Smart Hospitality Market Share, Size, Trends, Industry Analysis Report

By Offering; By Deployment Mode (Cloud and On-premises); By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM2777

- Base Year: 2024

- Historical Data: 2020-2023

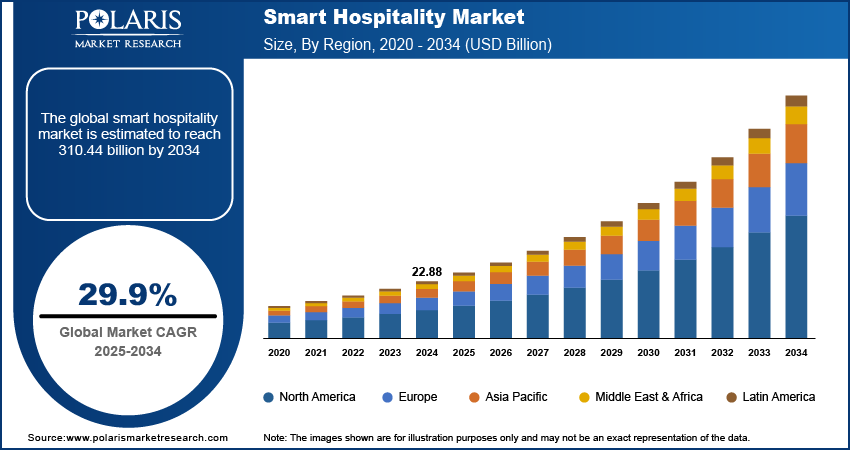

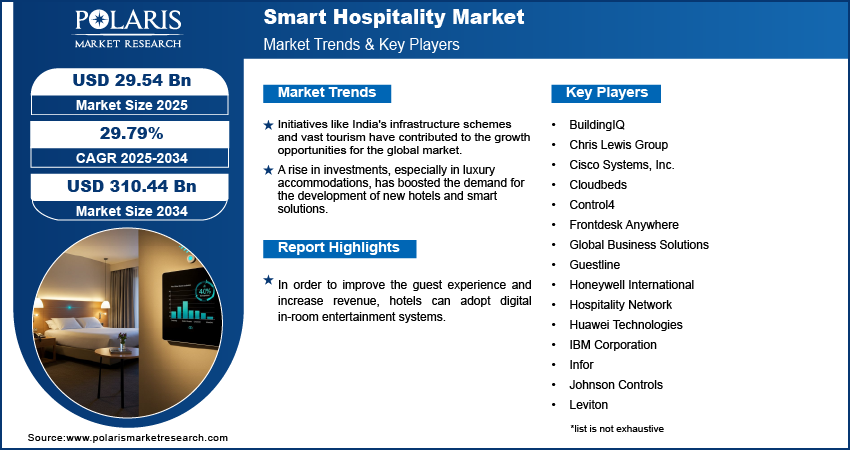

The global smart hospitality market was estimated at USD 22.88 billion in 2024 and is projected to grow at a CAGR of 29.79% during the forecast period. Key factors driving demand include growth in tourism and increased investments in hotel projects, and emerging hotel workplaces concept.

Key Insights

- The guest experience management type sub-part of the solution is expected to witness fastest growth during the forecast period. This is due to the growing need to streamline customer service operations and establish a powerful brand.

- In 2024, the cloud Segment dominated the market due to the Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS), which are two cloud deployments used in the hotel industry to lower the cost of infrastructure.

- North America dominated the market in 2024. This is due to the advances in technology and the presence of major technology companies.

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to technological advancements, internet infrastructure, Internet of Things applications, and efficient energy use.

Industry Dynamics

- A rise in investments, especially in luxury accommodations, has boosted the demand for the development of new hotels and smart solutions.

- Initiatives like India's infrastructure schemes and vast tourism have contributed to the growth opportunities for the global market.

- Implementing smart solutions and complex systems within existing infrastructure creates barriers for small hotels with budget constraints.

- The rise in guest demand for contactless service has encouraged hotels to invest in smart technology, which creates revenue growth for solution providers.

Market Statistics

- 2024 Market Size: USD 22.88 billion

- 2034 Projected Market Size: USD 310.44 billion

- CAGR (2025-2034): 29.9%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Smart Hospitality Market

- AI analyzes data to recommend services, filter room settings, and create customized stays which boost the guest satisfaction.

