Global Facial Injectable Market Share, Size, Trends, Industry Analysis Report

: Information By Product, By Application, By End-Use (MedSpa, Dermatology Clinics, Hospitals), And By Region (North America, Europe, Asia-Pacific, Middle East & Africa, And Latin America) – Market Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 117

- Format: PDF

- Report ID: PM1307

- Base Year: 2024

- Historical Data: 2020-2023

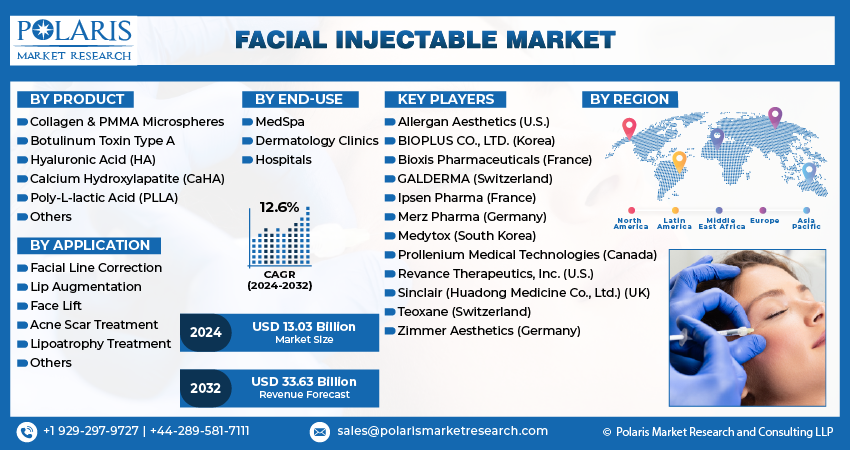

The global facial injectable market was valued at USD 12 billion in 2024 and is expected to grow at a CAGR of 8.00% from 2025 to 2034. The market expansion is driven by rising aesthetic awareness and increasing disposable incomes.

The facial injectable market is experiencing robust growth due to the increasing adoption of facial injectables among the male population. Further, growing awareness and acceptance of facial injectables among men, driven by social media and technological advancements, have significantly boosted the facial injectables market growth. Additionally, increasing disposable incomes globally drive demand for facial injectable market, spurred by rising affordability for cosmetic procedures that are influencing the market growth in aesthetics and anti-aging solutions.

To Understand More About this Research:Request a Free Sample Report

Facial injectables encompass dermal fillers and neurotoxins such as Botox, enhancing facial aesthetics by reducing wrinkles, adding volume, and rejuvenating skin. Injected beneath the skin, restores youthfulness, smooths contours, and addresses signs of aging. Popular for enhancing lips, smoothing wrinkles, and restoring facial volume in cosmetic procedures.

Further, Hyaluronic acid fillers are popular for their safe, effective skin-plumping properties. HA reduces wrinkles and folds by adding volume, reflecting their natural compatibility and widespread use in cosmetic procedures. Additionally, HA injections are used to reduce wrinkles in the face and augment soft tissue. Approximately 50% of total HA is found in the skin, which is produced by certain cells in the human body. The abundance underscores hyaluronic acid's vital role in maintaining skin hydration and resilience, which is crucial for its cosmetic applications and overall skin health.

Facial Injectable Market Trends:

Rising Demand for Minimally Invasive Cosmetic Procedures is Driving the Market Growth

Market CAGR for Facial Injectable is being driven by the increasing demand for cosmetic surgeries and minimally invasive or non-invasive procedures. For instance, according to the American Society of Plastic Surgeons (ASPS), in 2022, there were 26.2 million cosmetic and reconstructive procedures in the US, marking a 19% increase in cosmetic surgeries since 2019. This surge is primarily fueled by a rising emphasis on aesthetic enhancements and aging demographics seeking facial rejuvenation options.

