Industrial Pumps Market Share, Size, Trends, Industry Analysis Report

By End-Use (Textile, Water & Wastewater Treatment, Metal & Mining, Chemical, Power Generation, Oil & Gas, Agriculture, Others); By Type; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 114

- Format: PDF

- Report ID: PM2481

- Base Year: 2024

- Historical Data: 2020-2023

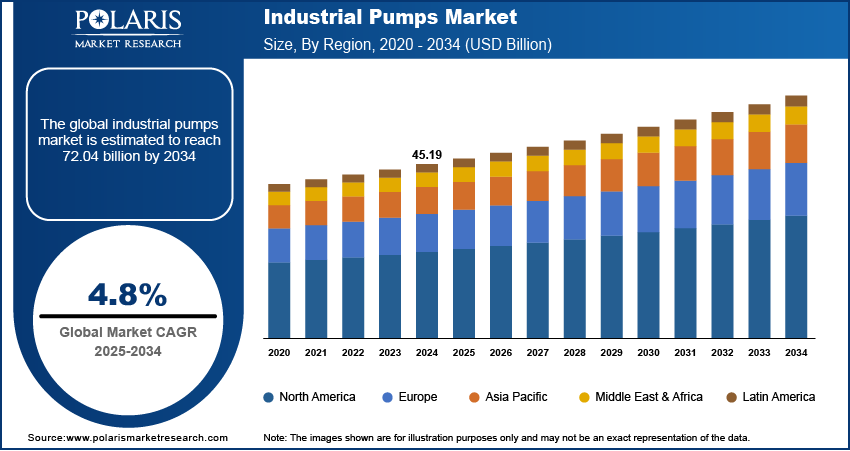

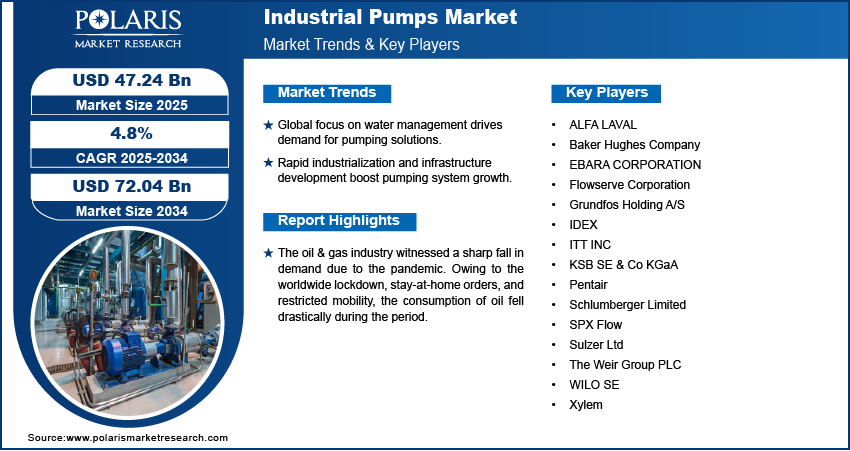

The global industrial pumps market was valued at USD 45.19 billion in 2024 and is expected to grow at a CAGR of 4.8% during the forecast period. The growing application of industrial pumps across several industries is expected to accelerate the growth of the market. The fiber and textile industry requires pumping solutions for accurately measuring color pigments, dye, bleach, etc., and also handling abrasive chemicals like latex, wastewater, sludge, etc. which can be extremely tough to handle.

