Organic Skin Care Market Size, Share, Trends, & Industry Analysis Report

By Consumer (Men and Women), By Distribution Channel (Supermarket/Hypermarket, Pharmacy & Drugstore, Online, Others), By Product, and By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM1146

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

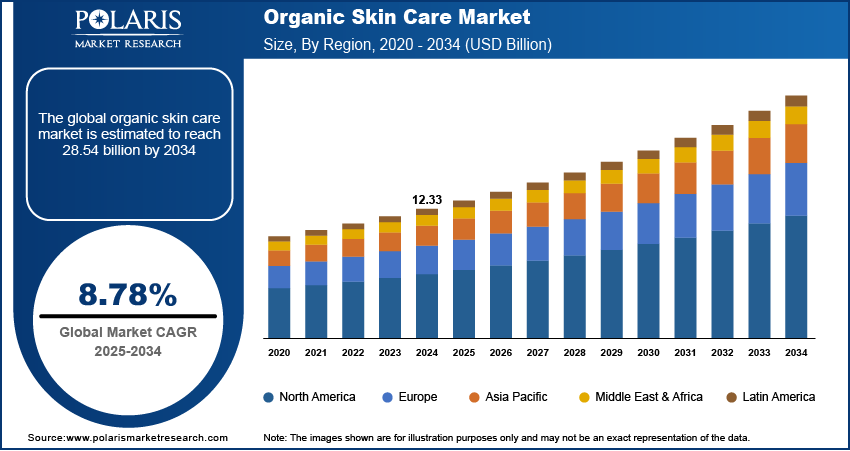

The global organic skin care market size was valued at USD 12.33 billion in 2024 and is anticipated to grow at a CAGR of 8.78% from 2025 to 2034. Key factors driving demand for organic skin care include a growing preference for natural and plant-based products and rising consumer awareness of harmful synthetic ingredients.

Key Insights

- The face cream & moisturizers segment dominated the global industry in 2024. This is mainly attributed to the growing demand for anti-aging products and sunscreen lotions.

- The supermarket/hypermarket segment is expected to witness the fastest CAGR during the forecast period. This is attributed to the significant advantages offered by supermarkets/hypermarkets to consumers.

- Asia Pacific is the largest revenue contributor in the global market due to the expansion of the chemical industry.

- North America is anticipated to witness considerable growth in the global market during the forecast period. This is attributed to the high purchasing power of the consumer.

Industry Dynamics

- The upsurge in demand for sunscreens, face creams, and body lotions is the key factor driving the growth of the global industry.

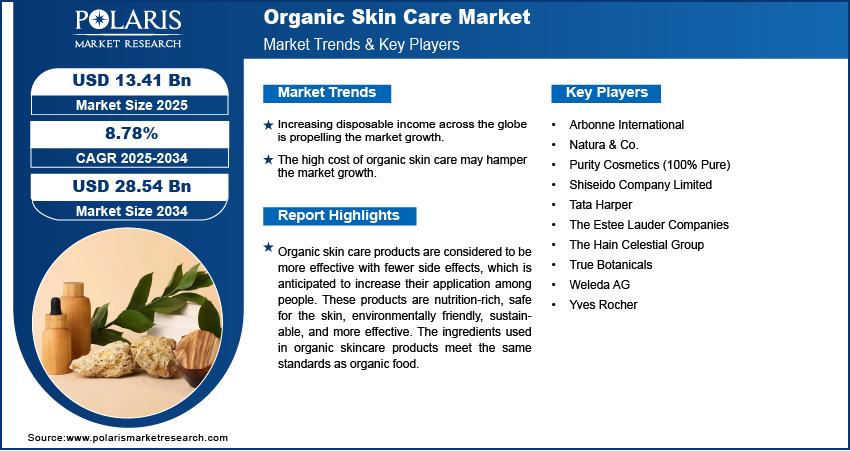

- Increasing disposable income across the globe is propelling the market growth.

- Growing investments in the R&D of products have created lucrative growth opportunities for the industry.

- The high cost of organic skin care may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 12.33 Billion

- 2034 Projected Market Size: USD 28.54 Billion

- CAGR (2025-2034): 8.78%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Organic Skin Care Market

- AI personalizes organic skincare by analyzing skin type.

- AI helps brands forecast trends in natural ingredients.

- AI is fueling the formulation of cleaner and more effective organic products.

Organic skin care products are considered to be more effective with fewer side effects, which is anticipated to increase their application among people. These products are nutrition-rich, safe for the skin, environmentally friendly, sustainable, and more effective. The ingredients used in organic skincare products meet the same standards as organic food. These products use natural organic ingredients such as honey, aloe vera, coconut oil, and shea butter to soothe, moisturize, nourish, and promote smooth skin. The rising interest towards organic beauty has primarily driven demand for the organic skin care. For instance, in 2021, the sales of Soil Association certified natural and organic beauty and wellbeing products grew by 15% due to the significant interest of the population towards health and wellness.

