Inspection Management Software Market Share, Size, Trends, Industry Analysis Report

By End-Use (Healthcare, Pharmaceutical, Automation, Energy & Utility, Manufacturing, Retail, Information & Technology, Others); By Organization Size; By Application; By Deployment; By Region; Segment Forecast, 2022 - 2030

- Published Date:Aug-2022

- Pages: 117

- Format: PDF

- Report ID: PM2532

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

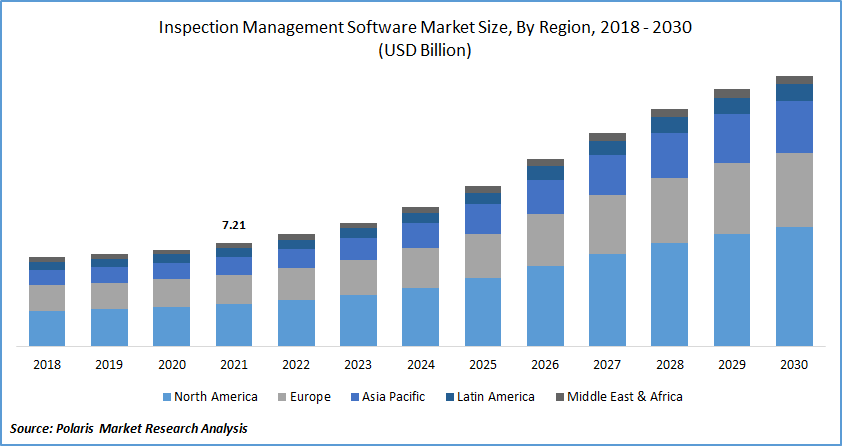

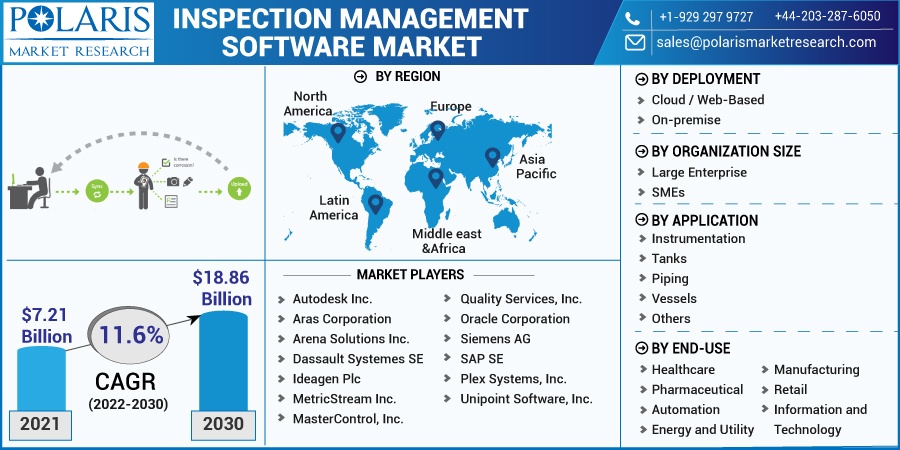

The global inspection management software market was valued at USD 7.21 billion in 2021 and is expected to grow at a CAGR of 11.6% during the forecast period. The benefits of the software and the availability of these solutions are driving the market growth during the forecast period. It is becoming more popular as the desire for hassle-free simplification of all processes, such as scheduling, producing forms and checklists, recording results, and monitoring corrective actions, grows.

Know more about this report: Request for sample pages

All duties connected to checking, analyzing, recording, scheduling, and tracking papers, checklists, and web forms are made easier using these applications. It enables constant upkeep, repair, and organizing in a fraction of the time it formerly took to do it manually. There is no other method to achieve compliance without devoting all of the time to upkeep.

The growing need for businesses to increase productivity has resulted in a significant shift away from traditional 'pen and paper management. Thus, the benefits of these systems across the various verticals are driving the market growth during the forecast period. For seamless supervision, industrial operators who are under undue strain from growing production expectations turn to automated solutions. As a result, the deployment of these softwares is projected to increase over the projection period.

Information on clients, locations, work orders, and audit scheduling activities are organized and classified by this software. These softwares help businesses of all sizes save time and improve profitable client engagement.

Further, quality management software includes such applications. Audit management, supplier quality management, statistical process control, employee training management, e-Signatures, email notifications, role-based security, and user dashboards are just a few of the features provided by QMS. Besides, this management software market effectively handles high-risk items while tracking overall asset performance and improving the supplier base.

Such companies offer various services, including advice, installation, support, and maintenance. These services provide inspection management software market creation and smooth installation, implementation, and maintenance of lasting solutions to end-users.

A global economic downturn is the effect of COVID-19's impact on all nations. The use of such applications in various industries has made the process much simpler than it was in the past, enabling both virtual and manual staff performance reviews. COVID-19 has a favorable effect on the industry, which is beneficial to all parties and offers virtual support for inspection.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rapid growth of advanced technologies and the adoption of AI, IoT, and cloud technologies are driving the inspection management software market growth during the forecast period. Inspectors and auditors benefit from AR and IoT because they can complete their tasks faster and more correctly. Businesses employ augmented reality (AR) technology to transform engineering, manufacturing, and service.

