Food Preservatives Market Share, Size, Trends, Industry Analysis Report

By Label (Clean label, Conventional); By Type; By Function; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 119

- Format: PDF

- Report ID: PM4885

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

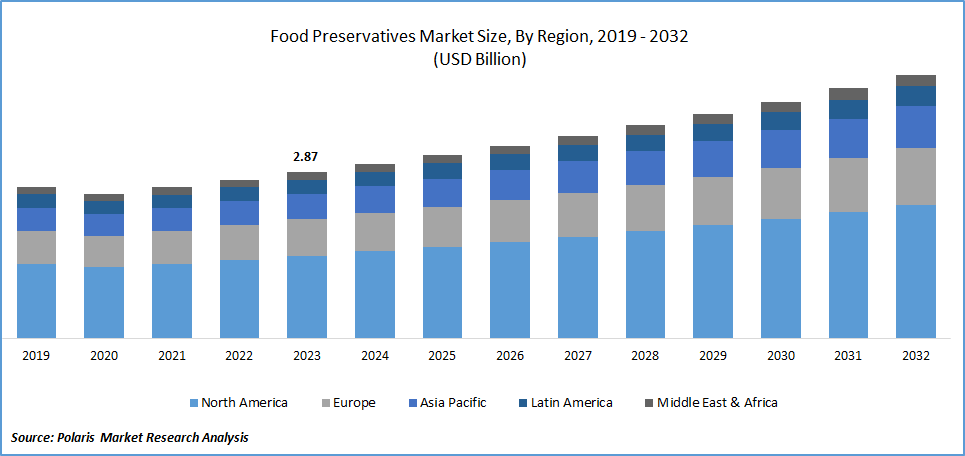

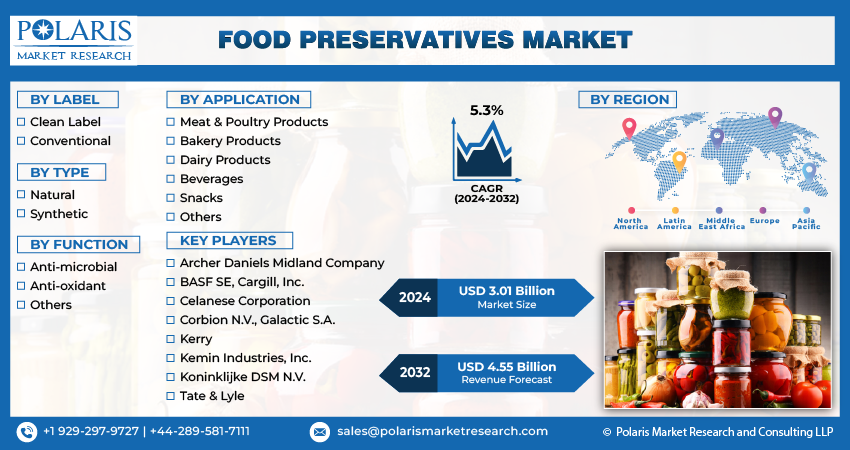

Food Preservatives Market size was valued at USD 2.87 billion in 2023. The market is anticipated to grow from USD 3.01 billion in 2024 to USD 4.55 billion by 2032, exhibiting the CAGR of 5.3% during the forecast period.

Market Overview

The rising demand for quality food at the global level is creating a significant need for food preservatives in the market. These food preservatives are assisting in the process of food sustainability, which is gaining attention nowadays with the increasing hunger rates. The increasing operational failures and food damage are anticipated to drive the food preservatives adoption.

To Understand More About this Research:Request a Free Sample Report

For instance, in 2023, according to the Grocery Manufacturers Association (GMA) and the Food Marketing Institute (FMI), food recalls can cost companies around USD10 million on average without considering brand image and sales losses.

Furthermore, the rising population in the global market is anticipated to create significant opportunities for food preservatives. According to the Harvard Business Review, there will be an increase in demand for food of 59–98% by 2050. Moreover, as per the United Nations Food and Agricultural Organization (FAO), feed and food production need to increase by around 70% to reach global food requirements by 2050. The rising importance of enhancing the food production capacity will boost the demand for food preservatives.

However, the standard food regulations and policies to promote food safety in the marketplace by the government authorities are expected to restrict the demand for food preservatives in the coming years.

Growth Drivers

Rising Demand for Convenience and Processed Foods

The increasing number of people opting for consuming ready-to-eat, processed, and convenience foods is expected to boost the food preservatives market growth in the forecast period, driven by their higher use in manufacturing. At the food ingredient, packaging, and processing industry show in 2023, the industrials revealed the possibility of a 6.7% growth in demand for food ingredients by 2029 in India. This is showcasing the increasing production of foods in the region, which will boost the need for food preservatives as they extend the shelf life of products in the future.

Government Initiatives to Boost Food Production

The growing demand for packaged and convenience foods is driving the government to step in and incentivize producers in their production activities. The safety and quality of food products are becoming a huge concern with the prevalence of lower-shelf-life products and improper storage conditions. This is enforcing stringent quality checks by the food regulatory authorities, positively influencing the adoption of food preservatives.

