Learning Management System Market Share, Size, Trends, Industry Analysis Report

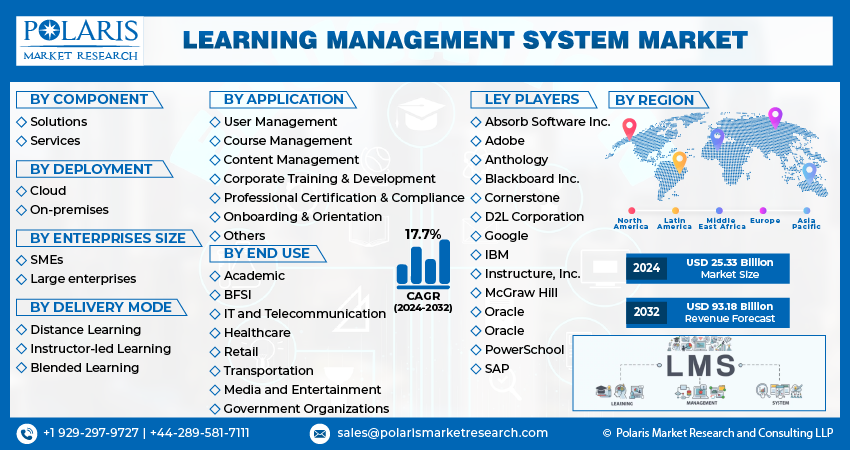

By Component (Solutions, Services); By Deployment; By Delivery Mode; By Enterprise Size; Application; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 119

