Industrial Air Compressor Market Share, Size, Trends, Industry Analysis Report

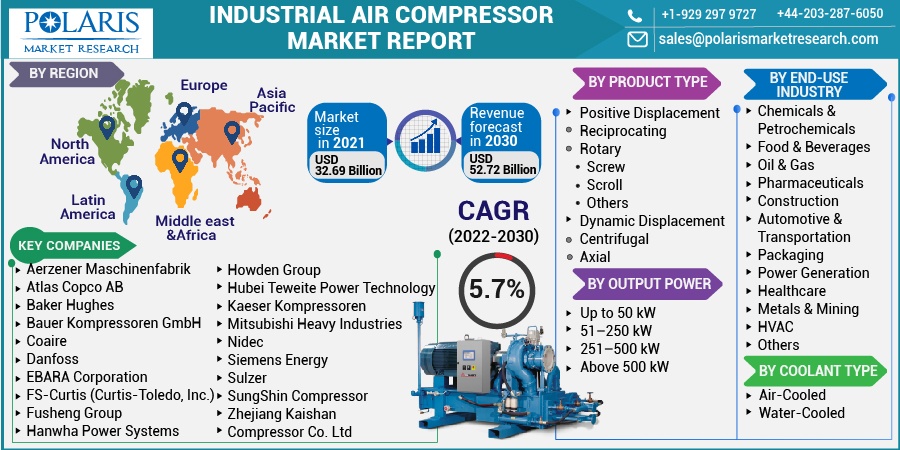

By Product Type (Positive Displacement, Dynamic Displacement); By End-Use; By Output Power; By Coolant Type (Air-Cooled, Water-Cooled); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 114

- Format: PDF

- Report ID: PM2446

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

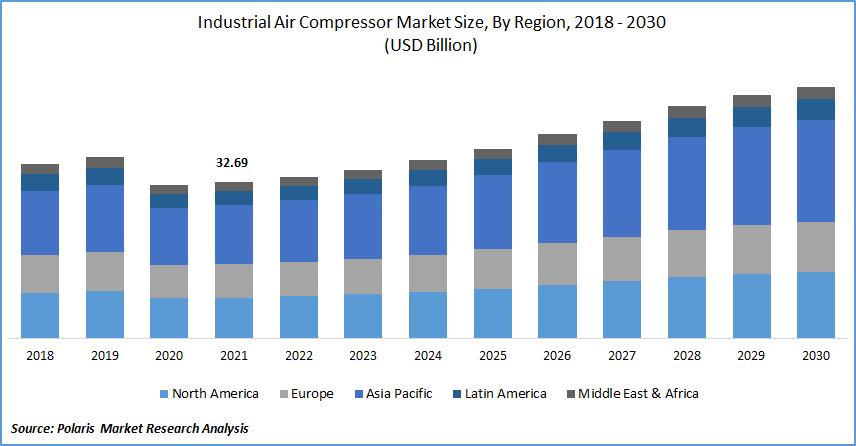

The global industrial air compressor market was valued at USD 32.69 billion in 2021 and is expected to grow at a CAGR of 5.7% during the forecast period. Rising GDP, improved population living standards, and an increase in the number of people living in middle and high-income groups worldwide contribute to increased demand for domestic cooling appliances.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The rise in market demand for industrial air compressors from the oil & gas industry and the rising demand for energy-efficient industrial air compressors is anticipated to drive the market growth during the forecast period. Despite significant advancements in alternate energy sources, the market demand for oil and oil-based products grows in tandem with the world population. As a result, industrial air and gas compressors have become indispensable for maintaining the proper pressure levels for these operations, with innovations focusing on lower energy requirements, increased speed, and greater ability to withstand harsh drilling environments to maintain a competitive edge. In today's oil & gas business, large and small enterprises rely heavily on industrial compressors.

Moreover, energy-efficient compressed air solutions are becoming more popular with an increasing focus on energy costs and increased greenhouse gas (GHG) emissions. European Union has proposed the "2030 Climate Target Plan" to reduce GHG emissions by around 55% compared to 2020. Meanwhile, compressors in numerous industrial applications are growing due to the easy and safe generation of compressed industrial air.

As per the U.S. Department of Energy, 50% of industrial plant systems have considerable energy savings potential with relatively cheap project costs. Compressed air systems necessitate proper upkeep and high-level monitoring to conserve energy. As a result, the life cycle of pneumatic instruments is extended, and compressed air systems are more reliable. However, the government's tightening limitations on greenhouse gas emissions and noise pollution are some of the issues limiting the industrial air compressor market's growth.

