Foley Catheter Market Size, Share, Trends, Industry Analysis Report

: By Product (2-Way Foley Catheters, 3-Way Foley Catheters, and 4-Way Foley Catheters), Material, Indication, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5566

- Base Year: 2024

- Historical Data: 2020-2023

Foley Catheter Market Overview

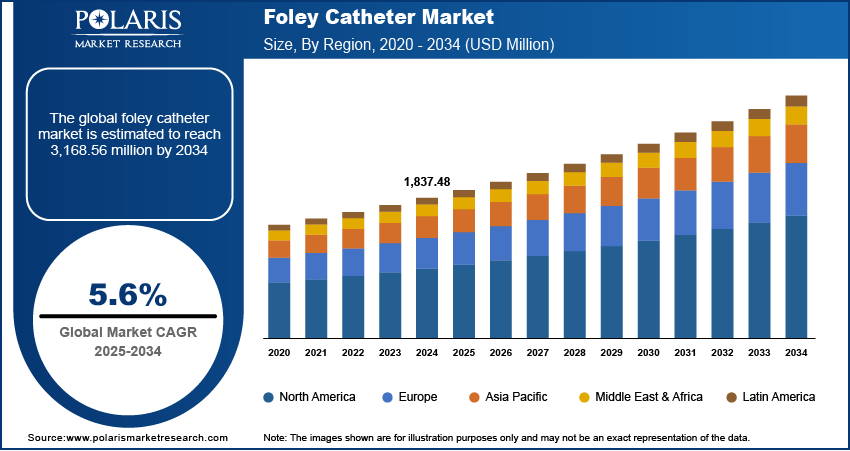

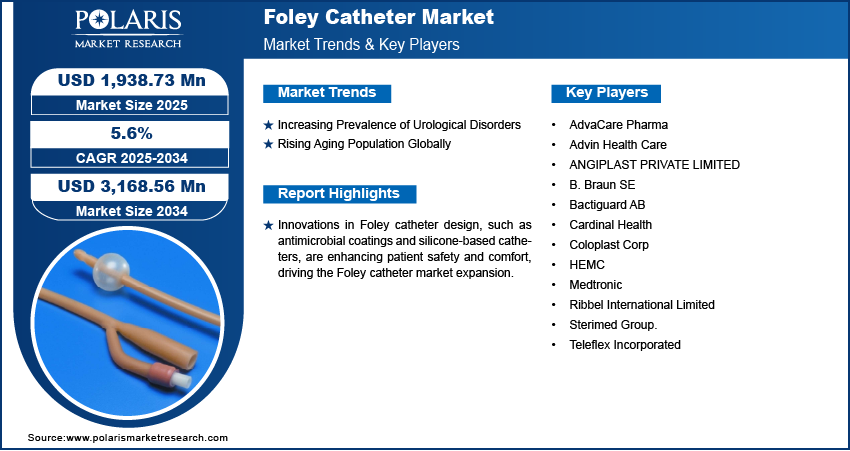

The global Foley catheter market size was valued at USD 1,837.48 million in 2024. The market is expected to grow from USD 1,938.73 million in 2025 to USD 3,168.56 million by 2034, exhibiting a CAGR of 5.6% during 2025–2034.

The Foley catheter market focuses on the production, distribution, and use of Foley catheters, which are flexible, indwelling urinary catheters designed to drain urine from the bladder. These catheters are widely used in healthcare settings for patients requiring prolonged catheterization due to conditions such as urinary retention, post-surgical recovery, or chronic illnesses.

Increasing surgical procedures, especially in urology, gynecology, and oncology, necessitate Foley catheters for postoperative care, which is significantly contributing to the Foley catheter market growth. Moreover, the shift towards home healthcare services for long-term catheterized patients is creating market opportunities.

Innovations in Foley catheter design, such as antimicrobial coatings and silicone-based catheters, are enhancing patient safety and comfort, driving the Foley catheter market expansion. In addition, growing awareness and adoption of better urinary management solutions among healthcare providers and patients are impacting the market development favorably.

