Hearth Market Share, Size, Trends & Industry Analysis Report

By Fuel Type; By Product Type; By Design; By Placement (Indoor, Outdoor and Portable); By Application; By Ignition Type; By Vent Availability; By Material; By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 148

- Format: PDF

- Report ID: PM2827

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

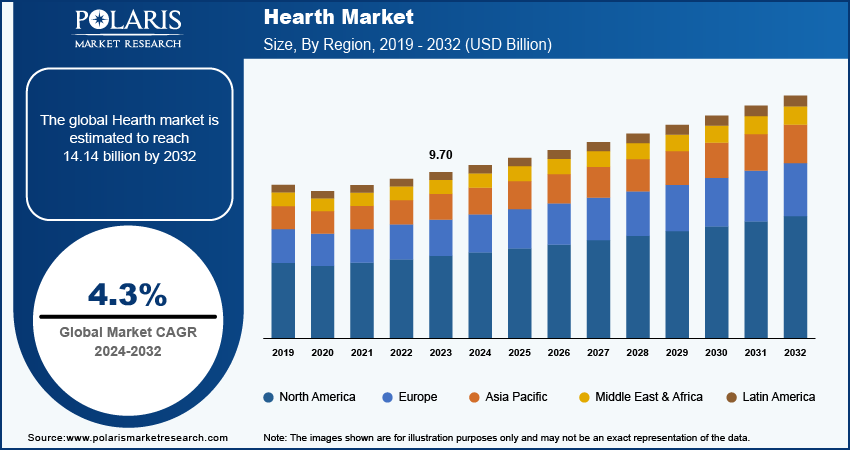

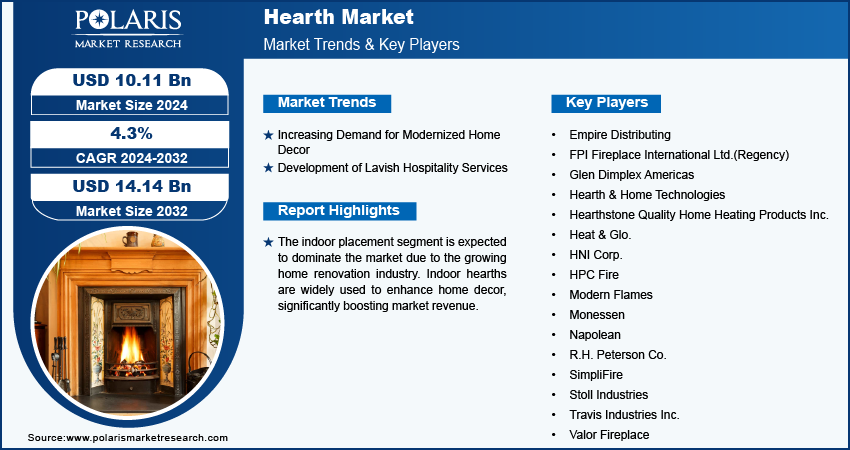

The global Hearth Market was valued at USD 4.8 billion in 2024 and is anticipated to grow at a CAGR of 5.50% from 2025 to 2034. A resurgence in home improvement projects and the rising preference for aesthetically pleasing heating solutions are bolstering market expansion.

Key Insights

- The indoor placement segment is projected to lead the market, driven by the booming home renovation trend and growing consumer preference for aesthetic yet functional interior heating solutions that complement modern residential design.

- The hearth market is expected to witness robust growth, especially within the hospitality sector, as hotels and resorts increasingly adopt hearth installations to enhance guest experience and create warm, inviting ambiances in lobbies and lounges.

