Green and Bio Polyols Market Size, Share, Trends, Industry Analysis Report

By Polyurethane (Flexible Polyurethane Foams, Rigid Polyurethane Foams), By Bio polyol, By Source Materials, By End Use Industry, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM2488

- Base Year: 2024

- Historical Data: 2020-2023

Overview

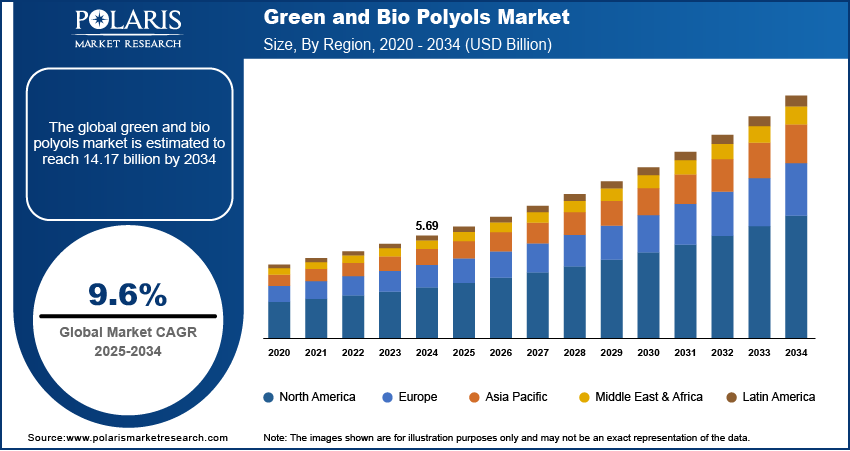

The global green and bio polyols market size was valued at USD 5.69 billion in 2024, growing at a CAGR of 9.6% from 2025 to 2034. The green and bio polyols market is driven by increasing demand for sustainable materials, stringent environmental regulations, and rising awareness of eco-friendly products. Growth in automotive, construction, and packaging industries also boosts adoption of bio-based polyurethane alternatives.

Key Insights

- In 2024, the insulation materials segment held the largest market share, fueled by growing demand for energy-efficient and sustainable building solutions.

- The algae-based segment is anticipated to witness robust growth during the forecast period, supported by the rising interest in next-generation renewable feedstocks for greener manufacturing.

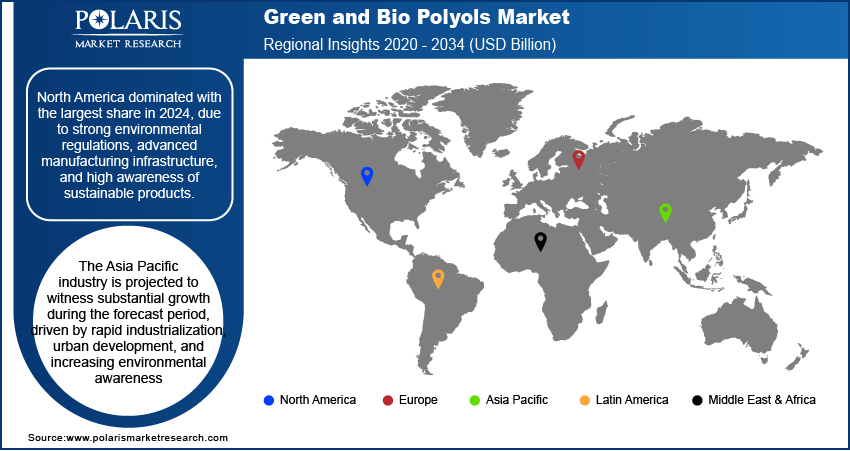

- North America led the market in 2024, driven by strict environmental regulations, well-developed manufacturing capabilities, and strong consumer preference for eco-friendly products.

- The U.S. market is expected to grow significantly during the forecast period. The market growth is supported by government incentives, increasing demand for green consumer goods, and a booming construction industry embracing bio-based materials.

- The Asia Pacific market is projected to expand rapidly in the coming years, driven by swift industrial growth, accelerating urbanization, and growing environmental consciousness among industries and consumers.

Industry Dynamics

- Support from end-user industries drives the demand for green and bio polyols.

- Rising crude oil prices are fueling the industry growth.

- Technological advancements have made it easier and more affordable to produce green and bio polyols at a commercial scale.

- High production costs and limited availability of raw materials restrain the growth of the industry.

Market Statistics

- 2024 Market Size: USD 5.69 billion

- 2034 Projected Market Size: USD 14.17 billion

- CAGR (2025–2034): 9.6%

- North America: Largest market in 2024

AI Impact on the Industry

- AI accelerates the discovery and optimization of bio-based feedstocks by analyzing large datasets on plant-derived raw materials and reaction pathways.

