Healthy Snacks Market Size, Share, Trends, Industry Analysis Report

By Product (Fruits and Fruits Bars, Savory, Cereal & Granola Bars), By Claim, By Distribution Channel, By Packaging, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM1039

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

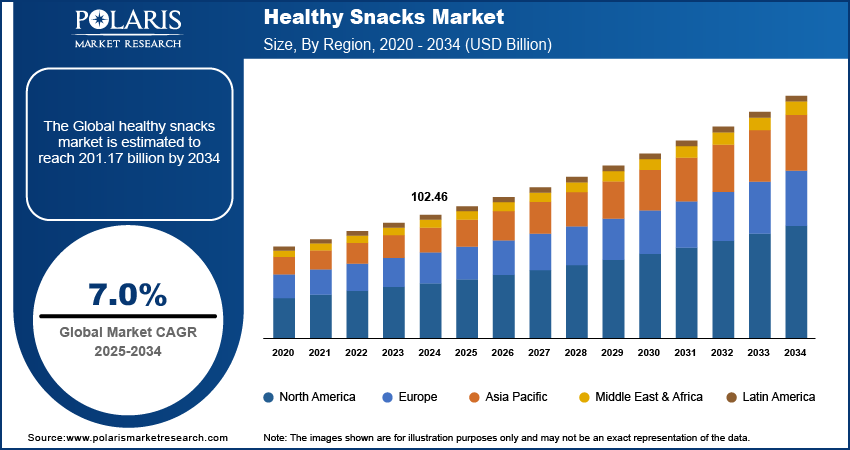

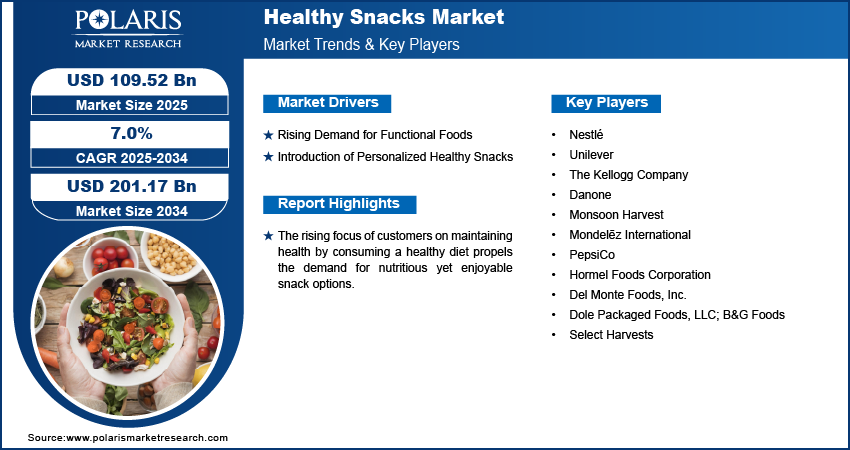

The global healthy snacks market size was valued at USD 102.46 billion in 2024 and is expected to register a CAGR of 7.0% from 2025 to 2034.

Key Insights

- The fruits and fruits bars segment is anticipated to register the fastest growth from 2025 to 2034. Fruit bars are available in various options, including those fortified with omega-3, prebiotics, and probiotics, which propels their popularity.

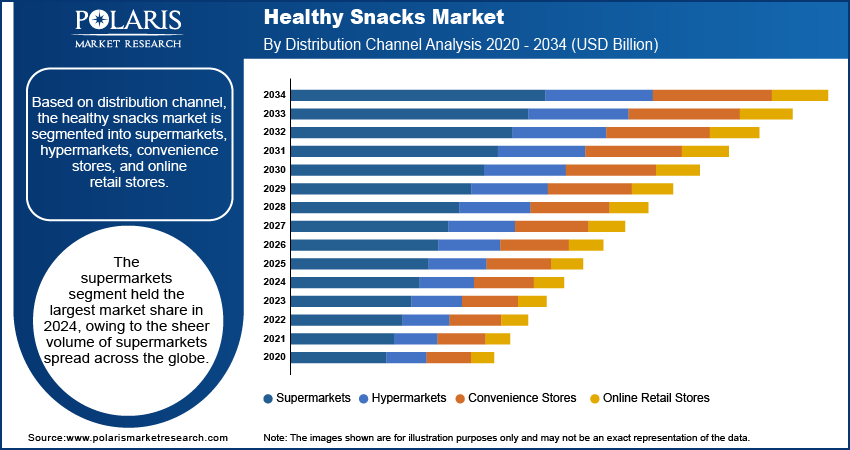

- The supermarkets segment held the largest share in 2024. The dominance of the segment is attributed to the sheer volume of supermarkets spread across the world.

