Gas Delivery Systems Market Share, Size, Trends, Industry Analysis Report

By Type (Signal Station Systems, Semi-Automatic Switchover Systems, and Fully Automatic Programmable Switchover Systems); By Application; By Region; Segment Forecast, 2023 – 2032

- Published Date:Sep-2023

- Pages: 114

- Format: PDF

- Report ID: PM3751

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

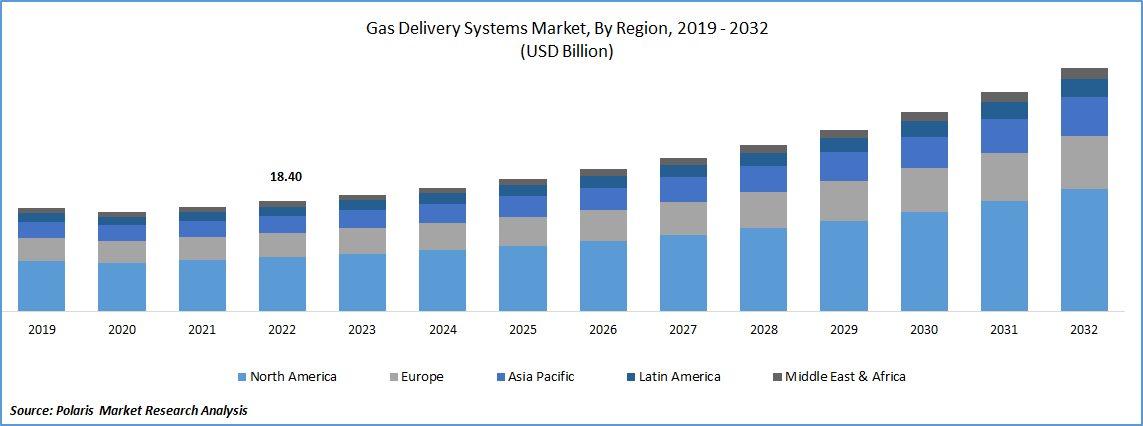

The global gas delivery systems market was valued at USD 18.4 billion in 2022 and is expected to grow at a CAGR of 8.5% during the forecast period.

To Understand More About this Research: Request a Free Sample Report

The rapid boost in global industrial and manufacturing sector and rising prevalence for using gases for several different purposes including metal fabrication, semiconductor manufacturing, and chemical production along with the heavy reliance of semiconductor and electronics industry on gases for performing various processes, are among the leading factors driving the gas delivery systems market demand and growth. Beside this, the growing popularity of gas delivery systems due to its ability to provide a reliable and efficient supply of gases to meet constantly rising infrastructure development needs, while ensuring the accurate and precise delivery of gases, are likely to further boost the growth of the global market.

- For instance, in March 2023, Linde, a global leading industrial gases and engineering company, introduced Linspray Connect, which is a new gas delivery system mainly developed for cold spray additive manufacturing. The newly launched system is likely to enhance the reliability and safety of Cold Spray AM process.

Moreover, the rising shift towards the renewable energy sources like hydrogen and biogas among others and significant emergence of specialized delivery systems in order to handle and distribute these alternative gases in an effective way along with the surging trend towards industrial automation and Industry 4.0 concepts, likely to opens up new opportunities for gas delivery systems across the globe.

However, the high initial capital investment of gas delivery systems including the cost of equipment, infrastructure, and installation and large number of stringent safety and regulatory requirements, are among the major restraints for the growth of the market. Coronavirus across the world led to huge disruptions in global supply chains including the transportation and delivery of gases and several end-use industries experienced a decline in the demand due to temporary closure or manufacturing facilities and reduced operations, as a result of imposed lockdown measures and restrictions on international trade globally.

Industry Dynamics

Growth Drivers

Increasing demand for natural gases like hydrogen and biogas are driving the growth of the market

The rapidly escalating need and demand for natural gases like hydrogen and biogas from residential, industrial, and commercial sector and continuous expansion of gas pipeline infrastructure across leading economies along with the emerging need and proliferation for safe, reliable, and efficient delivery systems in numerous applications, are among the major factors propelling the market growth.

- For instance, according to a report published by Worldometer, the global consumption of natural gas is approximately 132,290,211 million cubic feet every year and around 17,407 cubic feet of natural gas per capita every year.

Furthermore, the growing penetration among key market companies towards introducing advancements and innovations in gas systems like fully automatic switchover systems, which provides uninterrupted gas supply to laboratory and manufacturing processes along with the implementation on out-put contacts for the gas level detection & effective remote sensing, are further likely to create growth opportunities for the market soon.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Single station systems segment accounted for noteworthy market share during 2022

The single station systems segment accounted for a decent market share. The growth of the segment market can be mainly attributed to its cost-efficiency, higher durability, and ability to be easily installed in compact or limited spaces coupled with the growing product use in wide range of emerging industries including healthcare, biotechnology, and electronics. These systems are also globally known due to its various advantageous characteristics like improving communication between the several components of gas supply network and it further allows the operators to easily regulate valves, manage gas flow across the delivery system, and modify pressure setting, which are likely to create significant demand and growth opportunities in the segment market.

