Lawn & Garden Consumables Market Share, Size, Trends, Industry Analysis Report

By Product (Seeds, Fertilizers, Pesticides, Others), By End-User (Residential, Commercial, Industrial); By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 118

- Format: PDF

- Report ID: PM2293

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

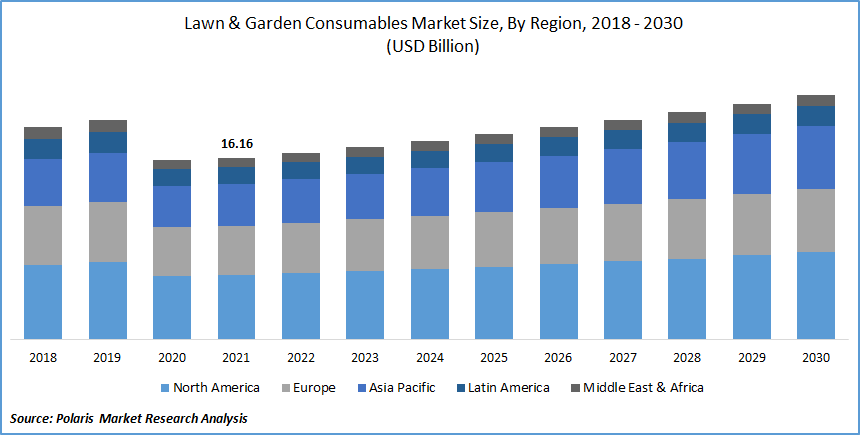

The global lawn & garden consumables market was valued at USD 16.16 billion in 2021 and is expected to grow at a CAGR of 3.4% during the forecast period. Lawn and garden spaces add an aesthetic look to their surroundings and are used as a play area for kids, relaxation purposes, and others across both residential and commercial infrastructures.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Both lawns & gardens require time to time maintenance of plants, such as the use of fertilizers & pesticides, controlling growth, and watering plants, among others. This is anticipated to boost the demand for lawn consumables, driving the overall development of the global lawn & garden consumables market. The benefits of these include improving soil, curbing carbon emissions, cleaning the air, trapping stormwater runoff, and maintaining an overall healthy environment. These benefits are estimated to fuel the growth of the global lawn & garden consumables market.

The spread of the COVID-19 reflects the downfall in the industry growth due to the significant disruptions in the supply chain of gardening consumable products. According to OECD (Organization for Economic Co-operation & Development), during the pandemic, the decreasing demand from consumers is putting pressure on the prices & production of garden consumables.

The disruptions in the supply chain, lockdown measures, and limited consumer spending are anticipated to hamper industry development. The lawn consumables industry is primarily dependent on raw materials. The imposed trade barriers and international border closures have resulted in the stoppage of exports and imports, disrupting the entire production process.

On the positive hand, the increasing awareness regarding health has increased gardening activities during the outbreak. For instance, in March 2020, W Atlee Burpee & Co. sold more seeds than they have sold in their history. Furthermore, according to Ozon, one of the leading retailers in Russia, the demand for sources increased by over 30% in March 2020.

Major players such as Agrium Inc., Scotts Miracle-Gro, and Spectrum Brands Holding Inc., among others, reported increased sales of lawn consumables during the outbreak. Additionally, the need for lawn & garden consumables is projected to bounce back as governments across nations are lifting lockdown restrictions.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The primary factor driving the industry's growth is the increasing inclination of the global population towards landscaping practices, including planting ornamental flowers and shrubs & arranging pottery plants in lawn architecture or well-designed gardens. This growing inclination can be attributed to the increasing urbanization coupled with the increasing per capita income of the population. The rising landscaping practices drive the demand for fertilizers, insecticides, fungicides along with different equipment, as landscaping requires regular maintenance of plants by the use of these consumables.

Furthermore, the rising trend of urban green parks and spaces is anticipated to offer huge lawn & garden consumables market growth opportunities. On account of the increasing environmental degradation due to rising urbanization and industrialization, governments across nations are launching various schemes to develop green parks and spaces. For instance, as per the guidelines by AMRUT (Atal Mission for Rejuvenation & Urban Transformation), each ULB (Urban Local Body) needs to have at least one green space/park based on the regulations of URDPFI (Urban & Regional Development Plans Formulation & Implementation).

Report Segmentation

The market is primarily segmented on the basis of product, end-user, and region.

|

By Product |

By End-user |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by End-user

The residential segment holds the larger shares in 2021 and is expected to lead the consumables market in the forecasting years. This considerable share of the segment can be attributed to the increasing residential construction activities globally. Furthermore, the rising renovation activities are anticipated to drive the segment's growth. For instance, various upcoming residential projects in Canada include Garibaldi at Squamish Ski Resort with a value of over CAD 3.5 billion, Oxford Place, and Rockcliffe Lands Redevelopment. Additionally, the rising per capita income of the population globally is anticipated to offer huge growth opportunities for the segment.

The commercial segment is projected to witness a progressive growth rate in the forecasting years. The segment's growth can be attributed to the rising number of outdoor restaurants and cafes globally. The increasing trend of upgrading outdoor space of various commercial infrastructures such as hotels, entertainment parks, and corporate offices, among others, to increase their value is anticipated to drive the segment's growth. Furthermore, the increasing commercial construction activity globally is anticipated to drive the segment's growth. According to RICS Economics, the global CAI (Construction Activity Index) increased to +25 in Q2 2021 compared to +14 of Q1 2021.

Geographic Overview

Geographically, North America held the highest industry shares in the global lawn consumables market in 2021. This huge industry share can be attributed to the rising trend for house parties across North America. The presence of key market players in the U.S. and the increasing consumer awareness regarding mental & emotional health is anticipated to boost the market's growth. Furthermore, the growing number of renovation projects for residential and commercial sectors is expected to offer huge market growth opportunities. Additionally, the increasing demand for food gardening is anticipated to drive the lawn consumables market's growth.

Moreover, the Asia Pacific lawn & garden consumables market is anticipated to exhibit the highest CAGR over the forecasting years. The fast growth of the market in the Asia Pacific can be attributed to the rapidly growing commercial & residential construction sector. Further, the lawn consumables market's growth is fuelled by the rapid urbanization, improving living standards, and rising disposable income of the population in the emerging nation.

Competitive Insight

Some of the major players operating in the global lawn & garden consumables market include Ace Hardware Corporation, AE McKenzie, Agrium Incorporated, AMBRANDS, Amrep, Andersons Incorporated, APEX Nursery Fertilizer, BASF SE, Bayer AG, Central Garden & Pet, DLF Seeds A/S, J.R., DowDuPont, Espoma Company, Ferry-Morse Seed, Premier Tech Limited, Sakata Seed Corporation, Scootney Springs Seed, Scotts Miracle-Gro, Simplot Company, Spectrum Brands Holdings Inc., The Andersons Inc.

Lawn & Garden Consumables Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 16.16 billion |

|

Revenue forecast in 2030 |

USD 21.73 billion |

|

CAGR |

3.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Ace Hardware Corporation, AE McKenzie, Agrium Incorporated, AMBRANDS, Amrep, Andersons Incorporated, APEX Nursery Fertilizer, BASF SE, Bayer AG, Central Garden & Pet, DLF Seeds A/S, J.R., DowDuPont, Espoma Company, Ferry-Morse Seed, Premier Tech Limited, Sakata Seed Corporation, Scootney Springs Seed, Scotts Miracle Gro, Simplot Company, Spectrum Brands Holdings Inc., The Andersons Inc.

|