Industry Dynamics

Growth Drivers

Growing urbanization and increasing automation in emerging economies are expected to drive market growth during the forecast period. It is estimated that the urban population is growing significantly across the globe. According to the United Nations (UN), the population residing in urban areas is further estimated to reach 68% by 2050. The global urban population in 2015 was approximately 3.7 billion, and the number is further estimated to get doubled by 2050. The urban population generates market demand for energy-saving AC systems, and therefore, it is estimated to augment the industrial air compressor market across the globe.

Further, chemicals and petrochemicals, oil and gas, pharmaceuticals, construction, automotive and transportation, healthcare, metals and mining, and other industries use industrial air compressors. Due to increased expenses and capacity expansions, rapidly growing industrialization and manufacturing activities propose enormous opportunities for the industrial air compressor market to flourish.

Furthermore, government measures to promote industrial automation and a focus on industrial automation for optimal resource usage boost market demand for industrial air compressors, which can be utilized to power pneumatic tools, packing, automation equipment, and conveyors. Additionally, major economies are expanding capacity and building new chemical facilities worldwide. As a result, compressors are required to process and operate in the chemical and oil & gas refining industries.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on product type, end-use industry, output power, coolant type, and region.

|

By Product Type |

By End-Use Industry |

By Output Power |

By Coolant Type |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Product Type

Based on the product type segment, the positive displacement segment is expected to be the most significant revenue contributor throughout the forecast period. Depending on the requirements, these compressors can be either oil-free or lubricated. Construction, automotive and transportation, packaging, food & beverage, metals and mining, and other end-user industries use positive displacement air compressors. These industries are projected to have increased investment, which would drive up market demand for positive displacement.

The 51–250 kW segment dominates the industrial air compressor market growth based on the output power. They're used in power plants, water, wastewater treatment plants, the chemical and petrochemical industries, the food & beverage business, mining, the automotive and manufacturing industries, packaging, construction, the metals sector, manufacturing, and others. Several chemical manufacturing projects, particularly in emerging nations, have increased the market demand for industrial air compressors ranging from 51 to 250 kW.

Geographic Overview

Asia Pacific had the largest revenue share. Rising investments in the LNG and mining and the rise of the domestic industrial sector, particularly automotive and food & beverage, are driving the regional market forward. The region witnessed a surge in investments in the hydrogen and green energy sectors to meet its energy demand while adhering to decarbonization policies. The need for air compressors for numerous applications, including food & beverage, manufacturing, home appliances, and the oil & gas industries, is driving market expansion. Furthermore, multiple manufacturers and Taiwan's significant industrial base for electronics and semiconductor manufacturing likely fuel market expansion.

Moreover, North America is expected to witness a high CAGR in the global market. The growing number vof industrial infrastructure projects and the ever-increasing investment across all process sectors, particularly the oil & gas industry, bolsters market expansion throughout all industry domains. Moreover, IoT penetration, efforts such as Industry 4.0, and technological breakthroughs related to new product development likely boost market demand.

Competitive Insight

Some of the major players operating in the global industrial air compressor market include Aerzener Maschinenfabrik, Atlas Copco AB, Baker Hughes, Bauer Kompressoren GmbH, Coaire, Danfoss, EBARA Corporation, FS-Curtis (Curtis-Toledo, Inc.), Fusheng Group, Hanwha Power Systems, Howden Group, Hubei Teweite Power Technology, Kaeser Kompressoren, Mitsubishi Heavy Industries, Nidec, Siemens Energy, Sulzer, SungShin Compressor, and Zhejiang Kaishan Compressor Co. Ltd (Kaishan Group).

Industrial Air Compressor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 32.69 Billion |

|

Revenue forecast in 2030 |

USD 52.72 Billion |

|

CAGR |

5.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product Type, By End-Use Industry, By Output Power, By Coolant Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aerzener Maschinenfabrik, Atlas Copco AB, Baker Hughes, Bauer Kompressoren GmbH, Coaire, Danfoss, EBARA Corporation, FS-Curtis (Curtis-Toledo, Inc.), Fusheng Group, Hanwha Power Systems, Howden Group, Hubei Teweite Power Technology, Kaeser Kompressoren, Mitsubishi Heavy Industries, Nidec, Siemens Energy, Sulzer, SungShin Compressor, and Zhejiang Kaishan Compressor Co. Ltd (Kaishan Group). |