- Integration of AI enables predictive modeling for polymer performance, supporting the development of high-quality green polyols tailored to specific applications.

- AI-driven lifecycle analysis helps manufacturers assess environmental impacts more accurately, guiding sustainable product design and regulatory compliance.

- AI automates production process optimization, reducing waste, energy consumption, and production costs in green polyol manufacturing.

Green and bio polyols are environmentally friendly alternatives to traditional petroleum-based polyols, used primarily in the production of polyurethanes. They are derived from renewable sources such as vegetable oils, castor oil, and recycled materials. These polyols help reduce carbon emissions and environmental impact while maintaining comparable performance in applications like foams, coatings, adhesives, and sealants.

Consumers and companies are choosing eco-friendly products as environmental awareness rises. Green and bio polyols, made from renewable resources such as vegetable oils, offer a sustainable alternative to traditional petroleum-based materials. Many industries, especially automotive, furniture, and construction, are now adopting measures to reduce their carbon footprint. Using bio-based polyols helps companies meet sustainability goals without sacrificing performance. This shift toward greener solutions is driving strong demand. Additionally, end-users prefer products labeled "bio-based" or "eco-friendly," making them more competitive, as environmental consciousness becomes the norm, further fueling the growth.

Technological advancement has made it easier and more affordable to produce green and bio polyols at a commercial scale. Improved processing techniques and better catalyst systems have improved the efficiency, performance, and consistency of bio-based polyols. Companies are investing in R&D to develop new formulations that match or exceed the quality of petroleum-based options. These advancements make bio polyols suitable for a wider range of industrial uses. Production costs decrease, and product performance improves as the technology continues to evolve, which make bio-based polyols more accessible and appealing across multiple industries, thereby fueling the growth.

Drivers & Opportunities

Support from End-User Industries: Many end-user industries such as automotive, construction, packaging, and consumer goods are actively seeking sustainable raw materials to meet their corporate environmental goals and satisfy eco-conscious customers. According to H&M, the company aimed to source all the raw materials sustainably by 2030. These industries are partnering with chemical companies to integrate green materials like bio polyols into their products. Automotive manufacturers are using bio-based foams for interior parts, while construction companies are adopting green insulation materials. This support from downstream sectors increases demand for bio polyols and encourages innovation and large-scale adoption, thereby driving the growth.

Rising Crude Oil Prices: The crude oil prices are rising worldwide due to various factors such as rising demand, OPEC+ maintaining output, and geopolitical tensions. According to the Indian Ministry of Petroleum and Natural Gas, in August 2025, the crude oil price per bbl was USD 71.7. Conventional polyols are derived from petroleum, making their cost highly sensitive to fluctuations in oil prices. The cost of petroleum-based polyols increases as crude oil prices rise, pushing manufacturers to seek more stable and cost-effective alternatives. Bio-based polyols, produced from renewable sources such as soy, castor oil, or recycled materials, offer a less volatile pricing structure. This economic advantage, coupled with their sustainability benefits, makes green polyols an attractive option. The demand for bio-based polyols grows as companies look to reduce production costs and price risks, especially in price-sensitive regions, thereby boosting the growth.

Segmental Insights

Polyurethane Analysis

The segmentation, based on polyurethane, includes flexible polyurethane foams, rigid polyurethane foams, coatings, adhesives, sealants, and elastomers (CASE), and insulation materials. In 2024, the insulation materials segment dominated with the largest share due to rising demand for energy-efficient buildings. Governments and builders are focusing on sustainable construction practices with growing awareness of climate change. Green building codes and energy-saving regulations have increased the use of eco-friendly insulation materials made with bio-based polyols. These materials reduce energy consumption and lower the environmental impact of buildings. There is a strong demand for green insulation as construction activity grows worldwide, thereby driving the segment growth.

Bio-Polyols Analysis

The segmentation, based on bio polyols includes sugar-based polyols, vegetable oil-based polyols, glycerin-based polyols, and lignin-based polyols. The lignin-based polyols segment accounted for significant growth driven by their abundant availability and low-cost production from biomass. Lignin, a natural polymer found in plant cell walls, is a renewable by-product of the paper and bio-refining industries. Companies are creating sustainable materials while reducing waste by converting this waste into valuable polyols. Lignin-based polyols further offer good thermal and mechanical properties, making them suitable for a variety of polyurethane applications. Lignin-based polyols demand is growing as industries seek cost-effective and eco-friendly raw materials, driving the segment growth.

