High Pressure Laminate Market Share, Size, Trends, Industry Analysis Report

By Type (General Purpose Type, Postforming Type, Backer Type, Others); By Application; By Width Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4025

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

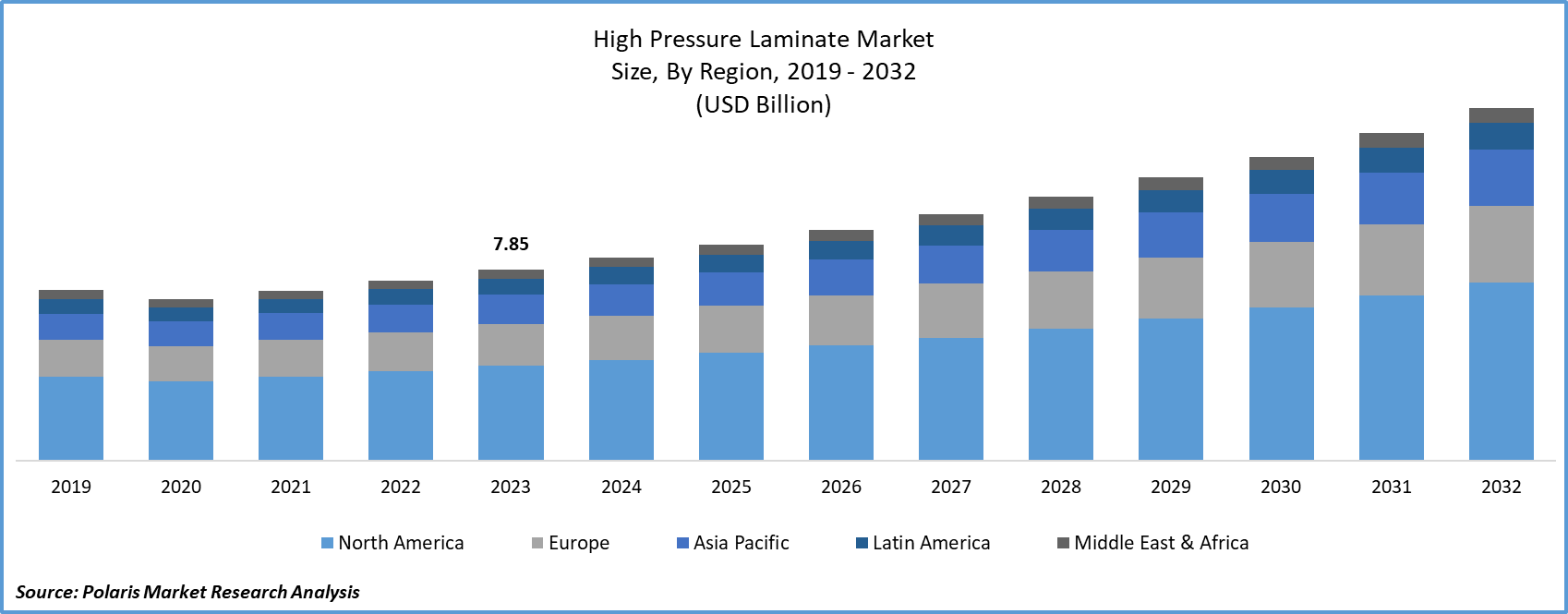

The global high pressure laminate market was valued at USD 7.85 billion in 2023 and is expected to grow at a CAGR of 7.0% during the forecast period.

High-pressure laminate, commonly referred to as HPL, belongs to the same family of decorative materials as the historically used and widely popular plastic laminate. High-pressure laminate is a versatile material that combines wood grains, abstract patterns, and vibrant solid colors.

To Understand More About this Research: Request a Free Sample Report

It enhances decorative surfaces both vertically and horizontally. HPL is fire-resistant, resistant to chemicals, and can support substantial weight. It is also resistant to scratches, abrasions, humidity, water, and moisture. It is easy to clean and maintain, making it a practical and stylish choice for a modern aesthetic.

High-pressure laminate (HPL) is esteemed as a top-tier and exceptionally attractive decorative surface material. An integral part of the production process for HPL involves impregnating multiple layers of kraft paper with phenol-formaldehyde resins, more commonly referred to as phenolic resins.

The global high-pressure laminate (HPL) market is expected to experience substantial growth in the near future due to the increasing trend of designing and building visually captivating hotels, restaurants, cafes, and various dining establishments. Changing consumer preferences, influenced by the evolving times and the significant impact of social media, have driven a surge in patronage for restaurants with exceptional ambiance. This shift in consumer behavior is a key factor contributing to the expanding HPL market.

The COVID-19 pandemic significantly impacted the HPL market used in interior design, furniture, and construction. Global supply chain disruptions, lockdowns, and reduced demand caused challenges. However, with an increased emphasis on hygiene, the market started to recover. The pandemic also accelerated the adoption of online sales and virtual design consultations, transforming the way HPL products are marketed and sold. Despite the challenging initial impact, the HPL market showed resilience and adaptability, with potential for growth beyond the pandemic.

