Infectious Respiratory Disease Diagnostics Market Share, Size, Trends, Industry Analysis Report

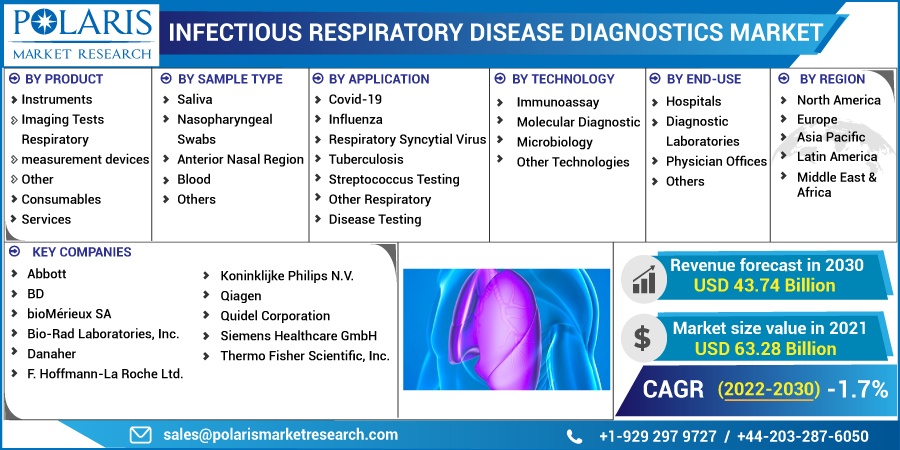

By Product; By Sample Type (Saliva, Nasopharyngeal Swabs, Anterior Nasal Region, Blood); By Application; By Technology; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 118

- Format: PDF

- Report ID: PM2603

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

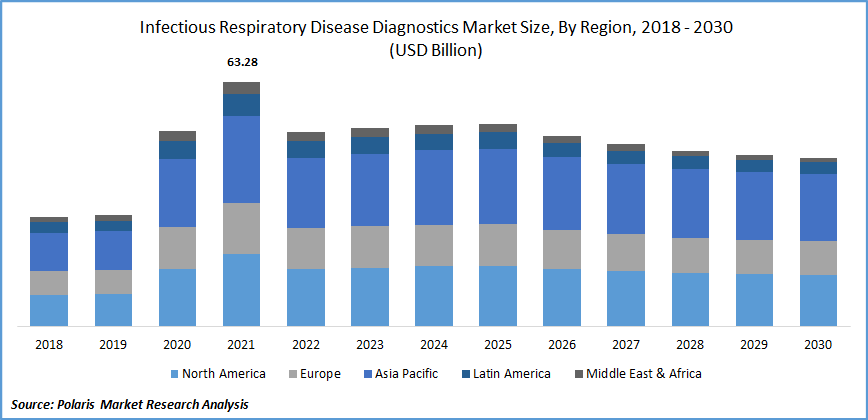

The infectious respiratory disease diagnostic market was valued at USD 63.28 billion in 2021 and is expected to grow at a CAGR of -1.7% during the forecast period. Respiratory diseases include pneumonia, sinus infection, bronchitis, and laryngitis. The growing population, adoption of a sedentary lifestyle, and rising respiratory disease globally have increased the demand for diagnosis. According to World Health Organization (WHO), a million cases of respiratory disease were registered in 2020.

Know more about this report: Request for sample pages

Frequent respiratory infections as well as increased exposure to indoor and outdoor air pollution and chemical occupational dust, is likely to boost the growth of the infectious respiratory disease diagnostic market. Technological advancements in diagnostic technology and increasing R&D investments by market players, nonprofit organizations, and the government for diagnostic testing have augmented the growth of the infectious respiratory disease diagnostic market.

The market is saturated with various new molecular diagnostic tests for detecting SARS-CoV-2. Technological advancements for portability, accuracy, and cost-effectiveness propel the market’s growth. In 2020, the Aquilion Prime SP CT system was launched by Canon Medical Systems for the rapid diagnosis of viral infectious diseases offering an in-built decontamination tool that sanitizes the whole equipment by utilizing automated UV-C technology after use for other patients.

Covid-19 has positively impacted the infectious respiratory disease diagnostic market. Increased stringent government rules and regulations for the compulsion of Covid-19 testing have driven the market’s growth. Furthermore, increased demand for assays and consumables during the pandemic coupled with increased product launches leading a spike in the market. Even every office after the pandemic made compulsion for the test, which increased sales and production, driving the market’s growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing prevalence of various respiratory diseases, including MERS, Covid-19, tuberculosis, chronic obstructive pulmonary disease, influenza, and others, are anticipated to drive the market's growth. Additionally, the increase in adoption of advanced molecular techniques, the growing geriatric population, and initiatives taken by the government and non- profile organizations for reducing the incidence of infectious disease have propelled the market's growth.

Furthermore, growth in concern about the disease in low-economic countries and the development of cost-practical tools for diagnosing infectious diseases has provided several opportunities for market growth during the forecast period.

Increased chronic obstructive pulmonary disorders such as asthma, emphysema, and chronic bronchitis have boosted the infectious respiratory disease diagnostic market. Furthermore, rising lower respiratory infectious disease drives the need for early detection, propelling the demand for diagnostics tests.

Report Segmentation

The market is primarily segmented based on products, sample type, application, technology, end-use, and region.

|

By Product |

By Sample Type |

By Application |

By Technology |

By End-Use |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Consumables accounted for the largest market share over the forecast

The consumables account for the largest market and are expected to grow fastest over the forecast period. Consumables include reagents and reagent kits used to perform in vitro diagnostic tests for respiratory diseases.

The increased testing volume has driven the segment’s growth. For instance, the U.S. FDA authorized around 261 molecular diagnostics products, 88 serological diagnostics tests, and 34 antigen diagnostics tests for the diagnosis of COVID-19 in 2021.