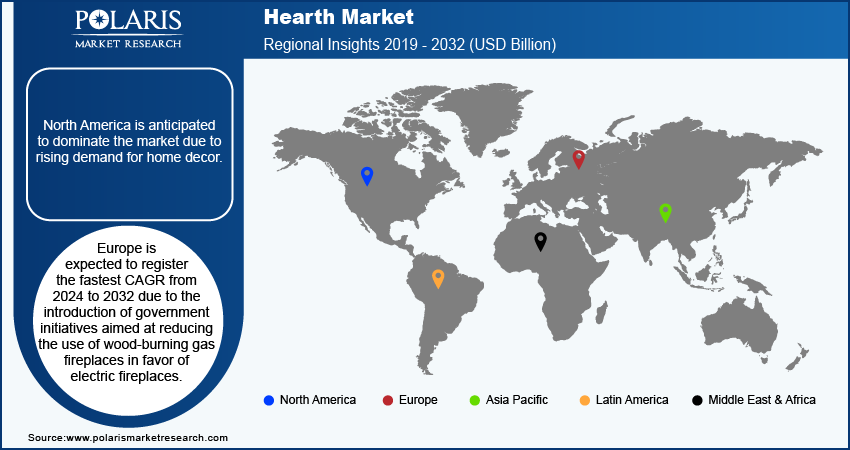

- North America is forecasted to dominate the market, fueled by rising interest in home décor upgrades and the integration of hearths as both a heating source and a stylish interior design element.

- The U.S. holds the largest market share due to increasing residential construction and frequent cold weather, which together drive demand for hearth installations that offer both warmth and energy-efficient heating.

- Europe is projected to record the highest CAGR from 2025 to 2034, supported by government policies promoting eco-friendly alternatives, such as electric fireplaces, over traditional wood-burning models to reduce emissions and meet sustainability goals.

Industry Dynamics

- Rising demand for energy-efficient heating solutions, combined with growing interest in home renovation and décor, is significantly driving the adoption of hearth products across residential and commercial sectors.

- Increasing use of hearths in hospitality and luxury real estate is creating new growth opportunities, as fireplaces become central to enhancing ambiance, guest experience, and property value.

- Safety concerns, high installation costs, and strict emissions regulations pose challenges to broader hearth adoption, especially in regions enforcing environmental standards and restrictions on wood-burning fireplaces.

- Innovations in electric and ethanol-based hearths support eco-friendly alternatives, offering efficient, low-emission solutions that align with sustainability goals and appeal to environmentally conscious consumers and policymakers.

Market Statistics

- 2024 Market Size: USD 4.8 billion

- 2034 Projected Market Size: USD 7.9 billion

- CAGR (2025-2034): 5.50%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A hearth is an open recess positioned at the base of a chimney within a wall that serves as a site for constraining and constructing fires. It is constructed from non-combustible materials that mitigate fire accidents. Additionally, the hearth is integral in diverse applications, such as regulating indoor temperatures and facilitating cooking. Moreover, it is extensively utilized in homes located in cold climate areas to sustain warmth, leading to increased demand and market growth.

The hearth market is significantly growing due to the adoption of advanced technology that propels automation and smart features. Moreover, the development of Wi-Fi hearths, smartphone applications for controlling and adjusting temperatures, and similar innovations are driving demand for hearths.

Drivers & Trends

Increasing Demand for Modernized Home Decor

Growing urbanization and rising income levels of individuals are driving demand for modernized and lavish home décor, fueling market growth. Individuals are demanding enhanced and featursitic home decor that includes furniture, wall paintings, and others. Moreover, the colder regions are widely utilizing hearths in their houses, resulting in the development of innovative and advanced hearths.

Many individuals are looking for nostalgic and old classic home décor, which has resulted in increased demand for hearths made from materials such as stones, bricks, and others. Along with modernization, the need to preserve cultural inheritance is further boosting the demand for traditional hearths and driving market growth. Additionally, the demand for versatile hearths is also increasing, as the heat capacity varies according to different home sizes. This has led to the development of hearths with diverse sizes, shapes, and materials, thereby encouraging customization as per the specific needs of homes.

Modernization is driving an increased demand for automated technology in hearths. As such, modern hearths feature smart technology that allows users to control heating remotely via smartphones or home automation systems. This convenience and integration into smart home ecosystems are major factors driving market demand. For instance, the Napoleon eFire app enables users to remotely oversee their gas fireplace using their smartphones. This app offers convenience and energy efficiency by optimizing heating schedules, resulting in potential cost savings.

