Fuel Additives Market Size, Share, Trends, & Industry Analysis Report

By Type (Deposit Control Additives, Cetane Improvers, Lubricity Improvers, Cold Flow Improvers, Stability Improvers, Octane Improvers, Corrosion Inhibitors, Anti-icing Fuel Additives, Dyes & Markers, Others), By Application, By Region -Market Forecast, 2025 – 2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM2405

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

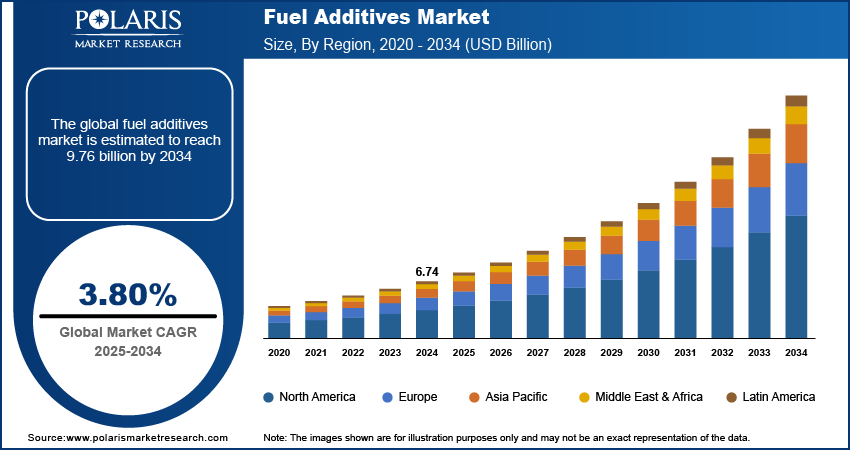

The global fuel additives market size was valued at USD 6.74 billion in 2024. The market is projected to grow at a CAGR of 3.80% during 2025 to 2034. Key factors driving demand for fuel additives include increasing demand for fuel efficiency, stringent environmental regulations, and the need for improved engine performance in the automotive.

Key Insights

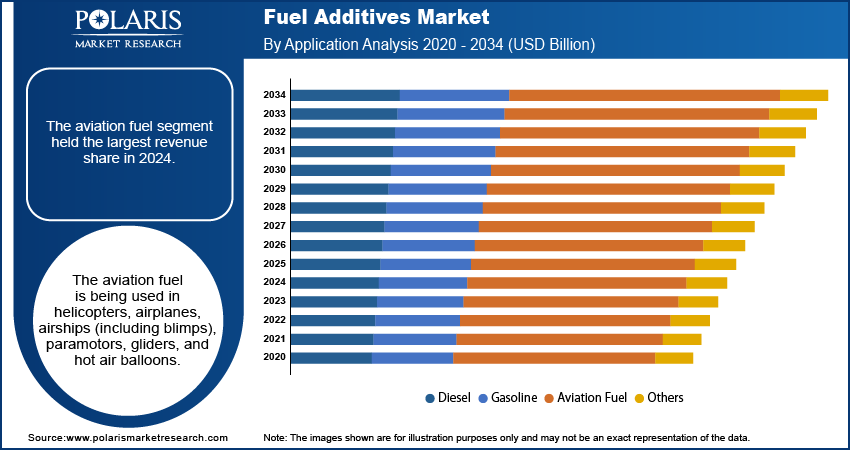

- The aviation fuel segment held the largest revenue share in 2024, due to growing numbers of helicopters, airplanes, and airships.

- The diesel segment is projected to grow at a robust pace in the coming years, owing to the use of high-power engines in trucks and passenger buses.

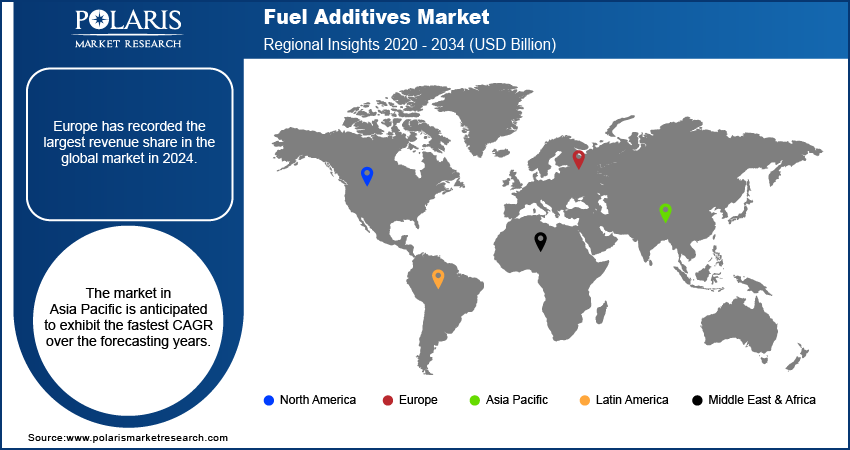

- Europe recorded the largest revenue share in the global market in 2024, due to the implementation of strict government norms towards the restriction of harmful energy resources.

