Interactive Kiosk Market Share, Size, Trends, Industry Analysis Report

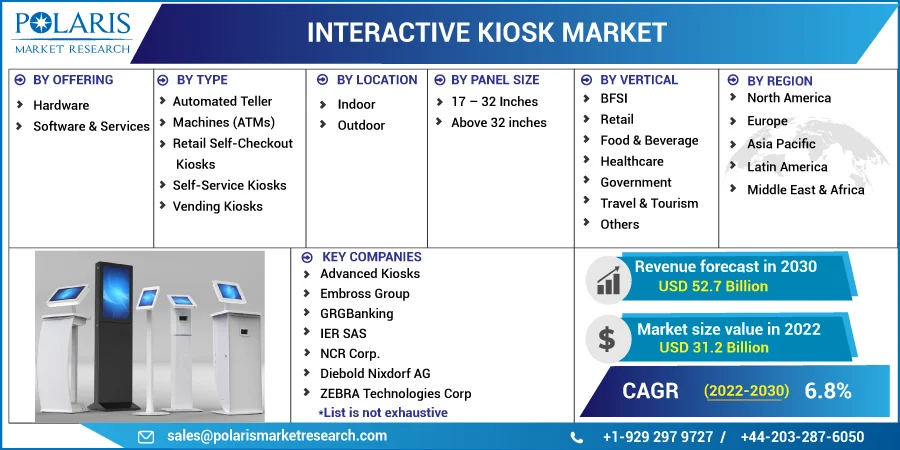

By Offering (Hardware, Software & Service); By Type; By Location, By Panel Size, By Vertical, By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 119

- Format: PDF

- Report ID: PM2822

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

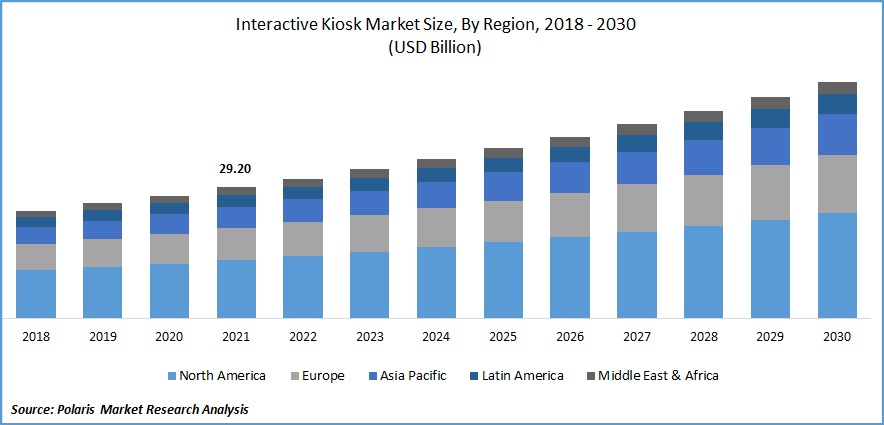

The global interactive kiosk market was valued at USD 29.20 billion in 2021 and is projected to grow at a CAGR of 6.8% during the forecast period.

Kiosks are commonly found at retail airports, libraries, establishments, corporate cafeterias, and other locations where personal computers are unavailable, yet self-service software might give some benefits.

Know more about this report: Request for sample pages

A kiosk, similar to personal computer (PC), provide internet connectivity for online activity and software programs. In contrast to a standard PC, a kiosk often performs few functions and is intended to be used by multiple users. Popular interactive kiosk applications include gift registries in retail shops, automated airport check-ins, and pay-per-use in cybercafes.

The industry has increased in recent years due to significant transaction and encryption technology advancements. Many self-service kiosk makers will continue to maximize the possibilities of these technologies and are likely to incorporate them as an integral part of their product portfolio. Interactive kiosks allow one to avoid long lines in public venues such as train stations, banks, shopping malls, and airport check-in counters. They assist decrease paperwork related to visitor data gathering and improve tourist experience in areas such as clinics and administrative buildings.

COVID had a positive impact on this market. The escalating challenges caused by the COVID-19 epidemic have boosted the use of self-checkout machines to minimize human interaction. Because self-checkout kiosks maintain social distance in stores, they allow for some human interaction. With respect to the COVID-19 epidemic, industry players have released a variety of innovative products and services aimed at promoting the adoption of and benefits provided by self-service kiosks to clients. The COVID-19 epidemic has quadrupled vendor R&D investment and innovation.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Integrated kiosks serve as self-service devices and are common in high-traffic areas such as retail stores, airports, and movie theatres. They are also employed in various tasks like clinic patient records, cinema ticket buying, and aircraft bookings. Service companies gain from self-service kiosks because they save personnel and infrastructure expenses.

By giving customers more power over their purchasing selections, interactive kiosks help merchants to achieve a better degree of pleasure. Customers can use interactive kiosks to choose and purchase items without the aid of store personnel. Because of technology advancements, interactive kiosks are more user-friendly than other informational gadgets and can complete complex tasks in less time.

The use of interactive kiosks has increased operational efficiency. For instance, Coca-Cola employed interactive kiosks for advertising strategies, which improved customer contact. This aided the business's brand marketing.