- AI automate daily tasks such as housekeeping schedules, check-in, management of inventory to reducie labour costs and improve resources.

- Its algorithm helps in adjusting rates of rooms based on demand and market trends to maximize occupancy and revenue.

- AI predicts equipment failure before it occurs, which helps in scheduling maintenance to maximize guest disruptions and avoid costly damages.

In order to improve the guest experience and increase revenue, hotels can adopt digital in-room entertainment systems. Various hospitality brands have the flexibility to modify and customize both their back-end solutions and those that give visitors a customized experience. For example, smart hospitality provides Wi-Fi, interactive T.V., IPTV services, and H.D. channels that are free to hotel guests. It helps to improve customer satisfaction and experience.

In addition, it greatly enhances hotel operations. For example, the hotel management software will keep cleaning and the front desk in sync and eliminate the need for paper forms for manual check-in. In addition, hotels now feature integrated sensors for T.V.s, lights, and voice recognition technology for addressing visitor questions. These reduce hotel costs and rates by taking a sizable amount of work off the front desk.

In some hotels, the mobile device can serve as the environmental control for the room. This allows the visitor to remotely adjust the temperature and open and close the window coverings. Therefore, "digital hospitality" is the core concept of smart hospitality.

In addition, smart hospitality means catering can give outstanding client service. The demand for hospitality software and services, as well as the increased need for real-time improved guest experience management, lower operating costs, and a growing propensity towards IoT, are the main reasons propelling the growth of the global market.

A technique called "smart hospitality" is utilized in hotels to employ connected equipment to communicate with one another. It is comparable to the internet of things (IoT) technology, which allows even common home appliances or hotel equipment to send and receive data and make logical judgments. It improves guest safety with warning and mobilization; staff mobility, guest reservation solutions; and storage solutions.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Investment in hotel developments is anticipated to increase dramatically over the next few years, due to the tourism industry's explosive growth. This results from rising spending power, increased demand for upscale accommodations, and other things. Additionally, it is anticipated that the tourism industry will grow, boosting hotel demand and contactless smart hospitality solutions. This is then expected to affect the expansion of the global market positively.

Cruises, wellness, sports, MICE, eco-tourism, film, and religious tourism are unique travel options it offers. In addition, both domestic and foreign tourists know India as a spiritual destination. Under the Swadesh Darshan Scheme, the Ministry of Tourism approved 76 projects in August 2022, totaling USD 678.39 million, to improve the nation's tourism infrastructure.

The travel and tourism sector is expected to contribute USD 51 billion by 2028. In India, the sector is projected to grow at an average yearly growth rate of 10.35%. Such government initiatives will drive global market growth.

Report Segmentation

The market is primarily segmented based on offering, deployment mode, end-use, and region.

|

By Offering |

By Deployment mode |

By End Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Offering Analysis

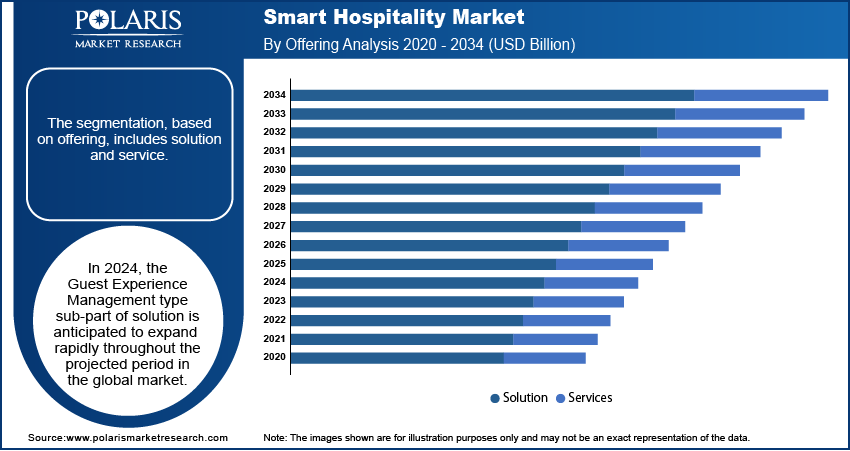

The segmentation, based on offering, includes solution and service. In 2024, the Guest Experience Management type sub-part of solution is anticipated to expand rapidly throughout the projected period in the global market. The growing need to streamline customer service operations and establish a powerful brand will be what propels the adoption of digital hospitality solutions. Additionally, improving the guest experience is the hotels' and other hospitality facilities' primary goal.

