaging industries.

Fluoropolymer processing aids are additives used in the manufacturing of fluoropolymers to improve their processing efficiency and enhance the properties of the final products. These aids help reduce melt viscosity, improve melt flow, and enhance the dispersion of fillers and additives. They play a crucial role in industries such as automotive, electrical and electronics, chemical processing, and packaging, where fluoropolymers are widely utilized. The growing demand for high-performance materials with superior thermal and chemical resistance drives the market for fluoropolymer processing aids. Additionally, advancements in processing technologies and the expanding applications of fluoropolymers in various industries further contribute to the market's growth.

The National Institute of Standards and Technology has investigated the potential of fluoropolymer-based polymer processing aids (PPA) to minimize surface melt fracture during polyethylene extrusion. The study specifically focuses on the relationship between PPA droplet size & shear rate concerning the effectiveness of PPAs.

The study provides empirical evidence that supports using fluoropolymer-based PPAs to mitigate surface melt fracture during polyethylene extrusion. The observed improvements in coating performance and the elimination of sharkskin demonstrate the potential of fluoropolymer processing aids to enhance the extrusion process and improve product quality. As a result, this study's findings can drive the market's growth as manufacturers recognize the benefits and integrate these additives into their extrusion processes.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The market is witnessing significant growth, primarily driven by the increasing demand for high-performance materials. High-performance materials like fluoropolymers offer exceptional properties like thermal and chemical resistance, low friction, and excellent electrical insulation. These materials have extensive applications in the automotive, electrical, electronics, chemical processing, and packaging industries. Fluoropolymer processing aids play a crucial role in optimizing the processing efficiency of these materials, improving their melt flow, and enhancing dispersion properties. With the need for superior performance and reliability in various end-use sectors, the demand for fluoropolymer processing aids is rising, fueling the market's growth.

Continuous advancements in processing technologies, such as extrusion, injection molding, and blow molding, have increased the efficiency and productivity of manufacturing processes. Fluoropolymer processing aids help enhance thermoplastic flow properties and processability, enabling manufacturers to achieve better quality products and higher production rates. The demand for high-performance materials is a significant driver behind the growth of the fluoropolymer processing aid market. High-performance materials, such as fluoropolymers, offer exceptional properties and performance advantages over conventional materials. They are engineered products with superior characteristics, such as high thermal stability, chemical resistance, and low friction. The demand for high-performance materials, such as fluoropolymers, and the need for processing aids to optimize their performance and processing efficiency are driving the market's growth in the coming years.

Report Segmentation

The market is primarily segmented based on polymer type, application and region.

|

By Polymer Type |

By Application |

By Region |

|

|

|

Know more about this report: Speak to Analyst

Polyethylene (PE) segment is expected to witness fastest growth in the forecast period

Polyethylene segment is expected to have faster growth for the market in the forecast period. This is one of the most widely used polymers globally, with applications in various industries such as packaging, automotive, construction, and electrical. The growing demand for polyethylene in these industries is driving the need for effective processing aids to enhance the polymer's performance during manufacturing. LDPE sub-segment is driving the growth of the market. According to IEA, LDPE production is projected to increase from 33.8 in 2020 to 69.4 in 2050, around 48.7% growth. This will further create new growth potential for the market in coming years. The use of fluoropolymer processing aids can also aid in meeting regulatory requirements related to food contact, environmental sustainability, and chemical resistance. As regulatory standards become stricter, the demand for processing aids that help comply with these requirements is expected to increase, benefiting the polyethylene segment.

Wires & Cables segment accounted for the largest market share

Wires & Cables segment holds the largest market share for the market in the study period. The demand for high-performance wires and cables is rising across various industries, including automotive, telecommunications, energy, and construction. These industries require wires and cables with enhanced properties such as better insulation, higher conductivity, and improved resistance to heat, chemicals, and abrasion. Fluoropolymer processing aids are used in the manufacturing process of wires and cables to improve their performance and durability.