- Format: PDF

- Report ID: PM4772

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

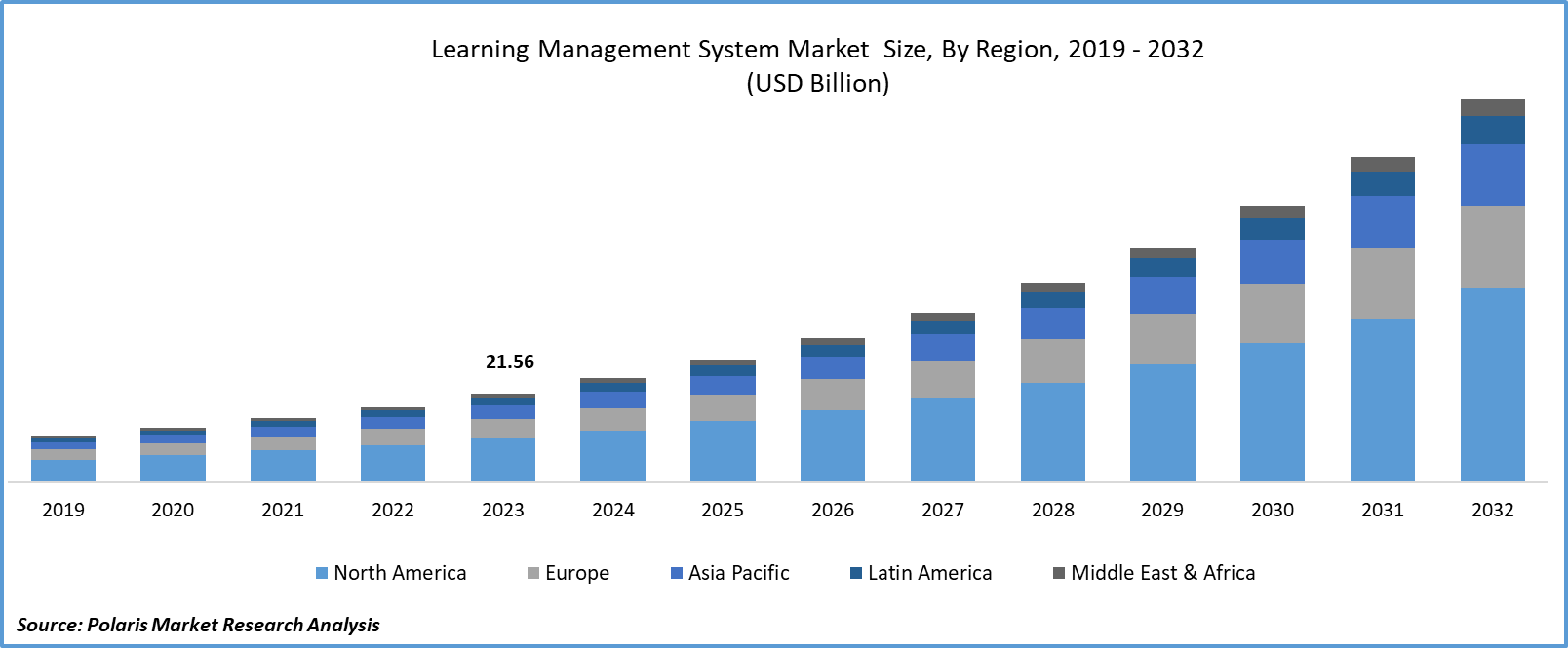

Global learning management system market size was valued at USD 21.56 billion in 2023. The market is anticipated to grow from USD 25.33 billion in 2024 to USD 93.18 billion by 2032, exhibiting the CAGR of 17.7% during the forecast period.

Industry Trend

The learning management system (LMS) industry is the proliferation of computerized learning options catering to both corporate and academic environments. This surge in digital learning alternatives is accompanied by key market drivers that fuel overall market expansion.

Emerging technologies such as big data, artificial intelligence (AI), online learning platforms, and mobile learning solutions play pivotal roles in driving the growth of the LMS market. These technological advancements are not only transforming traditional learning methods but are also expected to continue shaping market trends in the foreseeable future. Globally, the rapid evolution of communication technologies is reshaping the landscape of classroom education, with digital tools becoming increasingly integrated into educational practices. This may result in increasing the learning management system (LMS) market share during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Furthermore, incorporating gamification mechanics into the learning process has emerged as a significant strategy for enhancing user engagement and improving knowledge retention. By introducing elements like badges, quests, and avatars, learners are incentivized to actively participate in learning activities actively, fostering a sense of competition and motivation to achieve better outcomes.

The company has made a significant capital investment in an innovative collaboration aimed at revolutionizing its operations. Embracing a comprehensive strategy focused on expanding market reach, connecting with new demographics, and fostering sustainable growth in a dynamic business environment, the company is poised for success. Through harnessing the synergies of investment, technology, innovation, and strategic planning, it is well-positioned to maintain competitiveness and emerge as a frontrunner in its sector; hence, the learning management system (LMS) market size is expected to grow during the forecast period.

- For instance, in March 2023, Docebo S.p.A., a provider of learning management software, unveiled a strategic collaboration with ELB Learning, a major software company. This partnership is set to enhance learning experiences through the seamless integration of their respective top-tier solutions and services.

With the increasing adoption of online education, particularly in emerging markets, there are market opportunities for learning management system (LMS) providers. As more educational institutions and organizations worldwide embrace digital learning solutions, there is a growing demand for robust LMS platforms to support these initiatives. This innovative approach not only makes learning more interactive and enjoyable but also aligns with contemporary preferences for engaging educational experiences. Hence, the learning management system market is estimated to increase during the forecast period.

Key Takeaway

- North America dominated the largest market and contributed to more than 38% of share in 2023.

- Asia Pacific region is expected to witness the fastest growing CAGR during the forecast period.

- By component category, service segment accounted for the largest market share in 2023.

- By delivery mode category, the blended learning segment is projected to grow at fastest CAGR during the projected period.

What are the market drivers driving the demand for the learning management system market?

Shift Towards Digital Learning is projected to spur product demand.

The increasing digitization of educational content and the rise of online learning platforms have fundamentally transformed the landscape of education. Traditional methods of teaching and learning are being supplemented and, in some cases, replaced by digital alternatives. This shift is driven by various factors, including advancements in technology, changes in learner preferences, and the need for more flexible and accessible educational opportunities. As educational content becomes increasingly digitalized, there is a growing need for efficient systems to manage and deliver these resources effectively. Learning Management Systems (LMS) have emerged as essential tools in addressing this demand. LMS platforms provide a centralized hub where educators can create, store, organize, and distribute a wide range of digital learning materials, including documents, videos, presentations, quizzes, and interactive multimedia content. Hence, the learning management system market is estimated to increase during the forecast period.

