Industrial Networking Solutions Market Share, Size, Trends, Industry Analysis Report

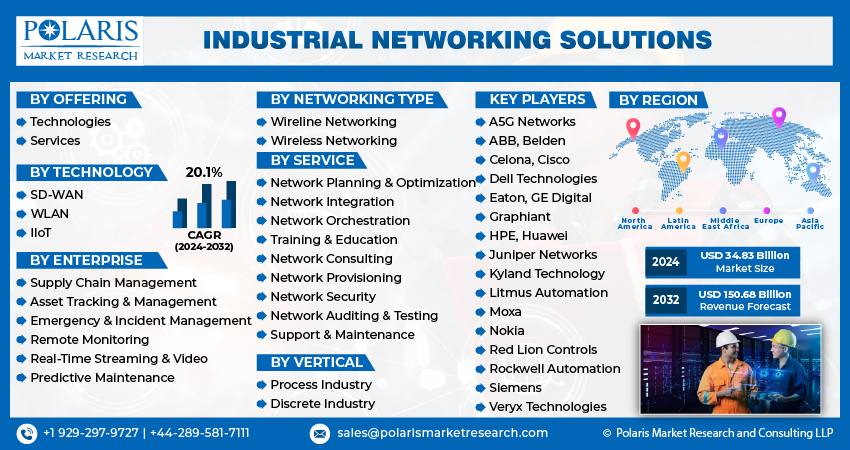

By Offering; By Technology; By Networking Type; By Service; By Enterprise; By Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4429

- Base Year: 2023

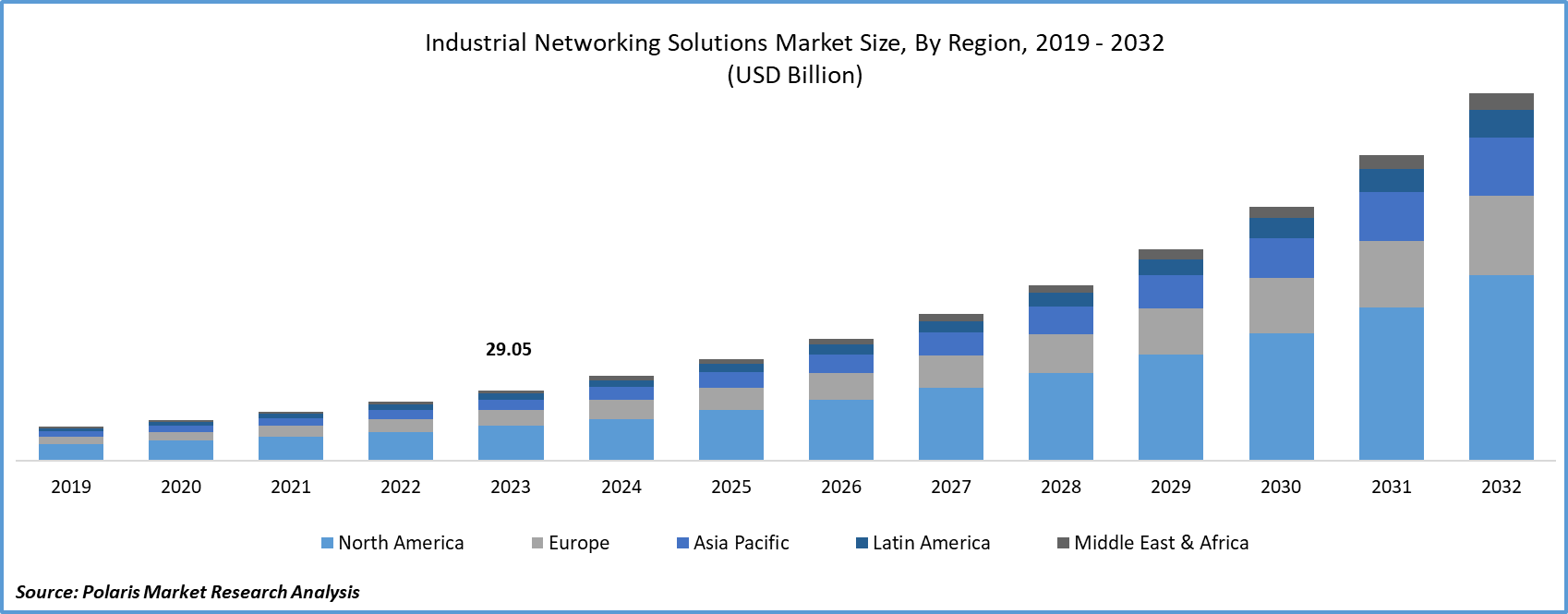

- Historical Data: 2019 – 2022

Report Outlook

Industrial Networking Solutions market size was valued at USD 29.05 billion in 2023. The market is anticipated to grow from USD 34.83 billion in 2024 to USD 150.68 billion by 2032, exhibiting the CAGR of 20.1% during the forecast period

Industrial Networking Solutions Market Overview

The industrial networking solutions market growth is anticipated to grow significantly due to the increasing instances of cyber-attacks and ransomware, the surging need for predictive maintenance, and the evolution of data analytics and data processing tools, which are anticipated to drive the growth of the market.