The ongoing global shift towards electric vehicles (EVs) is creating a surge in demand for specialized wires and cables. EVs require high-performance cables for power transmission, charging infrastructure, and onboard electronics. Fluoropolymer processing aids enable the production of wires and cables with improved flexibility, thermal stability, and resistance to harsh automotive environments, thus supporting the growth of this market segment.

North America garnered with the larger revenue share in the forecast time frame

North America is expected to witness a larger revenue share for the market. This region is known for its technological advancements and innovation capabilities. The region invests heavily in research and development activities, leading to the development of advanced materials and additives like fluoropolymer processing aids. The utilization of these advanced technologies in the manufacturing process increases the demand for fluoropolymer processing aids and contributes to the larger revenue share. The establishment of a state-of-the-art subsea cable manufacturing facility in the UK is a significant driver for the growth of the market. This facility, with its advanced capabilities and technologies, is expected to have a positive impact on the UK offshore renewables sector. As the UK offshore renewables sector thrives with the establishment of the new manufacturing facility, the demand for fluoropolymer processing aids will rise to support the production of superior quality subsea cables.

APAC region is projected to witness a higher growth rate for the market. This region is witnessing rapid industrialization, particularly in countries such as China, India, and Southeast Asian nations. The growth of industries such as automotive, electrical and electronics, packaging, and construction in this region is driving the demand for fluoropolymer processing aids. These aids enhance the performance, durability, and processability of various products, including wires, cables, films, and pipes.

The ambitious goal set by the Government of India to achieve turnover of around USD 25 Bn, including an export target of around USD 5 Bn, in Aerospace and Defense goods and services by 2025 is driving the growth of the market in this region. The aerospace and defense sectors are key drivers of technological advancements, innovation, and economic growth. As India aims to strengthen its aerospace and defense capabilities, there is an increased demand for high-performance materials and technologies that can withstand the rigorous requirements of these industries. Fluoropolymers, with their exceptional properties and performance characteristics, play a crucial role in meeting these demands.

Competitive Insight

Some of the major players operating in the global market include DuPont, Chemours, 3M, Daikin Industries, Solvay SA, Asahi Glass, Arkema, Saint-Gobain, Gujarat Fluorochemicals, Shanghai 3F New Materials, Halopolymer, Kureha, Dongyue, AGC, Juhua, Zhejiang Juhua, Shanghai Meilan Chemical, Whitford Corporation, Honeywell International, DAIKIN CHEMICAL SINGAPORE.

Recent Developments

- In April 2023, Arkema, renowned for its innovation in Kynar PVDF electrode binders and separator coatings, has recently expanded its product portfolio by introducing the Incellion range.

- In April 2023, Solvay and GKN Aerospace renewed their collaboration agreement with the shared objective of expanding the utilization of thermoplastic composite materials in aerospace structures.

Fluoropolymer Processing Aid Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,543.62 Million |

|

Revenue forecast in 2032 |

USD 1,932.76 Million |

|

CAGR |

2.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2023 to 2032 |

|

Segments covered |

By Polymer Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

DuPont, Chemours, 3M, Daikin Industries, Solvay SA, Asahi Glass, Arkema, Saint-Gobain, Gujarat Fluorochemicals, Shanghai 3F New Materials, Halopolymer, Kureha, Dongyue, AGC, Juhua, Zhejiang Juhua, Shanghai Meilan Chemical, Whitford Corporation, Honeywell International, DAIKIN CHEMICAL SINGAPORE. |

FAQ's

The Fluoropolymer Processing Aid Market report covering key are polymer type, application and region.

Fluoropolymer Processing Aid Market Size Worth 1,932.76 Million By 2032.

The global fluoropolymer processing aid market expected to grow at a CAGR of 2.5% during the forecast period.

North America is Fluoropolymer Processing Aid Market.

key driving factors in Fluoropolymer Processing Aid Market are Increasing demand for high-performance materials and Continuous advancements in processing technologies.