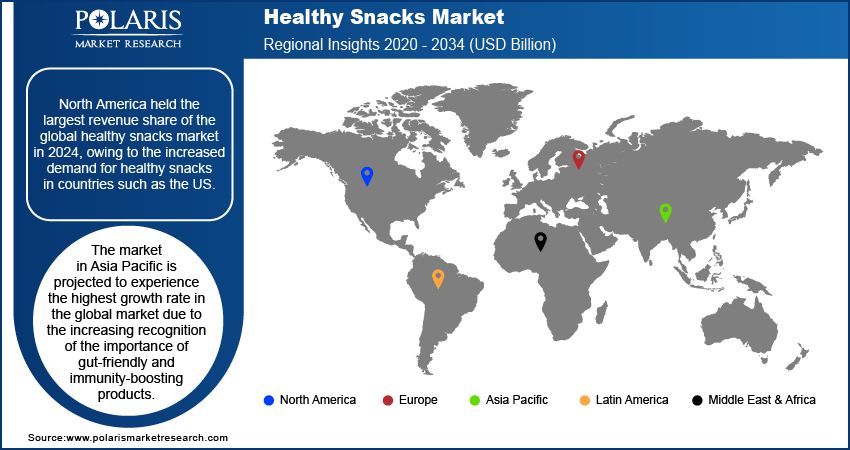

- North America held the largest global revenue share in 2024. Rising focus on consuming healthier and more nutritious options to prevent health-related risks drives the regional industry expansion.

- The Asia Pacific market is projected to experience the highest growth rate during the forecast period. The region’s dominance is driven by the increasing awareness regarding the importance of gut-friendly and immunity-boosting health food products.

Industry Dynamics

- Rising demand for functional food products fuels the healthy snacks industry expansion.

- Increasing demand for convenient snacking options, such as ready-to-eat foods and on-the-go snacking options, boosts the market growth.

- Increasing demand for personalized healthy snacks tailored to consumers' lifestyles and dietary restrictions is expected to emerge as a key industry trend in the future.

- Volatile costs of raw material hinder the healthy snacks market growth.

Market Statistics

2024 Market Size: USD 102.46 billion

2034 Projected Market Size: USD 201.17 billion

CAGR (2025–2034): 7.0%

North America: Largest market in 2024

AI Impact on Health Snacks Market

- Healthy snack industry players use AI tools to develop snacks with optimized nutritional profiles, including high protein and low sugar.

- Manufacturers and retailers use AI systems to manage inventory efficiently and reduce waste. It helps them ensure the availability of popular healthy snack products.

To Understand More About this Research: Request a Free Sample Report

This industry is witnessing rapid growth as consumers opt for nutritious, low-calorie alternatives. Increasing awareness about clean-label, plant-based, and functional snacks is driving product innovation. E-commerce expansion and demand for convenience are further propelling the market across various age groups.

Healthy snacks are food items that contain health-boosting ingredients that are good for the body. The snacks are nutrient-dense, containing fiber, proteins, vitamins, and minerals. Also, they are usually low in added sugar and offer enough calories to provide energy without promoting weight gain. Whole-grain snacks, low-fat dairy, nuts, and seeds are a few commonly consumed snacks.

The market for healthy snacks has experienced a significant surge in recent years, particularly following the global COVID-19 pandemic. With customers increasingly prioritizing their health, the demand for nutritious yet enjoyable snack options has grown. In addition, advancements in the supply chain are contributing to the market expansion. For instance, major supermarket chains are now partnering with third-party online delivery companies to broaden their reach through e-commerce channels.

The COVID-19 pandemic has significantly influenced individuals' dietary patterns, as restricted options for dining outside led to a surge in dependence on homemade meals. This shift has increased awareness of well-being, prompting individuals to maintain fitness, avoid sickness, and enhance their immunity. As a result, there has been an upsurge in inventive and nutritious snack choices catering to customers' health demands, convenience, and palatability. These snacks enable them to train for more extended periods at higher intensities.