Industrial networking solutions provide the foundation for automation system architecture. They provide robust data exchange and control capabilities, as well as efficient methods for managing information, facilitating information exchange, and adapting to connectivity with a wide range of devices. Unlike traditional communication networks, these solutions play a crucial role in product distribution, information technology services, and technical support, utilizing both wired and wireless networking technologies.

For instance, In February 2023, Cisco and NTT partnered to promote the widespread adoption of Private 5G in key industries such as automotive, logistics, healthcare, retail, and public services, with the goal of speeding up their transformation.

Industrial networking solutions are used in an extensive range of applications, including predictive maintenance, remote monitoring, remote monitoring, real-time streaming video, asset tracking and management, and emergency and incident management. These solutions serve a diverse range of industries, including energy and utilities, food and beverage, chemicals and materials, semiconductors and electronics, machine manufacturing, automotive, logistics and transportation, medical devices, and emergency and incident management.

To Understand More About this Research: Request a Free Sample Report

The COVID-19 pandemic has had a significant positive impact on the industrial networking solutions market development. The COVID-19 pandemic has accelerated the adoption of advanced technologies; businesses desired to improve their digital infrastructure to enable remote monitoring, control, and automation, and there was a growing demand for advanced networking technology. The COVID-19 pandemic is spurring many manufacturers to rely more heavily on digitalization and automation for long-term operations in order to mitigate the pandemic's cost impact and potential future economic crises. While initially expected to have a brief impact, the pandemic's ongoing nature has provided businesses with an industrial networking solutions market opportunity to implement critical operational enhancements, with a particular emphasis on the advancement of networking technologies.

Industrial Networking Solutions Market Dynamics

Market Drivers

Rising Adoption of Industry 4.0 Will Drive the Growth of the Market

The increasing adoption of Industry 4.0 will drive the growth of the market. The widespread adoption of Industry 4.0 principles has significantly increased demand for industrial networking solutions. The seamless integration of cyber-physical systems (CPS), which allows physical machinery to collaborate with digital systems in real-time, is central to this transformative shift. This integration emphasizes the importance of a robust industrial networking infrastructure that allows for seamless communication and coordination between machines, sensors, and control systems in smart factories. Industry 4.0 prioritizes data-driven decision-making and automation, relying on the continuous exchange of information enabled by industrial networking.

The integration of devices is critical for implementing advanced analytics, predictive maintenance, and various optimization strategies. Furthermore, Industry 4.0 prioritizes interoperability, and industrial networking standards such as OPC UA and MQTT are critical to ensuring seamless communication. As the manufacturing landscape evolves and adapts, industrial networking enables flexible manufacturing processes that can respond quickly to changing conditions. Industrial networking promotes supply chain integration, emphasizes security, and improves human-machine collaboration.

The Adoption of Iot Solution and Broad Use of Wireless Technologies Facilitating the Growth of the Market

Adoption of IoT solutions and extensive use of wireless technologies facilitating the growth of the market. Industrial IoT (IIoT) is the integration of Internet of Things (IoT) technology into a variety of industrial processes, including automation, optimization, maintenance, and network connectivity. This integration allows businesses and industries to increase the efficiency and dependability of their processes. The market is anticipated to increase in the forecast period due to significant improvements in efficiency and performance achieved through IIoT in operational processes.

Also, the widespread adoption of wireless technologies in industrial operations is anticipated to boost the market for industrial networking solutions. The rapid expansion of the smartphone and tablet markets has led many businesses to adopt these solutions with the aim of satisfying customer's digital experience needs.

Market Restraints

The Restriction of Cost Hamper on the Growth of the Market

The primary investment in software, which includes durable equipment designed for harsh industrial environments as well as specialized software for communication and security, comprises a significant portion of total costs. The integration of existing legacy systems with modern networking solutions necessitates additional investment in adapters, gateways, and personnel training. Maintaining equipment, updating firmware, and implementing cybersecurity measures all add to the financial burden.

As industrial activities grow, the demand for scalability necessitates increased investment in hardware upgrades and network expansion. Operational disruptions caused by networking issues not only result in production losses but also incur additional costs for problem resolution. Assessments, certifications, and documentation all add to the cost of meeting regulatory compliance. Uncertainty about return on investment may cause reluctance to use advanced networking technologies.

Report Segmentation

The market is primarily segmented based on offering, technology, networking type, service, enterprise, vertical, and region.

|

By Offering |

By Technology |

By Networking Type |

By Service |

By Enterprise |

By Vertical |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Industrial Networking Solutions Market Segmental Analysis

By Offering Analysis

The services segment held the largest revenue share in the industrial networking solutions market in 2023. Services are crucial in meeting the diverse needs of clients and include activities such as network orchestration, network testing and auditing, network provisioning, network consulting, training and education, network planning and optimization, and support and maintenance.

