Freight Wagons Market Share, Size, Trends, Industry Analysis Report

By Type (Open, Covered, Flat, Container, Powder/Tank, Hopper, Platform, Car Carriers, Others); By Axle; By Commodities Type; By Region; Segment Forecast, 2023 – 2032

- Published Date:Oct-2023

- Pages: 119

- Format: PDF

- Report ID: PM3835

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

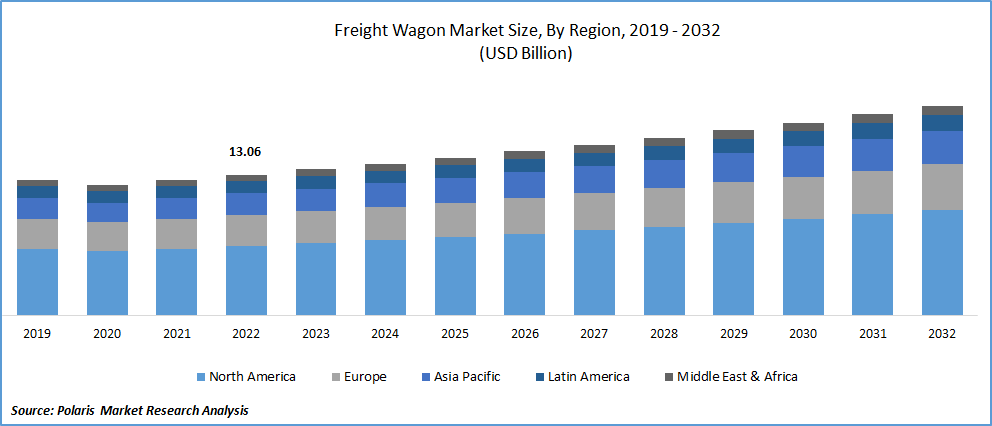

The global freight wagons market was valued at USD 13.06 billion in 2022 and is expected to grow at a CAGR of 4.1% during the forecast period.

The rapid increase in the global economy and significantly increased industrial production that led to greater demand for transporting raw materials finished goods, and components, and higher reliance of international trade on efficient and cost-effective transportation networks are major factors projected to drive the demand and growth of the market.

To Understand More About this Research: Request a Free Sample Report

In addition, with the surge in transportation activities of various energy sources, including minerals, coal, and oil, that require specialized freight wagons and the growing need for specific commodities such as agricultural products and minerals, the adoption of efficient wagons is likely to increase substantially in the near future.

- For instance, as per Trading Economics, the industrial output in India increased by 3.7 percent annually in June 2023, and the output from the manufacturing sector grew by 3.1 percent between the April-June period.

Moreover, with the growing awareness of environmental concerns and carbon emissions across the world, the demand and need for greener transportation solutions have increased dramatically in recent years. Hence, freight wagons are being considered more energy-efficient and eco-friendly than road transport and are well-positioned to capitalize on the trend toward sustainable logistics.

For Specific Research Requirements: Request for Customized Report

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the freight wagons market. The rapid spread of the lethal coronavirus across the globe resulted in a significant decline in international trade activities due to border closures and reduced consumer demand and spending. Lockdowns, travel restrictions, and temporary closures of manufacturing facilities have also disrupted supply chains globally, which have led to reduced production of goods and negatively influenced the demand for freight transportation.

Growth Drivers

Road congestion drives demand for efficient rail transportation.

The significant increase in the level of road congestion is compelling regional & state transportation planners to look for an alternative mode of bulk transportation to make freight transportation convenient and reduce the traffic level coupled with the growing government expenditure across both developed and developing economies in order to revamp their railway infrastructure are the primary factors influencing the demand and growth of the global freight wagons market. For instance, according to our findings, the Indian Railways is planning to unveil a mega-investment of RS 1 trillion in order to procure a total number of 90,000 wagons for transporting cement, coal, and food grains.

Furthermore, the rising number of innovations in wagon design, materials, and manufacturing processes that could enhance the efficiency, safety, and capacity of freight wagons, along with the changes in regulations related to safety standards, emissions, and load capacities, can impact the design and manufacturing of freight wagons, are further likely to influence the freight wagons market positively in the near future.