Moreover, LMS platforms can streamline the learning process for both instructors and learners. Educators can use these platforms to design and deliver customized learning experiences tailored to the needs and preferences of their students. They can create structured courses, set learning objectives, sequence content, and track student progress and performance in real time.

Which factor is restraining the demand for learning management systems?

Lack of Familiarity with Technology

One of the primary reasons for resistance is a need for more familiarity or comfort with technology. Some educators, administrators, and learners may have limited exposure to digital tools or may need to receive adequate training on how to utilize LMS platforms effectively. This lack of familiarity can lead to apprehension and reluctance to embrace new technological solutions for teaching and learning.

Moreover, concerns about the perceived complexity of using digital tools, including LMS platforms. Individuals may feel overwhelmed by the array of features and functionalities offered by these platforms, leading them to believe that incorporating them into their educational practices will require a significant investment of time and effort. As a result, they may resist adoption in favor of more familiar and comfortable teaching methods. Hence, the learning management system market is likely to impede the growth.

Report Segmentation

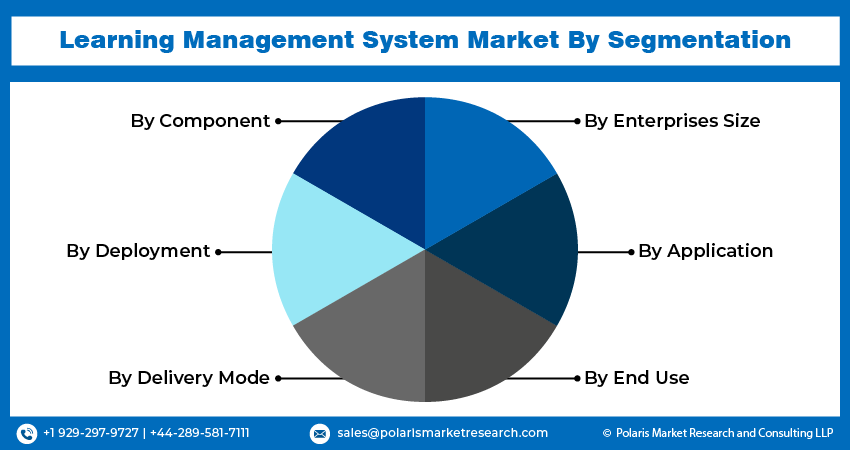

The market is primarily segmented based on component, deployment, delivery mode, enterprise size, application, end use, and region.

|

By Component |

By Deployment |

By Delivery Mode |

By Enterprises Size |

By Application |

By End Use |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Component Insights

Based on component analysis, the market is segmented on the solutions and services. The services held the largest market share in 2023. Deploying an LMS involves various technical aspects such as installation, configuration, and integration with existing systems. Service providers offer implementation services to help organizations set up their LMS platforms efficiently, ensuring seamless integration with other tools and systems used within the organization. These services are critical for ensuring a smooth transition to the new LMS and maximizing its effectiveness. Proper training and ongoing support are essential for ensuring the successful adoption and utilization of an LMS. Service providers offer training programs to educate administrators, instructors, and learners on how to use the platform effectively. Comprehensive training and support services contribute to the long-term success and sustainability of the LMS deployment.

Content creation is a crucial aspect of LMS implementation, as high-quality learning materials are essential for engaging and effective learning experiences. Service providers offer content development services to help organizations create and customize educational content tailored to their specific needs and objectives. This may include designing interactive multimedia modules, developing assessments and quizzes, or converting existing training materials into digital formats suitable for online delivery.