The instrument was the second-largest revenue-generating segment in 2021, owing to the introduction of innovative products for assisting physicians in diagnosing COVID-19 patients. For instance, in March 2021, Vyaire Medical, Inc. introduced AioCare for diagnosing respiratory diseases in European Union, Middle East countries, and Australia. The product is a mobile spirometry system that offers as accurate results as hospital-grade spirometers and allows the physician to monitor patients with advanced digital connectivity at home.

Nasopharyngeal swab is accounted for the largest market share over the forecast

The nasopharyngeal swab tests account for the largest market share in 2021 owing to the applications scope in conducting various tests, including rapid antigen detection tests, Polymerase Chain Reaction (PCR), direct fluorescent antibodies, and others.

The saliva sample segment is anticipated to witness a remunerative growth rate over the forecast period. With the increasing use of samples in testing and an urgent need for noninvasive tests, many industry players started developing and commercializing no-swabs saliva-based tests. For instance, in March 2021, BATM Advanced Communications Ltd. introduced an RT-PCR kit that uses Salivette to self-collect samples for COVID-19 diagnosis.

Covid-19 accounted for the significant revenue share

Based on the application, the market has been segmented for several applications in the infectious respiratory disease diagnostic market, in which the Covid-19 segment accounted for the largest market share due to the high incidence of COVID-19, increased product approvals, and a rise in R&D.

The increasing vaccination rates are anticipated to decrease the severity of the disorders, and the testing rates are expected to decrease during the forecast. Market players are introducing direct-to-consumer testing kits, which remove the requirement of trained personnel for sample collection and shorten the turnaround time.

Tuberculosis is estimated to witness a considerable growth rate. According to the WHO, globally, 10 million people suffer from TB, and approximately 86% of all new cases of TB were reported. Various new issues were registered in Indonesia, India, China, Nigeria, Bangladesh, and South Africa. Due to this, there was an increase in the launch of susceptible and flexible molecular tests for the diagnosis of TB, which drives the market.

Molecular Diagnostic segment is accounted the largest market revenue

Depending upon technologies, the molecular diagnostic segment accounts for the most prominent market share. The segment's growth is attributed to the increased requirements of RT-PCR tests for the diagnosis of COVID-19, RSV, influenza, and other diseases.

PCR is the traditional technology for boosting DNA material to perform molecular diagnosis. Many companies are introducing multiplex tests that can diagnose infectious respiratory diseases using a single swab which has driven the market's growth. For instance, in 2020, GENETWORx, LLC launched a breakthrough test that detects three respiratory viruses (SARS-COV-2, RSV, & Influenza A & B) in a single sample.

The immunoassays segment exhibits the fastest growth rate over the forecast due to technological advancements and the commercialization of innovative products. In April 2021, Bio-Rad Laboratories, Inc. launched a blood-based immunoassay kit to detect IgM, IgA, and IgG antibodies, helping diagnose COVID-19 patients. This immunoassay kit launch is expected to increase the diagnosis of COVID-19, propelling the overall industry growth.

Diagnostic Laboratories accounted for largest market share

Based on end-use, the diagnostic laboratories segment accounts for the market share as various laboratories are entering into strategic initiatives with multiple organizations to offer COVID-19 testing to combat the rising incidence of the disease.

For instance, in March 2020, Bio-Rad Laboratories, Inc. collaborated with Assurance Scientific Laboratories to provide its real-time qPCR products, such as Reliance One-Step Multiplex RT-qPCR Supermix, CFX RT-PCR Detection Systems, and CFX384 Touch Real-Time PCR Detection System for COVID-19 screening.

The physician offices segment is expected to witness significant growth over the forecast period due to the growing focus of manufacturers on developing PoC diagnostics and increased patient preferences. The introduction of novel assays that provide quick PoC results has driven the segment’s growth.

North America is accounted for the largest market revenue

Due to the high testing rates, improvements in healthcare infrastructure, proactive government measures, technological advancements, and significant players in North America, the region accounts for the most considerable market revenue. Reimbursement policies and approving government initiatives are the factors that have driven the market in this region.

According to the Academy Society for Microbiology, various laboratories in the U.S. reported a shortage of reagents used for diagnosing pneumonia, followed by tuberculosis. However, the limited supply of materials during the COVID-19 pandemic, including reagents required to perform diagnostic tests, may hamper the industry growth.

Europe is expected to account for a significant growth rate over the forecast period. The growing prevalence of respiratory indications and increasing testing rates have driven the market in this region. According to the European Center for Disease Prevention and Control (ECDC), in 2022, significant new cases of influenza were reported across Europe. Of this, approximately 98% and 2% were typed A and type B viruses.

Competitive Insight

Some of the major players operating in the global market include Abbott, BD, bioMérieux SA, Bio-Rad Laboratories, Inc., Danaher, F. Hoffmann-La Roche Ltd., Koninklijke Philips N.V., Qiagen, Quidel Corporation, Siemens Healthcare GmbH, Thermo Fisher Scientific, Inc.

Recent Developments

In September 2020, F. Hoffmann-La Roche Ltd. launched the Elecsys Anti-SARS-CoV-2 S antibody test in markets accepting CE marking.

Infectious Respiratory Disease Diagnostic Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 63.28 billion |

|

Revenue forecast in 2030 |

USD 43.74 billion |

|

CAGR |

-1.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product Type, By Sample Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Abbott, BD, bioMérieux SA, Bio-Rad Laboratories, Inc., Danaher, F. Hoffmann-La Roche Ltd., Koninklijke Philips N.V., Qiagen, Quidel Corporation, Siemens Healthcare GmbH, Thermo Fisher Scientific, Inc. |