Golf Equipment Market Share, Size, Trends, Industry Analysis Report

By Product (Golf Club, Golf Balls, Golf Gear, Golf Bags, Golf Footwear, and Apparel); By Distribution Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 114

- Format: PDF

- Report ID: PM2914

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

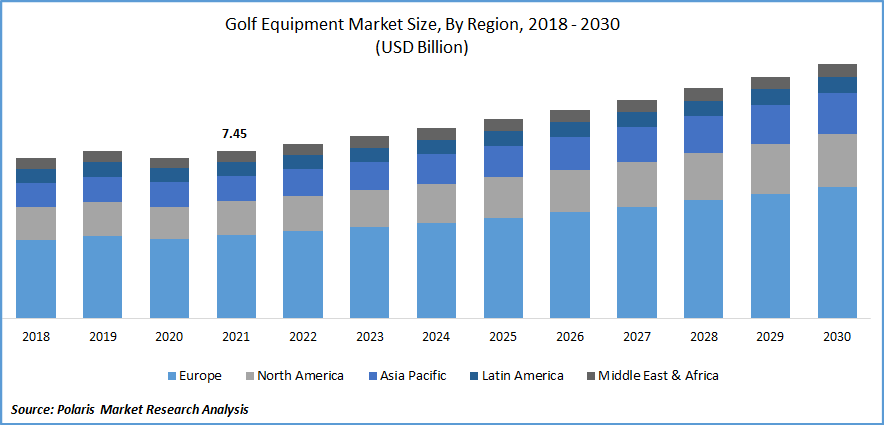

The global golf equipment market was valued at USD 7.45 billion in 2021 and is expected to grow at a CAGR of 4.8% during the forecast period.

Rapidly rising golf tourism across the globe and growing government support are boosting the market’s growth. The governments are marketing golf vacation spots to local and foreign travelers to increase their foreign exchange earnings through the growth of the specialty market and consequently support economic expansion. For instance, in August 2022, Scottish Golf Tourism and Visitor Strategy have just been unveiled.

Know more about this report: Request for sample pages

As the sector overcomes the difficulties caused by the COVID-19 pandemic and constructs for the future, it focuses on tourism planning, community engagement, training, and health. Scottish Golf, PGA in Scotland, SIGTOA, & Scotland Where Golf Began are all members of the SGTDG, representing various industries including lodging, tour operators, and travel agencies. Therefore, the market will expand as a result of the increasing government activities to promote golf tourism.

The products and accessories used to play the game of golf are referred to as golf equipment. It contains putters, wedges, golf balls, clubs, footwear, bags, tools, clothing, a cart, towels, ball indicators, club head covers, and other accessories. Golf is regarded as a good kind of exercise that helps enhance creativity, enhance sleep patterns, and lower blood pressure, stress, and depression. In contrast, golf equipment improves performance and uniformity, providing a golf swing, relaxation, protection, and gripping. Golf is becoming more and more popular worldwide, boosting the demand for gold equipment. Golf is a popular sport among those becoming more health conscious because it helps with weight loss, strengthens the heart, and increases focus.

Moreover, major industry players are concentrating on strategic alliances and partnerships to strengthen their position in the industry for boosting golf tourism which is increasing the demand for golf equipment. For instance, in October 2021, Goway joined Signature Travel Network to increase its presence in the US and improve its capacity to offer vacations to tourists worldwide. In October 2019, Scottish Golf and Golf Holidays Direct collaborated to provide players with the greatest prices on golf vacations in Scotland.

Additionally, in March 2021, Callaway Golf acquired Topgolf for USD 2.6 billion. By integrating Topgolf's cutting-edge technological platform and access to golfers of all abilities into its business, Callaway hoped to expedite its growth, forge competitive advantages, & establish a leadership position in the global industry. Thus, the demand for golf equipment due to rising golf tourism is boosting market growth.

COVID-19 has harmed the market due to the widespread lockdown and societal conventions of seclusion. Most golf is played in the Americas, Europe, and Oceania, which were severely affected by the epidemic and saw a fall in demand for golf equipment. Sports were put on hold with immediate effect, and the 3,000 golf clubs in the UK were compelled to close economic simulation. The governments estimated the financial impact of the lockdown on the golf business to support the argument to the Government for golf's safe return to play. But after the middle of the year, things started to get easier owing to better sales and market expansion.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rapidly rising number of product developments, like the introduction of smart sensors and advanced grips, fosters market expansion. They are frequently used to record, examine, and determine pressure levels for each shot. For instance, in April 2022, The new version of Arccos Golf's Smart Sensors would be most useful to golfers who want to understand their game better and advance more quickly. The fully electronic shot-tracking technology in Smart Sensors (Gen3+) uses A.I. deep learning and intimately combines Arccos hardware and software to identify a player's shots more precisely now than ever.

Moreover, top players also concentrate on innovations and new product improvements, giving them a competitive edge in the market. For instance, in January 2022, TaylorMade Company introduced the Stealth game-improving irons powered by the brand-new Cap Back Design featuring toe wrap construction. Stealth irons are designed to improve face mobility and offer rapid ball speeds with a self-assured shape, continuing on the ground-breaking Cap Back Design in SIM2 Max & SIM2 Max OS irons, which made use of the hollowed body structure.