During Covid-19, the demand for organic skin care market increased significantly due to the rising importance of wellbeing. This situation led to the demand for chemical-free products. However, lockdowns and movement restrictions disrupted the supply chain and hampered the production of such products. In addition, the pandemic has enabled digitization and caused changes in the online shopping behavior of the consumer. The greater number of industry players in the skin care industry are penetrating online with a major shutdown of cosmetics and beauty retail stores. For instance, in February 2022, Belviso launched its premium skin care product range in India. These products will be available on online platforms as well as premium organic beauty apps and websites.

Industry Dynamics

Growth Drivers

The upsurge in demand for sunscreens, face creams, and body lotions is the key factor driving the growth of the global industry. Wearing sunscreen consistently has become important as it can protect both children and adults against dangerous U.V. light. For instance, in May 2021, the survey by the “American Academy of Dermatology” revealed that 80% of U.S. citizens have awareness about putting sunscreen in 2 hours, with a conviction rate of around 33%. On the other hand, a significant rise in consciousness bout animal welfare and the environment has driven demand for organic skin care products that use plant-based ingredients in these products.

Furthermore, growing investments in the R&D of products have created lucrative growth opportunities for the industry. Moreover, the ongoing trend of herbal products has enabled industry players to launch such products in the concerned regions. For instance, in June 2021, SO’BiO introduced its grooming products in the U.S. The brand is aimed at developing beauty products that do no harm to the planet or user.

Know more about this report: Request for sample pages

Report Segmentation

The global organic skin care market is primarily segmented on the basis of product, consumer, distribution channel, and region.

|

By Product |

By Consumer |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Insight by Product

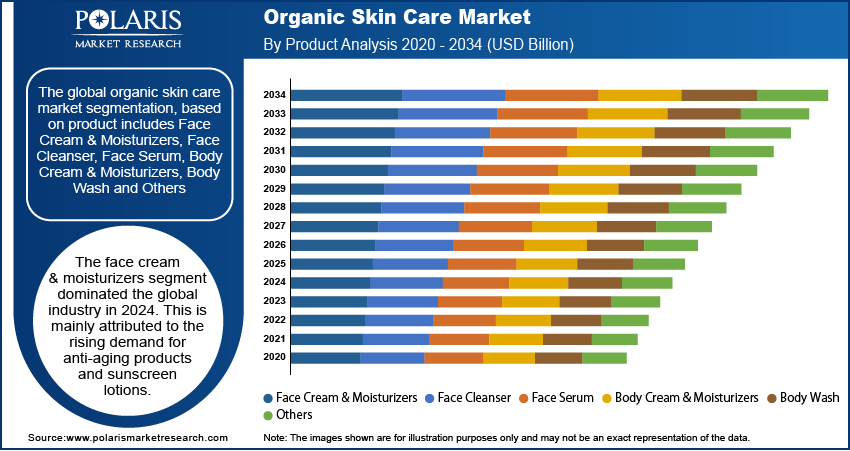

The face cream & moisturizers segment dominated the global industry in 2024. This is mainly attributed to the rising demand for anti-aging products and sunscreen lotions. In addition, improving quality of life coupled with the positive effects of personal attention and beauty on self-esteem and social interaction has boosted demand for face cream & moisturizers.

On the other hand, the body wash segment is anticipated to witness the fastest growth rate during the forecast period. The emergence of new players in the body care sector is projected to create lucrative growth opportunities for this segment. For instance, in March 2022, Vedix, the customized Ayurveda beauty brand, entered the body care segment to compete with players such as L'Oreal, Hindustan Unilever, and Nivea.

Insight by Consumer

The women segment contributed to the largest revenue share in 2024 due to the increasing usage of personal grooming products by women to enhance their confidence and appearance. For instance, according to a survey published in the Multidisciplinary Digital Publishing Institute (MPDI) open-access journal in June 2020, women who applied organic skincare products for a period of 28 days showed improved feelings of empowerment, significant improvement in self-esteem, and happiness. On the other hand, the studies show that 59% of women read beauty product labels to recognize harmful ingredients before the purchase.

The men segment is expected to witness the fastest CAGR growth during the forecast period owing to the increasing awareness among millennial men about the benefits of organic skincare. For instance, according to the blog published in 2020 by TIEGE HANLEY, a skincare brand, about 60% of men aged between 18 to 24 use organic skincare products.In addition, there is a huge demand for gender-specific products such as conditioners, shaving creams, shampoos, peels, and face masks by men.