- The Asia Pacific is anticipated to exhibit the fastest CAGR over the forecasting years, owing to the increasing industrialization and growing public and private sector investments.

Industry Dynamics

- The rising public awareness towards the adoption of clean energy sources is leading to market growth.

- The increasing adoption of gasoline vehicles, particularly in emerging economies, is also propelling the demand for fuel additives.

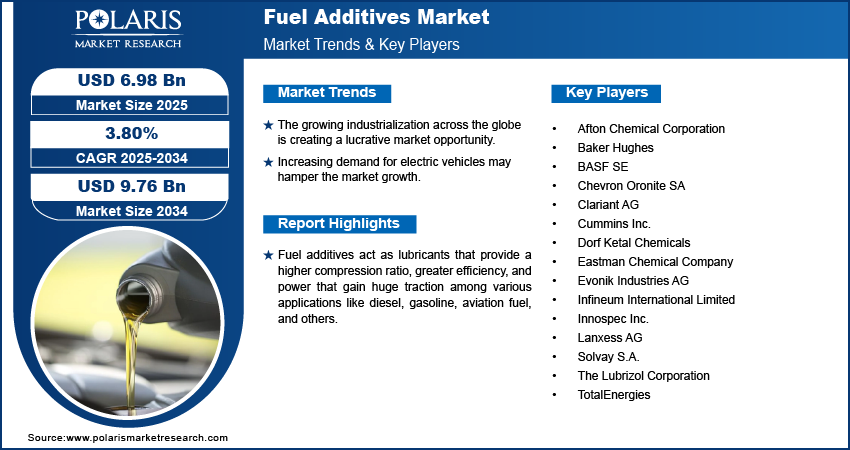

- The growing industrialization across the globe is creating a lucrative market opportunity.

- Increasing demand for electric vehicles may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 6.74 Billion

- 2034 Projected Market Size: USD 9.76 Billion

- CAGR (2025-2034): 3.80%

- Europe: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Fuel Additives Market

- AI accelerates the discovery of advanced fuel additive compositions that improve engine efficiency.

- AI models forecast how additives perform under varying fuel and engine conditions.

- AI helps in developing eco-friendly additives.

- AI streamlines production, inventory, and distribution of fuel additives.

Fuel additives act as lubricants that provide a higher compression ratio, greater efficiency, and power that gain huge traction among various applications like diesel, gasoline, aviation fuel, and others. The rising public inclination towards luxurious cars and increasing transportation activities also enhance the market expansion globally. Furthermore, increasing R&D investments and execution of stringent government norms for decreasing carbon emission levels are further presenting lucrative opportunities for fuel additives market development. The rising penetration of vehicles such as cars, buses, motorbikes, etc., globally enhanced the industry growth in the forecast period at a considerable rate. These additives are generally used to enhance the efficiency and quality of fuels used in vehicles.

At the onset of the COVID-19, the industry has witnessed a negative impact due to the ban on transportation worldwide. Implementation of stringent government laws and social distancing impedes industry growth. The sluggish demand for these additives from end-use industries during the pandemic drastically hinders industry development. During the pandemic, procrastination in trade, transportation, and public movement around the globe badly affected the industry. However, the gradual opening of the lockdown has a positive impact as the demand for fuel additives has risen again by end-user industries, which is anticipated to act as a catalyzing factor for the fuel additives demand, which in turn, accelerates the fuel additives market growth over the forecasting years.

Industry Dynamics

Growth Drivers

The increasing consciousness towards the environment across the world pushes the industry demand in the projected years. The fuel additives produce less carbon emission; thereby, it generates energy by causing less harm to the environment. In addition, there is a rise in the use of lubricity improvers as it improves efficiency and expands engine life. Various countries across the world are implementing stringent government laws towards the environment is the major driving factor. On the other hand, the rising construction, defense, aerospace, and automobile industries are pushing the fuel additives market growth.

