Ink Resins Market Share, Size, Trends, Industry Analysis Report

By Type (Acrylic, Polyamide, Polyurethane, Modified Rosin, Hydrocarbon Resin, Modified Cellulose, Others); By Technology; By Printing Process; By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 117

- Format: PDF

- Report ID: PM2897

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

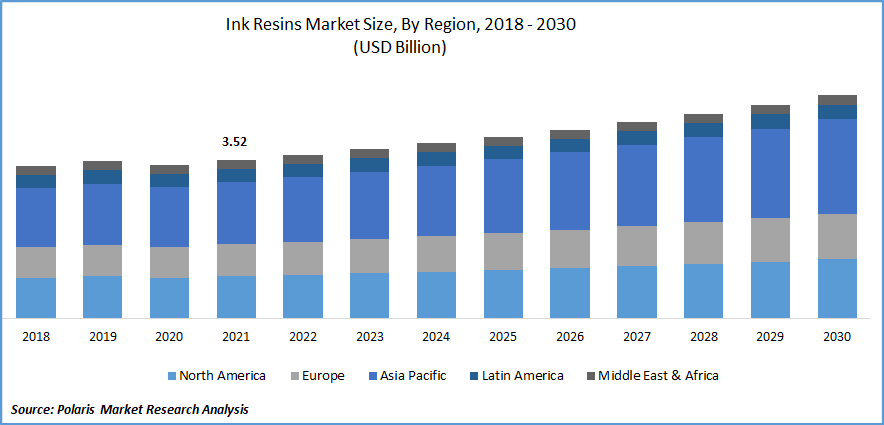

The global ink resins market was valued at USD 3.52 billion in 2021 and is expected to grow at a CAGR of 4.0% during the forecast period.

Increasing emission reduction rules for the printing ink sector, expansion of the packaging and energy needed curable inks sectors, rising demand for UV-cured inks, and innovative resin technologies are the main drivers driving the ink resins market.

Know more about this report: Request for sample pages

Ink resins are a kind of resin used in printing inks. These resins are used to create higher quality, more visually attractive inks. They enhance ink flowability by providing appropriate viscosity. The pigments also enhance durability and long-term surface adherence. Ink resins also increase the ink's gloss, durability, and distribution qualities while improving the drying speed. Ink polymers are commonly used in the manufacture of printing and publication inks, as well as the printing of sheet platforms, boxes, and packing materials.

The COVID-19 outbreak has hampered the manufacture of raw materials needed to create ink resins. The outbreak of COVID-19 caused several interruptions in the ink resin value chain. The shortage of suppliers caused by the shutdown of numerous businesses, particularly raw material producers, has been the most significant interruption in the value chain. This was exacerbated by global and provincial road restrictions placed throughout the world to stop the pandemic's spread.

The COVID-19 situation, for example, might influence both negative (short-term) and beneficial (long-term) ways in India. The ink resins for packaging market in India is expected to expand at a rapid pace in the future. Along with purchasing hamsters, the need for packaged food is increasing, and the demand for pharmaceuticals is expected to increase. The country's packaging sector will undergo tremendous expansion as more packaging is required to support a population of 1.3 billion.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Resins are critical in ink formulation because they provide vital properties to inks. They give numerous crucial properties of a final ink, including gloss and stickiness. Toluene, benzene, ethylene, and propylene are important raw chemicals for the ink business.

Isophorone diisocyanate (IPDI) and isophorone diamine (IPDA) is critical for the high-end polyurethane resin industry. The accessibility of acrylates will likely remain stable; however, seasonal and competitive demand in paint and coatings, sealants, and building applications will be present. Resin raw ingredients are accessible, but prices remain volatile due to feedstock price volatility or temporary supply-demand mismatches. Propylene oxide-based polyols are available, although their prices have risen. The availability of raw resources has increased, yet prices have not fallen.

Factors such as rising packaged food demand and polyurethane resin demand in plastic products are driving the ink resins rate of market growth. Furthermore, the improved availability of raw materials influences the development rates of the ink resins industry. The shift from traditional shopping to the internet and screen-based marketing, on the other hand, is impeding the growth of the industry. Regular study and improvement initiatives, as well as innovation by resin makers, create a variety of market prospects. The global surge in petrochemical ink resin source prices hinders the market's expansion.