Development of Lavish Hospitality Services

The growing influx of tourists is driving the need for smart hospitality services to enhance the infrastructure and interior design of hotels and resorts. Moreover, tourists are increasingly seeking luxurious and comfortable accommodations, which is a key factor fueling market growth. Hospitality services are heavily investing in high-quality, custom decor, such as furniture and decorative pieces, to attract and cater to these tourists. Additionally, the rising number of tourists visiting cold-temperature regions is creating a demand for more efficient heaters. Hospitality services are using lavish, highly efficient heaters both indoors to maintain room temperature and outdoors to enhance the aesthetics of restaurants and backyards, thereby boosting hearths market revenue.

Segment Insights

By Placement Insights

The hearth market segmentation, based on placement, includes indoor, outdoor, and portable. The indoor placement segment is expected to dominate the market due to the growing home renovation industry. Indoor hearths are widely used to enhance home decor, significantly boosting market revenue. In addition, consumer preferences for a comfortable and warm atmosphere inside the house tend to foster innovations in the hearth market. Technological advancements also contribute to improved safety, increased efficiency, and a diverse range of designs that elevate the architectural landscape of residential buildings.

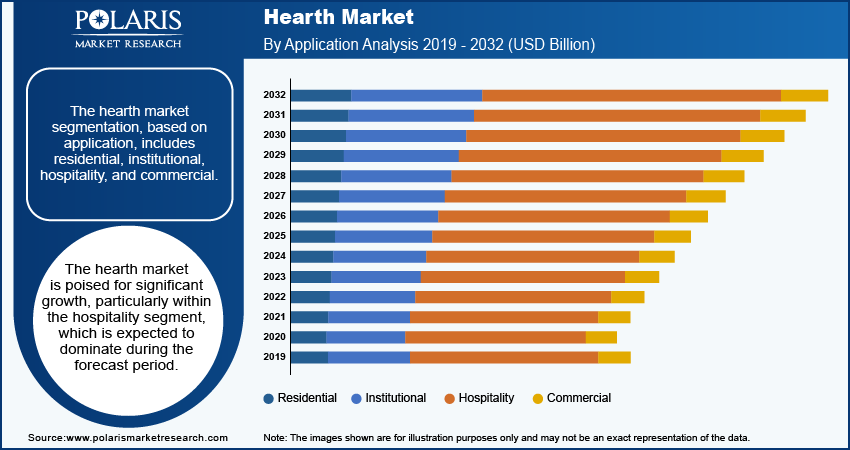

By Application Insights

The hearth market segmentation, based on application, includes residential, institutional, hospitality, and commercial. The market is poised for significant growth, particularly within the hospitality segment, which is expected to dominate during the forecast period. As the demand for unique and memorable interior designs in hotels and restaurants continues to rise, the appeal of aesthetically pleasing hearths and fireplaces becomes increasingly relevant.

Additionally, the surge in tourism is anticipated to further bolster the hospitality industry, leading to greater investment in affordable yet stylish interiors. Features like hearths and fireplaces not only enhance the ambiance of these establishments but also create inviting spaces for guests. This combination of factors underscores the growing importance of hearths in the hospitality sector, positioning them as a key element in creating unforgettable experiences for visitors.

Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is anticipated to dominate the market due to rising demand for home decor. In addition, the presence of major companies, such as Empire Comfort Systems Inc. and Travis Industries, offering their services further strengthens the market landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, which is expected to drive the market during the forecast period.

The US holds the largest market share due to the rising construction of new residential houses. In addition, the cold weather & snowfalls in the region are increasing the demand for hearths installations to maintain heat and warm temperatures. Furthermore, the rising purchasing power of individuals is driving the demand for innovative and luxurious home interiors. The expansion of hearth manufacturers across various regions is also boosting market revenue.

Europe is expected to register the highest CAGR from 2025 to 2034 due to the introduction of government initiatives aimed at reducing the use of wood-burning gas fireplaces in favor of electric fireplaces. Moreover, the easy installation, low maintenance, and remote control features of electric hearths are driving their demand. Furthermore, innovations and developments in electric hearth technology are boosting market revenue. The versatility of hearths is increasing demand across residential industries due to varied home sizes is significantly driving growth in the market.

