Glass Mat Material Market Share, Size, Trends, Industry Analysis Report

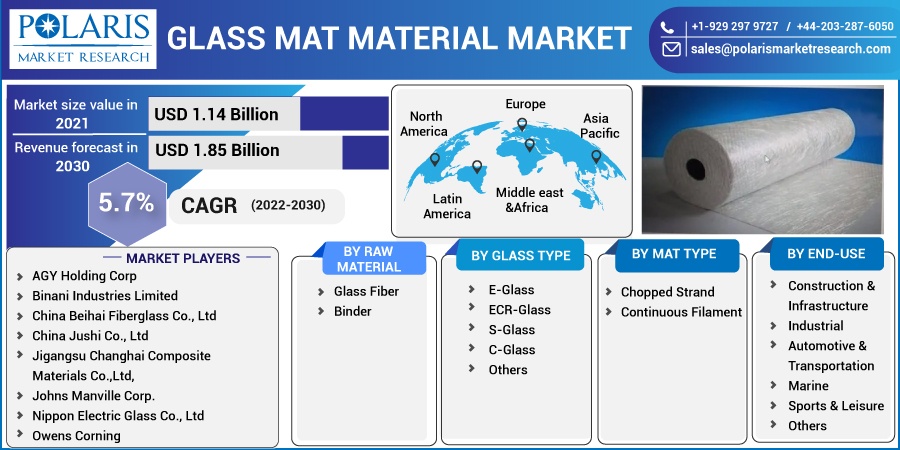

By Raw Material (Glass Fiber, Binder); By Glass Type; By Mat Type (Chopped Strand, Continuous Filament); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 115

- Format: PDF

- Report ID: PM2711

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

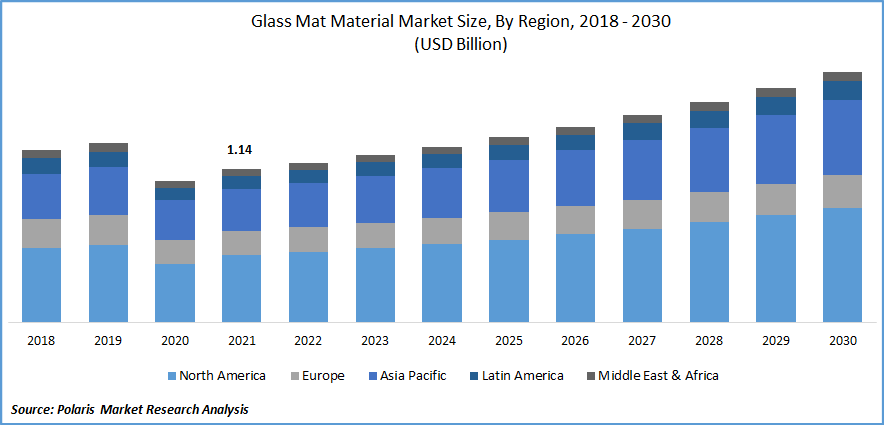

The global glass mat material market was valued at USD 1.14 billion in 2021 and is expected to grow at a CAGR of 5.7 % during the forecast period. The growing demand for glass mat material is expected to be driven by the increasing utilization of glass composite in the construction & industrial, and chemical sectors owing to its lightweight, flexible, heat, and corrosion resistance properties.

Know more about this report: Request for sample pages

Glass mat materials are durable, last longer, and prevent material from leaking when incorporated with binders. In addition, the extensive utilization of this material in flooring, roofing, and waterproofing owing to their resistance to water and mold and better mechanical strength is expected to drive the market.

In addition, the growing demand for lightweight components with high quality & solidity in various end-use industries is expected to fuel market growth over the forecast period.

The COVID-19 pandemic had a negative impact on the growth of the glass mat material market. The economic slowdown and negligible operation led to disruption in the supply chain due to a shortage of raw materials required for product manufacturing, hampered market growth. Moreover, strict government norms resulted in the temporary closure of many industries, including construction and industrial sectors which led to a decline in the demand for the product across the globe.

Moreover, glass mat materials are widely used in the aerospace and automotive industry, but most enterprises are looking for an alternative composite material providing the same tensile and bending strength. The industrial shift towards carbon fiber, which is used for structural strengthening and is more resilient, is restraining the market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growing demand for glass mat material in the automotive industry is due to its lightweight material and better resistance to chemicals and corrosion than steel. Many vehicle parts, such as doors and front and rear bumpers, are made with fiberglass. In addition, glass strings infused with rubber act as a strengthening agent, which is useful in manufacturing timing belts and v-belts; such factors accelerate market growth.