Customers' enhanced shopping experiences are anticipated to drive the interactive kiosk market over the forecast period. Also, the interactive kiosk business is expected to develop due to lower capital investment than traditional shops.

Furthermore, increased applications other than traditional ones are expected to buffer the expansion of the interactive kiosk market. On the other side, rising setup costs, the need for frequent maintenance, and a rise in cybercrime incidences are expected to impede the expansion of the interactive kiosk market throughout the forecast period.

Report Segmentation

The market is primarily segmented based on offering, type, location, panel size, vertical, and region.

|

By Offering |

By Type |

By Location |

By Panel Size |

By Vertical |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Hardware as an Offering Dominated the Global Interactive Kiosk Market

In 2022, the hardware sector led the market, accounting for more than 40% of worldwide sales. Kiosk equipment such as printers, displays, and others are included in the hardware sector. Designers and standalone kiosk computer programmers formulate strategies to interconnect and remotely control hardware devices. Companies combine software applications with various hardware devices to improve the usability of kiosks. Windows and Android are key examples of software segments. Windows has the highest market share, while Android is predicted to expand at the quickest CAGR throughout the forecast period. Implementing dynamic self-service kiosks to deliver goods and services is expected to reduce costs.

They will also allow the company to provide clients with customized programs. The main objective of positioning collaborative self-service kiosks has pushed users toward more consumer engagement. Organizations will also be able to evaluate performance of the system and plan maintenances for improved kiosk uptime through remote access and regular maintenance of self-service kiosks. Customers' widespread use of smartphones and tablets is expected to boost market growth throughout the forecast period. Clients can access several dynamic kiosk features through their cell phones and devices. This is going to have a direct influence on business kiosk implementation.

By type, ATM Accounted for a Maximum Market Share

In 2021, the ATM sector dominated the industry, accounting for major market share. Digitalization activities and rising ICT investment are likely to drive the global market for ATMs. Purchases or transaction tokens are accepted by dynamic dispensing kiosks, which subsequently distribute the items. In the retail business, customer pleasure is critical. Such a factor plays vital role in meeting client demand efficiently by interactive kiosks. Buyers also choose self-service, which is the fundamental cause for the Banking and finance sector's expanding self-service mindset.

BFSI Vertical was the Maximum Revenue Generator in 2021

The BFSI segment generated a maximum revenue in 2021 and is projected to show a similar trend over the forecast period. It provides method finding and listing services in the travel and transportation sectors to seek addresses and guide travelers. It also features a parking administration and booking system.

Constant technological progress broadens the application breadth and opens new prospects in a variety of industries. Moreover, BFSI vertical will remain to be the major end-user delivering a huge spectrum of self-directed solution providers for improved customer experience during the projection period.

The Demand in North America is Expected to Witness Significant Growth

North America emerged as the prominent market and is projected to witness substantial growth over the forecast period. Nations such as the United States are seeing substantial demand because of multiple kiosk producers offering various items and concentrating on sales tactics to meet these requirements from growing nations like India and others. Due to the increased development of these emerging countries in comparison to Western nations, key firms are extending the commercial potential for cash-handling equipment concentrated in these growing markets.

In addition, important manufacturing organizations are increasingly concentrating on deploying creative solutions to meet the needs of tech-savvy clients. North America followed by Europe are most likely to account for a substantial market share due to high standards and laws relating to data security and confidentiality.

Competitive Insight

The industry is defined by the presence of a few key companies that control a sizable portion of the industry. Some of the primary techniques used by big corporations to increase their market position include new product releases and technological alliances. Key industry participants are also substantially funding Research activities and emphasizing the establishment of manufacturing infrastructure to create and deliver innovative and cost-effective self-service solutions.

Some of the major players operating in the global market include Advanced Kiosks, Embross Group, GRGBanking, IER SAS, NCR Corp., Diebold Nixdorf AG, ZEBRA Technologies Corp.

Recent Developments

- In 2022, NCR Corporation has struck a contract with Bed Bath & Beyond. The company's checkout approach now includes cloud-enabled SCO. NCR's SCO solutions offer operational advantages like as speedier checkouts and sophisticated capabilities on a single powerful platform, as well as computer vision and shrink prevention solutions. Customers may now checkout depending on their preferences, resulting in less friction, and waiting times.

- In 2021, Global Healthcare Exchange (GHX) made enhancements to its Vendormate Kiosk system to boost its functionality and participatory features. Through a firmware update, the organization has improved visitor functionality.

- In 2021, Trigo, a maker of pickup technologies and kiosk settings, has created Intelligence technologies to make an automated shop. Payments will be resolved by evaluating client purchases utilizing interactive kiosks and ceiling-mounted webcams put in shops. Trigo has collaborated with Cloud Servers to build the technology.

Interactive Kiosk Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 31.2 billion |

|

Revenue forecast in 2030 |

USD 52.7 billion |

|

CAGR |

6.8% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By offering, type, location, panel size, vertical, and by Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Advanced Kiosks, Embross Group, GRGBanking, IER SAS, NCR Corp., Diebold Nixdorf AG, ZEBRA Technologies Corp |