By Networking Type Analysis

The wireless networking segment accounted for the largest market share during the industrial networking solutions market forecast period. Wireless networking is a technology that connects various devices in homes, telecommunications networks, and corporate settings without the use of costly cable installations. Radio communication is widely used in the design and operation of administrative telecommunications networks, with the physical layer of the OSI model network architecture serving as the primary interface.

By Vertical Analysis

Based on vertical analysis, the market has been segmented on the basis of process industry and discrete industry. Based on the process industry, the market has been segmented into energy & utilities, chemicals & materials, food & beverage, water & waste management, and other processes industries. The chemicals and materials segment has witnessed the fastest industrial networking solutions market growth. The growing use of advanced industrial networking technologies such as IIoT, SDWAN, and WLAN has played an important role in optimizing manufacturing processes and improving business operations in the chemicals and materials sector. The use of IoT-enabled equipment monitoring solutions and predictive analytics has allowed for continuous monitoring of quality and throughput in this industry vertical.

Based on the discrete industry, the market has been segmented into automotive, semiconductors & electronics, logistics and transportation, machine manufacturing, and medical devices. The machine manufacturing segment held the largest revenue share of the market in 2023. The machine manufacturing vertical's expansion is attributed to its interconnected supply chain, distribution system, and customer channels. This industry is rapidly moving toward system automation, with the goal of reducing human intervention and increasing manufacturing machine productivity and efficiency.

The adoption of industrial networking solutions in manufacturing industries improves real-time remote management, saving money on future maintenance labour while also reducing production costs and time. Manufacturing industries are particularly concerned about production downtime, which can lead to a variety of unexpected issues and defective goods. Industrial networking solutions enable manufacturing systems to operate efficiently, even in challenging environments, by ensuring seamless data transmission between equipment and networks.

Industrial Networking Solutions Market Regional Insights

North America Dominated the Market with the Largest Revenue Share in 2023

North America dominated the industrial networking solutions market with the largest revenue share, owing to the significant trends and technological advancements. The widespread adoption of Industry 4.0, as well as the growing integration of the Industrial Internet of Things (IIoT), are driving the growth of the market. The ongoing shift to Industry 4.0 has created a demand for sophisticated networking solutions that enable smooth communication and data exchange within industrial operations. Businesses are increasingly adopting intelligent sensors and interconnected devices to improve operational efficiency and decision-making through real-time data analysis.

Asia-Pacific has witnessed the fastest growth in the market owing to the quick development of network infrastructure. The rapid expansion of industrial activity provides significant growth opportunities for the market. China is poised to embrace industrial networking solutions with strong government support. Japan has launched a 5G spectrum at the end of 2019. The rise of automation is expected to boost industrial networking solutions market demand. Substantial investments by leading manufacturing companies are expected to boost demand for these solutions in Asia Pacific.

Competitive Landscape

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- A5G Networks

- ABB

- Belden

- Celona

- Cisco

- Dell Technologies

- Eaton

- GE Digital

- Graphiant

- HPE

- Huawei

- Juniper Networks

- Kyland Technology

- Litmus Automation

- Moxa

- Nokia

- Red Lion Controls

- Rockwell Automation

- Siemens

- Veryx Technologies

Recent Developments

- In December 2023, Nokia partnered with Innova Solutions to offer customizable network applications for enterprises via the Nokia Network as a Code platform. This partnership aims to accelerate the digital transformation of businesses in a variety of industries, including banking and financial services, transportation and logistics, technology, life sciences, retail, and manufacturing.

- In November 2023, Huawei introduced its All-Scenario WLAN Solution, which aims to accelerate the adoption of Wi-Fi 7 standard technology in the enterprise sector. This endeavor aims to continually improve the network experience for clients in a variety of industries, including education, manufacturing, and healthcare.

- In May 2023, Juniper Networks and ServiceNow partnered to provide comprehensive automation for the provisioning and monitoring of enterprise network services.

- In December 2022, Rockwell Automation partnered with Fortinet to improve the security of operational technology environments. This collaboration aims to provide comprehensive cybersecurity protection to a global customer base by combining advanced networking and security capabilities.

Report Coverage

The industrial networking solutions market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, offering, technology, networking type, service, enterprise, vertical, and their futuristic growth opportunities.

Industrial Networking Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 34.83 billion |

|

Revenue forecast in 2032 |

USD 150.68 billion |

|

CAGR |

20.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Offering, By Technology, By Networking Type, By Service, By Enterprise, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation |

FAQ's

The Industrial Networking Solutions market size is expected to reach USD 150.68 Billion by 2032

Key players in the market are ABB, A5G Networks, Belden, Celona, Cisco, Dell Technologies, Eaton, GE Digital, Graphiant, HPE

North America contribute notably towards the global Industrial Networking Solutions Market

Industrial Networking Solutions market exhibiting the CAGR of 20.1% during the forecast period

The Industrial Networking Solutions Market report covering key segments are offering, technology, networking type, service, enterprise, vertical, and region.