Hybrid Seeds Market Share, Size, Trends, Industry Analysis Report

By Acreage (Field Crops, Fruit & Vegetable Crops); By Type (Cereals, Pulses, Oilseeds, Fruits & Vegetables, Others); By Farm; By Seed Treatment; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 115

- Format: PDF

- Report ID: PM2235

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

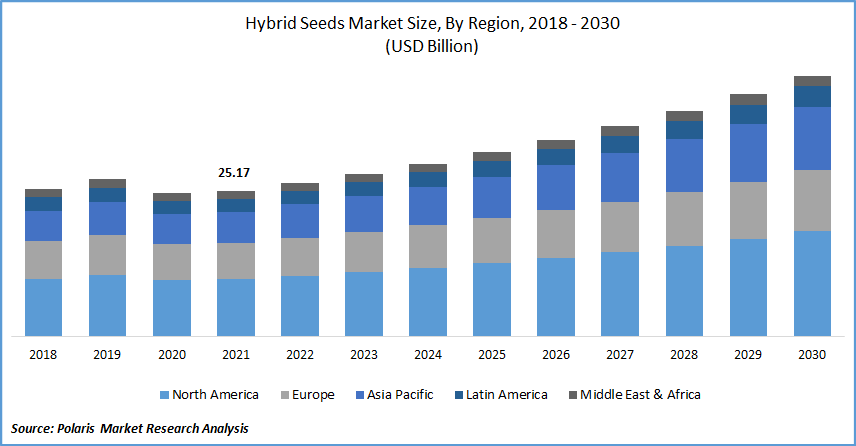

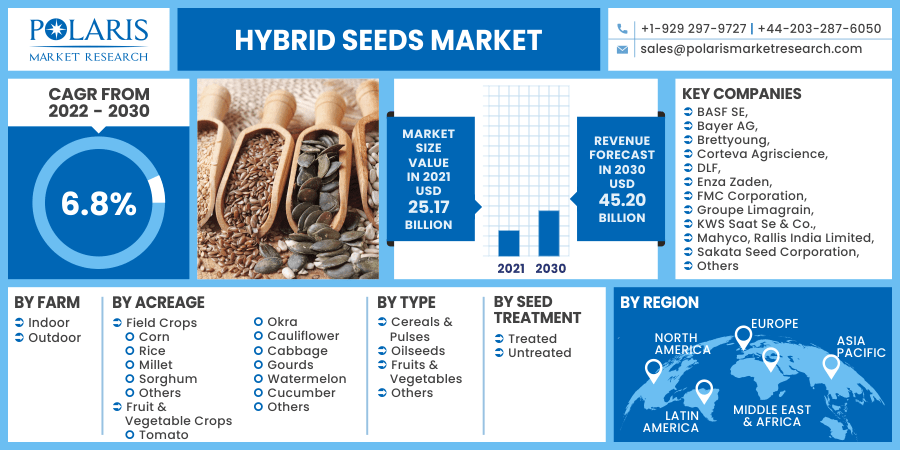

The global hybrid seeds market was valued at USD 25.17 billion in 2021 and is expected to grow at a CAGR of 6.8% during the forecast period. Product innovation and agricultural modernization are two significant drivers driving the market's global expansion. Other aspects that are predicted to supplement market expansion include the introduction of improved hybrid seed varieties, diet diversity, and the usage of hybrid seeds with advanced features attached, such as seed coatings.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Foreign agencies such as the United States Agency for International Development (USAID), the Rockefeller Foundation, the World Bank, and the Ford Foundation provide financial and technical assistance in the early development of seeds to strengthen breeding, seed processing, and quality control, which is essential to the industry's growth and development. The rising demand for the industry in emerging markets will likely open up the attractive potential for market expansion.

Further, several breeding organizations have undertaken extensive research and development initiatives with the goal of making the resulting crops disease resistant. These businesses are devoting resources to the development of disease detection systems. One of the most important areas of research in this business is abiotic resistance. Due to water constraints, hybrid seedlings with efficient water use and heat resistance have been produced. Disease-resistant onion hybrids with good storage properties and homogeneity are regarded as a huge achievement in this industry.

