Indoor Air Purification Market Share, Size, Trends, Industry Analysis Report

By Product; By Technology; By Application (Industrial, Commercial, Residential); By Region; Segment Forecast, 2021 - 2028

- Published Date:Aug-2021

- Pages: 101

- Format: PDF

- Report ID: PM1950

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

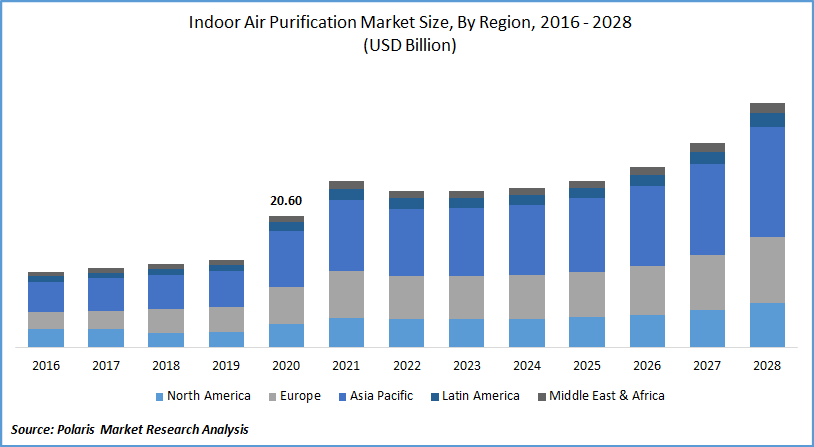

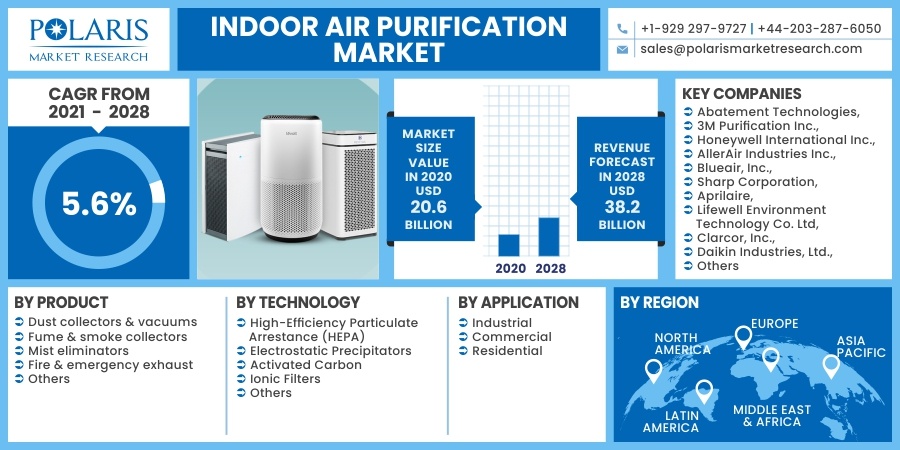

The global indoor air purification market was valued at USD 20.60 billion in 2020 and is expected to grow at a CAGR of 5.6% during the forecast period. The industry's expansion is anticipated to be driven by the growing incidence of various infectious pathogens and increasing levels of toxic substances in the atmosphere because of the increasing prevalence of motorization and industrialization in urban areas.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Other factors behind the industry's development include better working conditions, increased health awareness, and higher disposable income. The increasing need for implementing equipment that aids in air pollution control has resulted in a surge in demand for various air purifiers in many developing countries.

Supportive government rules and regulations and the surging knowledge of the harmful effects of indoor air pollution on safety and well-being are anticipated to drive the demand of the market during the forecast timeframe. Indoor purification is essential in the filtration of harmful contaminants found in the atmosphere. Their growing usage in the residential, industrial, retail, healthcare, manufacturing, hospitality, automotive, construction, and pharmaceutical industries is expected to drive market growth for indoor purification.

Industry Dynamics

Growth Drivers

The global indoor air purification market is seeing exponential growth. The major factors driving the growth of the market for indoor purification include surging incidences of infectious pathogens, growing public awareness about the harmful effect of indoor pollutants on health, the outbreak of novel coronavirus, and increasing disposable income in emerging economies.

The emergence of a novel coronavirus has raised global concerns about the spread of highly infectious diseases. Many industry players have adopted various technologies and introduced innovative products to fight the pandemic, potentially reducing virus transmission. COVID-19 was found in over 155 million people worldwide as of May 2021.