Key Insights

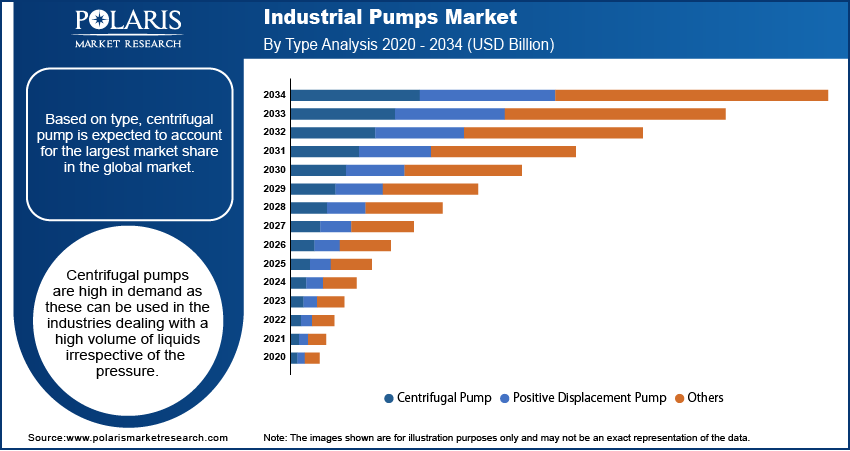

- By type, the centrifugal pump segment held the largest share in 2024 due to the inherent advantages of centrifugal pumps, such as their simple design, relatively lower maintenance needs, and high efficiency in handling large flow rates.

- By end-use, the water & wastewater treatment segment held the largest share in 2024 due to the increasing global focus on water scarcity and pollution control.

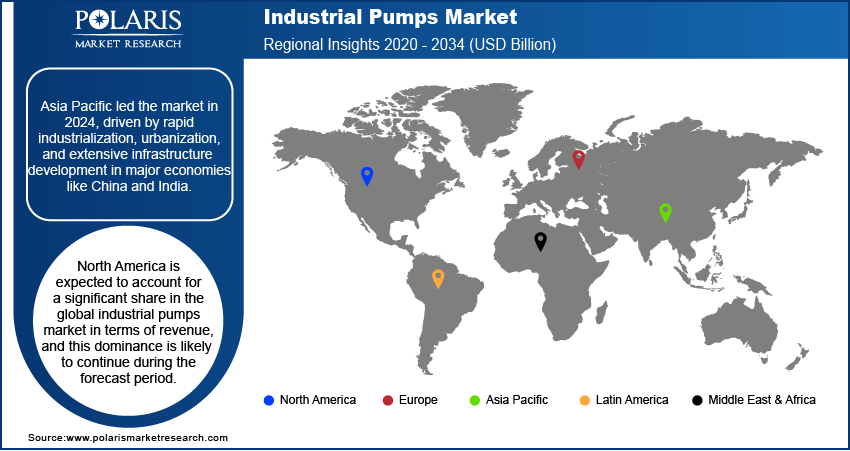

- By region, the Asia Pacific region held the largest share in 2024. The regional growth is largely propelled by rapid industrialization and urbanization across key economies like China and India, which fuels massive infrastructure development and expansion across multiple end-use sectors.

Industry Dynamics

- The rising global focus on water and wastewater management drives the need for pumping solutions to support treatment, recycling, and safe disposal.

- Rapid industrialization and extensive infrastructure development, particularly in emerging economies, are significant growth factors for pumping systems.

- A strong push toward energy-efficient technologies is a key driver, as industries aim to lower operational costs and meet growing sustainability goals.

Market Statistics

- 2024 Market Size: USD 45.19 billion

- 2034 Projected Market Size: USD 72.04 billion

- CAGR (2025-2034): 4.8%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Market

- AI is driving the shift from scheduled or reactive repairs to predictive maintenance by analyzing real-time data from smart sensors on the equipment.

- The technology is significantly optimizing pump performance and energy efficiency by continuously monitoring factors like flow rate, pressure, and power consumption.

- AI enables remote monitoring and control through the integration of the Internet of Things (IoT), allowing operators to oversee and manage equipment from any location.

Textile fibers are produced and processed using large quantities of water and energy in the textile industry, which demands innovative and efficient pumping solutions. For example, a pump can transport crude oil from a storage tank to a pipeline, and mud pumps can circulate drilling mud into the annulus of a drill bit and back to a storage tank for re-purification. Process fluids in oil and gas operations can be simple or complex which leads to the requirement of an appropriate pump for the subsequent need.

Furthermore, the chemical industry has perhaps the greatest demand for industrial pumps that could both perform and offer protection to employees and the surrounding work environment. A chemical producer handles aggressive acids which are not only toxic, but also highly flammable and explosive.

The oil & gas industry witnessed a sharp fall in demand due to the pandemic. Owing to the worldwide lockdown, stay-at-home orders, and restricted mobility, the consumption of oil fell drastically during the period. Furthermore, as COVID-19 caused unprecedented declines in demand, The pricing war between Saudi Arabia and Russia induced crude oil prices to fall.