Insight by Distribution Channel

The supermarket/hypermarket segment is expected to witness the fastest CAGR growth during the forecast period. This is attributed to the significant advantages offered by supermarkets/hypermarkets to consumers, such as lower prices, freedom of selection, and high visibility of international brands. They offer a suitable platform for all types of customers. For instance, according to the article published by Entrepreneur Handbook in July 2021, the supermarkets including Tesco, Asda, Sainsbury's, and Morrisons accounted for 63% of the retail sale in the U.K.

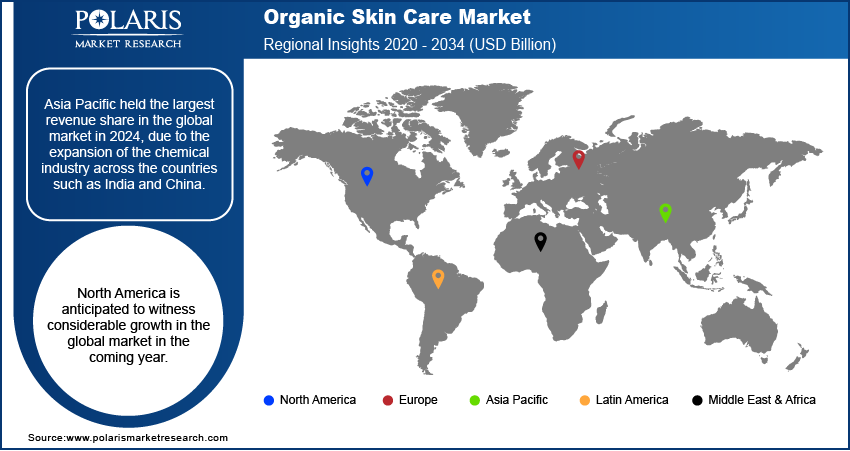

Geographic Overview

Asia Pacific held the largest revenue share in the global market in 2024, due to the expansion of the chemical industry across the countries such as India and China. China has become the major revenue contributor in Asia Pacific in terms of production as well as consumption. In addition, the country is witnessing the emergence of new industry players with advanced organic skin care product portfolios. For instance, in January 2022, Pula introduced a wide range of clean-label organic skin care products for children on Tmall and Douyin.

North America is anticipated to witness considerable growth in the global market in the coming year. This is attributed to the high purchasing power of the consumer across the U.S. and Canada, where customers are willing to pay a higher price for a youthful appearance. In addition to this, the region is home to established product manufacturers such as Unilever and Procter & Gamble, coupled with the growing infrastructure facilities for retailers. This factor is further projected to boost the growth of the industry.

Competitive Insights

The organic skin care market is seeing strong competition as more people look for products made with natural and safe ingredients. Well-known brands are expanding ranges and focusing on eco-friendly packaging to keep customer loyalty, while smaller companies stand out by using local ingredients and promoting clear labels. Online sales and social media campaigns are helping new names reach younger buyers quickly. Regional players also find space by offering products that match local traditions and preferences. The market is shaped by rising awareness of skin health, environmental concerns, and demand for chemical-free solutions. In this setting, success often depends on trust, product quality, and the ability to bring something fresh to the consumer.

Some of the major players operating the market include Arbonne International, Natura & Co., Purity Cosmetics (100% Pure), Shiseido Company Limited, Tata Harper, The Estee Lauder Companies, The Hain Celestial Group, True Botanicals, Weleda AG, and Yves Rocher.

Recent Developments

July 2024, BloomyBliss launched an organic skincare products

Organic Skin Care Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 12.33 Billion |

| Market size value in 2025 | USD 13.41 Billion |

|

Revenue forecast in 2034 |

USD 28.54 Billion |

|

CAGR |

8.78% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Arbonne International, Natura & Co., Purity Cosmetics (100% Pure), Shiseido Company Limited, Tata Harper, The Estee Lauder Companies, The Hain Celestial Group, True Botanicals, Weleda AG, and Yves Rocher. |

FAQ's

• The global market size was valued at USD 12.33 billion in 2024 and is projected to grow to USD 28.54 billion by 2034.

• The global market is projected to register a CAGR of 8.78% during the forecast period.

• Asia Pacific dominated the market in 2024.

• A few of the key players in the market are Arbonne International, Natura & Co., Purity Cosmetics (100% Pure), Shiseido Company Limited, Tata Harper, The Estee Lauder Companies, The Hain Celestial Group, True Botanicals, Weleda AG, and Yves Rocher.

• The face cream & moisturizers segment dominated the market revenue share in 2024.