Additionally, rising public awareness towards the adoption of clean energy sources is proved to be the significant factor driving the industry growth in foreseen years. For instance, according to the Indian Brand Equity Foundation (IBEF), in 2021, the renewable energy capacity in India is rising rapidly.

Report Segmentation

The market is primarily segmented on the basis of type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insight by Application

The aviation fuel segment held the largest revenue share in 2024. The aviation fuel is being used in helicopters, airplanes, airships (including blimps), paramotors, gliders, and hot air balloons. Accordingly, the increasing demand for these transportation facilities is propelling the segment growth. Additionally, with the rising per capita income, public inclination towards aviation is rising rapidly in forthcoming periods. For instance, according to the report of the World Bank in 2020, In Latin America number of passengers carried through air transport was approximately 121,313,047 thousand, more than forty percent of the total population. In Chile total number of people traveling by air transport was 8,019,753 thousand, and in Argentina, the number of people traveling by air was 3,680,874. Thus, air transport is generating high revenue and is the enabler of regional economic growth. Also, according to International Civil Aviation Organization, in 2019, the air transport and tourism facilities in Latin America are estimated to support more than about 11 million jobs and approximately USD 353 billion contributions to GDP by 2036. Hence, these factors may bolster the segment demand worldwide. The Diesel segment is projected to show the highest growth rate in the forecasting years.

Diesel is being used in vehicles with high power engines such as trucks and passenger buses and in the power generation by the end-user industries such as agriculture, construction, manufacturing sector, etc. Consequently, the rising investment across theese industries, increasing traffic, and sales of heavy trucks are anticipated to support the segment growth in the coming years. For instance, as per Crescendo Worldwide, in 2018, the global automotive industry has grown by around 3 %. The annual sales of automobiles are projected to reach approximately 110 million units by 2022.

Geographic Overview

Europe has recorded the largest revenue share in the global market in 2024. The implementation of strict government norms towards the restriction of harmful energy resources and regulations towards environmental protection is supporting the industry growth significantly. It is found that Europe is strictly following the REACH protocol, which refers to Registration, Evaluation, Authorisation, and Restriction of Chemicals. The governments of various countries across the region closely issue guidelines and focus on clean energy adoption, which, in turn, augments the regional market growth.

The market in Asia Pacific is anticipated to exhibit the fastest CAGR over the forecasting years. The increasing industrialization and growing public and private sector investments are the major factors that are contributing to the regional market growth. In addition, the increasing passenger traffic coupled with the rising working population. Moreover, the rising government and private investment in the improvement of infrastructure propels the market demand. For instance, in November 2020, Evonik Industries established new additives testing lab in Shanghai. Hence, the presence of well-established market players and rising demand for automobiles is fostering market demand in the near future.

Competitive Insight

Some of the major players operating in the global market include Afton Chemical Corporation, Baker Hughes, BASF SE, Chevron Oronite SA, Clariant AG, Cummins Inc., Dorf Ketal Chemicals, Eastman Chemical Company, Evonik Industries AG, Infineum International Limited, Innospec Inc., Lanxess AG, Solvay S.A., The Lubrizol Corporation, and Totalenergies.

In January 2024, BASF has launched the next generation of its Keropur gasoline additive bottle into Taiwan’s automotive aftermarket

Fuel Additives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.74 Billion |

| Market size value in 2025 | USD 6.98 Billion |

|

Revenue forecast in 2034 |

USD 9.76 Billion |

|

CAGR |

3.80% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2034 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Afton Chemical Corporation, Baker Hughes, BASF SE, Chevron Oronite SA, Clariant AG, Cummins Inc., Dorf Ketal Chemicals, Eastman Chemical Company, Evonik Industries AG, Infineum International Limited, Innospec Inc., Lanxess AG, Solvay S.A., The Lubrizol Corporation, and Totalenergies |

FAQ's

• The global market size was valued at USD 6.74 billion in 2024 and is projected to grow to USD 9.76 billion by 2034.

• The global market is projected to register a CAGR of 3.80% during the forecast period.

• Europe dominated the market in 2024

• A few of the key players in the market are Afton Chemical Corporation, Baker Hughes, BASF SE, Chevron Oronite SA, Clariant AG, Cummins Inc., Dorf Ketal Chemicals, Eastman Chemical Company, Evonik Industries AG, Infineum International Limited, Innospec Inc., Lanxess AG, Solvay S.A., The Lubrizol Corporation, and Totalenergies.

• The aviation fuel segment dominated the market revenue share in 2024.