Moreover, the penetration of glass composite material in the wind power industry to develop wind turbine blades is also supporting the market growth. Glass fiber mat plays an important role in designing the rotor blades as it reduces fatigue and weight and maintains rigidity. In addition, when impregnated with resins and wood epoxy, glass fiber improves the blade's performance and spins more efficiently; such glass mat applications in various industries are expected to bolster market growth.

Report Segmentation

The market is primarily segmented based on raw material, glass type, mat type, end-use, and region.

|

By Raw Material |

By Glass Type |

By Mat Type |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Glass fiber segment accounted for the largest share in 2021

The glass fiber segment accounted for the highest revenue share in 2021 and is expected to continue its dominance over the forecast period owing to its high temperature and humidity resistance and better chemical stability properties. In addition, the increasing demand for glass fiber in various industries, including construction, architecture, pipes and refineries, and aviation sectors, will likely complement market growth over the forecast period.

E-glass is expected to lead the market

The electrical grade glass (E-glass) is expected to lead the market over the forecast period owing to its thermal insulation property and resistance to abrasion and vibration. In addition, the growing demand for E-glass is due to its cost-effectiveness and better resistance to heat, chemicals, and moisture which is expected to drive the market's growth. Furthermore, e-glass has a wide application in aerospace, marine, and electronic circuit boards, boosting the market growth.

Chopped strand is expected to witness fastest growth

The demand for the chopped strand is expected to surge significantly over the forecast period owing to its random orientation, good strand integrity, and wettability used in waterproofing, bathroom units, and partition boards.

In addition, the growing demand for chopped strands is increasing due to their cost-effectiveness, better tailoring properties, and the ability to adapt quickly to complex molds. Moreover, it is widely used in machines, roads, and shipbuilding and has huge demand in the automotive and construction industry, which will likely complement the market growth.

Construction & infrastructure industry is expected to account for the largest share in 2030

The construction & infrastructure industry is expected to dominate the market over the forecast period owing to the penetration of lightweight composite materials in the construction sector. The growing need for glass mat composite materials due to their aesthetic properties, resistance to corrosion, and abrasion, which are used in the construction of bridges, lighthouses, doors, and windows, is likely to have a positive impact on revenue growth over the forecast period.

Asia Pacific is expected to dominate and witness fastest growth over the forecast period

The Asia Pacific is the largest region for the glass mat material market. It is expected to witness faster growth over the forecast period owing to the tremendous increase in glass production and availability of low-cost labor.

In addition, rapid industrialization, increasing projects in building & construction projects, and the growth of end-use industries, such as automotive and transportation, and marine, in emerging economies such as India, China, and South Korea are expected to drive demand over the forecast period.

Competitive Insight

Some of the major players operating in the global market include AGY Holding Corp., Binani Industries Limited, China Beihai Fiberglass Co., Ltd, China Jushi Co., Ltd, Chongqing Polycomp International Corporation, Jigangsu Changhai Composite Materials Co., Ltd, Johns Manville Corp., Nippon Electric Glass Co., Ltd, Owens Corning, PFG Fiber Glass Co.,Ltd, Saint-Gobain S.A., Superior Huntingdon Composite Co., LLC, Taishan Fiberglass Inc., Taiwan Glass Ind Corp.

Recent Developments

In August 2021, Owens Corning introduced PINK Next Gen fiberglass insulation. Higher fire-resistant performance, enhanced rigidity, excellent texture, and smooth finish are the product’s features. As compared to other items in the market, it allows quick installation.

In January 2021, Johns Manville Corp. established its thermal recycling unit in Trnava, Slovakia, which helps to reduce and recycle glass waste which would be further utilized in manufacturing their engineered products. It is expected that more than 3 tons of recycling can be done every hour.

Glass Mat Material Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 1.19 billion |

|

Revenue forecast in 2030 |

USD 1.85 billion |

|

CAGR |

5.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Raw Material, By Glass Type, By Mat Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AGY Holding Corp., Binani Industries Limited, China Beihai Fiberglass Co., Ltd, China Jushi Co., Ltd, Chongqing Polycomp International Corporation, Jigangsu Changhai Composite Materials Co.,Ltd, Johns Manville Corp., Nippon Electric Glass Co., Ltd, Owens Corning, PFG Fiber Glass Co.,Ltd, Saint-Gobain S.A., Superior Huntingdon Composite Co., LLC, Taishan Fiberglass Inc.,Taiwan Glass Ind Corp. |