4PL Logistics Market Share, Size, Trends, Industry Analysis Report

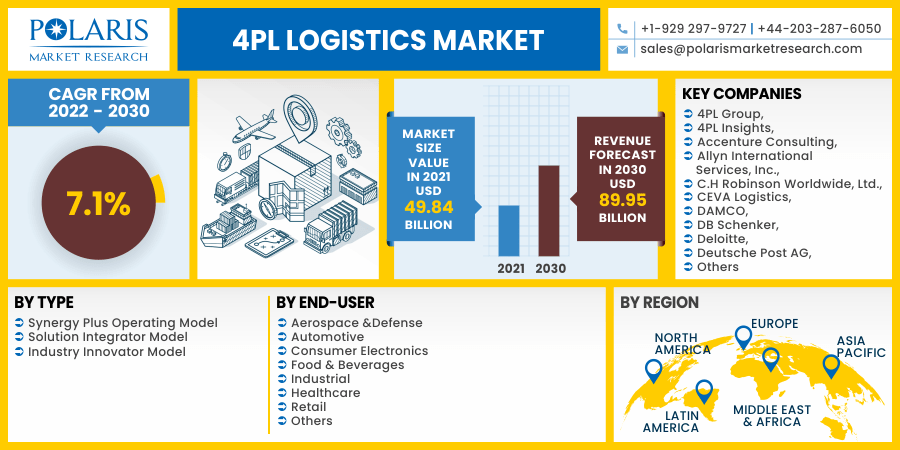

By Type (Synergy Plus Operating Model, Solution Integrator Model, Industry Innovator Model), By End-User (Aerospace & Defense, Automotive, Consumer Electronics, Food & Beverages, Industrial, Healthcare, Retail, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 114

- Format: PDF

- Report ID: PM2285

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

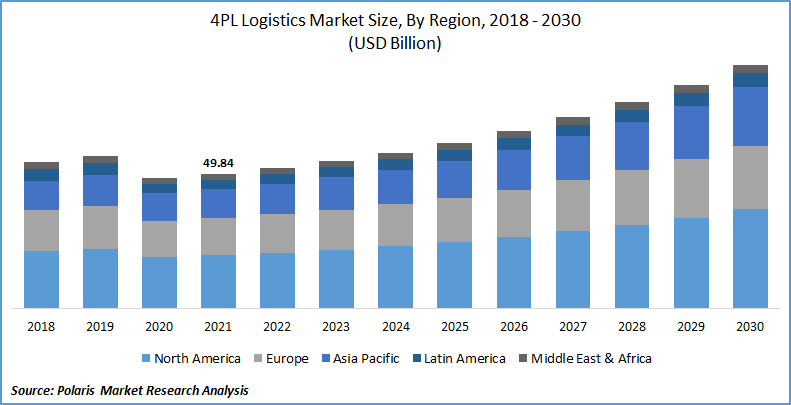

The global 4PL logistics market was valued at USD 49.84 billion in 2021 and is expected to grow at a CAGR of 7.1% during the forecast period. Fourth party logistics (4PL) services are also called supply chain services, where this service provider integrates with the customer's company supply chain department. This enables these service providers to work with a hands-on approach to the entire supply chain operations ranging from order management, warehousing, compliance regulations, and others.

Know more about this report: request for sample pages

4PL service providers act as a single interface between client organizations and various supply chain providers. 4PL service providers manage all the operations and deliver valuable services to their customers. As the competition is getting tough, companies from multiple sectors are shifting their focus from supply chain management to different strategies in order to improve their sales and revenue. Thus, those companies use these service providers to manage all of their supply chain processes. This is anticipated to drive the global demand for the 4PL logistics market.

The spread of the COVID-19 reflects the downfall in the industry growth because of the significant disruptions in the supply chain and the slowdown in manufacturing activities. The negative impact of the outbreak on various end-users such as automotive and retail, among others, is anticipated to hinder the growth of the 4PL logistics market.