The combination of increased disposable income and a corporate culture that involves long work hours and stressful lifestyles has also led to a shift in eating habits. Historically, snacks have been associated with unhealthy options that are high in oil and sugar, contributing to health problems such as obesity, hypertension, and high blood sugar. However, there has been a recent change in consumer behavior, shifting away from oily and spicy products toward healthier options that are sugar-free, low-calorie, and packaged in small portions. This significant trend is anticipated to drive the healthy snacks market growth during the forecast period.

Modern-day consumers seek out snacking options that are nutritious and convenient while also appealing to their taste buds and budget. The 2023 State of Snacking report by Mondelēz revealed that six in ten consumers prefer to consume multiple smaller meals throughout the day rather than a few larger ones. To meet these evolving needs, healthy snacks manufacturers are developing products that meet nutritional criteria and address age-specific concerns related to energy, digestion, immunity, weight loss, or memory.

In the coming years, the industry is anticipated to be led by products featuring unique and enticing flavors and textures, developed using sustainable technologies and packaged with recyclable materials. A few emerging future trends are vegan snacks; products made with zero fats, high or added protein content, whole grains, or reduced or zero sugar content; baked snacks with no oil; and gluten-free snacks, all accompanied by eco-friendly packaging. The market is also projected to witness many innovative offerings, thereby expanding the range of products.

Trends and Drivers

Rising Demand for Functional Foods

Consumers are consistently looking for healthier options in grocery stores, resulting in an influx of products containing functional ingredients such as proteins, micronutrients, organic, fiber, clean-label, and plant-based items in mainstream retail channels. These functional foods promote overall health by supporting digestive health; helping in weight management; and reducing the risk of conditions such as obesity, diabetes, and cardiovascular diseases. Thus, the rising consumer demand for functional foods is the primary driver of the growth.

Growing Need for Convenient Snacking Options

Convenient, ready-to-eat foods and on-the-go snacking options offer quick nourishment and satiety for people with busy schedules. According to the 2023 State of Snacking report by Mondelēz, 88% of consumers indulge in snacks daily. This trend indicates the increasing popularity of on-the-go snacking to fulfill nutritional requirements. In addition to their convenient packaging, consumers regard snacks as an integral component of a healthy diet as they come in manageable portion sizes. This makes it easier for individuals to boost energy while avoiding overconsuming during a busy workday. Therefore, the healthy snacks market value is rising largely due to the surging demand for convenient snacking options.

Introduction of Personalized Healthy Snacks

The trend of personalized healthy snacks is gaining traction in the global industry, with a growing demand for snacks tailored to consumers' lifestyles, dietary restrictions, and health requirements. It has led to a rise in personalized nutrition offerings, including keto-friendly and low-cholesterol snacks and those that promote mood-boosting, gut health, and better sleep. A notable example is the launch of the meatless jerky product by PepsiCo and Beyond Meat in March 2022, marking their first plant-based offering under their PLANeT Partnership joint venture, which aims to develop plant-based snacks and beverages.

Segmental Insights

Product Insights

The fruits and fruits bars segment is anticipated to register the fastest growth from 2025 to 2034. The fruit bars are available in various options, including those fortified with omega-3, prebiotics, and probiotics, as well as paleo and keto options that are low in carbohydrates and high in medium-chain triglycerides. In addition, the protein content in fruit bars is also increasing, with standard whey and soy proteins commonly used, while pea protein is gaining popularity.

Companies offer various nutritional supplements to cater to consumers' preferences for nutritious, delicious, and convenient snacks, including those in dairy and confectionery forms. The plant-based dairy segment's growth has been driven by the popularity of plant-based options, such as Good Karma's dairy-free products made with Flaxmilk and Chobani's Non-Dairy Greek yogurt. For example, in July 2023, the Chilled Snack Company introduced its first plant-based chilled snack, the Milino Coconutmilk Snack. The new snack features coconut milk cream, sponge cake, and dark chocolate coating.

Distribution Channel Insights

The supermarkets segment held the largest share in 2024. The dominance of this distribution channel can be attributed to the sheer volume of supermarkets spread across the globe. For example, 7-Eleven, one of the world's largest supermarket chains, operates over 46,000 outlets in 16 countries. Also, the rapid development of retail infrastructure across developing economies contributes to the market’s growth.