Report Segmentation

The market is primarily segmented based on type, axle, commodities type, and region.

|

By Type |

By Axle |

By Commodities Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The hopper segment accounted for the largest share in 2022

The hopper segment accounted for the largest market share on account of its greater adoption for transporting various types of goods, including steel, coal, ore, and cement, among others. Along with this, hopper wagons are mainly designed in the way to load or unload bulk materials efficiently, reducing the overall turnaround times, which leads to significant cost savings for industries that heavily rely on bulk transportation.

The powder/tank segment is anticipated to register the highest growth rate during the study period, mainly accelerated by its increasing demand from industries like chemicals, agriculture, energy, and mining, which require specialized wagons for transporting their products efficiently along with the stringent regulations related to the transportation of environmentally sensitive substances and hazardous chemicals, which makes the adoption of specialized tank wagons to adhere safety standards as well as reducing the risk of potential spills or accidents.

By Axle Analysis

4 axle segments held a significant market revenue share in 2022

The 4-axle segment held the majority market share in terms of revenue in 2022, which is significantly driven by the growing need and demand to move bulk goods efficiently and cost-effectively and the surging popularity and prevalence of the product due to its ability to provide a balance between the capacity and maneuverability and widespread use for transporting commodities like agricultural products and industrial goods.

In addition, with the growing integration of rail with other modes of transportation, such as trucking and shipping, intermodal transportation systems could also drive the demand for versatile freight wagons. As 4-axle wagons can be easily transferred between various modes of transport, they are likely to play a key crucial role in intermodal logistics and create significant growth opportunities for 4-axle freight wagons over the coming years.

By Commodities Type Analysis

The chemistry segment is expected to witness the highest growth throughout the study period.

The chemistry segment is expected to grow at the highest growth rate throughout the study period, which is largely accelerated by continuously growing production and consumption of chemicals and the exponential rise in international trade of chemicals and raw materials. Besides this, as chemicals often include hazardous substances or materials that require strict adherence to safety norms or regulations during transportation, they can be managed or comply with freight wagons, as various freight wagons are specifically designed for transporting such chemicals.

Regional Insights

North America region dominated the global market in 2022

North America held the largest share in 2022. The regional market growth can be largely attributable to the continuous expansion of the e-commerce sector, leading to a higher need for bulk transportation of goods along with the growing environmental concerns and push towards more sustainable options, which has resulted in a renewed interest in rail freight, as rail transportation is usually more environmentally friendly and fuel-efficient compared to road transportation, for instance, according to a recent study by OBERLO, the e-commerce sales in the United States in the first quarter of 2023 hit USD 272.6 billion, which is the highest ever in a single quarter period, and an increase of almost 7.8% from the previous year same quarter.

The Asia Pacific region is anticipated to register the fastest growth rate over the next coming years, owing to the rapid rate of industrialization and rising investments in the development and modernization of the transportation infrastructure coupled with the rising number of governments in the region promoting rail transportation as a more sustainable and environmentally friendly mode of moving goods.

Competitive Insight

The freight wagon market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AmstedMaxion

- CRRC Corporation Limited

- ELH Waggonbau Niesky GmbH

- FreighCar America

- GWI UK Holding Limited

- Jindal Rail Infrastructure Limited

- Jupiter Wagons Limited

- SABB S.A.

- Skoda Transportation GmbH

- Texmaco Rail & Engineering Ltd.

- Titagarh Wagons Ltd.

- United Wagon Company

- WH Davis Group of Companies

Recent Developments

- In October 2022, Hindalco Industries, 1st AL-based freight rail wagons, will support the country’s plan to modernize its freight transportation network. It is made from aluminum alloy plates & extrusions and is 180 tons lighter than the existing steel versions.

- In March 2022, Titagarh Wagons unveiled its first aluminum train at its West Bengal plant for the Pune Metro rail project. It will supply three trains from its plant in Italy & 31 trains from the company’s Indian facilities, with a total value of approximately INR 1,100 crore. It will be completed by around 2022-23.

Freight Wagons Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 13.56 billion |

|

Revenue forecast in 2032 |

USD 19.41 billion |

|

CAGR |

4.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Axle, By Commodities Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

key companies in freight wagons market are GWI UK Holding, Jindal Rail Infrastructure, ELH Waggonbau, Jupiter Wagons

The global freight wagons market is expected to grow at a CAGR of 4.1% during the forecast period.

The freight wagons market report covering key segments are type, axle, commodities type, and region.

key driving factors in industrial freight wagons market are road congestion drives demand for efficient rail transportation

The global freight wagons market size is expected to reach USD 19.41 billion by 2032.