IoT in Manufacturing Market Share, Size, Trends, Industry Analysis Report

By Component (Solution, Services); By Application; By Vertical (Process Manufacturing, Discrete Manufacturing); By Deployment Mode; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 116

- Format: PDF

- Report ID: PM2438

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

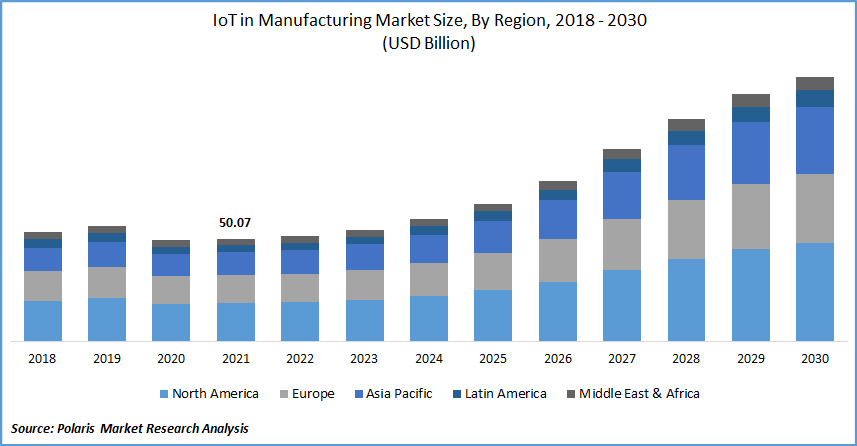

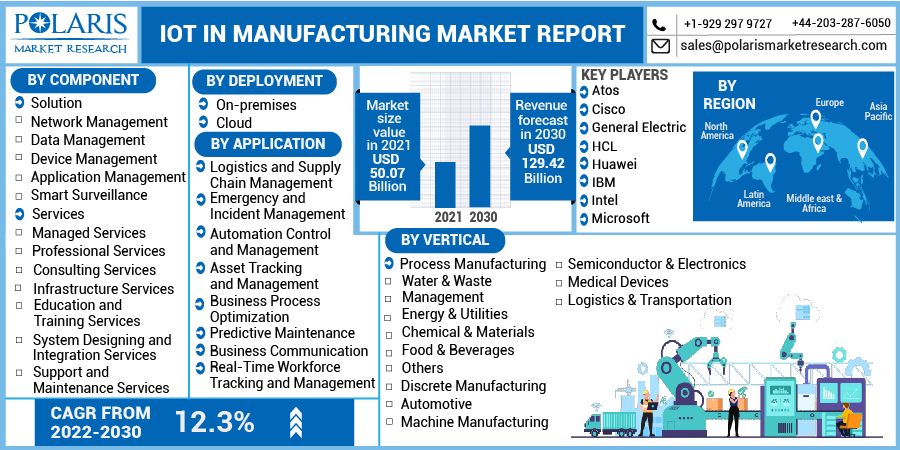

The global IoT in the manufacturing market was valued at USD 50.07 billion in 2021 and is expected to grow at a CAGR of 12.3% from the forecast period. Implementing technology in a wide range of applications across many industries has created a huge opportunity for companies in the market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The industry's increased demand for automated machines and equipment will lead to the wider use of IoT technologies. The IoT in the manufacturing industry will benefit from rising demand for customization, rising expectations for simpler and incredibly simple gear, and the requirement for efficient and reliable data.

Also, APIs will aid IoT operations in various ways, including connectivity among IoT platforms, devices, and gateways. APIs will also become an essential element of major software and service development initiatives. There is a growing opportunity for IoT database infrastructure to provide compatibility and access to IoT-related assets, particularly data linked with IoT occurrences gathered from devices and sensors.

Further, technological advancements such as sensing devices, and virtual & enlarged reality, and low operational costs drive the global market. The increase in demand for real-time asset monitoring positively affects IoT in manufacturing market growth.

However, many worries about data protection and privacy and a lack of precise standards for interoperability and connectivity are expected to limit the worldwide IoT in the manufacturing market's expansion throughout the projection period. The discrepancy in business semantics and the escalating conflicts over data ownership will likely hinder the market growth.

Industry Dynamics

Growth Drivers

The adoption of AI and IoT technologies in the manufacturing industry has accelerated since Industry 4.0. For instance, as per the International Society of Automation, the Internet of Things is a key enabler technology in the Industry 4.0 project, which was conceived as part of the German federal government's High-Tech Strategy, which focuses on information and communication technology to enhance IoT in manufacturing.

AI and IoT integrated fitted lines for optimizing production processes, sending early alarms, quality control, and machine failure prediction. Manufacturers may separate themselves from their competitors by gathering precise data and developing unique AI applications.

Furthermore, the pandemic of COVID-19 in 2020 put the manufacturing sector to the test. Businesses were compelled to innovate their manufacturing processes due to movement restrictions, rigorous lockdowns, and a lack of human resources. As a result, the usage of AI and IoT in manufacturing processes has increased.

AI and ML were used to perform tasks, including monitoring systems and equipment maintenance. Also, the strong growth in operational efficiency and agile production and the development of intelligent machine applications are expected to drive IoT in manufacturing market expansion in the near future.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on component, deployment mode, application, vertical, and region.

|

By Component |

By Deployment Mode |

By Application |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by component

Based on the component segment, the services segment is expected to be the most significant revenue contributor. In this market, services are essential because they allow manufacturers to create digitization and connected production processes. The services segment is significant since it focuses on enhancing business operations and lowering unnecessary charges and overheads for industrial firms.

Based on the application, the asset tracking and management segment held the highest share. Asset tracking and management improve operational efficiency, lowers costs, and boost productivity. Organizations immediately keep track of available assets by tracking non-fixed assets in a factory. Most industrial firms with valuable assets spread across a large geographical area face many issues that affect their productivity improvements, productivity, costs, staff numbers, and, ultimately, their bottom line.

Geographic Overview

North America had the largest share. It has stable and well-established economies, allowing it to invest heavily in R&D activities and contribute to the growth of new technologies. Connected devices and information flows are already being used in production. As a result of the lower cost of infrastructure, it is now possible to realize faster deliveries.

A highly skilled workforce in production companies in the country is rising in the adoption of advanced technologies, such as big data and analytics, which are the key factors driving the market's growth. Manufacturers are willing to integrate technologies into their processes due to the early implementation of trending technologies such as mobility and big data.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market. Rising digitalization, technical advancements, growing data centers, and other factors contribute to market growth. Furthermore, the deployment of Industry 4.0 technologies that meet the price, top-notch, and low-environmental-impact requirements would substantially speed up the development of smart technology frameworks.

Digitalization opens up new avenues for exploiting emerging technology and quickly adapting to market shifts, with internet infrastructure playing a key role. Phone and other apps have increased, and cloud technology implementation has allowed linked factories to incorporate. Because of the ever-increasing population and changing consumer demand, the industrial business has altered dramatically over the last few decades.

Competitive Insight

Major players operating in the global market are Atos, Cisco, General Electric, HCL, Huawei, IBM, Intel, Microsoft, Oracle, PTC, Samsara, SAP, Schneider Electric, Siemens, and Zebra Technologies.

IoT in Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 50.07 billion |

|

Revenue forecast in 2030 |

USD 129.42 billion |

|

CAGR |

12.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Deployment Mode, By Application, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Atos, Cisco, General Electric, HCL, Huawei, IBM, Intel, Microsoft, Oracle, PTC, Samsara, SAP, Schneider Electric, Siemens, and Zebra Technologies |