Consumers are increasingly opting for procedures such as botulinum toxin and dermal fillers to achieve youthful appearances without undergoing extensive surgical interventions. Moreover, the growing demand has bolstered the facial injectable market and also significantly impacted suppliers of dermatological preparations and non-invasive technologies. Companies specializing in skincare products, including topical treatments and advanced skincare devices, have seen a surge in demand as consumers complement injectable treatments with comprehensive skincare regimes. For instance, in March 2021, DSM launched the HYA-ACT line, expanding its hyaluronic acid range to satisfy the growing market demand for less-invasive, reliable, and effective beauty care solutions. The synergy between facial injectables and dermatological products underscores a growing trend toward holistic cosmetic solutions, driving innovation and expansion within the broader aesthetic market.

High Rate of FDA Approvals is a Significant Catalyst for Facial Injectables Market Growth

The increasing rate of FDA approvals has significantly catalyzed the growth of the facial injectables market. FDA approvals enhance consumer confidence in the safety and efficacy of new products, leading to higher adoption rates. Regulatory barriers are decreasing, and the market is experiencing an increase in innovative treatments that cater to diverse consumer needs, driving overall the facial injectables market growth.

Regulatory support aligns with key players' strong focus on launching novel products. Companies are leveraging FDA approvals to introduce advanced formulations and techniques, staying competitive and satisfying rising consumer expectations. For instance, in March 2024, Allergan Aesthetics announced that the U.S. Food and Drug Administration (FDA) approved Juvéderm Voluma XC, the first hyaluronic acid filler for upper face use. The collaboration between regulatory facilitation and corporate innovation accelerates market expansion, ensuring a continuous flow of advanced solutions that boost the facial injectable market revenue.

Facial Injectable Market Segment Insights:

Facial Injectable Product Insights:

The global facial injectable market segmentation, based on product includes collagen & PMMA microspheres, botulinum toxin type A, hyaluronic acid (HA), calcium hydroxylapatite (CaHA), poly-L-lactic acid (PLLA), and others. In 2023, the hyaluronic acid (HA) segment held the largest market share due to its high adoption rate for effective cosmetic enhancements and is anticipated to grow at the fastest CAGR over the forecast period. HA-based facial injectables are considered as gold standard in facial aesthetics due to their documented safety profiles, higher efficacy, and reversibility. For instance, according to the American Society of Plastic Surgeons, in 2020, nearly 2.6 million HA-based cosmetic minimally-invasive procedures were performed in the U.S. alone.

Moreover, several FDA-approved brands of HA-based fillers exist, with popular names including Juvederm Ultra, Restylane, and Belotero Balances. For instance, in June 2023, Galderma obtained FDA approval for Restylane Eyelight, an under-eye hyaluronic acid (HA) dermal filler. It uses NASHA technology to address under-eye hollows, delivering natural-looking results for up to 18 months. Therefore, FDA-approved HA-based fillers offer diverse options for cosmetic enhancements, meeting various aesthetic needs with proven safety and effectiveness.

Facial Injectable Application Insights:

The global facial injectable market segmentation, based on application, includes facial line correction, lip augmentation, face lift, acne scar treatment, lipoatrophy treatment and others. The lip augmentation segment is poised for rapid growth within the facial injectables market due to increasing consumer demand for fuller lips, advancements in injection techniques, and the availability of diverse lip-enhancing products catering to aesthetic preferences. Lip augmentation is a common cosmetic procedure done primarily to improve the aesthetics of the lips. Social media influencers are driving consumer interest towards lip enhancement treatments.

Additionally, the consumer shift towards minimally invasive procedures is another influencing factor that will boost the demand for facial injectables in the following years. For instance, according to the Aesthetic Society, the number of lip enhancement procedures amounted to 8,030 in 2021 and 9,768 in 2022, an increase of 22% from the previous year. Therefore, the significant rise in lip enhancement procedures reflects a growing trend toward achieving fuller lips, contributing to the overall expansion of the facial injectable market.