The imposed trade barriers and international border closures have resulted in the stoppage of exports and imports, disrupting the entire production process. These disruptions in the supply chain, lockdown measures, and limited consumer and corporate spending are anticipated to hamper industry development. However, the need for these services is projected to bounce back as governments across nations are lifting lockdown restrictions.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The rise in the demand for a seamless supply chain to enhance productivity is anticipated to drive the 4PL logistics market's growth globally. The advent of the fourth-party supply chain concept is an essential move towards removing most of the bottlenecks associated with the complex global supply chain.

Further, the growth of various end-users such as automotive, retail, food & beverage, healthcare, and consumer electronics, among others, is anticipated to drive the growth of the global 4PL logistics market. For instance, with the rise of the e-commerce sector and the digitization of infrastructure in emerging economies, retailers create a parallel supply chain to fulfill both offline & online demands.

4PL services help provide a strategic vision and greater visibility of the inventory, enabling retailers to allocate stocks according to and to meet the customer's growing needs. The use of these services enables the manufacturers to focus on creating a better and more innovative product portfolio by managing their complex supply chains.

Report Segmentation

The market is primarily segmented on the basis of type, end-user, and region.

|

By Type |

By End-User |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by End User

The retail segment holds the most significant shares in 2021 and is expected to lead the industry in the forecasting years. This considerable share of the segment can be attributed to the rising retail sector across emerging nations such as India, China, and others. The rise in e-Commerce has changed consumer buying behavior. On account of the increasing sales, retail companies seek a complete supply chain solution, enabling them to develop new products, expand their regional presence, and enhance their capabilities.

The consumer electronics segment is projected to show the fastest growth rate in the forecasting years. The consumer electronics industry is witnessing explosive growth globally, thus influencing consumer electronics manufacturers to invest in fourth-party logistic services to promote door-step delivery for consumers. The explosive growth of the consumer electronics industry can be attributed to the rising popularity of technologically advanced devices, changing lifestyle of the population, and increasing per capita income, among others.

Geographic Overview

Geographically, Asia Pacific accounted for the highest industry shares in the global market in 2021. This huge industry share can be attributed to the increasing penetration of e-commerce across emerging nations. The emerging countries such as South Korea, India, Japan, and China are primarily attributed to industry growth. Major providers such as APL Logistics, Yusen Logistics, and Nippon express provide these services across the region. Thus, the increasing demand for a fourth-party supply chain from various e-commerce players is anticipated to drive the industry’s growth.

Further, the industry’s growth is fueled by the rapid growth of the end-user sector in the region, such as consumer electronics, automotive, food & beverage, healthcare, and others. The rising demand for an easy supply chain process from the manufacturers in the emerging nations is anticipated to drive market growth. Moreover, the North American 4PL logistics market is anticipated to exhibit a progressive growth rate over the forecasting years. The fast growth of the market in North America can be attributed to the presence of a considerable number of corporate companies. The increasing need for effective supply chain services is being met with new platforms and technologies in countries across North America.

Further, the rising demand for inbound logistic services from the manufacturing sector is estimated to present huge market growth opportunities. The market is further influenced by consumer demands thus, manufacturers of various goods are focusing on creating better offerings, giving rise to complexities in the supply chain, increasing the demand for these customized solutions. Moreover, the recent developments by various market players are estimated to open up new market growth opportunities. For instance, in 2019, Logistics Plus Inc., a company based in the US, started its distribution center to offer fourth-party solutions for the oil & gas sector.

Competitive Insight

Some of the major players operating in the global market include 4PL Group, 4PL Insights, Accenture Consulting, Allyn International Services, Inc., C.H Robinson Worldwide, Ltd., CEVA Logistics, DAMCO, DB Schenker, Deloitte, Deutsche Post AG, GEFCO Group, Global4PL Supply Chain Services, Logistics Plus Inc., Panalpina World Transport, United Parcel Service, Inc., and XPO Logistics, Inc.

4PL Logistics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 49.84 billion |

|

Revenue forecast in 2030 |

USD 89.95 billion |

|

CAGR |

7.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

4PL Group, 4PL Insights, Accenture Consulting, Allyn International Services, Inc., C.H Robinson Worldwide, Ltd., CEVA Logistics, DAMCO, DB Schenker, Deloitte, Deutsche Post AG, GEFCO Group, Global4PL Supply Chain Services, Logistics Plus Inc., Panalpina World Transport, United Parcel Service, Inc., and XPO Logistics, Inc. |