To Understand More About this Research: Request a Free Sample Report

Foley Catheter Market Dynamics

Increasing Prevalence of Urological Disorders

The rising prevalence of urological disorders, including urinary incontinence, benign prostatic hyperplasia (BPH), and bladder dysfunction, is significantly contributing to Foley catheter market growth. For instance, according to the Urology Foundation, in the UK, every year, 78,000 people are diagnosed with urology cancer. The need for advanced urinary care solutions is expanding as these disorders continue to rise globally. Healthcare providers are increasingly adopting Foley catheter for both short-term and long-term catheterization, recognizing its importance in improving patient outcomes. This shift highlights the critical role of the Foley catheter in addressing the growing burden of urological diseases, creating significant opportunities for innovation and driving sustained market expansion.

Rising Aging Population Globally

The rising global aging population, which is highly susceptible to urinary disorders and other age-related health complications, is driving the Foley catheter market demand. For instance, according to the World Health Organization, the population aged 60 years and above was 1 billion in 2020 and is expected to reach 1.4 billion by 2030. Older individuals often require long-term catheterization due to conditions such as urinary incontinence, bladder dysfunction, and postoperative care needs. This demographic shift is boosting the adoption of improved catheter designs and biocompatible materials, reflecting evolving patient requirements. The aging population's reliance on these medical devices highlights their essential role in addressing the growing demand for effective urinary management solutions, thereby supporting market expansion.

Foley Catheter Market Segment Insights

Foley Catheter Market Assessment by Product Outlook

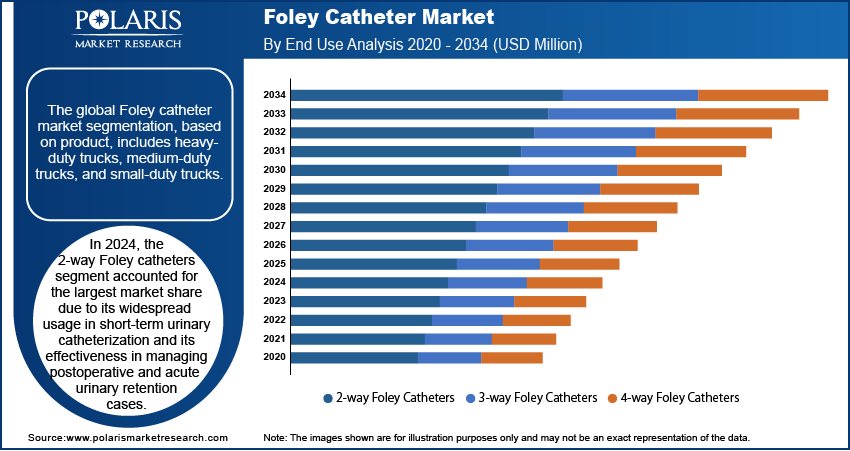

The global Foley catheter market segmentation, based on product, includes 2-way Foley catheters, 3-way Foley catheters, and 4-way Foley catheters. In 2024, the 2-way Foley catheters segment accounted for the largest market share due to its widespread usage in short-term urinary catheterization and its effectiveness in managing postoperative and acute urinary retention cases. Its dual-lumen design, enabling simultaneous drainage and inflation, ensures efficiency and ease of use, particularly in critical care and surgical applications. Additionally, the cost-effectiveness and availability of 2-way catheters make them a preferred choice in hospitals and outpatient settings. Innovations in materials, such as silicone-based options, have enhanced patient comfort and reduced infection rates, further driving market demand for this segment and contributing to its significant market share.

Foley Catheter Market Evaluation by End Use Outlook

The global Foley catheter market segmentation, based on end use, includes hospitals, long term care facilities, and others. The hospitals segment accounted for the largest market share in 2024 due to its high patient inflow and extensive use of catheters in surgical, critical care, and geriatric management. The prevalence of urinary disorders, particularly among hospitalized patients with chronic illnesses or undergoing postoperative care, has created substantial demand for Foley catheters. Hospitals are also prioritizing the adoption of advanced catheter designs with features that reduce urinary tract infections (UTIs). Additionally, well-established healthcare infrastructure and the availability of skilled professionals in hospitals ensure the efficient deployment and monitoring of Foley catheters, driving their adoption and expanding the market value within this segment.

