Industrial Batteries Market Share, Size, Trends, Industry Analysis Report

By Type (Lithium-based, Lead-acid, Nickel-based, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 115

- Format: PDF

- Report ID: PM2475

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

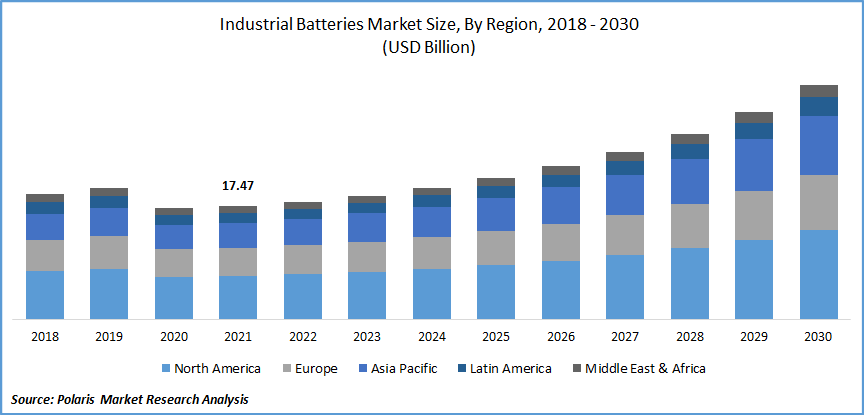

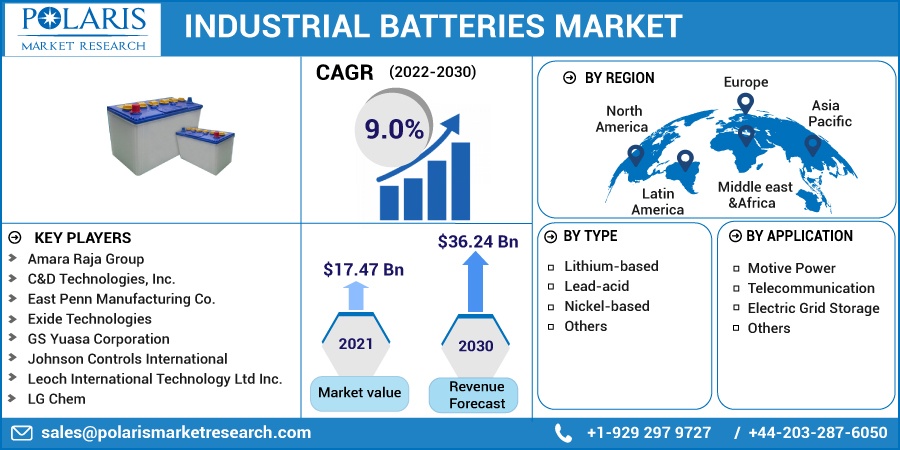

The global industrial batteries market was valued at USD 17.47 billion in 2021 and is expected to grow at a CAGR of 9.0% during the forecast period. Industrial batteries are electrochemical devices used as power sources for large equipment. Some of the most prevalent battery types include lithium-ion, nickel-based, lithium titanate, lithium magnesium oxide, and lead-based batteries.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Compared to the traditional batteries, they have a longer life and can be used in remote areas and extreme temperatures where devices need to be self-powered. They are rechargeable and extensively used in energy, grid storage, utility, and telecommunication systems. Their components include cathode, anode, and electrolyte.

Implementation of government regulations related to carbon emission will increase the use of lithium-ion batteries. Favorable government policies for infrastructural development at the domestic level through the National Infrastructural Plan (NIP) will promote the growth of the Uninterruptible Power Supply (UPS) market, thereby strengthening the demand for the product.

Additionally, to reduce operating costs and enhance the productivity of industrial batteries, manufacturers have developed various solutions and improved equipment with upgraded technology. This has increased the demand for the product in equipment manufacturing applications. Industrial battery manufacturers are collaborating with raw material suppliers to strengthen their supply and introduce new battery technologies.

The COVID-19 pandemic has affected the industrial batteries market as the industry supply chain, raw material prices, import and export of batteries, and organization operations were impacted. There was a shortage of components in the market.

Leading industrial battery manufacturers were forced to completely shut down their manufacturing capacities. The demand in various segments fell due to reduced industrial operations and decreased spending power of consumers due to the lockdowns. As the majority of the industrial battery supply chain is linked to China, it resulted in a decline in production and sales.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising adoption of lithium-ion batteries in the renewable energy sector is a key driver for the global industrial batteries market. They offer enhanced electrochemical performance as compared to others. They are majorly used in systems that store energy generated from renewable energy sources such as solar and wind.

Market players such as Panasonic, and Samsung among others provide lithium-ion batteries and are installing them in their energy storage systems. The demand for the product has increased with the greater use of lithium-ion batteries in the renewable energy sector. An increase in environmental concerns and a shift in the trend toward renewable sources drives the growth of the industrial batteries market.