Additionally, they are spending a lot of money on marketing and promotional initiatives, enabling them to reach a broader geographic audience and increase their customers.

Report Segmentation

The market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

The sporting goods retailer segment was a significantly high revenue share in 2021

Increased manufacturer focus on showcasing their products in these shops and the development of the retail sector, including hypermarkets and retail shops, will further favor market growth. Supermarkets and hypermarkets are among the most frequently visited retail facilities, mostly in big cities and metropolitan areas, due to their accessibility and proximity to residential areas. Due to these factors, equipment suppliers showcase their product lines through these channels to connect with a larger audience of buyers.

Specialty shops that sell golf equipment have focused on improving clients' tailored shopping experiences on a global scale. The majority of specialty shops see to it that the needs of their clients are addressed, and some may even provide beneficial recommendations based on previous purchases. As a result, the vast majority of golfers prefer physical stores.

The golf clubs segment industry accounted for the highest market share in 2021

Consumer demand is increasing due to manufacturer innovation in clubs, such as hybrid clubs comprised of higher-lofted wood and iron, which are becoming increasingly popular. For instance, in January 2022, Callaway Golf, a market-leading golf equipment, apparel, and amusement provider, officially unveiled its new Rogue Collection of Drivers, Fairway Woods, Irons, and Hybrids. The extended longevity of iron clubs might have a significant impact on the product repurchase cycle, which is limiting the segment's growth.

Golf Footwear is expected to hold the significant revenue share

A developing trend in the market is footwear for young people, as they provide the player with more comfort and flexibility than traditional shoes. For instance, in June 2021, Adidas introduced the Solarthon, a golf shoe that is both comfy and light. This results from the shoe's Fishcale Traxion outsole, which enhances grip and durability, and the silhouette's comprised entirely boosted midsole, which offers comfort. Additionally, the company plans to release limited-edition grey, blue, and white color variations of Solarthon. To support the company's "End Plastic Waste" effort, the shoe has an upper made of recycled yarn with at least 50% Parley Ocean Plastic from Adidas.

The demand in Europe is expected to witness significant growth

The demand for golf equipment is rising rapidly across the European region due to the rising awareness of physical activity and the availability of different material golf types of equipment in the region—golfers all around Europe on a variety of clubs that can be used for various shots. The clubs come in different types and materials, such as wedges, putters, hardwoods, irons, and hybrids. For rainy, rough, and soft ground, there is also a great need for attractive, lightweight shoes.

The increased interest in physical fitness and the actual workout provided by playing golf can be ascribed to the rise in golf equipment and apparel use. During the forecast period, this is anticipated to boost the European market. To introduce the game to millions of individuals of all ages, the “International Golf Federation” runs numerous European initiatives and events. The rise in middle-class money and the recent increase of female golfers in Europe are other factors contributing to the rising demand.

Moreover, consumer spending is driving the Asia-Pacific region's growth. Many of the world's population now plays golf, and the region has a growing middle class with more discretionary cash, which bodes well for the golf equipment industry. An increasing number of golf events and participants are a primary factor driving golf equipment sales. The time players devote to honing their swings while employing the appropriate equipment, including clubs, gloves, and other gear, is a major contributing cause to the high concentration of professional players in the area. The elements above are anticipated to increase consumer demand for golf equipment.

Competitive Insight

Some of the major players operating in the global market include Anta Sports, Acushnet Holdings, Adidas Group, Bridgestone, Callaway Golf, Cleveland Golf, Dunlop Sports, Dixon Golf, Golfsmith International, Mizuno Corporation, Puma SE, PING, Roger Cleveland Golf, SRI Sports, Sumitomo Rubber, Nike Inc., Taylormade Golf Company, and Wilson Sporting.

Recent Developments

In January 2022, Cleveland Golf unveiled information on its brand-new Launcher XL line of clubs, which will be available in shops in the UK and around Europe. Drivers, fairway woods, hybrids, and irons are all available on the range, and they all have game-improving characteristics.

In January 2020, the newest versions of Chrome Soft and Chrome Soft X from Callaway Golf were released to improve Tour ball performance. The superb feel and spin qualities that Chrome Soft and Chrome Soft X are recognized for have been preserved while promoting additional speed and range.

Golf Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 7.76 billion |

|

Revenue forecast in 2030 |

USD 11.33 billion |

|

CAGR |

4.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Anta Sports Products Limited (Amer Sports), Acushnet Holdings Company Limited, Adidas Group, Bridgestone Group, Callaway Golf Company, Cleveland Golf Corp., Dunlop Sports Co. Ltd., Dixon Golf Inc, Golfsmith International Holdings Inc., Mizuno Corporation, Puma SE, PING Inc., Roger Cleveland Golf Company Inc, SRI Sports Limited, Sumitomo Rubber Industries, Nike Inc., Taylormade Golf Company Inc., and Wilson Sporting Goods. |