Foley Catheter Market Regional Analysis

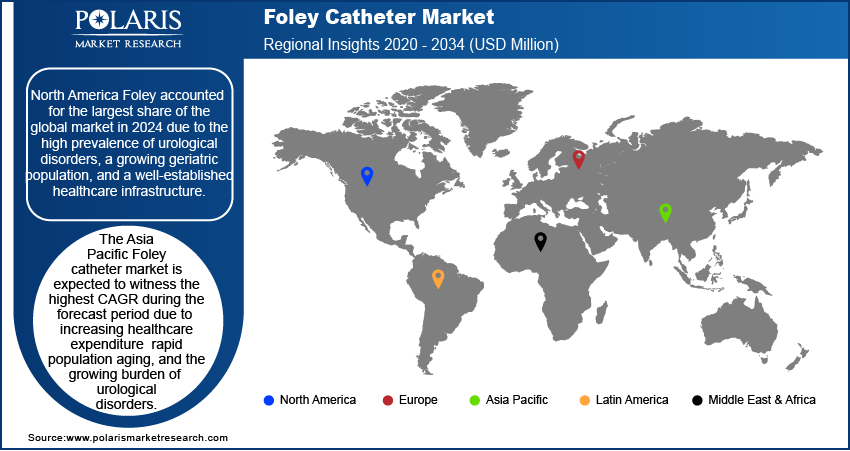

By region, the study provides the Foley catheter market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest market share in 2024 due to the high prevalence of urological disorders, a growing geriatric population, and well-established healthcare infrastructure. Increased awareness regarding urinary health, coupled with the rising incidence of conditions like urinary incontinence and benign prostatic hyperplasia (BPH), has significantly contributed to market demand. For instance, in the US, the prevalence of benign prostatic hyperplasia (BPH) at autopsy is 50% to 60% in men in their 60s, rising to 80% to 90% in those over 70 years old. Furthermore, advancements in catheter technology, such as antimicrobial-coated Foley catheters to reduce infections, have driven adoption in hospitals and outpatient clinics. Favorable reimbursement policies and a high level of healthcare expenditure in the region have further strengthened North America's leading position in the Foley catheter market.

The Asia Pacific Foley catheter market is expected to witness the highest CAGR during the forecast period due to increasing healthcare expenditure, rapid population aging, and the growing burden of urological disorders. For instance, in Asia, the prevalence of nephrolithiasis which is one of the most prevalent urologic diseases, ranges from 1% to 19.1%. Improved access to healthcare services and rising awareness about urinary health are fueling market expansion. Additionally, the development of healthcare infrastructure in emerging economies like India and China is contributing to market growth. Government initiatives aimed at improving medical device accessibility, along with the rising adoption of advanced catheter technologies, are further accelerating the regional market growth. The cost-effectiveness of treatments in the region and the increasing focus on long-term patient care also present significant market opportunities.

Foley Catheter Market – Key Players and Competitive Insights

The competitive landscape of the Foley catheter market is characterized by the presence of several key players striving to expand their market share through innovations, strategic collaborations, and geographical expansions. Leading manufacturers focus on developing advanced catheters, such as antimicrobial and hydrogel-coated variants, to reduce infections and improve patient comfort. Companies are also leveraging R&D investments to create eco-friendly and biocompatible catheter materials, enhancing their product portfolios. Strategic mergers and acquisitions, such as partnerships with hospitals and distribution networks, are further contributing to market expansion. Moreover, the entry of new players, coupled with the rising demand for cost-effective products in emerging markets, is intensifying competition. Key market participants, such as B. Braun, Teleflex Incorporated, Coloplast, and Cardinal Health, are implementing aggressive marketing strategies to strengthen their global presence and capitalize on evolving market dynamics.