Furthermore, developing countries like India are focusing on building their capacity to meet rising food demand, with a view to building self-sufficiency in the nation. For instance, the Ministry of Food Processing Industries (MoFPI) announced an investment of INR 4,600 crore until March 2026 under the PMKSY (Pradhan Mantri Kisan SAMPADA Yojana) scheme in the food processing sector in India.

Restraining Factors

The Side Effects of Food Preservatives are Likely to Impede Food Preservatives Market Growth

Growing awareness about the side effects associated with food preservatives is likely to hinder market growth. The ongoing branding initiatives to promote brand outreach are also significantly limiting market growth. For instance, in February 2024, McCain Foods India announced a new campaign to enhance preservative-free food products. Consumer concerns about health impacts associated with these additives, coupled with proactive marketing efforts towards preservative-free alternatives, collectively contribute to a challenging landscape for the market, potentially hindering its expansion.

Report Segmentation

The market is primarily segmented based on label, type, function, application, and region.

|

By Label |

By Type |

By Function |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Label Analysis

The Conventional Segment is Expected to Witness the Highest Growth During the Food Preservatives Market Forecast Period

The conventional segment will grow at a rapid pace, mainly driven by its cost-effectiveness. The growing research activities in the food industry to extend product life are driving new growth potential for the food preservatives market.

The clean label segment led the market with a substantial revenue share in 2023, driving its ability to provide longer shelf life to the products in a natural way. The rising concern about artificial food additives and preservatives is bolstering the importance of clean-label preservatives. Moreover, the growing product developments are expected to augment market growth during the study timeframe. For instance, in January 2022, Florida Food Products unveiled its new natural meat preservative, which is made up of rosemary, rice bran extract, acerola, and green tea.

By Type Analysis

The Synthetic Segment Accounted for the Largest Food Preservatives Market Share in 2023

The synthetic segment held the largest food preservatives market share. This is primarily due to the development and application of synthetic preservatives in the food production process. The ongoing companies' initiatives to minimize their costs are showing interest in utilizing synthetic preservatives, mainly sorbates, propionates, and benzoates, driven by their lower costs. Potassium sorbate is widely employed in bakeries to safeguard food from yeast, mold, and microbes. The increasing demand for dried fruits, beverage syrups, cakes, and pie fillings in the marketplace is expected to fuel the demand for food preservatives in the global market.

The natural segment is expected to grow at the fastest rate due to the rapid increase in demand for natural and healthy food products among consumers. People are becoming more health-conscious with the rising prevalence of diseases caused by artificial food additives in packaged goods. This trend is driving the adoption of natural food preservatives, such as vinegar, edible oil, chitosan, and rosemary extracts by food production companies. The presence of acetic acid in vinegar works as a natural food preservative with the propensity to kill microbes that lead to food spoilage.

Regional Insights

North America region registered the largest share of the global market in 2023

The North American region dominated the market. Region's growth is primarily due to the changing consumer purchasing pattern and rising disposable income. According to the Cleveland Clinic Survey in 2023, around 45% of Americans consume fast food at least once time in a week. 23% of the people said they do not have time to cook healthy meals. This demonstrates the hectic work schedule among the people in the region, leading to the increased production of food by the food and beverage market players, thereby creating the need for food preservatives.

The Asia-Pacific will grow rapidly, owing to the growing consumption of snacks, poultry, and dairy products. The presence of populous nations in the region, primarily India and China, is optimally boosting the need for food production with a longer shelf life. This necessitates the adoption of food preservatives, as they can promote the shelf life of food, which is pivotal to meeting the growing population's food demand.

Key Market Players & Competitive Insights

Growing Product Innovations and Expansion Activities to Drive the Competition

The food preservatives market is highly fragmented. Market players are stepping forward with the motive to reduce food waste in the world with the development of food preservatives with organic ingredients. For instance, in May 2023, Kerry unveiled its new science research hub in the Netherlands, aiming to develop sustainable methods to mitigate food waste. The growing product innovations in the field and technological advancements are expected to drive market expansion.

Some of the major players operating in the global market include:

- Archer Daniels Midland Company

- BASF SE

- Cargill, Inc.

- Celanese Corporation

- Corbion N.V.

- Galactic S.A.

- Kerry

- Kemin Industries, Inc.

- Koninklijke DSM N.V.

- Tate & Lyle

Recent Developments in the Industry

- In June 2022, Chinova Bioworks, a food technology company, received USD 6 million to boost its production of the natural mushroom-based preservative Chiber to meet the ongoing need for clean-label preservatives in the marketplace.

Report Coverage

The food preservatives market report emphasizes key regions across the globe to help users better understand the product. It also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, label, type, function, application, and their futuristic growth opportunities.

Food Preservatives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.01 billion |

|

Revenue forecast in 2032 |

USD 4.55 billion |

|

CAGR |

5.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Food Preservatives Market Size Worth $ 4.55 Billion By 2032

Rthe top market players in Food Preservatives Market are ADM, BASF, Cargill, Celanese Corporation, Corbion

North America is region contribute notably towards the Food Preservatives Market

Food Preservatives Market exhibiting the CAGR of 5.3% during the forecast period.

Food Preservatives Market report covering key segments are label, type, function, application, and region