Product demand for applications such as backup power for telecom base stations and data centers or to power forklifts in the industrial sector has been rising. They do not emit hazardous chemicals such as sulfuric acid, thus promoting environmental sustainability, and contributing towards the growth of the industrial batteries market.

In addition, extensive usage of the battery in various applications, such as UPS and motive power, is expected to fuel the market growth. Also, ongoing advancements in the industry such as the increase in annual deployed capacities for industrial batteries and stringent government regulations to control pollution are major drivers of the global industrial batteries market.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Lithium-Ion Batteries Segment is Expected to Witness the Fastest Growth

Lithium-ion batteries are utilized in numerous industrial applications, such as UPS systems, industrial automation systems, and grid-level storage systems. The lithium-ion battery segment is gaining more popularity than others due to better performance, higher energy density, and decreasing price.

It is expected to witness significant growth in the industrial battery market due to its favorable capacity-to-weight ratio. Increasing investments in R&D activities to enhance the battery performance will boost its adoption in various applications. Energy storage systems (ESS) help store renewable energy sources such as wind and solar and convert them into storable forms. The emergence this new and exciting market for both commercial and residential applications, is driving the demand for lithium-ion-based battery.

Telecommunication Segment is Estimated to Grow at a Significant Rate

The telecommunication sector is expected to grow at a significant rate across the globe during the forecast period. Greater penetration of smartphones, tablets, and laptops supports the growth of this segment. Market players are developing solutions to cater to the growing demand for satellite TV on the telephone and the internet. Battery storage technology supports higher electricity generation from renewable sources.

They have developed higher traction for energy storage applications with recent development in battery storage technology. They are inherently shallow-cycle cells intended to stay charged for the majority of the lifetime of the battery, with only a few rare discharges. They are utilized in stationary applications in the commercial and residential sectors, and also by utilities.

Asia Pacific is Estimated to Account for a Major Share in 2021

Asia Pacific is a major consumer as well as producer of industrial batteries. The market demand in the region is driven by developing economies such as China, Japan, and India, which have a large number of product manufacturers as well as consumers. The growth in the region is attributed to the rising demand for renewable energy storage requirements in residential, commercial, and utility segments.

The robust manufacturing base and rapid growth of the automotive industry will enhance the demand for industrial vehicles, such as a battery-operated forklift, which will drive the demand for the product in the Asia Pacific. This growth and development are attributed to economic growth exhibited by this region, accompanied by huge investments in industries.

Competitive Insight

The key players of the industrial batteries market are Amara Raja Group, American Battery Solutions, Bulldog Battery Corporation, C&D Technologies, Inc., East Penn Manufacturing Co., Exide Technologies, GS Yuasa Corporation, Johnson Controls International, Leoch International Technology Limited Inc., LG Chem, NorthStar Battery Company LLC, Panasonic Corporation, Samsung SDI, TotalEnergies SE, and Victron Energy.

These industry players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Recent Developments

In November 2021, Baidu introduced its “Pinghu” DC Lithium Battery System in Shanghai. It also announced Shanghai Electric Guoxuan New Energy Technology Co., Ltd. as its strategic partner on the system. Shanghai Electric is responsible for delivering lithium batteries for the data center of the Pinghu System and LFP batteries for the energy storage parts. They are aimed at offering higher specific energy, longer cycle life, higher charging and discharging rates, and environmental friendliness in applications such as energy storage and HVDC (high-voltage direct current).

In October 2021, Samsung SDI and Stellantis NV announced that the companies had formed a joint venture (JV) to make battery cells and modules for North America, commencing in 2025. They aim to achieve an initial annual production capacity of 23 gigawatt-hours, with the ability to expand up to 40-gigawatt hours later.

In June 2021, the Chhattisgarh State Renewable Energy Development Agency (CREDA) invited bids for a tender to procure 15,000 low-maintenance lead-acid batteries with a five-year on-site warranty and will be used in solar applications of different capacities. The contract was estimated to be around USD 1.37 million.

In May 2022, Exide Industries, along with its joint venture partner Leclanche SA initiated mass production at the lithium-ion battery plant in India. The plant is equipped with six automated assembly lines, which produce batteries for automobiles and energy storage applications. The development is aimed at addressing the increase in demand from the mobility and utility sectors.

Industrial Batteries Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 17.47 billion |

|

Revenue forecast in 2030 |

USD 36.24 billion |

|

CAGR |

9.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Amara Raja Group, American Battery Solutions, Bulldog Battery Corporation, C&D Technologies, Inc., East Penn Manufacturing Co., Exide Technologies, GS Yuasa Corporation, Johnson Controls International, Leoch International Technology Limited Inc., LG Chem, NorthStar Battery Company LLC, Panasonic Corporation, Samsung SDI, TotalEnergies SE, Victron Energy |