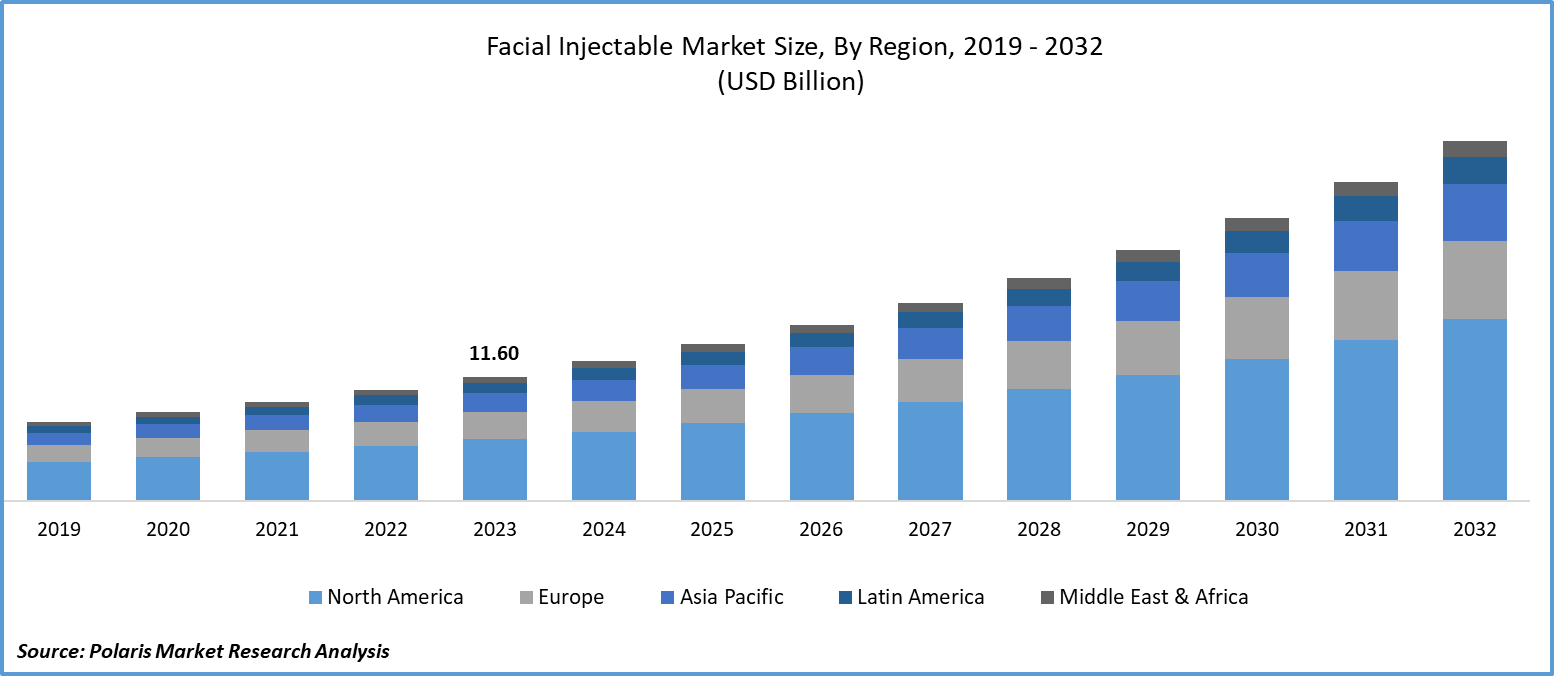

Facial Injectable Regional Insights:

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Middle East & Africa. North America dominated the global facial injectable market in 2023, driven by an increasing number of procedures being performed across the region. According to the International Society of Aesthetic Plastic Surgery (ISAPS), about 5.8 million nonsurgical procedures were performed in the U.S. in 2022. More individuals are opting for nonsurgical procedures and treatments to address signs of aging and enhance facial features, leading to the North American facial injectable market growth.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

The Asia-Pacific facial injectable market is anticipated to grow at the fastest CAGR from 2024 to 2032. The demand is propelled by an expanding aging population seeking cosmetic enhancements. Demographic shifts lead to increased concerns about aging and appearance, there is a rising acceptance and adoption of injectable treatments such as botulinum toxin and dermal fillers. The demographic trend, combined with rising disposable incomes and burgeoning beauty industry, is driving significant growth in the facial injectables market across Asia Pacific.