Source Material Analysis

The segmentation, based on source material, includes plant-based, algae-based, animal-based, and waste-based. The algae-based segment is expected to experience significant growth during the forecast period. The demand for next-generation renewable resources drives the growth. Algae can be cultivated quickly, require minimal land and water, and absorb carbon dioxide, which makes them an ideal sustainable feedstock. Interest from environmentally conscious industries is increasing as researchers develop efficient methods to extract oils from algae for polyol production. These polyols have strong potential in packaging, automotive, and coatings applications, propelling the segment growth.

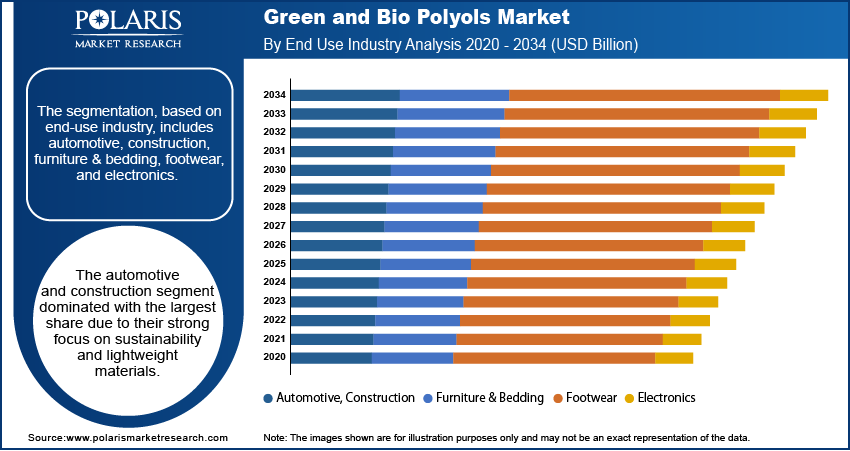

End Use Industry Analysis

The segmentation, based on end-use industry, includes automotive, construction, furniture & bedding, footwear, and electronics. The automotive and construction segment dominated with the largest share due to their strong focus on sustainability and lightweight materials. In the automotive sector, green polyols are used in foams, seat cushions, and interior panels to reduce vehicle weight and emissions. In construction, bio-based insulation, adhesives, and coatings help meet green building certifications and energy efficiency goals. Both sectors are adopting measures to reduce environmental impact and adopt eco-friendly materials. This growing emphasis on cleaner, more efficient solutions drives the adoption of green and bio polyols, further fueling the growth.

Regional Analysis

North America Green and Bio Polyols Market Trends

North America dominated with the largest share in 2024, due to strong environmental regulations, advanced manufacturing infrastructure, and high awareness of sustainable products. The region has a well-established polyurethane industry, with significant demand from automotive, construction, and furniture sectors. Government policies supporting bio-based materials and incentives for green buildings have encouraged manufacturers to shift toward eco-friendly polyols. Additionally, major companies in the region are investing in R&D and commercial-scale production of bio-based solutions, thereby fueling the growth of the industry in North America.

U.S. Green and Bio Polyols Market Insights

The industry in the U.S. is expected to witness significant growth during the forecast period. Strong support from government initiatives, rising demand for sustainable consumer goods, and a booming construction sector fuel the rapid adoption of bio-based materials. Major players such as Cargill and Dow Chemical are headquartered in the U.S. and continue to develop advanced bio polyol technologies. Growing trends such as electric vehicles, green buildings, and consumer preference for eco-friendly products further boost growth. Moreover, innovation, infrastructure, and sustainability commitments further drive the growth of the industry.

Asia Pacific Green and Bio Polyols Market Analysis

The Asia Pacific industry is projected to witness substantial growth during the forecast period, driven by rapid industrialization, urban development, and increasing environmental awareness. Countries in the region are investing in renewable technologies to reduce their dependence on fossil fuels. Rising middle-class income, changing consumer lifestyles, and government support for green manufacturing practices are accelerating the use of bio-based materials. The demand from automotive, construction, and furniture industries is strong in emerging economies such as India and Vietnam. The region is expected to witness strong expansion in the coming years as local manufacturers adopt sustainable practices.

China Green and Bio Polyols Market Assessment

The China industry is projected to witness substantial growth during the forecast period, driven by its sustainability goals and large-scale industrial base. The Chinese government’s push for carbon neutrality by 2060 is prompting industries to adopt bio-based and low-emission materials. Rapid urbanization and infrastructure development are fueling demand in the construction sector, while the electric vehicle boom is driving the use of lightweight, bio-based components. Local companies are further investing in renewable feedstock and advanced processing technologies. Moreover, strong policy backing, large consumer demand, and growing industrial capabilities fuel the growth.