Deployment Mode Analysis

Based on deployment mode, the segmentation includes, cloud and on-premises. Cloud Segment dominated the industry in 2024, the Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) are two cloud deployments used in the hotel industry. This method lowers the cost of infrastructure by allowing hotels to install their software and services in a virtual ecosystem. The price of buying, maintaining, and powering server-class equipment decreases with the cloud-based deployment of smart hospitality software. Hotels benefit from enhanced scalability and lower ownership costs with this subscription model.

Additionally, it lessens the chance of security breaches while ensuring the reliability of data backup. The company that provides cloud solutions is responsible for managing the back-end operations. As a result of all of the benefits provided by the cloud deployment option, there is a likelihood that demand for these solutions will increase over the upcoming years. This is because cloud-based solutions are required for the sensors and other devices that smart hospitality solutions increasingly utilize.

End Use Analysis

In terms of end use, the segmentation includes, hotel, cruise, luxury yachts, and others. In 2024, the hotel segment held the largest market share. The requirement for hotels to provide intelligent hospitality services and solutions is fueling the segment's rise. Additionally, the market will be driven by the rising standard of living, the abundance of five-star accommodations, and a marked improvement in customer service.

As per the hotelier magazine, investors concentrated on purchasing luxury or resort properties with high domestic or leisure demand across all areas. In 2022, this trend is anticipated to pick up even more speed, with estimates placing the worldwide transaction volume up between 35% and 40% from 2021 levels. Additionally, the industry's increased dedication to environmentally friendly operations and procedures presents opportunities for investment groups worldwide, raising asset prices.

North America Smart Hospitality Market

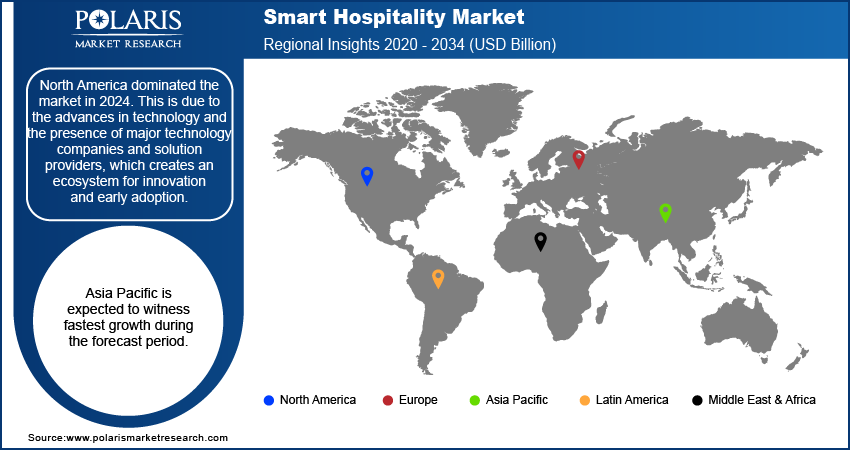

North America dominated the market in 2024. This is due to the advances in technology and the presence of major technology companies and solution providers, which creates an ecosystem for innovation and early adoption. This environment encourages consumers and hospitality companies to adopt digital transformation for operational efficiency and improved guest experiences. Furthermore, Major hotel chains are investing in smart automation systems for long-term return on investment. Adoption of energy management systems, automated check-in, and others have boosted the demand to streamline operations, reduce pressure on staff, and optimize resources.

Asia Pacific Smart Hospitality Market

Asia Pacific is expected to witness fastest growth during the forecast period. A favorable government policy to expand the hospitality sector is likely boost the market's growth in the projected years. In addition, the region's hospitality sector is increasing because of technological advancements, internet infrastructure, Internet of Things applications, and efficient energy use. Furthermore, the market in the region will be driven by a booming domestic tourism sector, a more modern hotel infrastructure, and a high rate of new hotel openings in numerous Asia-Pacific nations like Thailand, Malaysia, and Indonesia.