This technology offers on-premises and SaaS solutions and establishes a relationship between both the digital and real worlds. Companies make connections, systems, technology, and supply chains using manufacturing performance, ERP, supply chain development and scheduling, industrial internet of things, and analytics. This enables them to operate with accuracy.

Further, the major players are also focusing on launching advanced technologies-based software. It provides various benefits and is high in demand, which boosts the market growth during the forecast period. For instance, in June 2021, Visual Inspection AI, a higher-purpose technology from Google Cloud, was developed to assist manufacturers, consumer packaged goods businesses, and other enterprises minimize product faults and quality control costs.

Visual Inspection AI is based on Google Cloud's AutoML overall AI product that has been used in quality control operations for generations. Thus, these advancements in technologies are the factor boosting the market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on deployment, organization size, application, end-use, and region.

|

By Deployment |

By Organization Size |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Healthcare is expected to witness fastest market growth

An inspection management system helps streamline critical procedures in the healthcare business, such as performance assessment, staff planning and training, and better patient. Healthcare facilities require a robust inspection management system that keeps patients and personnel safe. It enables inspection teams to perform more efficiently, lowering total risk in healthcare facilities. Thus, the benefit of this is boosting the growth of the healthcare segment.

Further, for a variety of audit activities in the telecom sector, Certainty Software is a great option. For everything from contractor assessments and energy exclusion audits to fall security and work at height safety inspections, Surety is an ideal solution for gathering, managing, and reporting audit and inspection results and remedial action to guarantee adherence, reduce risk, and boost efficiency across the business.

ACTIA has developed a software system for the end-to-end management of vehicle inspection centers to provide customers with global solutions. The vehicle inspection management modules offered by ACTIA include appointment, supervision, check-out, lounge, and delivery modules. Alliance Inspection Management is a different automobile inspection business in the sector.

On-Premise segment accounted for the highest market share in 2021

The on-premises deployment model provides high speed, scalability, flexibility, and safety, excluding remote internet connectivity. The private ownership of individual data and the digital rights management associated with organizational digital assets are driving growth. The consumer has control over the infrastructure and security, which is an advantage.

One negative is that upgrades and support become more difficult, resulting in higher costs, including those imposed by the software provider. Normally, the customer is responsible for the deployment costs.

Large Enterprise is expected to hold the significant market share

According to the size of the company, the large enterprise segment is predicted to have the largest share. Large organizations have multiple locations worldwide for their offices and divisions. These companies benefit from having centralized, cloud-based inspection management software that allows corporate headquarters to monitor their branches and divisions.

Compared to SMEs, large businesses are more likely to employ the inspection management software market. Larger businesses are more likely than SMEs to employ inspection management software since there is a greater number of data to manage.

The demand in North America is expected to witness significant market growth

In terms of geography, North America had the highest share in 2021 in the global market. The region's deployment of inspection management software market is projected to be driven by the implementation of cloud technologies, robots, big data, medical devices, 3D printing, stainless steel, drilling process storage material, and the growth of major manufacturing plants and huge retail chains.

For instance, in March 2021, Simesys launched Evolis Integrity V3, the latest edition of its software suite specializing in examining complex industrial infrastructures. Evolis Integrity version 3 now includes a 3D overview of the inspection.

Also, technology advancement and supply chain operations such as logistics, warehousing, fulfillment, production, and transportation management are driving the region's economy. The North American market is being driven by the widespread use and adoption of AI, cloud computing, big data, and 3D printing technologies.

Moreover, Asia-Pacific is expected to witness a high CAGR in the global market in 2021. As new technologies enable more automation in various products, the risks that must be controlled have increased as well. In the Internet of Things, a large volume of essential data is traveling between many newly linked items and services, posing cybersecurity and resiliency threats to manufacturers and end-users. As a result of these improvements, the industry should be able to offer a wider choice of inspection management software market.

Competitive Insight

Some of the major players operating in the global market include Autodesk Inc., Aras Corporation, Arena Solutions Inc., Dassault Systemes SE, Ideagen Plc, MetricStream Inc., MasterControl, Inc., Quality Services, Inc., Oracle Corporation, Siemens AG, SAP SE, Plex Systems, Inc., and Unipoint Software, Inc.

Recent Developments

In September 2021, SAP SE announced a partnership with Amazon Business to allow employees to access hundreds of millions of products on Amazon Business straight from SAP Ariba solutions, assisting with corporate purchasing policies compliance. Amazon Business becomes a source of supply for Spot Buy, a functionality within SAP Ariba solutions that allows customers to buy things from trusted suppliers, thanks to this relationship and technology connection.

Inspection Management Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 7.21 billion |

|

Revenue forecast in 2030 |

USD 18.86 billion |

|

CAGR |

11.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Deployment, By Organization Size, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Autodesk Inc., Aras Corporation, Arena Solutions Inc., Dassault Systemes SE, Ideagen Plc, MetricStream Inc., MasterControl, Inc., Quality Services, Inc., Oracle Corporation, Siemens AG, SAP SE, Plex Systems, Inc., and Unipoint Software, Inc. |