The increased demand for ink resins for printing and publishing is projected to provide substantial future prospects for the market. Ink resins are used as essential ingredients by printing ink makers to impart key properties to printing inks.

Report Segmentation

The market is primarily segmented based on type, technology, application, printing process and region.

|

By Type |

By Application |

By Printing Process |

By Technology |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The modified rosin type was the largest market share in 2021

During the forecast period, the modified rosin category is expected to occupy a significant proportion of the worldwide market. Modified rosins have various advantages, including low pricing, easy availability, and increased product recognition. Most of the world's gum rosin is produced in Indonesia, Brazil, and China. Rosin for gum is used in the creation of altered rosin, an ink resin used as an essential ingredient in printing inks.

The polyamide sector is expected to trail the modified rosin segment during the projection period. Polyamide is used in the packaging industry for various purposes, including food packaging and cold-seal layers. Polyamides are frequently utilized in multilayered structures to give strength and toughness. The high demand for polyamide in the packaging sector drives the worldwide market. When opposed to petrochemical-based products, price variations are negligible due to the steady supply of bio-based sources.

Furthermore, considerable growth in the adhesives and sealants sector and the cosmetics industry is expected to affect the worldwide rosin resins industry favorably. Rosin resin is mainly used in printing inks as a color carrier and to promote adherence to paper. The expansion of the document and printing ink industries will likely pave the groundwork for considerable development in the rosin resins market in the coming years.

Flexible packaging is expected to grow dominantly over the forecast period

During the forecast period, the flexible packaging category is expected to earn a larger proportion of the worldwide market. Packaging has evolved beyond its conventional role in product protection to become a vital aspect of the product lifecycle. The growing trend of packaging because of online shopping and packaging food and drinks is expected to increase the international market for ink resins in the coming years.

The printing and publication segment is expected to occupy a significant proportion of the global ink resins market. During the forecast period, the increased usage of ink resins in publications and attractive prices is expected to boost the industry.

The demand in the Asia Pacific is expected to witness significant growth

Asia-Pacific is the biggest market for ink resins. Because of active and expanding economies in the area, such as India, Singapore, Japan, China, and South Korea, Asia-Pacific is the quickest-growing market for ink resins. Because of the expanding need for ink resin in packaging, India and China are the region's largest stockholders. In terms of volume, the ink resins market is growing in tandem with the growing inclination of on-the-go prepackaged food products and online purchasing.

North America is expected to dominate the market. The United States leads the market in this area, owing to the high demand for prepared foods and other retail items and a developing food and beverage industry. Another key area in the worldwide ink resins market is Europe. Latin America is expected to expand rapidly, thanks to Brazil and Mexico's rising economies and strong growth potential. The Middle East and Africa area is likely to develop at a significant CAGR in the following years due to the enormous growth potential of the tourist sector.

Competitive Insight

Key players include IGM Resins, Lawter B.V., Royal DSM, Dow Chemical, Indulor Chemie, Arakawa Chemical, Arizona Chemical, BASF, Evonik Tego Chemie, and Hydrite Chemical.

Recent Developments

- In 2021, Bodo Moller Chemie South Africa increased its exclusive sales & distribution arrangement for resins & additives with the BASF. Bodo, The company, is now completing its offers for local clients by expanding its relationship in dispersions for the CASE sector.

- In 2021, Azelis announced a new distribution deal with the BASF for dispersions, additives & resins throughout Australia and New Zealand. The goods covered by the agreement are frequently used in coatings, adhesives, sealants, and elastomers (CASE).

Ink Resins Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3.64 billion |

|

Revenue forecast in 2030 |

USD 4.97 billion |

|

CAGR |

4.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Application, By Printing Process, By Technology and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

IGM Resins, Lawter B.V., Royal DSM N.V., The Dow Chemical Company, Indulor Chemie GmbH, Arakawa Chemical, Arizona Chemical, BASF SE, Evonik Tego Chemie GmbH, Hydrite Chemical |