Furthermore, specialist cucumber, tomato, and watermelon products have significantly impacted the industry's growth. However, hybrid seed preparation is an expensive and complicated process, which is projected to limit industry expansion. They are also incapable of surviving in shifting environmental circumstances and reproducing once planted in the field. Furthermore, lack of customer awareness and biotic stress tolerant hybrids are two important obstacles to the hybrid seeds market growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The hybrid seeds market has observed extensive developments over the last few decades supported by various factors, including the rising public and private initiatives for the hybris seeds, such as new seed launches, expansion of geographical location, and extension of area for fertilization. For instance, in January 2021, Bayer's Vegetable Seeds division has conducted its fourth annual PragatiDiwas at its Bengaluru mega breeding station.

More than 120 high-yielding seeds from 14 fruit & vegetable crops, including tomatoes, hot peppers, watermelon, cabbage, cauliflower, cucumber, and beans, were displayed during the event. It also allowed farmers to learn about effective agricultural practices for proper cultivation. Four new Seminis vegetable seed varieties were unveiled at the gathering: 'Anshuman' tomato, 'SVHA9093' hot pepper, 'Bazlet' cucumber, and 'Himgauri' cauliflower. These cultivars have been commercially released.

Further, in November 2021, East-West Seed, a Nigerian company, has released new hybrid seed varieties to enhance farmers' yield as part of an initiative to expand and diversify the vegetable sector. Tomato, pepper, pumpkin, watermelon, and pawpaw are among the hybrid varieties. East-West Seed Nigeria highlighted that the product launch, exhibition, and seed fair in Abuja aimed to enhance farmers' access to quality seeds and expand marketing and distribution channels to consumer markets. Thus, the expansion of geographical location to emerging areas and launches of new seeds is the factor driving the hybrid seeds market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on farm, acreage, type, seed treatment, and region.

|

By Farm |

By Acreage |

By Type |

By Seed Treatment |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on the type, the cereals & pulses segment is expected to be the most significant revenue contributor in 2021 and is expected to retain its dominance in the foreseen period. This is increasing since it is used as a staple meal to a huge extent. It's also employed in the food and feed processing sectors. Some of the world's largest producers, such as China, India, the United States, and Brazil, meet rising global demand for cereal commodities like rice and corn. One of the primary elements driving the cereals & pulses segment's rise is the increased usage of hybrid seeds in maize.

Geographic Overview

In terms of geography, North America had the largest revenue share in 2021. The market for the North American region is anticipated to grow significantly as a result of the presence of major players and high-quality seeds availability in the region. For their seed requirements, Canada and Mexico rely on the US seed industry. There are no seed shortages in the US seed industry at the national or regional levels.

The demand for home garden seeds is exploding, and producers are scrambling to keep up with the unprecedented demand. The American Seed Trade Association (ASTA) keeps a careful eye on the global epidemic and its influence on the seed sector, both in the United States and worldwide. Seed supplies were disrupted, reducing yields and profits for American farmers seeking to export more crops to China this year under the provisions of a trade pact inked.

Moreover, APAC is anticipated to witness a high CAGR in the global market in 2021. Due to the rising population and high demand for healthy food, India and China have gained substantial traction in the hybrid seed market. With the loss of farmland due to urbanization, there is a greater need for food produced in a smaller area. This increase can be due to the growing understanding of such seedlings amongst farmers in emerging countries like India and China and their significant impact on per hectare production, resulting in increased hybrid seed sales. Farmers have demonstrated a propensity to pay a higher price for these seedlings.

Assistance is provided for the development and dissemination of hybrid rice under this component. Various beneficiaries receive a production subsidy of INR 20 per kg and a distribution subsidy of INR 25 per kg. As a result, the emerging countries' farmers' willingness to pay for hybrid seeds and government support for seed production and distribution enhances regional market growth over the forecast period.

Competitive Insight

Some of the major players operating in the global market include BASF SE, Bayer AG, Brettyoung, Corteva Agriscience, DLF, Enza Zaden, FMC Corporation, Groupe Limagrain, KWS Saat Se & Co., Mahyco, Rallis India Limited, Sakata Seed Corporation, SL Agritech, Syngenta Group, and Takii & Co., Ltd.

Hybrid Seeds Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 25.17 billion |

|

Revenue forecast in 2030 |

USD 45.20 billion |

|

CAGR |

6.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Farm, By Acreage, By Type, By Seed Treatment, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

BASF SE, Bayer AG, Brettyoung, Corteva Agriscience, DLF, Enza Zaden, FMC Corporation, Groupe Limagrain, KWS Saat Se & Co., Mahyco, Rallis India Limited, Sakata Seed Corporation, SL Agritech, Syngenta Group, and Takii & Co., Ltd. |