According to Hotelier India, the Indian hospitality sector is anticipated to grow by 2028 at a rate of 10.35%. By 2027, it is expected that the Indian travel market will be worth USD 125 million. The global market's highest revenue share in 2021 came from Europe. An essential domestic cloud provider, an openness to new technologies, and a reasonably robust internet infrastructure have all contributed to the expansion of the industry. As a result, there is a growing market for Internet of Things (IoT) products in Europe.

Key Players & Competitive Analysis Report

The smart hospitality market creates multiple Growth Opportunities as hotels continue to embrace IoT, Artificial Intelligence, and automation technologies to improve Guest Experience and hotel efficiency. Industry players dominate the market through comprehensive property management systems and integrated solutions. Competitive Intelligence And Strategy indicates that established technology providers leverage their deep domain hospitality expertise and global sales/distribution networks while small and medium-sized enterprises create distinct advantages by introducing niche Innovation solutions through Mobile Check-in, Keyless Room Entry, and Personalization in guest services. Key Industry Trends indicate the emergence of artificial intelligence to leverage predictive analytics, contactless technologies from the pandemic requirements, and the founding of sustainable systems tracking smart energy use. Moreover, revenue Growth Analysis is witnessing accelerated growth as more Guests expect seamless experiences in digital access and providers release more pressures to reduce operational costs.

There are numerous significant players in the global market, such as Cisco Systems, Honeywell International, IBM Corp, Johnson Controls, NEC Corporation, Oracle Corporation, Schneider Electric, Siemens, Winhotel Solution, Huawei Technologies, Oracle, Johnson Controls, Samsung, Leviton, Sabre, Springer-Miller Systems, Control4, Qualsoft Systems, Hospitality Network, Guestline, Cloudbeds, Frontdesk Anywhere, Chris Lewis, Xie Zhu, BuildingIQ, Stayntouch, and others.

Recent Developments

June 2025: Panasonic Life Solutions India launched solutions for the Indian hospitality industry with contactless services, data analytics, and sustainable digital solutions such as Electronic Smart Labels (ESL) and eSignCard to enhance efficiency and guest experiences.

May 2022: Sigma and El Attal Holding each signed a memorandum of understanding with Siemens. By implementing a BMS control system for commercial and residential buildings and the SCADA system, the companies sought to create an electronic platform to reduce energy consumption, handle operating mistakes, and anticipate breakdowns after forming this cooperation.

July 2021: Honeywell partnered with Signify, to enhance the customer experience by increasing productivity and well-being through connected lighting solutions for smart buildings in order to reduce energy consumption.

Smart Hospitality Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 22.88 billion |

| Market size value in 2025 | USD 29.54 billion |

|

Revenue forecast in 2034 |

USD 310.44 billion |

|

CAGR |

29.79% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Offering, By Deployment Mode, By End Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Cisco Systems, Inc., Honeywell International, IBM Corporation, Johnson Controls, NEC Corporation, Oracle Corporation, Schneider Electric Se, Siemens AG, Winhotel Solution S.L., Inc., Huawei Technologies, Oracle, Johnson Controls, Samsung, Infor, Leviton, Sabre, Springer-Miller Systems, Control4, Global Business Solutions, Wisuite, Qualsoft Systems, Hospitality Network, Guestline, Cloudbeds, Frontdesk Anywhere, Chris Lewis Group, Xie Zhu (China), BuildingIQ, Stayntouch, and others. |

FAQ's

• The global market size was valued at USD 22.88 billion in 2024 and is projected to grow to USD 310.44 billion by 2034.

• The global market is projected to register a CAGR of 29.9% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market are Cisco Systems, Inc., Honeywell International, IBM Corporation, Johnson Controls, NEC Corporation, Oracle Corporation, Schneider Electric Se, Siemens AG, Winhotel Solution S.L., Inc., Huawei Technologies, Oracle, Johnson Controls, Samsung, Infor, Leviton, Sabre, Springer-Miller Systems, Control4, Global Business Solutions, Wisuite, Qualsoft Systems, Hospitality Network, Guestline, Cloudbeds, Frontdesk Anywhere, Chris Lewis Group, Xie Zhu (China), BuildingIQ, Stayntouch.

• In 2024, the cloud segment dominated smart hospitality revenue share.

• The guest experience management type sub-part of the solution is expected to witness fastest growth during the forecast period.