Industry Dynamics

Growth Drivers

The pump industry has a wide range of applications in oil & gas, agriculture, metal & mining, water & wastewater treatment, textile, chemical, construction, manufacturing, and many other sectors. In the oil & gas industry, every aspect of oil & gas production necessitates the use of industrial pumps. They basically facilitate the transfer of process fluids from one place to another.

The increasing strict rules and regulations regarding wastewater treatment are necessitating the demand for industrial pumps. The government of several economies present across the globe is coming up with new laws and guidelines for wastewater discharge. Effluent guidelines are the regulatory standards for wastewater discharged to surface waters and municipal sewage treatment plants.

An industrial pump is vital to industrial existence and is extensively used in the various industries, that accounts for 30% of total energy consumption on an average industrial site. However, 90% of pumps across the globe are inefficient and operating at low efficiencies at the same time, wasting millions of dollars in energy and generating millions of tons of carbon dioxide each year.

Report Segmentation

The market is primarily segmented on the basis of type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insight by Type

Based on type, centrifugal pump is expected to account for the largest market share in the global market. Centrifugal pumps are high in demand as these can be used in the industries dealing with a high volume of liquids irrespective of the pressure. Centrifugal pumps are usually used for the liquids that are low in viscosity as well as low in solid concentration.

These pumps are currently in use across a vast array of domestic and industrial processes. From supplying the water used in residential buildings to industrial applications such as food, beverage, and chemical manufacturing, different types of centrifugal pumps are required to effectively meet pumping requirements.

Insight by End-Use

The textile segment is anticipated to register the highest growth rate during the forecast period of the industrial pumps. This is largely driven by the increasing need for water management and the expansion of manufacturing activities globally, especially in emerging economies. Pumps are vital in numerous processes within the textile industry, such as dyeing, finishing, and wastewater treatment, which is critical due to the large volumes of water and chemicals involved.

Geographic Overview

Asia Pacific dominated the industrial pumps market in 2024 and is expected to account largest market share over the forecast period. Asia Pacific is one of the world's largest agricultural producers and plays a vital role in the overall region's GDP growth. Since industrial pumps have a wide range of applications in the agriculture sector, from irrigation to the movement of fluid from one place to another, the market demand for the industrial pumps market is expected to grow over the forecast period.

An increase in demand for power & electricity across the region is likely to drive the growth of the market over the forecast period. Countries present across the region are switching to a cleaner source of energy with the government's new rules and standards. With this, the increased adoption of renewable sources of energy for power generation is projected to push the market demand.

North America is expected to account for a significant share in the global industrial pumps market in terms of revenue, and this dominance is likely to continue during the forecast period. The oil & gas industry is one of the largest consumers of industrial pumps across the region as they are extensively used in the production and extraction of oil & gas. However, fluctuation in prices of oil impacted the upstream and downstream activities of the industry over the years, which hindered the growth of the market.

Competitive Insight

Some of the major players operating in the global market include Xylem, Grundfos Holding A/S, EBARA CORPORATION, Flowserve Corporation, WILO SE, KSB SE & Co. KGaA, Sulzer Ltd, Schlumberger Limited, The Weir Group PLC, ALFA LAVAL, Pentair, IDEX, Baker Hughes Company, ITT INC., and SPX Flow.

Industrial Pumps Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 45.19 Billion |

| Market size value in 2025 | USD 47.24 billion |

|

Revenue forecast in 2034 |

USD 72.04 Billion |

|

CAGR |

4.8% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Xylem, Grundfos Holding A/S, EBARA CORPORATION, Flowserve Corporation, WILO SE, KSB SE & Co. KGaA, Sulzer Ltd, Schlumberger Limited, The Weir Group PLC, ALFA LAVAL, Pentair, IDEX, Baker Hughes Company, ITT INC., and SPX Flow. |

FAQ's

? The global market size was valued at USD 45.19 billion in 2024 and is projected to grow to USD 72.04 billion by 2034.

? The global market is projected to register a CAGR of 4.8% during the forecast period.

? Asia Pacific dominated the market share in 2024.

? The centrifugal pump segment accounted for the largest share of the market in 2024.