Europe Green and Bio Polyols Market Insights

The industry in Europe is expected to experience significant growth in the future, driven by stringent environmental regulations and strong government support for bio-based materials. The European Union’s Green Deal and circular economy initiatives encourage industries to adopt low-carbon, renewable alternatives. Large automotive, packaging, and construction sectors further fuel the demand, where manufacturers are adopting measures to reduce emissions and increase sustainability. Additionally, the presence of established chemical players and advanced R&D facilities further boosts innovation in bio-polyol technologies, thereby boosting the growth.

Germany Green and Bio Polyols Market Outlook

The market in Germany is expected to experience significant growth due to its leadership in sustainable manufacturing and chemical engineering. The country’s strong automotive and construction industries are adopting bio-based polyols for lightweight parts and energy-efficient materials. The national sustainability goals and EU climate policies are promoting German manufacturers to integrate renewable raw materials into their production processes. Leading chemical companies in Germany are further investing in R&D for bio-polyol innovations. Moreover, a firm focus on energy efficiency, product performance, and environmental responsibility is further fueling the growth.

Key Players and Competitive Analysis

The green and bio polyols market is characterized by the presence of several key players focusing on sustainability, product innovation, and strategic partnerships to gain a competitive edge. Major companies such as BASF SE, Covestro AG, The Dow Chemical Company Inc, and Cargill dominate the market through extensive R&D capabilities, global reach, and diverse product portfolios. These players are actively investing in bio-based polyols derived from renewable sources such as soy, castor oil, and recycled materials to meet growing environmental regulations and consumer demand for eco-friendly products. Emerging players such as Jayant Agro-Organics and Novomer Inc are gaining traction by offering specialized, high-performance bio polyols tailored for niche applications. Strategic collaborations, acquisitions, and capacity expansions are common tactics, helping companies strengthen supply chains and enter new markets. The competitive intensity is expected to increase as sustainability mandates tighten and demand for greener alternatives continues to rise globally.

Key Players

- Arkema

- BASF SE

- Bayer AG

- Cargill

- Covestro AG

- Emery Oleochemicals

- Huntsman International LLC

- Jayant Agro-Organics Limited

- Koch Industries Inc

- Mitsui Chemicals Inc

- Novomer Inc

- PolyGreen

- Roquette Frères

- Stepan Company

- The Dow Chemical Company Inc

Green and Bio Polyols Industry Developments

In August 2024, Cargill unveiled three 100% bio-based polyols at FEICA 2024. It showcased innovations such as isocyanate-free polyols, rPET-based polyols, and high-performance bio-based alternatives, reinforcing its commitment to sustainability and customer-specific polymer solutions in coatings and adhesives.

In November 2022, Huntsman launched the ACOUSTIFLEX VEF BIO system, a bio-based polyurethane foam for automotive acoustics, incorporating 20% vegetable oil content and reducing carbon footprint by 25%, while maintaining high acoustic performance, low emissions, and fast processing capabilities.

Green and Bio Polyols Market Segmentation

By Polyurethane Outlook (Volume Kilotons, Revenue, USD Billion, 2020–2034)

- Flexible Polyurethane Foams

- Rigid Polyurethane Foams

- Coatings, Adhesives, Sealants, and Elastomers (CASE)

- Insulation Materials

By Bio polyol Output Outlook (Volume Kilotons, Revenue, USD Billion, 2020–2034)

- Sugar-Based Polyols

- Vegetable Oil-Based Polyols

- Glycerin-Based Polyols

- Lignin-Based Polyols

By Source Material Outlook (Volume Kilotons, Revenue, USD Billion, 2020–2034)

- Plant-Based

- Algae-Based

- Animal-Based

- Waste-Based

By End-Use Industry Outlook (Volume Kilotons, Revenue, USD Billion, 2020–2034)

- Automotive, Construction

- Furniture & Bedding

- Footwear

- Electronics

By Regional Outlook (Volume Kilotons, Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Green and Bio Polyols Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.69 Billion |

|

Market Size in 2025 |

USD 6.23 Billion |

|

Revenue Forecast by 2034 |

USD 14.17 Billion |

|

CAGR |

9.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.69 billion in 2024 and is projected to grow to USD 14.17 billion by 2034.

The global market is projected to register a CAGR of 9.6% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Arkema; BASF SE; Bayer AG; Cargill; Covestro AG; Emery Oleochemicals; Huntsman International LLC; Jayant Agro-Organics Limited; Koch Industries Inc; Mitsui Chemicals Inc; Novomer Inc; PolyGreen; Roquette Frères; Stepan Company; and The Dow Chemical Company Inc.

The insulation material segment dominated the market share in 2024.

The algae-based segment is expected to witness the significant growth during the forecast period.