Medtronic is a developer, manufacturer, and seller of device-based medical therapies. The company's business operations are divided into four segments: Cardiovascular Portfolio, Medical Surgical Portfolio, Neuroscience Portfolio, and Diabetes Operating Unit. The Medical Surgical Portfolio segment provides a range of surgical products, including vessel sealing instruments, surgical stapling devices, wound closure and electrosurgery products, hernia mechanical devices, surgical artificial intelligence and robotic-assisted surgery products, mesh implants, lung products, gynecology, and various therapies to treat diseases. Medtronic is actively engaged in the development and production of Foley catheters, including innovative models like the Mon-a-therm Foley Catheter with a temperature sensor. These catheters are designed to provide effective urinary bladder drainage while simultaneously monitoring core body temperature, enhancing patient care in various clinical settings.

B. Braun SE is a medical technology company that produces a wide range of medical devices and pharmaceutical products. These include surgical instruments, infusion pumps and systems, suture materials, dialysis equipment and accessories, hip and knee implants, and products for disinfection, ostomy, and wound care. The company operates through Hospital Care, Avitum, and Aesculap. The Hospital Care division specializes in providing nutrition, infusion, and pain therapy products. B. Braun SE also specializes in the production of Foley catheters, including their Urimed Cath line, which features 100% silicone designs that minimize tissue irritation and enhance patient comfort. These catheters are intended for indwelling catheterization, providing reliable solutions for urinary drainage in various clinical settings.

List of Key Companies in Foley Catheter Market

- AdvaCare Pharma

- Advin Health Care

- ANGIPLAST PRIVATE LIMITED

- B. Braun SE

- Bactiguard AB

- Cardinal Health

- Coloplast Corp

- HEMC (Hospital Equipment Manufacturing Company)

- Medtronic

- Ribbel International Limited

- Sterimed Group.

- Teleflex Incorporated

Foley Catheter Industry Developments

In January 2025, UNOQUIP launched Open Tip Silicone Foley Catheters for urinary drainage. The company stated that its 100% silicone design enhances patient comfort and reduces the risk of blockages.

In December 2024, Sanford Health Radiologist Dr. Bruce Gardner and InnoCare Urologics achieved a significant milestone with the FDA’s 510(k) clearance for the Egress Foley catheter. The approval falls under a newly established FDA product classification code (SCT) for Foley catheters featuring enhanced safety measures.

In December 2022, CATHETRIX launched the World’s Most Stable Foley Catheter Fixation at Arab Health 2023.

Foley Catheter Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- 2-Way Foley Catheters

- 3-Way Foley Catheters

- 4-Way Foley Catheters

By Material Outlook (Revenue, USD Million, 2020–2034)

- Silicone Foley Catheters

- Latex Foley Catheters

By Indication Outlook (Revenue, USD Million, 2020–2034)

- Urinary Incontinence

- Enlarged Prostate Gland/BPH

- Spinal Cord Injury

- Others

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Long Term Care Facilities

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Foley Catheter Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,837.48 million |

|

Market Size Value in 2025 |

USD 1,938.73 million |

|

Revenue Forecast in 2034 |

USD 3,168.56 million |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Foley catheter market size was valued at USD 1,837.48 million in 2024 and is projected to grow to USD 3,168.56 million by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

In 2024, North America accounted for the largest market share due to the high prevalence of urological disorders, a growing geriatric population, and a well-established healthcare infrastructure.

Some of the key players in the market are AdvaCare Pharma; Advin Health Care; ANGIPLAST PRIVATE LIMITED; B. Braun SE; Bactiguard AB; Cardinal Health; Coloplast Corp; HEMC (Hospital Equipment Manufacturing Company); Medtronic; Ribbel International Limited; Sterimed Group; and Teleflex Incorporated.

In 2024, the 2-way Foley catheters segment accounted for the largest market share due to its widespread usage in short-term urinary catheterization and its effectiveness in managing postoperative and acute urinary retention cases.

The hospitals segment accounted for the largest market share in 2024 due to its high patient inflow and extensive use of catheters in surgical, critical care, and geriatric management.