The pandemic had a positive influence on various countries, including India, United States, and Brazil. Currently, over 33 million people in the U.S. are infected by the disease. India is experiencing the worst second wave of disease outbreaks, with 400,000 cases being reported daily, the most for any country since the outbreak began. The increasing cases of COVID-19 will significantly increase the adoption of purification systems across the globe.

Emerging economies such as India, Russia, China, and Brazil are expected to provide significant opportunities for producers and suppliers of purifiers in the near term. This is due to the pollution levels in these countries and growing public knowledge, an uptick in the number of diseases due to air pollution, increased consumer spending due to population growth, increasing disposable incomes, and increased investment by the government efficient quality monitoring.

Many innovative products are being launched in the market to meet the needs of the customer requirement. For instance, in August 2020, Smartmi announced the introduction of the Smartmi Air Purifier. This innovative new design purification systems tracks and analyses indoor air quality, automatically filters air, and protects against pollutants and germs with a three-stage system with antimicrobial and antiviral coating.

In October 2020, Philips announced a new series of air purifiers in urban areas and via VitaShield Intelligent Purification System technology. The company says that the technology can remove 99.97% of contaminants as minute as 0.003 microns.

The COVID-19 crisis has created significant business opportunities for purification systems producers, with high-performance units incorporating HEPA and activated carbon technologies becoming increasingly common to reduce virus transmission in confined spaces. The manufacturers have shown confidence in offering a solution for indoor conditions, which will maintain market demand in the foreseeable term.

Know more about this report: request for sample pages

Indoor Air Purification Market Research Scope

The market is primarily segmented on the basis of product, technology, application, and region.

|

By Product |

By Technology |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The dust collectors & vacuums market segment dominated the market and generated the highest revenue in 2020. The segment is expected to grow at a high growth rate during the forecast period due to increasing residential and industrial demand. Fume and smoke collectors had the second-largest share. Over the next few years, the widespread use of fume and smoke collectors to remove wet and dry vapors, dust, gases, and smoke from an air stream is anticipated to drive the overall market for indoor purification.

Mist collectors also occupy a significant share in the global market for indoor purification. Mist collectors are widely used to remove sub-micron pollutants from the atmosphere of plants. These air purification systems are low-profile, machine-mountable, highly efficient, wet machining solutions for oil-based, water-soluble, and synthetic coolants. Indoor factory processes may also benefit from mist collectors, which can eliminate both tiny and large particles.

Insight by Application

The industrial market segment is expected to dominate the market during the estimated period. Favorable regulations on ensuring safe indoor quality standards in manufacturing plants and production sites are anticipated to drive the growth of this segment during the forecast timeframe. The residential sector is projected to have a high growth rate during the projected period. The market for residential purification products used in kitchens and rooms is expected to rise due to falling prices.

Geographic Overview

The Asia Pacific market for the indoor purification industry accounted for the largest revenue share in 2020. The demand for indoor purification systems and solutions is expected to be highest in this area. Over the forecast period, rising demand in the manufacturing, commercial, and residential sectors in India, China, and Japan is estimated to drive regional development.

North America market for the indoor air purification industry is expected to have high growth during the forecast period. Indoor purifiers demand in this region is expected to rise as people become more aware of increasing levels of indoor air pollution. The U.S., Canada, and Mexico are the countries that have increased purification demand in the North American region.

Competitive Insight

Major players in the market for indoor air purification are investing in research & development to achieve product innovation based on consumer requirements, and the companies are introducing new products to widen their market reach across the globe.

Some of the major players operating in the indoor air purification market include Abatement Technologies, 3M Purification Inc., Honeywell International Inc., AllerAir Industries Inc., Blueair, Inc., Sharp Corporation, Aprilaire, Lifewell Environment Technology Co. Ltd, Clarcor, Inc., Daikin Industries, Ltd., Halton Group, Trane Inc., Electrocorp and Lennox International Inc., and Industrial Air Solutions Inc.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 20.6 billion |

|

Revenue forecast in 2028 |

USD 38.2 billion |

|

CAGR |

5.6% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Application, By End-Use, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

Abatement Technologies, 3M Purification Inc., Honeywell International Inc., AllerAir Industries Inc., Blueair, Inc., Sharp Corporation, Aprilaire, Lifewell Environment Technology Co. Ltd, Clarcor, Inc., Daikin Industries, Ltd., Halton Group, Trane Inc., Electrocorp and Lennox International Inc., and Industrial Air Solutions Inc. |