Hotels and restaurants can now opt for high-pressure laminates (HPL) to furnish their establishments with durable and visually appealing materials. This versatile choice allows facility owners to enjoy the best of both worlds without having to sacrifice one quality for the other. As discretionary income continues to grow and investments in the global food service industry increase, we can anticipate a surge in demand for HPL in the forecast period.

Industry Dynamics

Growth Drivers

- Increasing preference of High-pressure laminates in the furniture industry owing to its resistance, durability to scratches and serenity of maintenance will drive market growth

The furniture industry is currently witnessing a significant shift towards high-pressure laminates as the primary material for furniture. High-pressure laminates are the preferred choice due to their exceptional resistance, durability against scratches, and low maintenance requirements. They are highly resistant to wear and tear, making them an ideal choice for furniture that undergoes heavy daily use, such as kitchen cabinets, tables, and countertops. Their scratch and scuff resistance ensure that the furniture retains its aesthetic appeal even after extended periods of use.

Additionally, high-pressure laminates are easy to maintain, requiring minimal effort to keep them looking their best. The growing preference for high-pressure laminates in the furniture industry is a clear indication of the industry's commitment to providing long-lasting, functional, and visually pleasing furniture solutions.

Report Segmentation

The market is primarily segmented based on type, application, width type, and region.

|

By Type |

By Application |

By Width Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The General Purpose Type segment accounted for the largest revenue share in 2022

The general purpose type segment accounted for the largest revenue share in 2022. Due to the remarkable adaptability of these different versions, they are well-suited to meet the needs of all three market sectors – residential, commercial, and industrial. High-pressure laminate can serve a multitude of manufacturing purposes, encompassing the creation of wall decorations, furniture, flooring, cabinets, and various elements that contribute to a functional setting.

High-pressure laminate (HPL) is especially well-suited for wrapping around rounded or curved surfaces. Still, this specialized characteristic restricts its versatility by narrowing the range of surfaces it can effectively cover. The manufacturing process of HPL requires the incorporation of six to eight distinct sheets of kraft paper.

By Application Analysis

- The commercial segment accounted for the highest market share during the forecast period

The commercial segment accounted for the highest market share during the forecast period, The commercial sector of the market encompasses businesses in the food service industry, hospitality sector, and entertainment centers. In recent years, there has been a significant rise in segmental demand, driven by the increasing need for aesthetically appealing yet durable and functional environments. Furthermore, the utilization of professional curators to enhance the appeal of these spaces has led to heightened customer awareness. High-pressure laminates (HPLs) also offer an extended lifespan, ranging from 5 to 15 years, making them an ideal selection for office furniture and interior decoration due to their durability.

Regional Insights

- Asia-Pacific dominated the market during the forecast period

Asia-Pacific dominated the market during the forecast period. Demand for HPL and related lamination products is driving regional expansion. China and India have many HPL manufacturers and suppliers, contributing to this growth. Population surge, rising disposable incomes, and increasing middle-income groups are accelerating housing requirements. Economic growth and foreign investments are fostering commercial development, seen in new corporate offices, food establishments, and entertainment centers.

North America is anticipated to grow at the fastest during the forecast period. The North American home renovation and interior decoration industry is experiencing a surge due to increasing demand for modernization, upgrades, and value addition. Aging homes require repairs, updates, and energy efficiency improvements. Homeowners also seek contemporary and personalized aesthetics for their living spaces.

Furthermore, the North American high-pressure laminate market is marked by a diverse range of applications. While countertops and cabinetry remain traditional strongholds, laminates are increasingly finding use in various commercial settings, such as retail stores, hospitality, and healthcare facilities, owing to their durability and design versatility. The market also benefits from technological advancements in digital printing, enabling manufacturers to offer an extensive range of designs and textures, further expanding their customer base.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Abet Laminati S.p.A.

- Abet Laminati UK Ltd.

- Arpa Industriale S.p.A.

- Durian Laminates

- Finsa - Fibras Industriales S.A.

- Formica Corporation

- FunderMax GmbH

- Greenlam Industries Ltd.

- Kronospan Holdings Ltd.

- Laminex Group

- Merino Group

- Pionite Surfaces

- Shaw Industries Group Inc.

- Stylam Industries Limited

- Trespa International B.V.

- Wilsonart LLC

Recent Developments

- In 2022, Arborite launched Arborite Fusion, a new range of high-pressure laminate (HPL) that offers architects and designers endless possibilities to create unique designs with its fusion of textures, colors, and patterns.

- In 2021, Polyrey SA unveiled its latest collection of High-Pressure Laminates, which they named Polyrey Boreal. This exquisite range draws its inspiration from the enchanting Nordic forests, showcasing a delightful array of wood textures and designs that faithfully capture the innate splendor of wood, infusing any environment with a welcoming and cozy atmosphere.

- In 2020, Abet Laminati S.p.A unveiled Abet Digitalia, a fresh collection of high-pressure laminates. This line showcases digitally printed patterns, opening the door to limitless opportunities for crafting distinctive and personalized designs, making it a perfect option for imaginative endeavors and branding needs.

High Pressure Laminate Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.34 billion |

|

Revenue forecast in 2032 |

USD 14.50 billion |

|

CAGR |

7.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Application, By Width Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |