Kidney Preservation Market Size, Share, Trends & Industry Analysis Report

By Technique (Static Cold Storage, Hypothermic Machine Perfusion, Normothermic Machine Perfusion), By Preservation Solution, By Donor Type, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5749

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

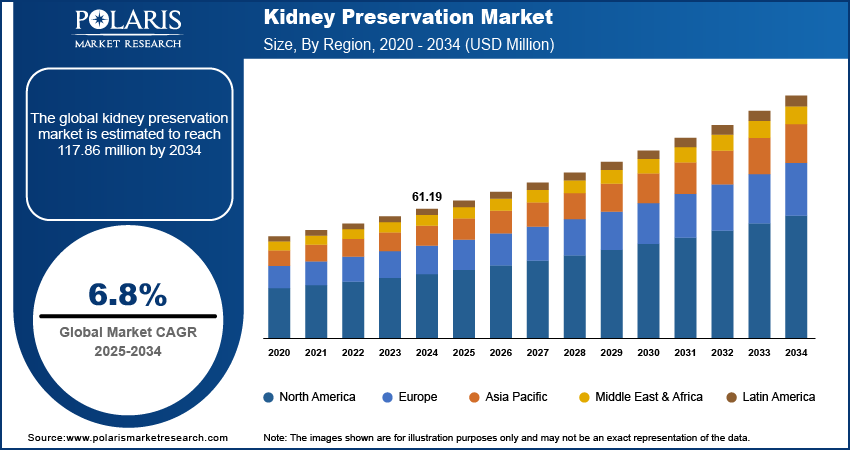

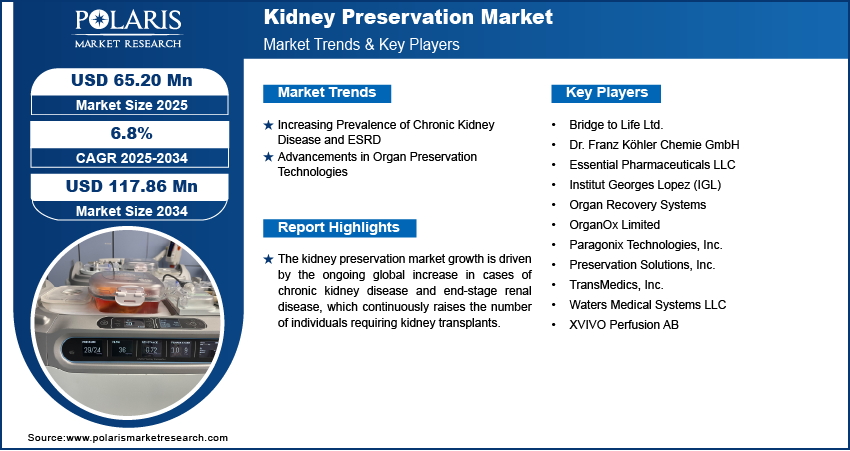

The global kidney preservation market size was valued at USD 61.19 million in 2024, and is anticipated to register a CAGR of 6.8% from 2025 to 2034. The market is primarily driven by the increasing number of chronic and end-stage renal disease patients, which is significantly raising the demand for kidney transplants. Advances in preservation technologies, such as machine perfusion systems, play a key role by improving organ viability and extending storage times.

The kidney preservation market focuses on the solutions, equipment, and techniques to maintain donor kidneys' viability from retrieval until transplantation. This critical process aims to minimize damage to the organ, extending its usable life and increasing the chances of a successful transplant.

Several important factors drive the kidney preservation and kidney functional test market. One major driver is the increasing number of people worldwide suffering from chronic kidney disease (CKD) and end-stage renal disease (ESRD). These conditions often require a kidney transplant as the best treatment option for improved quality of life and survival rates. As the prevalence of CKD continues to rise, especially with an aging global population and increasing rates of diabetes and hypertension, the demand for kidney transplants also grows, directly fueling the need for effective kidney preservation methods.

To Understand More About this Research: Request a Free Sample Report

The ongoing development of organ preservation technologies propels the market expansion. For decades, static cold storage served as the standard, where kidneys were cooled with cold preservation solutions. However, newer methods such as machine perfusion, both hypothermic (cold) and normothermic (near body temperature), are gaining importance. These advanced systems actively perfuse the organ with a solution, mimicking physiological conditions, improving organ quality, and extending the time it can be stored. This technological progress allows for using more donor kidneys, including those from extended criteria donors or those after circulatory death, which might have been considered unsuitable with older preservation techniques.

Industry Dynamics

Increasing Prevalence of Chronic Kidney Disease and ESRD

The rising global incidence of chronic kidney disease (CKD) and end-stage renal disease (ESRD), along with severe cases of kidney stones, is a significant factor driving the demand for kidney preservation solutions. CKD is a progressive condition that, if left untreated, can lead to ESRD, where the kidneys fail. For patients affected by ESRD, a kidney transplant often offers the best chance for a longer, healthier life compared to long-term dialysis. The rising number of individuals affected by kidney conditions propels the demand for kidney transplantation, directly impacting the need for effective organ preservation methods.

The Centers for Disease Control and Prevention (CDC) reported in an article "Quick kidney disease facts and stats" of 2025, over 1 in 7, or 14%, of American adults have CKD, with many unaware of their condition. The same source also states that there were about 131,000 Americans newly diagnosed with kidney failure in 2022. This high prevalence of kidney disease and the increasing number of new kidney failure cases directly translate to a greater demand for organ donations and, consequently, advanced preservation techniques to ensure these organs remain viable until transplantation.

Advancements in Organ Preservation Technologies

Technological advancements in organ preservation techniques are crucial in expanding the market. Historically, static cold storage (SCS) was the standard method, but it has limitations in terms of preservation time and organ viability. Newer, more sophisticated methods, such as machine perfusion, are changing the landscape by offering better outcomes and allowing for a wider range of donor kidneys. These innovations enhance the quality of preserved organs and extend the time available for transportation and compatibility matching. For example, a review published in Current Opinion in Organ Transplantation in February 2025, titled "How do we increase deceased donor kidney utilization and reduce discard?", highlights that innovations in organ preservation, including hypothermic and normothermic machine perfusion, have shown effectiveness in improving outcomes for marginal and extended-criteria kidneys.

Segmental Insights

By Technique

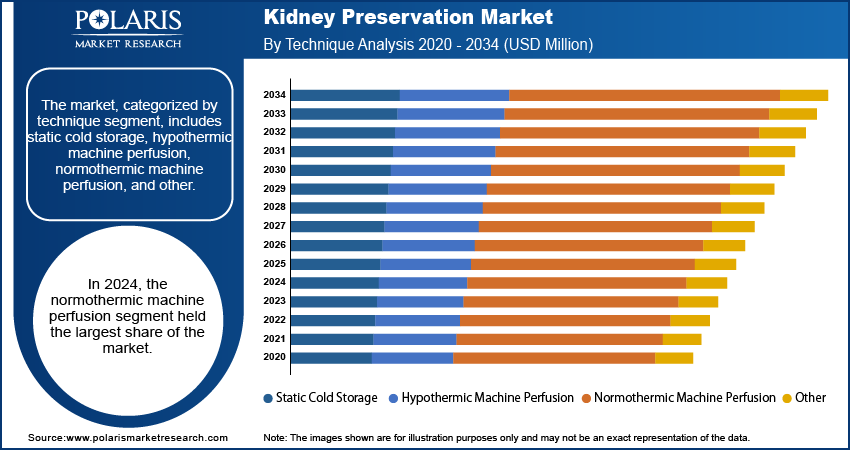

The Normothermic Machine Perfusion (NMP) segment holds the largest share in 2024. NMP involves perfusing the kidney with an oxygenated solution at near-body temperature, allowing the organ to remain metabolically active and even facilitating repair of some ischemia-reperfusion injury. This technique offers significant advantages, such as providing a real-time assessment of organ viability before transplantation, leading to better outcomes and reduced rates of delayed graft function. An article from UW Health describes that NMP helps keep the kidney healthy longer in the transplant box, allowing transplant teams more time to ensure the kidney is in the best possible condition and find the best-matching recipient.

The Static Cold Storage (SCS) segment is growing at the highest growth rate due to its simplicity, cost-effectiveness, and established reputation as the standard method for organ preservation. This technique involves cooling the kidney to a low temperature, typically around 4°C, and immersing it in a specialized preservation solution. The cold temperature slows down metabolic processes, reducing oxygen and nutrient demand, thereby extending the time an organ can be safely stored. Many transplant centers globally continue to rely on SCS as their primary method as it is easy to implement and does not require complex machinery or highly specialized personnel.

By Preservation Solution

The University of Wisconsin (UW) solution segment holds the largest share. This dominance is attributed to its proven track record and exceptional properties in preserving organ viability during static cold storage. UW solution contains a unique blend of components, including lactobionate and raffinose, which help prevent cell swelling, and adenosine and glutathione. It supports cellular energy and reduces oxidative damage. Its effectiveness in prolonging the safe preservation time for kidneys, often up to 48–72 hours, has made it a preferred choice for transplant centers worldwide.

The Institut Georges Lopez (IGL-1) solution segment is expected to witness the highest growth rate in 2024. IGL-1 is a newer generation solution that aims to improve existing formulations by optimizing electrolyte balance and including polyethylene glycol (PEG) as an impermeant. This composition offers enhanced organ protection and potentially better immediate graft function post-transplant. Studies have indicated that IGL-1 may lead to better early outcomes for transplanted kidneys.

By Donor Type

The Donation after Brain Death (DBD) segment holds the largest share in 2024. DBD donors are individuals who have suffered irreversible brain damage, leading to brain death, but whose bodily functions, including heart function, are maintained mechanically. This allows for scheduled organ retrieval, minimizing warm ischemia time and often resulting in organs with better initial function. The ability to thoroughly assess and prepare these donors before organ recovery, coupled with the generally healthier state of the organs due to continued perfusion, has made DBD donors the traditional and most common source for kidney transplants.

The Donation after Circulatory Death (DCD) segment is expected to register the highest growth rate during the forecast period. DCD donors are individuals whose organs are recovered after their heart and breathing have stopped, and death has been declared based on circulatory criteria. With the increasing disparity between the number of patients on transplant waiting lists and the availability of DBD organs, DCD has become a crucial avenue for expanding the donor pool. Advances in preservation techniques, especially machine perfusion, have made DCD kidneys more viable, improving their post-transplant outcomes despite the initial warm ischemia time.

By End Use

The transplant centers and hospitals segment holds the largest share in 2024, as these facilities are the ultimate destinations for donor kidneys and where transplantation surgeries take place. They have the specialized surgical teams, infrastructure, and post-operative care units necessary for successful kidney transplants. Transplant centers are responsible for receiving the preserved organs, assessing their final viability, and performing the complex surgical procedures. Their central role in the transplantation process, from patient selection to post-transplant follow-up, naturally positions them as the primary consumers of kidney preservation solutions and equipment.

The Organ Procurement Organizations (OPOs) segment is expected to witness the highest growth rate during the forecast period. OPOs are nonprofit organizations responsible for identifying potential deceased donors, obtaining consent for donation, managing donor care, recovering organs, and ensuring their proper preservation and transport to transplant centers. With increasing efforts to expand the donor pool and improve organ utilization, OPOs are adopting advanced preservation technologies and processes to ensure more organs are viable for transplantation. A report by the Association of Organ Procurement Organizations (AOPO) in February 2025 indicated that US OPOs recovered a record number of organs in 2024, demonstrating their expanding role.

Regional Analysis

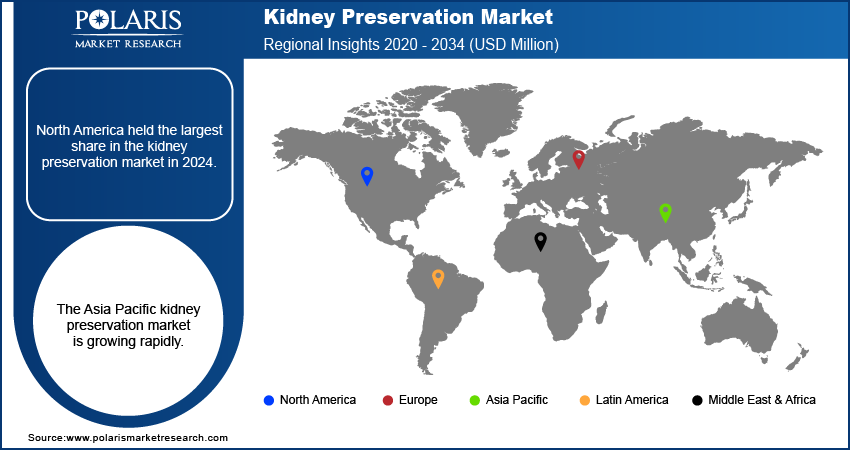

The North America kidney preservation market accounted for 37% of the global market share in 2024. The major driving factors for this large market share are the presence of advanced healthcare infrastructure, high awareness regarding organ donation, and a significant burden of chronic kidney disease, which contribute to the region's strong position. In particular, the US and Canada have well-established organ transplantation programs and a robust network of transplant centers. Continuous research and development activities and the adoption of innovative preservation techniques such as machine perfusion support the market development. The region also benefits from favorable reimbursement policies and government initiatives to increase organ donation rates.

US Kidney Preservation Market Insights

The US is a key contributor, as it faces a substantial challenge with the high prevalence of chronic kidney disease and end-stage renal disease, leading to a large number of patients awaiting kidney transplants. For example, the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) reported in December 2024 that over 1 in 7 US adults, approximately 35.5 million Americans, are affected by CKD. This high disease burden drives a constant demand for organ transplantation and, consequently, for effective kidney preservation solutions and technologies. Moreover, the US has a high volume of deceased donor transplants, as per the data from the Organ Procurement and Transplantation Network (OPTN), further solidifying its demand for advanced preservation methods.

Europe Kidney Preservation Market

Europe is a significant region in the kidney preservation market, marked by varying levels of transplant activity and healthcare development among its countries. The region benefits from increasing awareness campaigns for organ donation and the implementation of advanced medical technologies in many nations. Efforts by the European Commission, as outlined in their "Organs" section of the Public Health website (last updated December 2022), have focused on increasing organ availability and improving the safety and quality of transplantation. While there are discrepancies in donation rates across different European countries, the overall trend points towards a growing need for effective preservation solutions to meet the increasing demand for kidney transplants.

The UK and Germany are significant contributors to the European market. Despite a relatively high prevalence of chronic kidney disease—approximately 10% of adults in Germany have CKD—according to a study in BMC Nephrology published in November 2021, titled "High Unawareness of Chronic Kidney Disease in Germany," the country maintains a strong healthcare system. This system supports a considerable number of kidney transplants each year. Germany's focus on clinical research and adoption of advanced medical practices, including modern organ preservation techniques, further boosts the Germany kidney preservation market expansion.

Asia Pacific Kidney Preservation Market Overview

The Asia Pacific market is growing rapidly, owing to the rising prevalence of chronic kidney diseases, an aging population, and the improvement of healthcare infrastructure across many countries. Nations in this region are also experiencing increased awareness of organ donation and transplantation, leading to a rise in the number of transplant procedures performed. Although challenges such as organ shortages still exist, the growing investments in healthcare facilities and the adoption of modern medical practices create a favorable environment for the expansion of the kidney preservation market in Asia Pacific.

Key Players and Competitive Insights

The competitive landscape is characterized by a mix of established companies and innovative players, all striving to enhance organ viability and improve transplant outcomes. Competition primarily revolves around developing more effective preservation solutions and advanced perfusion technologies that can extend storage times, reduce organ damage, and successfully utilize a wider range of donor organs. Companies also focus on creating user-friendly devices and comprehensive service offerings to cater to transplant centers and organ procurement organizations globally.

A few prominent companies in the industry include XVIVO Perfusion AB; TransMedics, Inc.; Bridge to Life Ltd.; Paragonix Technologies, Inc. (currently an acquired company of Getinge AB but still operating under its brand); OrganOx Limited; Organ Recovery Systems; Institut Georges Lopez (IGL); Preservation Solutions, Inc.; Dr. Franz Köhler Chemie GmbH; Essential Pharmaceuticals LLC; and Waters Medical Systems LLC.

Key Players

- Bridge to Life Ltd.

- Dr. Franz Köhler Chemie GmbH

- Essential Pharmaceuticals LLC

- Institut Georges Lopez (IGL)

- Organ Recovery Systems

- OrganOx Limited

- Paragonix Technologies, Inc.

- Preservation Solutions, Inc.

- TransMedics, Inc.

- Waters Medical Systems LLC

- XVIVO Perfusion AB

Industry Developments

October 2024: Paragonix Technologies got FDA 510(k) clearance for its KidneyVault Portable Renal Perfusion System.

September 2024: XVIVO Perfusion announced its acquisition of a unique communication platform designed to streamline the transplant process. This move is aimed at improving efficiency and coordination in organ transplantation workflows.

Kidney Preservation Market Segmentation

By Technique Outlook (Revenue – USD Million, 2020–2034)

- Static Cold Storage

- Hypothermic Machine Perfusion

- Normothermic Machine Perfusion

- Other

By Preservation Solution Outlook (Revenue – USD Million, 2020–2034)

- University of Wisconsin (UW) Solution

- Histidin-Tryptophan-Ketoglutarate (HTK) Solution

- Celsior Solution

- Hypertonic Citrate Adenine (HC-A) Solution

- Institute Georges Lopez (IGL-1) Solution

- Others

By Donor Type Outlook (Revenue – USD Million, 2020–2034)

- Standard Criteria Donor (SCD)

- Expanded Criteria Donor (ECD)

- Donation after Brain Death (DBD)

- Donation after Circulatory Death (DCD)

- Living Donor

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Transplant Centers/Hospitals

- Organ Procurement Organizations (OPOs)

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Kidney Preservation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 61.19 million |

|

Market Size in 2025 |

USD 65.20 million |

|

Revenue Forecast by 2034 |

USD 117.86 million |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization per your requirements concerning countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 61.19 million in 2024 and is projected to grow to USD 117.86 million by 2034.

The global market is projected to register a CAGR of 6.8% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include XVIVO Perfusion AB; TransMedics, Inc.; Bridge to Life Ltd.; Paragonix Technologies, Inc. (currently an acquired company of Getinge AB but still operating under its brand); OrganOx Limited; Organ Recovery Systems; Institut Georges Lopez (IGL); Preservation Solutions, Inc.; Dr. Franz Köhler Chemie GmbH; Essential Pharmaceuticals LLC; and Waters Medical Systems LLC.

The normothermic machine perfusion (NMP) segment accounted for the largest share of the market in 2024.

The static cold storage (SCS) segment is expected to grow fastest during the forecast period.