The fully automatic switchover systems segment is projected to gain substantial growth rate over the coming years, mainly accelerated to its ability to offer highest level of safety and reliability by ensuring continuous supply without interruption and these systems can effectively optimize the utilization of gas resources through automatically managing the transition between multiple resources.

By Application Analysis

Industrial segment held the significant market revenue share in 2022

The industrial segment held the majority market share in terms of revenue in 2022 and will grow at decent growth rate over the forecast period, on account of exponential growth of various industries including oil & gas, pharmaceuticals, electronics, chemical, and manufacturing, that necessities or requires the use of several types of gases for production and transportation purposes.

The significant advancements in technology in gas delivery systems like gas purification, control systems, and distribution, that improve and enhance the reliability, efficiency, and safety of these processes, and encouraging players to opt for these innovations into their operations, have also paved the way for higher adoption of advanced gas delivery systems in industrial sector.

The chemical segment is likely to exhibit fastest growth rate during the projected period, mainly due to rapidly surging demand for gases like hydrogen, nitrogen, oxygen, and several other specialty gases to be used in different types of chemical processes along with the rise in global population and rapid rate of industrialization leading to the development of new chemical plants and facilities, thereby positively influencing the need and demand for gas delivery systems to meet this rising demand.

Regional Insights

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the market, that is largely accelerated to widespread presence of large end-use sectors such as power generation, industrial, pharmaceutical, and chemical and emergence of the region as major hub for sectors like chemical and manufacturing.

Additionally, many emerging countries in the region are heavily implementing on favorable policies and initiatives to support or promote industrial growth, energy efficiency, and infrastructure development and governments are investing on development projects, that requires gas delivery systems as a major part of their infrastructure, thereby influencing the regional market growth.

The North America region is likely to emerge as fastest growing region with a healthy CAGR over the study period, owing to drastic increase in the consumption of natural gas in industrial sector, rising emphasis on renewable energy sources like biogas and hydrogen, and presence of well-established and developed electronics and semi-conductor industry particularly in the U.S.

- For instance, according to USA Energy Information Administration, the consumption of natural gas in the United States was stood at around 32.31 trillion cubic feet, and the electric power and industrial sector was major contributor to the consumption of natural gas with 38% and 32% respectively.

Key Market Players & Competitive Insights

The gas delivery system market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Airgas Inc.

- Air Liquide

- Air Products and Chemicals

- BOC Group

- Chart Industries

- Colfax Corporation

- CVD Equipment

- Fuel Cell Store

- GCE Group

- HARRIS, Linde Plc

- Iwatani Corporation

- Messer Group

- Parker Hannifin

- Praxair, Ichor Systems

- Taiyo Nippon Sanso

- Watlow

- WITT-Gastechnik

Recent Developments

- In August 2021, The Fuel Delivery, announced the expansion plans in Bengaluru. This door delivery system of fuel will likely to cater to diverse sectors such as infrastructure development, corporate offices, IT parks, hospitality and healthcare and others.

- In December 2022, Air Liquide, announced that they have signed a long-term contract with Kumho Mitsui Chemical, for the supply of additional carbon monoxide & hydrogen in the South Korea Yeosu National Industrial Complex. With this contract, the Air Liquide will be able to support the KMCI’s expansion of nearly, 200,000 tons’/year production of the MDI.

Gas Delivery Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 19.50 billion |

|

Revenue forecast in 2032 |

USD 40.5 billion |

|

CAGR |

8.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Taiyo Nippon Sanso, CVD Equipment, Watlow, Air Products and Chemicals Inc., The Fuel Cell Store, Air Liquide, Praxair, Ichor Systems, HARRIS, Linde Plc, Iwatani Corporation, Messer Group GmbH, The BOC Group, Airgas Inc., Parker Hannifin Corporation, Colfax Corporation, Chart Industries Inc., GCE Group, and WITT-Gastechnik GmbH & CO KG. |

FAQ's

key companies in gas delivery systems market are Air Liquide, The Fuel Cell Store, CVD Equipment, Messer Group GmbH.

The global gas delivery systems market is expected to grow at a CAGR of 8.5% during the forecast period.

The gas delivery systems market report covering key segments are type, application, and region.

key driving factors in industrial gas delivery systems market are advancements and innovations in gas systems

The global gas delivery systems market size is expected to reach USD 40.5 billion by 2032.