By Delivery Mode Insights

Based on delivery mode analysis, the market has been segmented on the basis of distance learning, instructor-led learning, and blended learning. The blended learning segment is expected to witness the fastest-growing CAGR during the forecast period. Blended learning, which combines traditional face-to-face instruction with online learning activities, plays a crucial role in the Learning Management System (LMS) market due to its capacity to enhance learning outcomes, flexibility, and engagement. By integrating offline and online learning modalities, blended learning optimizes the strengths of each approach, resulting in a more comprehensive and effective learning experience. Within the learning management system market, the inclusion of blended learning features enables organizations and educational institutions to cater to the diverse learning styles, preferences, and needs of learners.

Blended learning empowers learners to access educational materials and resources at their own pace and convenience while facilitating real-time interaction, collaboration, and feedback with instructors and peers.

Regional Insights

North America

North America region accounted for the largest market share in 2023. North America is known for its advanced technological infrastructure and digital innovation. The region is home to numerous technology companies and startups that continuously develop and deploy cutting-edge learning technologies, including LMS platforms. This technological prowess drives the adoption of LMS solutions across various industries and educational institutions in the region. Education and workforce development are top priorities in North America, with a growing emphasis on continuous learning and skill development. North America has a favorable regulatory environment that encourages innovation and investment in education technology. Government initiatives aimed at promoting digital learning, increasing access to education, and bridging skills gaps further stimulate the growth of the LMS market in the region. Additionally, policies that support online education and remote workforce training contribute to the widespread adoption of LMS solutions.

Asia Pacific

Asia pacific is expected for the growth of fastest CAGR during the forecast period. Asia-Pacific is home to some of the world's fastest-growing economies, including China, India, and Southeast Asian countries. This economic growth translates into increased investment in education and workforce development as organizations and governments prioritize human capital development to drive innovation, productivity, and economic competitiveness. As a result, there is a growing demand for LMS platforms to support online learning initiatives, professional development programs, and skill-building efforts across various industries.

The Asia-Pacific region has a large and diverse population, with a significant portion of the population seeking access to quality education and training opportunities. These platforms enable institutions to deliver online courses, virtual classrooms, and distance learning programs to a wide audience, regardless of geographical location or socioeconomic background.

Competitive Landscape

The learning management systems (LMS) market is characterized by a diverse range of players offering various solutions to cater to the evolving needs of educational institutions, corporations, and government organizations. Competing LMS providers offer a wide range of product offerings, including cloud-based, on-premises, and hybrid solutions, catering to the diverse requirements of users. Products differ in terms of features such as course creation and management, assessment tools, collaboration capabilities, analytics, and integration with other learning tools and systems.

Some of the major players operating in the global market include:

- Absorb Software Inc.

- Adobe

- Anthology

- Blackboard Inc.

- Cornerstone

- D2L Corporation

- IBM

- Instructure, Inc.

- McGraw Hill

- Oracle

- Oracle

- PowerSchool

- SAP

Recent Developments

- In November 2023, D2L entered into a partnership with Quality Matters, Inc. (QM), aimed at ensuring the quality of online and innovative digital teaching and learning environments. Quality Matters is committed to improving the quality of online education and student learning globally through research, expert knowledge, and opportunities for professional development.

- In September 2023, Intellek, an innovative frontrunner in learning management technology, announced an exciting strategic collaboration with Litera, a renowned global provider of legal technology solutions. Intellek's integration of Litera's CE Manager as a crucial add-on module for its cutting-edge Learning Management System (LMS).

Report Coverage

The learning management system market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, deployment, delivery mode, enterprise size, application, end use, and their futuristic growth opportunities.

Learning Management System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 25.33 Billion |

|

Revenue forecast in 2032 |

USD 93.18 billion |

|

CAGR |

17.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Deployment, By Delivery Mode, By Enterprise Size, By Application, By End Use, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global learning management system market size is expected to reach USD 93.18 billion by 2032

Key players in the market are Absorb Software Inc., Absorb Software Inc., Adobe, Anthology, Blackboard Inc., Cornerstone

North America contribute notably towards the global Learning Management System Market

Learning management system market exhibiting the CAGR of 17.7% during the forecast period.

The Learning Management System Market report covering key segments are component, deployment, delivery mode, enterprise size, application, end use, and region.