Key Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the hearth market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the hearth market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the hearth market to benefit clients and increase the market sector. In recent years, the market has offered some technological innovations. Major players in the market include Empire Distributing; Modern Flames; Valor Fireplace; Heat & Glo; SimpliFire; Stoll Industries; FPI Fireplace International Ltd. (Regency); R.H. Peterson Co.; HPC Fire; Monessen; HNI Corp.; Hearthstone Quality Home Heating Products Inc.; Travis Industries Inc; and Napolean.

R.H. Peterson was founded in 1937 and is headquartered in the United States. The company manufactures specialty fireplaces and hearths. Its product line includes gas logs, outdoor grills, and outdoor and indoor hearth accessories. R.H. Peterson is the parent company of several brands, including American Fyre Designs, Real Fyre, and Fire Magic Grills, which provide specialized designs to manufacturer hearths.

Regency Fireplace was founded in 1979 and has its headquarters in Canada. The company manufactures hearth products. Its product line includes wood hearths, electric hearths, pellet fireplaces, inserts, stoves, and outdoor units. Regency Fireplace supplies its products across North America, Europe, Japan, and Australia. The company introduced next next-generation traditional gas fireplace with the new Grandview series. The Grandview has various models, including the Grandview G600, G800, and G1200 models.

List of Key Companies

- Empire Distributing

- FPI Fireplace International Ltd.(Regency)

- Glen Dimplex Americas

- Hearth & Home Technologies

- Hearthstone Quality Home Heating Products Inc.

- Heat & Glo.

- HNI Corp.

- HPC Fire

- Modern Flames

- Monessen

- Napolean

- R.H. Peterson Co.

- SimpliFire

- Stoll Industries

- Travis Industries Inc.

- Valor Fireplace

Market Developments

March 2024: Hearth & Home Technology and URC announced integration to innovate next-generation smart hearth control for residential and commercial users.

March 2024: HNI Corporation received the Better Project Award from the US Department of Energy’s Better Buildings Initiative. The award acknowledged HNI’s energy-efficient initiatives within its manufacturing operations to reduce gas emissions and provide a better work environment.

January 2024: Ascendis Pharma expanded TransCon hGH (lonapegsomatropin) into additional markets after successful launches in the US and EU, continuing its growth and broadening patient access to the treatment.

June 2023: HNI Corporation completed the acquisition of Kimball International Inc. The acquisition aimed at expanding and widening the customer base for both companies.

Market Segmentation

By Product Type Outlook

- Stoves

- Wall Mounted

- Built-in

- Fireplace

- Single-sided

- Multisided

- Inserts

- Mentel/Freestanding

- Tabletop

By Fuel Type Outlook

- Wood

- Gas

- Electricity

- Pellet

By Placement Outlook

- Indoor

- Outdoor

- Portable

By Application Outlook

- Residential

- Institutional

- Hospitality

- Commercial

By Design Outlook

- Traditional / Conventional Hearth

- Modern Hearth

By Ignition Type Outlook

- Electronic Ignition

- Standing Pilot Ignition

By Vent Availability Outlook

- Vented Hearths

- Unvented Hearths

By Material Outlook

- Bricks

- Marble

- Granite

- Stones

- Concrete

- Slate

- Quarry Tiles

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.8 billion |

|

Market Size Value in 2025 |

USD 5.1 billion |

|

Revenue Forecast in 2034 |

USD 7.9 billion |

|

CAGR |

5.50% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025-2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The hearth market size was valued at USD 4.8 billion in 2024 and is expected to grow to 7.9 billion in 2034.

The market is projected to register a CAGR of 5.5% from 2025 to 2034.

North America dominates the hearth market share during forecast period.

The key players in the market are Empire Distributing; Modern Flames; Valor Fireplace; Heat & Glo; SimpliFire; Stoll Industries; FPI Fireplace International Ltd. (Regency); R.H. Peterson Co.; HPC Fire; Monessen; HNI Corp.; Hearthstone Quality Home Heating Products Inc.; Travis Industries Inc; and Napolean

The outdoor segment dominates the market during forecast period.