Moreover, the growing awareness of physical appearance in developing countries such as India, Australia, and South Korea is fueling demand for the facial injectable market. These countries become more affluent and connected due to rising emphasize on aesthetics and self-image. Therefore, the cultural shift is encouraging individuals to explore non-invasive cosmetic procedures, driving the expansion of the facial injectable market in Asia Pacific regions

Facial Injectable Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the facial injectable market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, facial injectable industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global facial injectable industry to benefit clients and increase the market sector. In recent years, the facial injectable industry has offered some technological advancements. Major players in the facial injectable market, including Allergan Aesthetics (AbbVie), BIOPLUS CO., LTD., Bioxis Pharmaceuticals, GALDERMA, Ipsen Pharma, Merz Pharma, Medytox, Prollenium Medical Technologies, SINCLAIR PLASTIC SURGERY, and Teoxane.

Allergan Aesthetics (AbbVie) is a pharmaceutical manufacturing company that offers BOTOX Cosmetic for facial lines, JUVÉDERM fillers for facial contouring, KYBELLA for double chin reduction, CoolSculpting for fat reduction, CoolTone for muscle toning, Natrelle breast implants, and SkinMedica skincare products. In May 2023, Allergan Aesthetics, part of AbbVie, gains FDA approval for SKINVIVE by JUVÉDERM, a HA microdroplet injection enhancing cheek skin smoothness for six months.

Medytox, based in South Korea, specializes in botulinum toxin products like Neuronox and INNOTOX, hyaluronic acid fillers Neuramis and Potenfill, and medical devices including ComfortDual and Carewave, exported to over 60 countries. In January 2024, Medytox's subsidiary, Luvantas, introducied NivobotulinumtoxinA and other aesthetic innovations in North America, emphasizing regulatory approvals and partnerships.

Key Companies in the Facial Injectable market include:

- Allergan Aesthetics (AbbVie)

- BIOPLUS CO., LTD.

- Bioxis Pharmaceuticals

- GALDERMA

- Ipsen Pharma

- Merz Pharma

- Medytox

- Prollenium Medical Technologies

- SINCLAIR PLASTIC SURGERY

- Teoxane.

Facial Injectable Industry Developments

- In April 2025, Galderma launched Sculptra® in China, expanding its aesthetics portfolio with the first regenerative biostimulator, offering patients innovative treatment for mid-facial volume loss and natural-looking results backed by 25 years of clinical evidence.

- August 2023: Maypharm CO, LTD launched METOOFILL, a hyaluronic acid dermal filler with advanced second-generation technology, setting new standards in cosmetic innovation.

- February 2022: Merz Aesthetics launched Radiesse (+) Lidocaine, the first FDA-approved injectable using calcium hydroxylapatite for jawline contour improvement in adults.

- October 2022: Prollenium Group acquired SoftFil, merging with Revanesse® to enhance their portfolio with advanced medical devices and dermal fillers, emphasizing innovation in aesthetic medicine.

Facial Injectable Market Segmentation:

Facial Injectable Product Outlook

- Collagen & PMMA Microspheres

- Botulinum Toxin Type A

- Hyaluronic Acid (HA)

- Calcium Hydroxylapatite (CaHA)

- Poly-L-lactic Acid (PLLA)

- Others

Facial Injectable Application Outlook

- Facial Line Correction

- Lip Augmentation

- Face Lift

- Acne Scar Treatment

- Lipoatrophy Treatment

- Others

Facial Injectable, End-Use Outlook

- MedSpa

- Dermatology Clinics

- Hospitals

Facial Injectable Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Facial Injectable Report Scope:

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12 billion |

|

Market size value in 2025 |

USD 12.96 billion |

|

Revenue Forecast in 2034 |

USD 25.9 billion |

|

CAGR |

8.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global facial injectable market size was valued at USD 12 Billion in 2024.

The global market is projected to grow at a CAGR of 8.00% during the forecast period, 2025-2034.

North America had the largest share in the global market

The key players in the market are Allergan Aesthetics (AbbVie), BIOPLUS CO., LTD., Bioxis Pharmaceuticals, GALDERMA, Ipsen Pharma, Merz Pharma, Medytox, Prollenium Medical Technologies, SINCLAIR PLASTIC SURGERY, and Teoxane.

The hyaluronic acid (HA) category dominated the market in 2023

The lip augmentation had the largest share in the global market.