Rapid delivery services are gaining increased traction worldwide, and supermarkets are embracing this process to maximize their value. In recent times, many supermarkets have partnered with or invested in large rapid delivery companies. By leveraging their existing supply chains, supermarkets can increase their margins, while delivery services can extend their distribution networks and reduce competition.

Regional Insights

North America healthy snacks market held the largest revenue share in 2024. The demand has increased significantly in the US since the emergence of the COVID-19 pandemic. The focus has shifted toward consuming healthier and more nutritious options to prevent health-related risks associated with excessive snacking.

The high proliferation rates of supermarkets, hypermarkets, and convenience stores have contributed to sales growth in the region. Convenience stores are collaborating with delivery platforms to enhance their online retail presence. For example, in June 2022, Instacart expanded its partnership with Walmart Canada for the launch of Walmary Now, a new virtual convenience store powered by the Instacart platform. This trend is expected to boost the industry growth in North America.

The Asia Pacific healthy snacks market is projected to experience the highest growth rate. The region’s dominance is largely attributed to the increasing recognition of the importance of gut-friendly and immunity-boosting products, including prebiotics and probiotics. Many manufacturers have added functional ingredients such as macronutrients and antioxidants to snacks to create healthy options. Additionally, companies are emphasizing clean labels and product flavors to entice customers, which is expected to propel the regional market growth in the coming years.

Key Players and Competitive Insights

The leading players are emphasizing research and development to improve their offerings and meet the rising demand. Besides, they are adopting several strategic initiatives, including collaborations, new product launches, and increased investments, to enhance their global footprint. To expand and survive in a more competitive environment, the market players must offer innovative solutions.

In recent years, the health snacks market has witnessed several innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. A few major players in the industry are Nestlé; Unilever; The Kellogg Company; Danone; Monsoon Harvest; Mondelēz International; PepsiCo; Hormel Foods Corporation; Del Monte Foods, Inc.; Dole Packaged Foods, LLC.; B&G Foods; and Select Harvests.

List of Key Companies

- Nestlé

- Unilever

- The Kellogg Company

- Danone

- Monsoon Harvest

- Mondelēz International

- PepsiCo

- Hormel Foods Corporation

- Del Monte Foods, Inc.

- Dole Packaged Foods, LLC; B&G Foods

- Select Harvests

Industry Developments

September 2023: Danone UK and Ireland announced the launch of a new high-protein dairy range called GetPRO. The new range of high-protein snacks, which includes puddings, mousses, yogurts, and drinks, is designed for people who want to keep up with their fitness goals while enjoying a great-tasting healthy snack.

June 2023: Unilever announced the completion of an acquisition of Yasso Holdings, Inc., a premium frozen Greek yogurt brand in the US. With the acquisition, Unilever aims to premiumize its ice cream portfolio in North America.

Healthy Snacks Market Segmentation

By Product Outlook

- Fruits and Fruits Bars

- Savory

- Cereal and Granola Bars

- Nuts and Seeds

- Trail Mix

- Frozen & Refrigerated

- Confectionery

- Dairy

- Bakery

By Claim Outlook

- Gluten-Free

- Low-Fat

- Sugar-Free

- Others

By Packaging Outlook

- Jars

- Boxes

- Pouches

- Cans

- Others

By Distribution Channel Outlook

- Supermarkets

- Hypermarkets

- Convenience Stores

- Online Retail Stores

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Healthy Snacks Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 102.46 billion |

|

Market Size in 2025 |

USD 109.52 billion |

|

Revenue Forecast by 2034 |

USD 201.17 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The healthy snacks market value is expected to reach USD 201.17 billion by 2034.

The market is expected to record a CAGR of 7.0% from 2025 to 2034.

The rising demand for functional foods and the growing need for convenient snacking options are among the key factors driving market growth.

Nestlé; Unilever; The Kellogg Company; Danone; Monsoon Harvest; Mondel?z International; PepsiCo; Hormel Foods Corporation; Del Monte Foods, Inc.; Dole Packaged Foods, LLC.; B&G Foods; and Select Harvests are a few major players in the market.

Key segments covered in the research report are product, claim, distribution channel, packaging, and region.